2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

What is the main purpose of budgeting? Why is this process taking place? Why is it needed? What tasks are being performed? What is the essence of this process? How is the overall system structured? These, as well as a number of other questions, will be answered within the framework of the article.

Introduction

Budgeting is a tool to change the activities of the enterprise. What is this process? He is in charge of managing the financial and economic condition and activities of the enterprise. This is done through the system of budgetary management, abbreviated - SBU. Its importance is often underestimated. And in vain. But let's get back to this. With careful preparation, budgeting goals are achieved. The stages of budget development include planning, accounting, analysis and control of the state of the enterprise. The main object of influence is the ongoing activity. Thanks to budgeting, its main features are changing. For example, it is typical to delegate responsibility to process subjects in an enterprise.

Goals and objectives

Budgeting should work to improve the efficiency of the expanded reproduction of capital in the enterprise. The commercial structure is considered as an object of the process. This is the main goal. Budgeting is a complex process that requires a number of tasks to be completed successfully. These are:

- Definition of objects and subjects.

- Development of a classifier of articles, their relationship with the factors of capital reproduction, breakdown into direct/overhead and constant/variables.

- Determination of the financial structure (if necessary, together with the project and process).

- Development of regulations for the approval and subsequent cash payments.

- Identification of capital reproduction factors and establishing their relationship with budget components.

- Development of a classifier of articles according to the balance sheet.

- Development of management accounting policies.

- Development of regulations affecting the creation, control, adjustment and analysis of enterprise budgets during annual, quarterly, monthly and weekly planning.

- Automation of the SBU.

- Development of forms of budgets for objects.

In conclusion, the preparation of the initial balance and the subsequent launch of the SBU follows.

Organizational moments

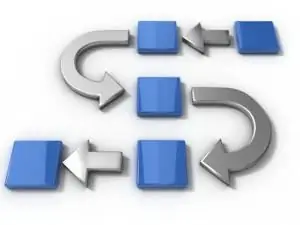

Achieving the goal of the budgeting process is difficult if there is no order. The organization helps a lot in achieving the necessary conditions. Briefly, thenthe following steps should be highlighted:

- Staging. The provisions of the budget management system are being developed.

- Introduction. The activity of the enterprise is changing through the implementation of the previously developed provisions of the SBU. At the same time, it is necessary to distinguish between formal directive implementation and practical creation, when the system becomes an integral element of the employees' activity process.

- Automation. This stage is carried out in parallel with the implementation. It represents the installation, configuration and start of operation of an automated budget management system.

Using the software package

The goal and objectives of budgeting are much easier to achieve if new technologies are used. Let's take a look at what the most popular options offer:

- Programs 1C. Their main task is the automation of accounting. But the complex can also be used in solving problems with budget management. Although it should be noted that settings must be made in order to be able to use, in addition, there are specific differences compared to accounting. Although, to be honest, it is better to recognize the 1C platform as the standard for budgeting automation.

- Intalev programs. Popular developments that attract not only with a good product, but also with well-developed methodological guides and books that allow you to gain a theoretical understanding of the system and facilitate its configuration. In addition, you can exploit the elements associated with management accounting in budgeting within the framework ofone complex. True, there are also disadvantages. For example, there is no standard convenient procedure for importing data, and there is no built-in economic and mathematical subsystem. In other words, there are no tools for optimization.

- Cube Expert. This program provides very flexible options for setting up the budget system of the enterprise. Of particular note is the convenient procedure for importing data from various accounting systems, while setting them up on the fly. Although there is still no subsystem of economic and mathematical modeling.

- MS Excel. A classic present on almost every computer. With the introduction of the PowerView and PowerPivot tools in the 2013 version, this tool can be used for automation beyond the entry level.

There are other software options used by organizations.

About examples

The purpose of budgeting is to increase efficiency. How does it manifest itself? Consider the situation with a banking institution. Budgeting in this case can first of all be characterized by a specific cycle of capital reproduction. This situation leads to the emergence of areas of activity that are unusual from the classical point of view. As a result, value is created and redistributed within the bank.

Risk management plays a special role in accomplishing tasks and achieving goals. Thus, bank optimization should take into account not only the budget, but also potentially dangerous moments in the ongoingactivities (non-repayment of loans). Budgeting is also closely related to costing. After all, this process allows you to find out the cost of a particular product, depending on the organizational and technological decisions made. Costing is useful for budget departments, projects, products, and processes. But do not forget about financial planning. It is also of interest to the SBU. The budget management system can be seen as a financial planning tool.

But one should not think that this is the end of the matter. Budget management is not limited to serving financial planning. It is precisely the tool with which you can calculate the state in the future. At the same time, the proposed actions relate not so much to finance as to the economy. The SBU is a tool that allows you to implement calculated plans by influencing the activities of people who work at the enterprise.

About communication with other systems

It is impossible to talk about successfully achieved budgeting goals at an enterprise if work is carried out only with a separate direction. What should you pay attention to? The essence and goals of budgeting require paramount attention to the system of motivation and development of personnel. It is necessary to achieve the responsibility of the participants in the process. The best way to do this is through a system of motivation and staff development.

Secondly, attention should be paid to the possibilities of automation. This is due to the fact thatfull budgeting is very cumbersome. And its implementation without automation will turn into a very costly business.

