2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

Plastic cards are a convenient replacement for cash. They are compact, safe and easy to use. But the already familiar mechanism for paying for goods with a plastic card rarely makes people think about what processes take place during the contact of a bank card with a payment terminal. Therefore, today we will talk about processing systems.

Term

To describe the whole essence of this phenomenon in an accessible way, you need to introduce a few terms. Processing is the process of processing information used when making a payment using a bank plastic card. It follows from this that a processing system is a system that provides information processing when conducting transactions using plastic cards.

Processing schemes always contain three mandatory participants:

- Acquiring organization responsible for settlements.

- Issuing bank issuingpayment plastic cards.

- A payment system that acts as an intermediary between the acquirer and the issuing bank.

Companies that provide services to provide and maintain the software required for processing are called "processing centers". They are also one of the links in the acquiring system.

The main goal of the processing system is to ensure constant and uninterrupted communication between all participants in the processing scheme. Otherwise, making payments using bank plastic cards will become impossible.

Acquiring system: what is checked during settlements?

In a few seconds, which are needed to complete a payment transaction, the acquirer checks the data, without which it is impossible to complete the transaction. Among them:

- The capacity of a plastic card.

- Amount of funds available for withdrawal.

- Status of the issuing bank.

In addition, it is the processing system that is responsible for the security of payments, which means the safety and confidentiality of transactions, as well as protection from fraudsters.

Processing system: organizational features

From the above, it is easy to understand that processing is a rather complicated process that requires a responsible and serious approach to its organization. The processing system must promptly track transactions between plastic card holders, issuing banks, payment gateways, and so on. For this, autonomouspayment processing systems that are most common in the e-commerce industry.

Organization of processing includes:

- Checking the status of plastic cards (balance, status, etc.).

- Transmitting information about the transaction request to the issuing bank.

- Processing the bank details protocol.

- Creating and maintaining a database.

- Formation of reports and their transfer to the issuing bank (performed daily).

- Processing stop lists and bringing information to counterparties.

In addition to this, processing centers can issue plastic cards, personalize and protect them.

Types of processing systems

Processing systems are conditionally divided into "white", "grey" and "black". Their status depends on the legality of the operations:

- "White". Processing systems before cooperation must check the legal status of the issuing company and the legality of the transactions. "White" processors work exclusively with proven companies that regularly pay all local and international taxes. As a rule, "white" international precession systems are residents of the European Union or the United States of America.

- "The Grays". "Gray" processing centers can serve not only legal businesses, but also suspicious companies that are in a high-risk area. However, if the legality of the company's activities is in question, "gray" processing canrefuse service. Therefore, you need to be able to negotiate with them in order to get the best value for money services. Most often, "gray" processing centers are residents of Asian countries.

- "Black". This type includes all processors that cooperate with any business, even openly illegal ones. Naturally, it is rather difficult to find representatives of these companies, therefore, in order to conclude a service agreement, customers have to look for a way out to the right person. Most often, "black" processing centers are represented by Chinese banks or odious offshore companies.

Safety

The main security threat to any bank's processing system is hackers. Their methods of influence are becoming more aggressive each time, so an integral part of any processing center is the security service.

In 2006, a key security standard for plastic cards was developed, which must be obeyed by absolutely all participants in the processing system - PCI DSS. More than 600 qualified specialists of various fields took part in its development. That is why this standard is relevant to this day.

PCI DSS Security Standard Commitments

Based on the text of the document, clear obligations are imposed on all participants in the processing scheme that make remote payments using a plastic card:

- For issuing banks. A legal entity engaged in the issuance of plastic cards mustensure their security from unauthorized access. Mandatory conditions include: applying a chip, placing a security code (CVC2, CVV2, etc.), assigning a magnetic track with the name of the owner, protecting the card with a pin code, and the 3D-Secure function. In addition, the issuing bank must store the data on the owner of the plastic card only in encrypted form.

- For processing centers. To participate in financial activities, processing centers must obtain an international certificate for compliance with security requirements, as well as undergo mandatory re-certification during the period of their activities. In addition, the company's employees are checked by the federal security service when they are hired, which constantly monitors their subsequent participation in the processing scheme.

Processing systems in Russia

Previously, banks mainly used only international processing for transactions. Now the trend is changing. They prefer to create their own processing centers. This allows them to free themselves from dependence on third-party companies, as well as independently introduce new technologies. And this applies not only to banks. Large firms are also working on the creation of processing systems. For example, on the secure.sirena-travel.ru website, the processing system used to make a payment is the result of development based on Sirena-Travel solutions.

But either wayotherwise, the use of such payment systems as Visa or MasterCard obliges banks to use foreign international processing systems. A vivid example of such cooperation is Sberbank and Way4 processing system.

The main disadvantage of domestic services is locality. Each bank develops processing exclusively for personal use, which, in turn, does not allow combining all payment schemes into a single system.

The benefits of creating your own processing system

Sometimes it is financially unprofitable for banks to create personal processing. But for some reason, they still invest in it. Most often this is due to the following benefits:

- Reducing the cost of servicing electronic payments.

- Independence from third parties.

- Fast adoption of new technologies and features.

- Reducing the risks of transferring data to a third party.

To date, the largest developer of card processing systems in Russia is the United Credit Cards Company, which services about 20% of the transaction turnover. More than 90 domestic and foreign banks cooperate with it, stimulating the expansion and improvement of the quality of services provided.

Recommended:

Hydraulic system: calculation, scheme, device. Types of hydraulic systems. Repair. Hydraulic and pneumatic systems

The hydraulic system is a special device that works on the principle of a liquid lever. Such units are used in the braking systems of cars, in loading and unloading, agricultural machinery and even in the aircraft industry

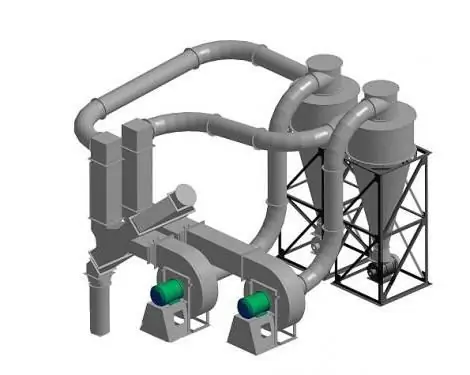

Aspiration systems: calculation, installation. Production of aspiration systems

Aspiration systems are systems that are designed to purify the air. The use of these installations is mandatory at all industrial enterprises that are characterized by harmful emissions into the atmosphere

Meat: processing. Equipment for meat and poultry processing. Production, storage and processing of meat

Information of state statistics show that the volume of meat, milk and poultry consumed by the population has significantly decreased in recent years. This is caused not only by the pricing policy of manufacturers, but also by the banal shortage of these products, the required volumes of which simply do not have time to produce. But meat, the processing of which is an extremely profitable business, is very important for human he alth

Visa and Mastercard systems in Russia. Description of Visa and Mastercard payment systems

Payment system - a commonality of methods and tools used for money transfers, settlements and regulation of debt obligations between participants in economic turnover. In many countries, they differ significantly from each other due to the diverse provisions in the levels of economic development and the characteristics of banking legislation

Corporate systems - enterprise management systems. Basic Models

The article discusses the concepts of "corporate enterprise management systems" and "corporate project management system". In addition, the basic models of CPMS are described