2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Another noticeable relief for small businesses is reduced reporting forms. So the Ministry of Finance did this job for small businesses that craved lightweight forms: in August 2012, they finally received examples of how balance sheet items might look. They were also able to see the profit and loss statement of the "kids" with their own eyes.

The balance sheet items for management and commercial expenses have been crossed out, more precisely, they, together with the cost price, have merged into the general line “Expenses for ordinary activities”. As expected, everything related to PBU 18/02 has disappeared, since small businesses still do not apply it. Completely removed the reference section of form 2.

This “sequestration” for small businesses that needed it could have been done on their own before, but since samples have appeared, it’s a sin not to use them.

By the way, special regimes indicate the amount of unified agricultural tax, tax under the simplified tax system or UTII in the line "Income taxes - income" of the simplified income statement. If they use the regular form, then these taxes are reflected in the "Other" line.

On the other hand, what prevents us from making two versionsreporting? Simplified forms must be submitted to the IFTS and statistics, and ordinary forms to participants. It may seem that this is double work, but the reporting will get to the tax authorities as enlarged as possible. Consequently, they will have less opportunity to catch on to some alleged inconsistency with tax reporting when analyzing the company's balance sheet.

Take at least the line "Tangible non-current assets" of the balance sheet for small businesses. Go figure out what the amounts formed the total amount indicated in the line, and how much of it falls on fixed assets. And if the inspector does not know the accounting data on the OS and the necessary data to decipher the balance sheet item, he will have less reason to doubt the correctness of the calculation of the property tax base indicated in the declaration. More precisely, it’s not like that - he can doubt as much as he wants, but he has nothing to justify his doubts, and he will somehow be unable to scribble requests to you.

True, here one can object: in response, the inspection will send a demand to submit a transcript of any balance sheet item, run later, take it or send it by mail! It’s better to immediately show the cost of fixed assets in the balance sheet.

I agree, this approach also has the right to life. But, strictly speaking, according to the Tax Code of the Russian Federation, if the inspectors did not find errors in the declaration, they cannot demand anything from you within the framework of the office. This is the first. Second: no transcripts, analytical reports and other documents, the compilation of which is not provided for by law, inspectionalso not en titled to ask. This was confirmed by the Federal Tax Service itself in September 2012.

You can also ask yourself: "Isn't it an accounting violation that there are two versions of statements?" It can be answered with a counter question: "Where does it say that an organization is prohibited from developing forms in the context of accounting user groups?" Nowhere. All regulations, including Law N 402-FZ, refer to reporting in general, in an abstract way. Nothing prevents them from submitting simplified forms to the IFTS, and traditional ones for participants or investors, where all balance sheet items are deciphered in detail.

Recommended:

Net sales in the balance sheet: string. Sales volume in the balance sheet: how to calculate?

Annually, enterprises prepare financial statements. According to the data from the balance sheet and income statement, you can determine the effectiveness of the organization, as well as calculate the main planned indicators. Provided that the management and finance department understand the meaning of terms such as profit, revenue and sales in the balance sheet

General concepts of the balance sheet: assets, liabilities, balance sheet currency

The balance sheet contains important information for assessing the company's financial results. Each section of the asset, liability, as well as the balance sheet currency is necessary to calculate many financial indicators

Formula of net assets on the balance sheet. How to calculate net assets on a balance sheet: formula. Calculation of net assets of LLC: formula

Net assets are one of the key indicators of the financial and economic efficiency of a commercial firm. How is this calculation carried out?

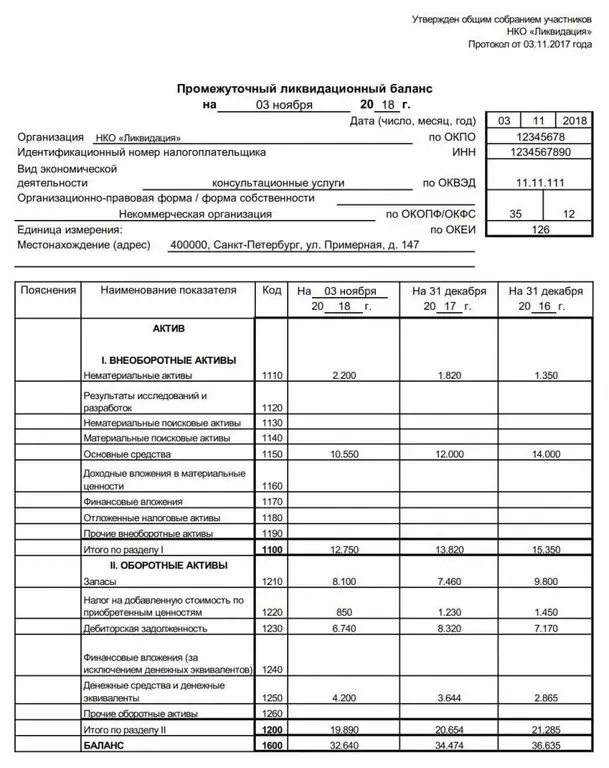

Liquidation balance sheet is Definition of the concept, approval, form and sample of filling out the liquidation balance sheet

The liquidation balance sheet is an important financial act drawn up during the closing of an organization. It can be intermediate or final. The article tells what is the purpose of these documents, what information is entered into them, as well as how and when they are approved and submitted to the Federal Tax Service

Balance: types of balance. Types of balance sheet

The balance sheet is the most important accounting document of an institution. What is it, what are the rules for filling it out, types and classification