2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

For profitable trading in financial markets, special tools are used. All of them are divided into certain groups and perform specific functions. This article will discuss a popular trading tool for traders - an indicator of the strength of currencies. The reader will learn what types of trading instruments exist for determining the strength and weakness of currency pairs, their functions, as well as how they can be used in trading.

Determining the strength of currencies

Before using the appropriate tools to trade in the financial markets, it is necessary to understand what currency strength is. By definition, if we consider its classic version, then this is the arithmetic difference between the number of open positions in the market for sale and purchase in relation to other currency assets or pairs. That is, it is inappropriate to consider the strength of any specific individual currencies, it is necessary to conduct a comprehensive analysis of currency pairs directly.

The best option for identifying this parameter is one specially designed for analysis andtrading technical tool - currency strength indicator. For many years of the financial market, experts and professionals have identified the natural characteristics of the movement between assets and their correlations. As a result, a variety of specialized tools are available for traders to determine the strength or weakness of currencies.

Types of indicators

Movement in the financial markets is due to many different components of the parameters. These could be:

- important economic or political news;

- events taking place in the world;

- speculative transactions on exchanges of major market participants and much more.

And also the movement is determined by the correlation between currencies. That is: the stronger/more expensive one currency, the weaker/cheaper the asset interconnected with it. To understand the weakness or strength of a currency in relation to another, special tools are used in trading.

Types of currency strength indicators:

- Bulls Power and Bears Power.

- Dollar and euro indicators that calculate their indices.

- Currency Power Meter.

- Indicator of the relative strength of currencies.

- Currency Slope Strength.

- Cruscotto and more.

All technical indicators have their own characteristics and characteristics. For example, one of the most popular tools among traders is the currency strength indicator for mt4 - Bulls Power and Bears Power. According to its parameters, it is very convenient and does not require special additionalsettings, and it is also easy to use and therefore is found on almost all marketplaces for trading by default.

Tool functions

The main function of this tool is to determine the strength or weakness of one currency against another asset. All currencies are interconnected and directly dependent.

Each trading currency asset consists of two components: the main/base currency and the quoted/dependent asset. For example, consider the Eurodollar pair, where the European currency is the main asset, and the US dollar is the currency dependent on it. Therefore, if the euro rises in price, the dollar will fall accordingly.

In addition, there is a correlation between currency pairs. There are two types of relationships in trading: direct and inverse correlations. Based on these regularities, special technical tools were developed, for example, such as an indicator of the strength of currencies. It helps traders identify the strength of one asset and the weakness of another.

These tools can be represented as a histogram, lines, scale, and even have non-standard solutions, such as a currency strength indicator in the form of hours.

Description of the tool for determining the strength of currencies

To understand how indicators that determine the strength or weakness of currencies work, you need to know their main characteristics, functions and purposes.

For an example, the article will consider the Bulls Power indicator andBear Power. This tool is presented as a histogram. If a trader analyzes charts and makes deals on the MetaTrader trading platform, then there is no need to specifically install it, since it is already there by default. The indicator displays the strength of "bulls" and "bears", and also by its parameters, you can determine the strength or weakness of one currency in relation to another asset in the traded pair.

Analysis of Bulls Power and Bears Power:

- If the Bulls Power parameters are high and the histogram bars are far up, then the base currency is stronger than the quoted asset.

- If Bears Power is lower and the histogram bars go down quite far, then the quoted currency is stronger than the underlying asset.

In the analysis of forecasting market movement, it is necessary to simultaneously take into account the indicators of the Bears Power and Bulls Power parameters. To understand which currency is stronger, you need to analyze both assets. The lower values one currency has, and its histogram bars are closer to zero, the weaker it is in relation to another asset.

The analysis of other indicators, which are presented in the form of lines or a scale, is similar.

Description of the indicator Closed cycle FI

In addition to the standard indicators for determining the strength and weakness of currencies, we can consider a cluster instrument - the Closed cycle FI currency strength indicator. With the help of this indicator and the clusteranalysis, the trader will be able to determine and calculate the strength of the currency he needs in relation to other assets.

This tool is based on cluster analysis of market movement forecasting, as well as correlation and other relationships between assets. It calculates the index of currencies, which is expressed in the number of points for a certain period of time.

The settings of this indicator are quite simple, you only need to set 2 parameters. By default, the instrument has the H4 timeframe and the number of bars for analysis - 6. If desired, you can increase the number of bars, as well as the time period, or vice versa, reduce it. On the chart, the indicator is displayed as a list on the left side, and does not interfere with trading at all.

Non-standard tool options

The original versions of indicators include non-standard solutions for determining the strength of currencies. In most cases, all technical tools have the form of a scale, lines, or are represented by histograms. However, non-standard currency strength indicators have been developed for trading in financial markets.

