2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Most large and small companies prefer to pay their employees wages to bank cards. This is done for many reasons, most of which can be combined under one concept - "convenience". A salary project is a program that allows you to organize such payments as simply as possible. In addition, it also allows you to receive certain bonuses in the process of its use by both the employer and the employee.

What is the essence of the concept?

A salary project is a special agreement between an organization and a banking institution that allows you to transfer wages to employees of an organization not directly in cash, but on a bank card. To do this, the bank issues a specialized salary card, to which funds will be credited.

Issuing a card, opening a special account, andalso, the maintenance of the entire project as a whole is carried out at the expense of the employer. Each banking institution offers its own conditions for such services. For example, the proposals of the banking organization "AK Bars": salary project and "Orion" (information system for automation and maintenance).

Due to the fact that there are a large number of different projects and specific products provided by credit institutions to customers, it makes sense to consider in more detail both the system itself as a whole and individual offers on the banking services market.

What is the employer for?

A company that connects to such a service has several goals at once. Key benefits for the organization through this service:

- The payroll project is a significant saving of time and money, as it allows you to reduce the cost of accounting, as well as abolish the cash desk, which is so necessary when paying salaries to employees in cash.

- Employee's earnings are completely anonymous.

- The project allows remote control.

- In some cases, with it, a company can receive acquiring services at reduced rates, which is especially important for trade enterprises.

- It happens that banking organizations provide additional bonuses to connected organizations in the form of discounts on cellular communications, insurance, and also on some office purchases.

Why does an employee need it

Employees of companies likeas a rule, they are also happy to join payroll projects, as individual users are also en titled to small bonuses:

- Employee, as a rule, can issue additional plastic cards linked to his account. They are designed for ease of use by family members.

- Some banks offer payroll project users services that require payment outside of such projects.

- For other services, a banking organization can provide special service conditions that will be much more profitable. This may affect not only the size of commissions, but sometimes such clients receive a higher interest on deposits and deposits or more convenient loans.

- Loy alty programs for salary projects often have much nicer conditions.

- From time to time, additional promotions may be arranged for holders of such cards.

How to connect a salary project in a bank

Most banks conduct connection according to a single algorithm in all payroll projects. This is primarily an agreement that an organization must conclude with a bank and organize an electronic exchange of documents. After that, the bank issues a set of cards for each employee connected to the project, which are registered in the company's accounting department.

After the need to pay wages, the accountant generates payrolls that are transferred to the bank, after which the banking organization transfers money to the cards of the connected project.

The cost of withdrawing cash varies greatly from bank to bank. For example, the AK Bars salary project allows you to withdraw money from any ATM of absolutely all banks in Russia without a commission, but the amount is limited to 50,000 Russian rubles. But such conditions will not be everywhere. In another bank, cash withdrawals are not limited, but you need to look for an ATM of a particular bank, and in other credit organizations you can withdraw money at separate payroll project rates.

What are the similarities of different systems

Most of these projects are basically similar to each other and are based on an agreement between the bank and the organization. As a rule, an enterprise opens a salary project in the same bank where its main financial assets are placed. This simplifies the interaction of accountants with finance. Further, the bank accepts money using a payment order, after which they are transferred in the required amount to employees on cards.

How do salary projects of different banks differ from each other

Each credit institution tries to make its offer the most attractive. Since any company prefers to keep its money in one bank, then by covering the salary part of the organization's finances, the bank can count on attention to its other products.

The most significant differences in salary projects show in the bonus program. Various banking organizations have loy alty programs at their disposal that the client can use. In the salary project"Alfa-bank" the user has the same opportunities as for ordinary cardholders, but in addition, there is an increased interest on the savings account and preferential rates for conversion.

Overview of the services of various banks

In order for a potential holder to better navigate the large number of offers on the market, it is necessary to consider in more detail the salary projects of the largest and most popular banks among people. Each of them has both its pluses and a certain number of minuses. Each client will decide for himself which of the offers is best.

VTB

The salary project "VTB-bank" selects for each organization individually. The financial institution does not offer uniform conditions for everyone, specific tariffs will depend on the contract, the number of employees and the size of the company. In total, it is possible to connect three service packages: "Individual", "Basic" and "Premium". An individual contract is concluded separately with each employee and is suitable for a user with an average salary of 10 thousand. The basic one suits the widest audience, requires more than 10 people in the state and is suitable even for those with an average salary of up to 10 thousand. The premium package is the most advanced, however, its cost requires an employee salary of at least 10 thousand and also from 10 people in the state.

Also, after the conclusion of the contract for the connection of the payroll project, VTB can install an ATM on the territory of the enterprise. This opportunityit is advisable to use in large enterprises with a large number of employees.

Alfa Bank

To connect a salary project in Alfa, you first need to apply for registration. You can do this by calling the phone number indicated on the website, after which you will need to come to the bank and draw up an agreement.

If the salary project was concluded without any additional requirements from the organization, then by default a free corporate tariff is connected, within which the issuance of gold and platinum cards is allowed.

