2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

How to lend money right? This question worries many people. Some people just want to help their friends and relatives, but they are afraid that after that they will never see their money again. As in the good old saying: “If you want to lose a friend, lend him.”

Others look for a certain benefit in this and borrow at interest, turning into a kind of microfinance institution. But if the latter are protected by all sorts of federal laws, then citizens-lenders often simply "gift" their savings. We'll talk about how to lend money correctly.

The main rule is that a written contract is mandatory

Any amount over 1 thousand rubles must be accompanied by contracts in writing.

This is an obligation for an individual according to the Civil CodeRF. For legal entities, a different law - any amount is drawn up by contract. Therefore, the first rule of how to properly lend money is to conclude a written agreement.

Lender or lender?

Under the contract, the borrower will be called the borrower, and the giver will be called the lender. Not a lender. It is important. With such a wording, problems may arise in court with the lender himself. The defendant, with a competent legal position, can simply annul the contract, citing the fact that an individual cannot be a creditor.

But, as they say, "words cannot be sewn into deeds." Therefore, we advise you to draw up absolutely any amount through a loan agreement.

How to tell a friend about this?

Many citizens are uncomfortable, and sometimes just too lazy to draw up all kinds of written documents. They give money, hoping for honesty and decency. Of course, this is their right. We are just talking about how to properly lend money from the point of view of jurisprudence, so that later there is something to present in court.

But what if you don't want to offend your friend with all sorts of notes? There are people who are uncomfortable with this offer. On the one hand, they want to insure themselves, and on the other hand, they are afraid of offending a person. After all, it is not known how a friend will perceive this information. Perhaps, after the offer to conclude a loan agreement, he will no longer be considered as such. There are some tricky tips for this:

- Tell the person that this is how your lawyers or you yourself learned how to return income tax. Like, I help you, and you help me. For all questions about how this can be“crank”, answer evasively: “I will be helped”, “I have a friend who will do this”, etc. From a legal point of view, this is complete nonsense, but a friend is unlikely to turn out to be a lawyer either. In addition, there are many cases of tax deductions and benefits in the legislation, it is difficult to figure it out right away without diving into this topic. Alternatively, it can be said that it is necessary to submit income and expenses to social protection in order to apply for a subsidy, and a loan agreement will help reduce the “profit” of the family budget. It is unlikely that a friend will go to understand. If he needs money, he will most likely sign the document.

- Finish everything through alleged intermediaries. For example, you have money, but it is "in the circulation of a mutual fund." To take them out of there, you need a loan agreement. Without it, you simply cannot get this money.

You can think of other ways. But know one thing: if you are going to return the money, they will sign any contract. These tricks are needed so as not to offend a friend. A legally educated person will understand that all this is a fiction, but he will treat such an agreement with understanding. You can not come up with any reasons, but simply say straight out: “Money ladies, sign the document.”

How to lend money on receipt: sample writing

Receipt is drawn up in any form. But there is only one rule - the more information, the better. It should contain the following data:

- Accurate information about the lender and borrower. This is a surname, name, patronymic, addresses of registration and actual residence, passport data. Remember:Claims must be filed with the court at the place of registration of the borrower. In the Code of Civil Procedure of the Russian Federation, this is called “territorial jurisdiction.”

- Amount in rubles in words. The correct wording is “5 (five) thousand rubles”, where both the digital and verbal meanings are mandatory.

- If the money is taken in dollars or euros, then it is necessary to specify in detail at what exchange rate the Central Bank will return (on the day of the loan or return). An example is foreign exchange mortgages. Many people sue banks to recalculate their debt at the rate at the time of taking out a loan. Recall that the ruble from 2014-2016 "fell" twice against the dollar and the euro. One court case was even won in connection with the ill-conceived contract. To avoid such incidents, it is better to write everything in more detail.

- Refund deadline. In the absence of this item, the debt must be returned within 30 days.