Their features include such characteristics as sound alerts or an unusual display of parameters that help visually more clearly determine the weakness and strength of currency assets. And technical indicators using alerts inform the trader about the parameters he needs in sound mode, for example, when the currency pair reaches a certain level or quote.

Application in trading

These types of indicators, as well as most other instruments, are not used separately in trading, but can form the basis of trading strategies. In most cases, they are used as filters to filter out false signals when opening a position.

Depending on the trader's goals, it is possible to analyze the market movement by their indicators and open orders for market weakness or strength. For example, if any asset shows its weakness, it means that another currency, which is paired with it, has more strength. Therefore, you need to open a position in the direction of a strong asset. For example, if the US dollar shows weakness in the Eurodollar pair, then you need to open an order to increase/growth of market quotes.

In closing

Many beginners choose trading strategies that use tools to determine the strength or weakness of the market. It is quite difficult even for professionals to choose and determine which currency strength indicator is better, since they all have their own characteristics and positive characteristics.

The advantages of such tools include the fact that their indicators are never redrawn, and the disadvantages are the delay, which is the scourge and lot of many technical indicators. Therefore, it is most expedient to use various variants of instruments in a trading strategy. It should be based on graphical constructions, technical indicators, as well as tools for filtering false market entry points and opening positions.

Recommended:

Currency system: types, elements, essence. Characteristics of the types of currency systems

What is the currency system. What types of currency systems are known today, how they are characterized

Determination of concrete strength: methods, equipment, GOST. Control and evaluation of concrete strength

When checking building structures, the determination of the strength of concrete is carried out to determine their state at the current time. Actual performance after the start of operation usually does not match the design parameters

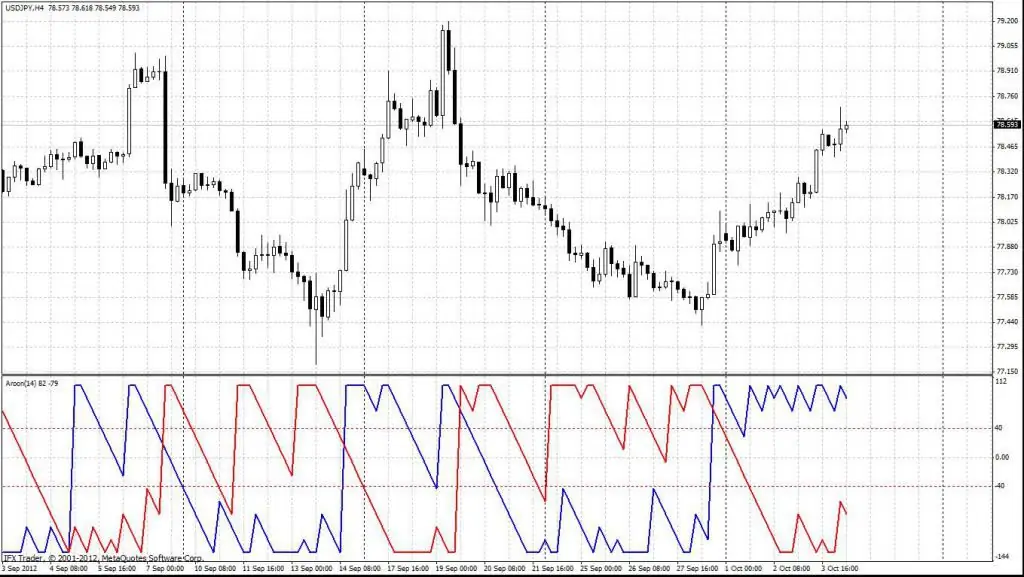

Indicator Aroon: description of the indicator, application in trading

The Aroon indicator is a great tool that every trader should have in their arsenal. It is a visual representation of the market movement that can be easily interpreted to make decisions according to price direction and momentum. You can also significantly increase the chances of a profitable trade if you build a trading technique around Aruna in combination with a breakout strategy or any other based on price movement

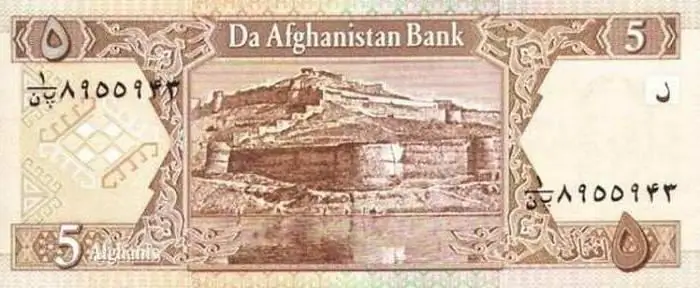

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article