All users connected to this system have the opportunity to use individual tariffs for card transactions, and the package of services required for using an Alfa-Bank card is provided completely free of charge in the salary project. At the same time, all loy alty program bonuses available to the bank on a specific card are also included for payroll clients. Each person can order the type of card that suits him personally and will be the most profitable.

Payroll projects of other banks

Of course, the largest bank in the country, Sberbank, also has its own salary project, which is aimed at the widest possible audience. However, despite the myth that this institution is the most profitable of all available, in reality its offer is not much different from others on the market: classic and premium cards, participation in the bank's loy alty program, the possibility of issuing cards with an individual design and other conditions.

A rather original solution is offered by "AKBars": the bank accompanies its offer with the Orion information system. The salary project in this system is convenient to control, and the interface is user-friendly. Also, a salary client, by connecting to this salary system, will be able to freely withdraw money from ATMs throughout Russia, albeit with limited amount.

How to connect an employee to a salary project?

No additional action is required on the part of the employee, he just needs to get his issued salary card at the office or at the bank branch and familiarize himself with the tariffs.

However, the enterprise needs not only to conclude an agreement with the bank, but also to organize the accounting of the salary project at the enterprise. To do this, data on an open project must be transferred to accountants so that they can set it up in 1C or another accounting program used by the organization. Therefore, the process of such a setting needs to be considered in a little more detail.

Accounting for a salary project in 1С

In all well-known software "1C: Enterprise" it is necessary to organize a separate accounting of funds paid using a salary project. Of course, you can receive earned money through the bank without participating in the project described above. However, if the enterprise has it, then accounting must be kept by setting it up in accounting documents.

To set up a salary project in "1C: ZUP" you need to open the menu item "Payroll projects" in the section"Payouts".

In the created card, enter the name of the organization and the bank with which the contract was concluded.

Above the item "Payroll projects" is "Entering personal accounts", where you can enter personal personal accounts of employees issued by the bank. However, this should be done only if electronic document management is not configured with the bank. Entering personal accounts in this case is made as simple as possible: after filling out the card header, you need to click on filling, after which the personal accounts of all employees of the enterprise will be entered.

Since one company can have several payroll projects, you need to select the one that will be considered the main one in the settings. This can be done in the "Accounting and payroll" tab. Subsequently, the accounting program will automatically select it by default.

Main myths about salary projects

The first myth is that in order to join such a project, you will need to open a current account. This is not so: most banks operate using an electronic registry, and there is no need to open a current account, which additionally saves the company time and money.

The second myth is a long process of changing the bank if necessary to change the conditions of the salary project. As a rule, most large banks manage to meet within a few weeks: they provide their employees for the speedy execution of all necessary papers.

The third myth concerns complexityaccounting of the salary project at the enterprise. As we could see above, setting up such a project in the software version is not difficult, and most of the data can be entered automatically.

The salary project is the most convenient method of paying salaries for both the company and employees. At the moment, most organizations recognize that the convenience of using this service more than covers the costs, and many employees prefer to use payroll cards, as they provide more favorable conditions and rates for the user than a regular debit card from the same bank. Therefore, the salary project, without exaggeration, is desirable for any Russian organization, especially medium and large businesses.

Recommended:

Municipal bonds: concept, types, yield, advantages and disadvantages

Government bodies are implementing economic policy aimed at improving the standard of living of citizens. Covering the deficit of finance intended for the implementation of state programs is carried out by attracting loans. One of the ways to fill local budgets is the sale of municipal bonds

Collective investments: concept, types and forms, advantages and disadvantages

Collective investment is a type of trust management with a low entry threshold that allows small investors to invest in the stock market, real estate market, precious metals and others, making a profit from investing their money. This is an investment of the joint capital of investors, which makes it possible to earn money by significantly increasing their capital

Compressor units: definition of the concept, advantages and disadvantages

Compressor units are used to operate pneumatic equipment. There are many types of models. They differ in design and parameters

Investments in production: concept, types, risks, advantages and disadvantages

Investment in production can be full or equity. They depend on the company chosen for investment and the features of its work. The article describes what types of productive investments exist, how to choose the right investment object, and what risks investors face

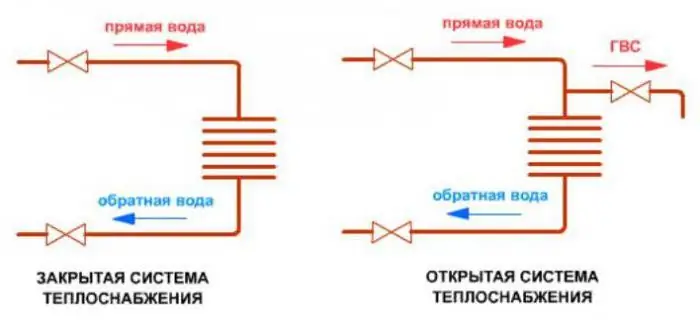

Closed and open heating system: features, disadvantages and advantages

At present, it is promising to introduce the technology of a closed heat supply system for consumers. Hot water supply allows you to improve the quality of the water supplied to the level of drinking water. Although new technologies are resource-saving and reduce air emissions, they require significant investment. Ways of implementation are at the expense of commercial and budgetary financing, competitions for investment projects and other events