2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

One of the classic and beloved ways to store your savings is bank deposits. Despite the relatively low yield, this option is chosen much more often than, say, investing in a business or trading on stock exchanges. Commercial banks are now advertising a wide variety of deposit offers, which are called beautifully, "packaging" the usual standard agreement in a bright attractive wrapper.

To figure out what is really a good and profitable offer, and what just seems like a profitable and profitable option, let's look at what types of deposits are now on the financial services market.

Main types of deposits, their characteristics and conditions

According to the duration of the contract, bank deposits are divided into term and termless. In the first case, the client grants the financial institution the right to use its funds for a certain period of time - from 3 months to 2-3 years. As a rule, the longer the term of the deposit, the higher the interest rate on it. Types of demand deposits are convenient in that you can withdraw the required amount at any time or withdraw the deposit in full, but the income from them is small. Moreover, commission costsbanking services sometimes reduce it to almost zero. It's a way to keep money until the right moment without worrying about the cash being stolen.

It is also possible to deposit in the form of a deposit line, which can be replenished at any time, with a limited or unlimited maximum amount. Such types of deposits are often called “Piggy Banks” and words similar in context, because in this way it is convenient to make savings for some big purchase or just for the future.

The types of bank deposits differ in the currency in which they are accepted. Some banks, for example, Sberbank, offer almost all types of their deposits in different currencies, and there are also multi-currency deposits. Depending on its choice, the interest rate also changes - the more reliable and stable the currency, the lower it is.

As for the payment of interest, there are also options: paying them monthly or at the end of the contract, or capitalization (adding to the principal amount of the deposit) every month or quarter. It is convenient when you have the opportunity to choose, or to report the interest yourself through Internet banking. This service is offered by many leading Russian banks.

These are almost all classic types of deposits, their combinations and variations give rise to a whole sea of special offers from financial institutions. The conditionally high income from deposits can be compared with the level of risk for the client: the larger the amount of investments and the term of the contract, the higher the rate. Increasing profits are also such opportunities,as capitalization and replenishment of the account.

There are more exclusive offers from financial institutions. These are the so-called indexed deposits, the profit from which is tied to a certain factor, for example, the price of precious metals or oil, an exchange indicator, etc. They already belong to the category of investment, and have their own characteristics and nuances.

Important to remember

When choosing the type of deposit, you need to pay attention not only to the conditions, but also to additional payments, commissions and fines. Different types of deposits have their own nuances and features. For example, in case of early termination of the contract, there may be a recalculation of interest for the entire period of its validity, and a separate fee may be charged for replenishment of the account, withdrawal of interest and other banking services. It is also worth noting that only those deposits whose amount does not exceed 700,000 rubles are insured.

Recommended:

Dutch technology for growing strawberries all year round: how to use it correctly?

Many gardeners are interested in the question of how strawberries are grown using Dutch technology. This method of cultivating the fetus is today considered the most progressive. It allows you to get a quality crop all year round

Features of hydraulic oils. How to choose them correctly?

An article about what characteristics different brands of hydraulic oils can have. What is important to know when choosing the appropriate composition for a particular equipment? Should manufacturers be listened to when they make recommendations and set their own requirements?

Cold calls - what is it and how to use this tool correctly?

Marketing is ubiquitous. Wherever we go, whatever we do, we are both consumers and sellers. Along with advertising, there are active ways to promote goods and services, such as cold calls. What is it and how to use this tool in marketing?

Frozen deposits of Sberbank. Can deposits be frozen? How secure are deposits in Russian banks?

The frozen deposits of Sberbank in 1991 are systematically paid out by a financial institution. The bank does not refuse from its obligations, and guarantees the complete safety of their funds to new depositors

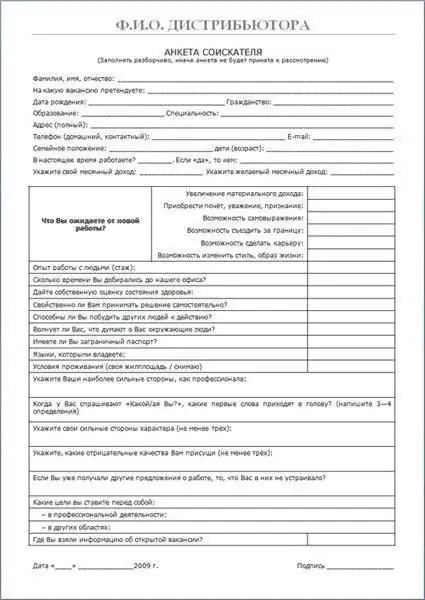

Sample questionnaires for employment: how to fill them out correctly

Let's look at sample job application forms. What blocks does the document consist of, how to fill it out correctly? What information can be requested in the questionnaire? We will talk about all this in the article