- Signature. Must be done by the borrower. Remember: a signature without decryption is invalid, no matter what examination is then assigned.

- Data on witnesses. It is advisable that they also put their personal signatures.

- Additional conditions. Guarantees, interest, guarantees, pen alties, etc.

Preferred but not required

Now we know how to properly lend money, what documents to draw up in this case. First of all, it is a receipt or a loan agreement. Now about what it is desirable to do when making it, but not necessary:

- Appeal to a notary. Does not provide any additional advantage in court whencorrect receipt. But a notarized signature psychologically places additional responsibility on the borrower.

- Finding witnesses. Their participation is optional in the preparation of the receipt. This is not a search protocol with the participation of two witnesses. Therefore, the phrase: “Bring witnesses that I signed it” sounds stupid. It is enough to conduct a handwriting examination, and everything will fall into place. In addition, the defendant will have to pay for it after winning the court.

Agreement without interest?

Now let's talk about percentages. This is always a sore subject in court. As a rule, when a borrower needs money urgently, he agrees to any percentage. But, as in the famous catchphrase, "you take someone else's - you give yours." When the time comes to return the money, disagreement with interest begins, that is, no one disputes the amount of the principal debt (this is useless). They are trying to reduce interest, pen alties and fines.

As far as legislation is concerned, there is no clear position. Courts have discretion to decide how much interest, pen alties and forfeits are payable. It's not regulated in any way. In addition, the Supreme Court of the Russian Federation ordered the lower courts to apply the articles of the Civil Code of the Russian Federation on the reduction of interest, fines, pen alties.

Consequently, by giving 10 thousand rubles at 25% per annum with fines and pen alties for each day of delay, after a few years you can return 10 thousand + 100 rubles.

And now the other side of the coin. If the receipt does not indicate the interest for the use of money, then by default it is assumed that it is. The borrower is obliged to pay interest on the refinancing rate of the Central Bank of the Russian Federation. It changes every year.

What is the refinance rate?

The refinancing rate is the percentage at which the Central Bank of the Russian Federation lends to other banks and credit organizations. This is more than inflation. Therefore, before you correctly lend money against a receipt, you need to find out the key refinancing rate. It is important if the amount of interest is not indicated on the receipt.

How to lend money on bail

Now let's talk about the so-called secured loans. Or rather, how to properly lend money at interest with collateral. The latter is usually a car or an apartment.

Let's start with the vehicle. The legislation allows private investors to lend money secured by a car. There are two options:

- The vehicle is with the owner in temporary use until the end of the calculation.

- The car is placed in a special parking lot. Then measures must be taken to ensure safety.

But how to lend money secured by a car? Main points of the contract:

- Terms, loan rates, extension sizes.

- The subject of the pledge, its transfer (with the relevant acts, documents for the car, tickets, etc.).

- Obligations of the parties.

- Detailed description of the vehicle equipment, so that in case of non-fulfillment of the contract, you will not receive a frame from it if the vehicle remains with the owner.

Remember that under the Pledge Law an agreement will be void if it is not in the prescribed form.

In addition, notaries have the right to register a transaction with a pledge in a special register at the request of the pledgee. This minimizes fraudulent schemes. For this, in addition to the services of a notary, you will have to pay a state duty. But the main advantage is obtaining the registration of the contract, which gives guarantees to both parties.

But if the vehicle is mortgaged several times? Then the person who first registered the transaction officially gets the right to it. A loan agreement secured by a car is considered concluded from the moment the money is transferred. This is spelled out in the Civil Code of the Russian Federation.

Bailing an apartment

Now about how to properly lend money secured by real estate. The first thing to do is to carefully study all the documents for the apartment. Maybe she's already on bail. Of course, this is fraud on the part of the borrower - not to inform the lender about this, but the latter is of little material benefit from this.