Third, it must be remembered that increased responsibility must be accompanied by delegation of authority. It is necessary to clearly draw the whole system, to strive for linkage between various positions and people. All this should be implemented within the process management system. And fourthly, it must be remembered that the enterprise is not just interested in creating budgets. They should not exist simply to be and for their own sake. Budgets have a specific purpose - to optimize performance. To obtain useful information, and not just shift papers, it is necessary to use reliable data in economic and mathematical models, and then make the necessary management decisions.

It should also be remembered that the goals of the budgeting system will be achieved better if operational-tactical tasks are connected with strategic leadership. If it is possible to realize a close relationship between various elements, then for optimal development there will be only one step left to take - to create a unified enterprise development management system.

How does change manifest itself?

The SBU is actively using the mechanism of delegation of responsibility and authority. That's just the question arises - to whom? Attention must be paid not only and even not so much to the top management as to the heads of departments and below. Even individual workers do not need to be bypassedattention. How is it implemented? Organizational changes at the directorate level are often implemented in the form of bonus payments, partnerships, participation in the ownership of the enterprise through shares / options. For ordinary workers, the approach is different. In this case, the development and implementation of a motivation system, the issuance of bonuses, and, in some cases, participation in profits are expected. The SBU directively begins to act at the moment of signing the corresponding order. But its preparation, automation and other bureaucratic moments before use take a lot of time.

Real implementation

It is not enough just to know the essence, purpose and objectives of budgeting. In reality, it will be possible to talk about implementation when this approach enters into living practice and will affect the activities of the organization on a daily basis. This is possible when changing the culture of work and management of the organization. In fact, elements of self-government are being introduced. That is why it is necessary to delegate authority and responsibility.

Let's look at the example of the financial service. It carried out directive planning and performed many functions. But as the enterprise grew and the volume of work, it was decided to move on to budget management. In this case, the functions of coordination, consolidation, training, analysis and control of indicators remain with the financial service. But the planning rests with the employees. At the same time, the principles of work of people in the company are changing. Horizontal responsibility will be strengthened, the relationship between employees will improve due to the need forinteraction and mutual coordination.

Real implementation involves step-by-step planning, starting with the owner. They challenge top management. Then comes the turn of process responsibility centers (sales, production, advertising, and so on). This creates opportunities for the manifestation of initiative on the part of both managers and employees. It should be noted that the actual implementation is usually delayed for several months, and maybe even for a year.

What are the drawbacks in this case?

Alas, you can't do without negativity. Interestingly, the strengths are also a vulnerability at the same time. Thus, the delegation of responsibility is typical for the SBU. This presupposes the existence of the necessary competence and authority. And because of this, problems often arise. After all, when delegating authority with the help of an order, it is impossible to transfer or make a person competent. This property is not gained or lost in this way. Either the subject has competence or it doesn't.

If you give opportunities to a person who does not meet the responsibilities, then this will negatively affect the results of activities. The person to whom responsibilities are delegated must be competent. This implies the presence of economic literacy, initiative, responsibility. If at least one of the listed components is missing, then it makes no sense to give the subject additional opportunities within the framework of the budget management system. Because of this, it is not uncommon for the SBU to be implemented not in full or not with the maximum possibleefficiency.

In closing

So the concept, goals and objectives of budgeting are considered. And finally, you can touch on all sorts of manipulations that can be carried out with him. The first is a budgeting overhaul. It is often easier to do something from scratch than to change existing developments. This fully applies to the SBU. But these are the most extreme measures. Better budgeting is more desirable. This refers to the changes that are necessary to increase the capabilities of the SBU. Improvement is characterized by the elimination of shortcomings and mistakes that were made earlier when creating the organization. New functions may also be introduced, the need for which arises due to a certain change in the activity of the enterprise. Improvements also include software updates. In general, radically new aspects are being introduced. But the SBU itself is not being redesigned. And the last is the modernization of budgeting. This is done to increase the capabilities of the system. All in all, it looks like an improvement. Only when changes are made, radically new aspects do not appear.

Recommended:

Tasks and goals of management accounting. Management Accounting and Budgeting Courses

Management accounting is always focused on determining the cost of products / services and company costs. At the same time, each enterprise independently determines how information will be processed within the framework of a particular production. If accounting is used correctly, then managers will be able to determine the break-even points and budget correctly

Project budgeting. Types and purpose of the budget. Project stage

Project budgeting should be understood as the determination of the cost of those works that are implemented within a certain scheme. In addition, we are talking about the process of formation on this basis of the budget, which contains the established distribution of costs by items and cost centers, types of work, by the time of their implementation or other positions

Insurance: essence, functions, forms, concept of insurance and types of insurance. The concept and types of social insurance

Today, insurance plays an important role in all spheres of life of citizens. The concept, essence, types of such relations are diverse, since the conditions and content of the contract directly depend on its object and parties

Category management: concept, basics, essence and process

Simple and accessible about category management. How to organize the space of your store to increase sales? What is strategy and tactics in assortment management? What is the essence of category management and what is its significance for modern retailing?

General concept of the process: essence, definition, characteristics and types

A process is a set of actions that complement each other in order to achieve a result. This concept has a broad definition, and the term "process" is found in almost any science