2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

International monetary and credit relations - the total system of economic relations that arises between countries in the process of acquiring various goods and providing services. The entire payment and settlement system that arises between suppliers, consumers, importers and exporters across countries is directly influenced by monetary relations.

International monetary and credit relations have come a long way in their development. It was in ancient Greece and Rome that the commodity exchange and bill of exchange system first appeared, which later spread throughout Western Europe.

Further development of international monetary and financial relations received in the banking system. This happened when feudalism was replaced by the capitalist system. Creation of a global world market, due to a complex system of interconnection of production forces and relations, deepening and division of labor processes, as well as their complete mechanization and robotization, the formation of a global system of economic relations, the process of globalization and internationalizationall economic relations - it is this combination of factors that has a huge impact on international monetary and credit relations.

When a country needs to purchase certain products that it does not produce itself, it becomes necessary to seek assistance from the power that is the manufacturer of this product. At the same time, the question reasonably arises - how to pay for this product if the buyer's currency is not quoted on the seller's market, and the buyer does not have the supplier's currency in stock? It was this need to exchange their own means of payment that led to the formation of the foreign exchange market. This mechanism was the basis for the emergence of such a category as international monetary and credit relations.

In such an economic mechanism as the monetary system, there are many important elements, the main of which is the exchange rate. This component is necessary for conducting foreign exchange transactions in the implementation of trading activities, in the circulation of capital and loans. It is also worth noting that the exchange rate is an invariable component in the process of comparing world and national markets, as well as using various economic indicators reflected in national or foreign currency. In addition, it is this element that characterizes international credit relations and is used to revalue the accounts of various companies and banking organizations. This process takes place withgenerally accepted international legal tender.

International loans are directly involved in every stage of capital turnover:

1. the first stage is the transformation of the total capital of funds into its production analogue. This happens through the acquisition of equipment produced outside the country, a variety of raw materials, energy and, of course, fuel;

2. the second stage is sometimes the release of loans for work in progress;

3. the final stage is the sale of manufactured goods on the world market.

There are many organizations that regulate international monetary and credit relations. The most important of them is the IMF. Its name stands for International Monetary Fund. A huge number of other organizations operate on the territory of states, one way or another connected with the activities of countries on the world market.

Recommended:

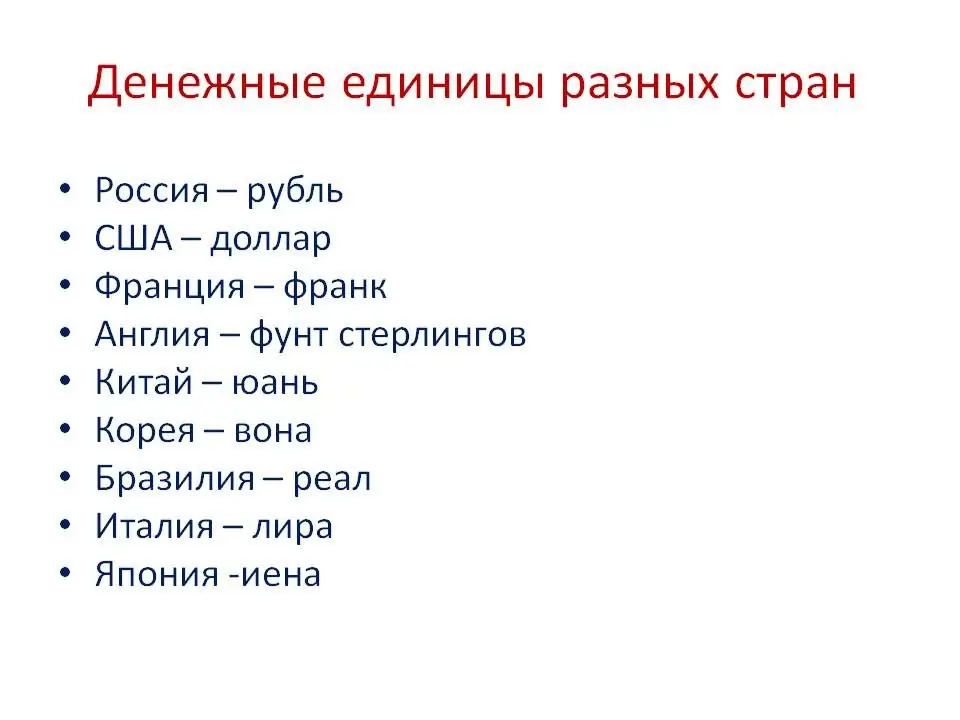

Monetary unit - what is it? Definition of the monetary unit and its types

The monetary unit serves as a measure for expressing the value of goods, services, labor. On the other hand, each monetary unit in different countries has its own measure of measurement. Historically, each state sets its own unit of money

Public relations (speci alty). Advertising and public relations

The last decades were marked not only by a change in the political system and lifestyle of people, but also by the emergence of completely new professions that no one had even heard of before. In the West, many of these speci alties have already existed for a long time, but they came to us only with the beginning of market relations in the country's economy

Faculty of International Relations: professions. What speci alty do you get after graduating from the faculty?

Sometimes such romance and mystery emanates from the sphere of human employment… For example, international relations. Professions related to diplomacy are social events, negotiations, constant business trips abroad… This is how it seems to a person who is far from this speci alty

Evolution of world monetary systems briefly. Stages of evolution of the world monetary system

The evolution of world currency systems includes 4 stages of development. The gradual and systematic transition from the "gold standard" to monetary relations became the basis for the development of the modern world economy

Lev Geykhman's biography: the gray eminence of Russia from international monetary funds

Recently, the Internet community is increasingly interested in the life of Lev Geykhman, whose biography is hidden from a wide audience by a veil of secrecy. What do we know about this powerful man? Lev Geykhman - the young inventor of Lev Geykhman biography For the first time, the name of Lev Isaakovich Geykhman appears in the Bulletin of the State Committee of the Soviet Union at number 13 for 1991. It reports that the young talent received a patent for an invention number 1639593. But then he invented