2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

Corporate governance is a system of the highest level of management of a joint-stock company. In 1932, in the works of Burley A. and Minza G., for the first time, the following questions were considered and answered:

- How to separate ownership from management?

- How to separate control from ownership?

As a result, a new layer of professional managers emerged and the stock market developed.

Corporate systems - enterprise management systems that are aimed at the implementation of specific functions. First, they are designed to regulate the interactions between managers and owners of companies. Secondly, through management systems, the goals of all stakeholders are aligned. This ensures the efficient functioning of the organization.

Depending on the directions and goals of the corporate governance system, there are several basic models. Let's describe the main ones.

American model

American corporate systems - control systems thatare typical for the USA, New Zealand, Canada, Australia and Great Britain. This model works subject to the following laws:

- market mechanisms of corporate control or external control over the company's management are applied;

- shareholder interests are supported by a significant number of small investors who are isolated from each other;

- the role of the stock market is increasing.

German model

German corporate systems - management systems that are based more on the use of internal methods. This model is popular in Central Europe, Scandinavian countries, less common in France and Belgium. Within its framework, the development of corporate management systems is carried out in the form of self-control methods.

This model works subject to the following laws:

- the main principle is social interaction, when any interested party (managers, auctioneers, banks, public organizations) has the opportunity to make a joint decision;

- weak focus on shareholder value in management and equity markets.

Corporate enterprise management systems, which are based on the German model, contribute to the company itself being able to control results and competitiveness.

The selected models are two opposite systems. Between them, there are currently a large number of national options that are put intoas a foundation, the predominant dominance of one or another system.

Japanese model

This system was formed in the post-war years on the basis of financial and industrial groups. The principles on which it relies are:

- model completely closed;

- relies on full bank control.

Given the highlighted features of its functioning, little attention is paid to the problem of control of managers.

Family model

Family corporate systems - management systems in which management is carried out by members of the same family. This model is common in all countries.

The family model differs from others by the presence of a pyramid structure. Shareholders are also often involved. But this is done in order to get additional capital. If, of course, there is a need for this. Shareholders generally do not receive a majority vote. Although the family pools its capital with others and shares the risks with them, the control is entirely hers. The main tools to help achieve this are:

- presence of a pyramidal group structure;

- cross shareholding;

- Application of dual stock class.

Corporate governance model in Russia

This system in our country is only being formed and does not adhere to any of the forms outlined above. The basic principle is thatthe principle of separation of ownership and control rights is not recognized in the domestic system. Business development in the future will be directed to other models of corporate governance.

Consequently, the choice of the base model will depend on the following features:

- national characteristics of a particular country and its economy;

- tasks facing the board of directors;

- basic shareholder rights protection mechanism.

Corporate project management system

In order to improve the efficiency of planning and management, company managers are recommended to develop and implement CPMS. This system is a complex that includes methodological, organizational, software, technical and information tools.

To create it, you need the following components:

- regulatory and methodological support (standard);

- technical and information support;

- organizational and staffing.

CPMS will allow managers to:

- create an optimal portfolio of projects focused on the strategic objectives of the organization;

- analyze the implementation of the project portfolio, correcting existing deviations;

- get an objective picture of project progress;

- oversee the process of achieving the strategy by coordinating the use of company resources, timelines, budgets and the overall flow of the project;

- carry out regular auditsactivities of the company and take timely corrective action.

Recommended:

Porter's strategies: basic strategies, basic principles, features

Michael Porter is a renowned economist, consultant, researcher, teacher, lecturer and author of numerous books. who developed their own competition strategies. They take into account the size of the market and features of competitive advantages. These strategies are detailed in the article

Corporate websites: creation, development, design, promotion. How to create a corporate website?

What do corporate websites mean? When do they become necessary? This article will discuss the main nuances that accompany the development of such projects

Corporate lawyer: duties. Corporate Lawyer Job Description

This article discusses the position of "corporate lawyer", what duties are assigned to a person in this profession, which is included in the range of his competencies. In addition, at the end it will be considered what must be indicated in the resume in order to draw the attention of a potential employer to your candidacy

Corporate client. Sberbank for corporate clients. MTS for corporate clients

Each attracted large corporate client is considered an achievement for banks, insurance companies, telecom operators. For him, they offer preferential terms, special programs, bonuses for constant service, trying to attract and subsequently keep him with all his might

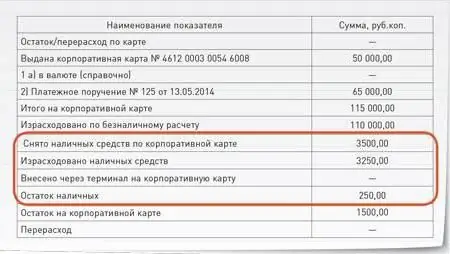

Corporate card report: example. Accounting for a corporate bank card

Accounting for corporate cards is quite simple. Experienced accountants, as a rule, do not have any problems recording transactions. Difficulties may arise when compiling a report on a corporate card by an employee to whom it was issued