2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Employees are sometimes paid various types of benefits. But is financial assistance taxable? The answer here will be in the affirmative. When providing their employees with certain financial support, employers must take into account that personal income tax, or income tax, may be withheld from this payment. But it is also important to know that there are types of financial assistance that are not taxed. What's this? What conditions are introduced by the tax legislation in the current year? This is what we will understand in the article.

Key Questions

Is financial aid taxable? It depends primarily on two conditions. It is important for the employer to know the answers to the questions:

- Which category of citizens is en titled to such financial assistance?

- What amounts of financial support are taxable?

Material support differs from all other incomes of citizens by the following characteristics:

- She does not depend on activityworker.

- It is independent of the performance of the employing organization.

- It is not affected by the cyclical nature of work.

In Russia, the grounds for receiving financial assistance can be divided into two groups - targeted and general.

Key terms

Before we specifically decide whether financial assistance is taxable, we will give definitions of the main concepts that appear in the article:

- Material assistance is cash payments to a citizen who is in dire need of such financial support. These funds are allocated by the employer to a specific employee. What could it be? Financial support from the union for working students. Financial assistance in case of serious illness of an employee. Benefit in the event of the death of a member of the employee's family. Financial assistance here is distinguished by another special characteristic: it is a lump sum payment.

- NDFL. The definition is in the decoding of the abbreviation. These are personal income taxes. Accordingly, material assistance is, in its own way, the income of a citizen. Financial compensation that is issued by organizations (including the employer) is income from which personal income tax must be paid.

But there are exceptions. So is financial assistance taxable? No, if its amount does not exceed 4000 rubles. From the financial support that is more tangible than this value, personal income tax must be paid according to the law of the Russian Federation.

To whom is it issued?

Is materialincome tax help? We determined that yes, but not in all cases. For example, if this is a payment of less than 4,000 rubles, then you do not need to pay tax.

But this is not the only exceptional condition. There are categories of citizens whose material support should not be subject to personal income tax. First of all, this:

- Victims of a terrorist takeover, attack, attack.

- Citizens affected by natural disasters as a result of an accident.

In addition, financial support will be exempted from taxation in the following cases:

- Paying damages in the event of certain harm to he alth.

- Cases where a citizen must incur unexpected monetary expenses. The reasons here are different - from marriage and the birth of children to the funeral of close relatives.

- Additional material support for large and low-income families.

At the same time, it is important to determine that in such situations the legislation does not force the employer to help his employee financially. This decision is up to the employer. And if he determines that cash assistance is needed, it is paid.

Legislative regulation

Is an employee's financial assistance taxable? The answer can be found in the legislative acts of the Russian Federation:

- St. 217, p. 8 of the Russian Tax Code. Circumstances under which financial assistance is / is not due.

- St. 224 NK. There is a limit to such financial support.

- St. 421, 422 of the Tax Code of the Russian Federation. Listed are the points at which insurance premiums are not paid in the case of financial assistance.

- St. 217 NK. Is financial assistance subject to income tax? This article answers this question. It explicitly lists the circumstances under which the allowance is not taxed. Also listed are benefits that are also not subject to taxation. It was also said about the maximum allowable tax-free limit of 4000 rubles.

- Ch. 23 NK. It lists which material payments are exempt from paying certain interest, taxes from them to the state treasury.

What is exempt?

Is financial assistance subject to income tax? As we have discussed, not in all cases. We list the types of financial support for employees who are completely exempt from taxation:

- Birth or adoption of a child/children. But it is important to note that the amount of the benefit here does not exceed 5,000 rubles.

- Death of a family member of a worker.

- Material assistance for disaster survivors.

- Financial support for citizens who have been subjected to a terrorist attack or suffered material damage due to a terrorist act committed by criminals.

What benefits does the government have to provide?

Is financial assistance subject to income tax? Yes, but it is important to remember the above-mentioned exceptional cases, of which there are relatively many.

Now consider when this kind of supportcitizens are provided not by their employers, but by the state:

- In cases where the age of the needy is over 60.

- If the needy, the victim is an officially unemployed citizen, is listed in the status of "unemployed".

- If a disabled relative is cared for in the family of the needy.

- If the needy is a low-income and/or large family.