A pledge for an apartment, as well as with a car, is accompanied by registration with Rosreestr. In the contract itself, in addition to the main points, you can specify the rule of pre-trial alienation of the apartment.

What are the benefits of registering a transaction with a pledge in Rosreestr

The main advantage of an official deal in a government agency is the safety for both parties from fraud. If the contract has passed Rosreestr, then the apartment or car is not officially pledged. At least the state agency does not know anything about it. This means that in court the law will be on the side of the lender who officially registered the deal.

Results

Thus, we tried to answer the question of how to lend money correctly.

The first rule is to document any amounts. Don't be afraid to ask for a receipt.

Second rule - require collateral when borrowing large amounts. It can be a car, real estate, securities, antiques, etc. We have already said about the main nuances of how to lend money correctly on the security of a car or apartment. The main thing is to register all transactions through a notary in Rosreestr. Remember that if you signed a contract with security in this state body, and then it turned out that you are not the first applicant for a car or apartment, then the court will be on your side. Here the rule applies - whoever first registered in Rosreestr, that is the pledge.

We hope now you know how to lend money correctly. For forewarned is forearmed.

Recommended:

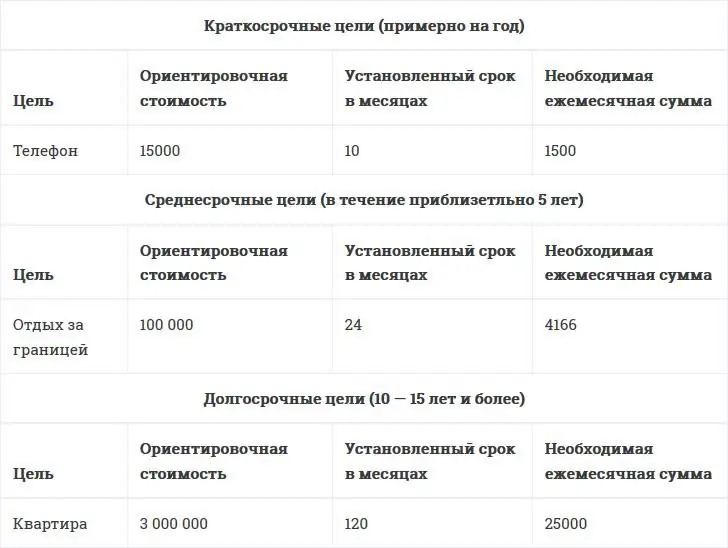

How to save money with a small salary? How to save correctly?

In addition to monthly expenses for utility bills, groceries and other expenses, I want to save up money for a long-awaited vacation, buying real estate or educating children. Unfortunately, not everyone succeeds, and some are so obsessed with savings that they cross the line on the path to outright stinginess. So how to save money with a small salary, while not infringing on the little things?

Sample and example of a receipt: how to write it correctly?

Many people, when they borrow some money, do not even think about the fact that they might not get it back. In such cases, the ability to write receipts may come in handy. This is a simple matter, but a document drawn up incorrectly may not have any legal significance. In this article, we will analyze an example of a receipt for receiving funds and documents. We will also talk about what items must be specified so that it does not lose its force

How to make money without money? Ways to make money. How to earn real money in the game

Today everyone can make good money. To do this, you need to have free time, desire, and also a little patience, because not everything will work out the first time. Many are interested in the question: "How to make money without money?" It's a perfectly natural desire. After all, not everyone wants to invest their money, if any, in, say, the Internet. This is a risk, and quite a big one. Let's deal with this issue and consider the main ways to make money online without vlo

Loan to a legal entity: what can affect the quick receipt of money

What businessmen need to know in order to quickly and reliably receive a bank loan, and what rules in reporting must be observed - this will be discussed in the article

The Konstantin Khabensky Foundation will always lend a helping hand

Many people know that the famous actor of the Russian theater and cinema Konstantin Khabensky is not a public person and tries to be the object of attention of the press as little as possible