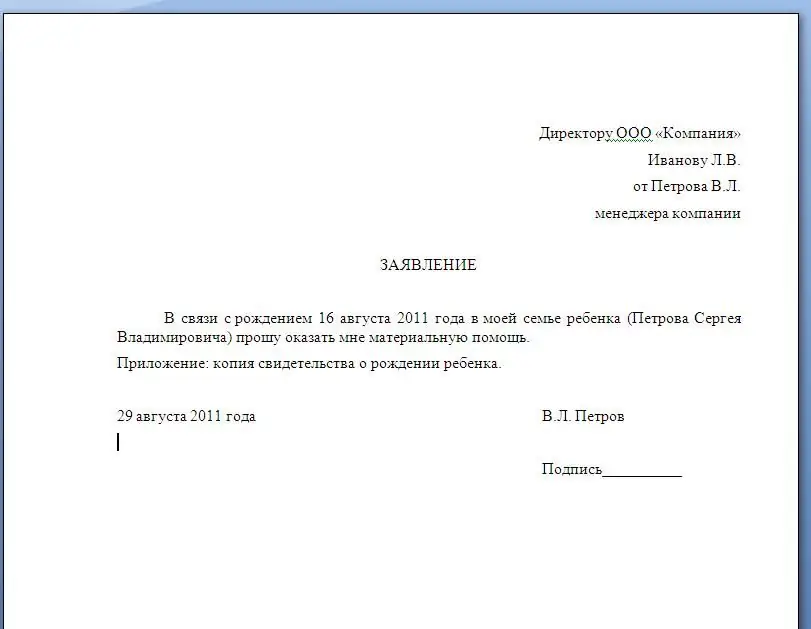

It is important to pay attention to such a moment. The employer provides material assistance to a needy employee only if the latter submits an appropriate application. Moreover, the employee must document the fact that he needs the benefit.

Financial support from the state

Is taxable vacation aid? Yes, if the amount of this payment exceeds 4 thousand rubles.

Now we will focus on obtaining financial support not on behalf of the employer, but on behalf of the state. Here you also need to start the case with writing a statement. Only on its basis will the question of providing a citizen with material state support begin to be de alt with. When compiling a document, you need to pay attention to the following:

- Unambiguously and clearly state the reason why you need this type of financial support.

- Attach documents to the application that certify the fact that you need financial assistance. For example, certificates confirming that anythe situation really took place.

With all prepared documents, then you should come to one of these government agencies:

- Department of social protection of the population of your locality.

- Local branch of the state FIU.

Please note that in this case, financial assistance will be a one-time, not periodic support. This applies to benefits from both the employer and the state.

Benefit decision

At the workplace, the citizen submits his application to the employer. The latter gets acquainted with the content of the document, the attached certificates. Based on this, he can decide on the appointment of material assistance - issue an order for the issuance of a certain amount of money.

If the application was submitted to the social security authorities or the Pension Fund, you should wait for the decision of the state structure within 7 working days. At this time, a commission will be created, which will issue a verdict on whether this citizen needs to be assigned financial support.

If the public authority has made a positive decision, the applicant is notified of this. He can then receive financial assistance from the state in the way indicated by him in the application:

- Withdraw this amount from your bank account (it must be indicated in the document).

- Get cash from a savings bank.

Amount of monetary support

Is employee benefits taxable? Yes, butnot in all cases, as we have established above.

What is the value of such financial assistance? Depends on the category of citizens to which the applicant belongs. And from the severity of his financial situation. At the same time, the Tax Code of the Russian Federation has the following restrictions:

- Aid cannot exceed 5 times the salary.

- The amount of financial support is calculated on the basis of the money spent by the citizen (this is judged by the documents attached to the application).

- If the amount of financial assistance is less than 4,000 rubles, it will not be taxed.

Types of support

In conclusion, consider what types of material assistance Russian citizens can apply for:

- To leave. An additional incentive that is voluntarily paid by the employer. But if the fact of the obligation of such compensation is indicated in the employment contract, then the employer must accrue it without options.

- To the award. Let us recall once again that all types of income of citizens that are not taxed are indicated in Art. 210 of the Tax Code of the Russian Federation. As for this financial assistance, it is exempt from personal income tax if it does not exceed 4 thousand rubles.

- For the burial of a close relative.

- For an employee's wedding.

- For an employee's anniversary.

- Under tragic circumstances. Severe illness of an employee, natural disasters, etc.

- Students. In case of unforeseen financial expenses, in case of damage, at the funeral of close relatives.

- Help former employees. If the employee is alreadyis a pensioner who has stepped over the 60-year threshold, such benefits are not taxed. In other cases, if the limits are exceeded, such income is subject to personal income tax.

Material assistance is a type of support for citizens on behalf of the employer or the state in special life circumstances. Such payments are considered income and, according to the tax code, are subject to personal income tax. However, there are a number of conditions under which financial assistance is exempt from this taxation.

Recommended:

Government assistance to small businesses. How to get government assistance for small businesses?

Today, many people are not satisfied with being hired, they want to be independent and get the maximum profit. One acceptable option is to open a small business. Of course, any business requires initial capital, and not always a novice businessman has the necessary amount on hand. In this case, help from the state to small businesses is useful. How to get it and how realistic it is, read in the article

Benefits when buying an apartment: types of benefits, government assistance, tax calculation and legal advice

The statistics in our country are disappointing: every second Russian has problems with housing. Some people save half their lives, others take out mortgages, others get in line for social programs. But people in any category will not forego benefits at the time of the transaction because they want to save money. So what are benefits and who do they apply to?

What is financial grant assistance. Financial assistance free of charge from the founder

Property owned by an LLC and its founders exists as two separate categories. The company cannot rely on the money of its members. Nevertheless, the owner has the opportunity to assist the company in increasing working capital. You can arrange it in different ways

Material assistance to an employee: payment procedure, taxation and accounting. How to arrange financial assistance for an employee?

Material assistance to an employee can be provided by the employer in the form of cash payments or in kind. Sometimes it is issued to both former employees and persons who do not work at the enterprise

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer