2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:41

In Russia, many draw up a tax deduction. The timing of the payment of the due funds varies. However, by law, citizens must receive the deduction at a certain time. Otherwise, the tax office will pay late fees. What are the deadlines for issuing tax deductions? What might the population face? You can read the answers below!

The concept of return

Tax deduction is a return of 13% of funds from certain expenses. Today in Russia you can return the money:

- for the purchase of property;

- for tuition fees;

- for treatment;

- for the children.

At the same time, only adult citizens who receive a stable income subject to 13% income tax are allowed to issue a deduction. If this rule is not followed, you will not be eligible for a refund.

Design

How to get a tax deduction? The timing of the payment of the due money plays an important role. But first you need to understand the procedure for submitting the corresponding request. Otherwise, you can not wait for the return of personal income tax.

In general, the design of a tax type deduction is as followsaction:

- Collect the documents necessary for this or that case. The exact list of required papers can be clarified in the Federal Tax Service. It will be different with different transactions.

- Complete an application for a deduction.

- Submit a written request with prepared documents to the Federal Tax Service at the place of registration.

- Get results from the tax office. If the request is satisfied, you can expect the receipt of funds to the account specified in the application.

This is how the tax deduction is processed. The timing of the payment of the due funds varies. What could be the situations?

Generally accepted rules

It all depends on the situation. What is the deadline for paying a tax deduction in Russia?

78 Article of the Tax Code sets strict time limits in this regard. The legislation of the Russian Federation states that funds in the form of deductions, as well as overpaid taxes / fines / fees, are subject to return after a written request from the taxpayer.

But that's not all. What are the deadlines for paying a tax deduction? Article 78 of the relevant code of the Russian Federation indicates that 1 month is allotted for this operation. The countdown starts from the moment you submit the prescribed form.

Ambiguity

Accordingly, if the tax authorities have no claims to the taxpayer's documents, the funds must be transferred within a month. But the Tax Code does not indicate which month is considered to be fullor incomplete.

In the literal sense, the second scenario is understood. Suppose that a citizen declared a desire to receive a deduction on March 28. Then by April 1, the money should be returned to him.

It is difficult to imagine such situations in practice. For the specified period, you will have to check the documents for a tax deduction. The timing of the payment of financial compensation will not increase. The Tax Code of the Russian Federation also indicates that all ambiguities and inaccuracies in the laws are interpreted in favor of the taxpayer.

Full months

But that's not all. You will have to study the tax legislation of the Russian Federation in more detail. What do they say about full and incomplete months when returning overpayments and deductions?

Assume that a tax deduction is issued when buying an apartment. The terms of payment in this case will be equal to one month. A citizen submits a declaration, documents and an application in March. Then the full month will end in April. And by May 1, the tax authorities are required to transfer funds to the account of the taxpayer. In case of delay, a pen alty fee is due from the relevant government agency for each day.

No statement

The deadline for paying a tax deduction after submitting an application with documents and a declaration is already clear. It is 1 month. And no more. But this does not mean at all that the money due will be quickly transferred to the citizen using the specified details. Russian legislation in this area hasmany features.

For example, it is worth paying attention to the fact that the Federal Tax Service will start the countdown of the prescribed month only from the moment it receives a written application from the taxpayer. While this paper is not there, you do not need to wait for the allotted time for a refund. The tax authorities can delay this moment indefinitely.

You can say this: no statement - no money. There are no deadlines for the payment of a tax deduction after filing a declaration without an application. They just don't have room.

Practice

In reality, the situation is different. The term for payment of a tax deduction after filing an application by law is 1 month. But in fact, the tax authorities usually extend this period. How exactly?

By organizing document verification. It's called cameral. Only 3 months are allotted for its implementation by the state body. And nothing more.

Accordingly, after the end of such a period, the taxpayer must either refuse to return the money, or transfer them to the specified details. The exception is cases when a desk audit was carried out without a written application for a deduction. In this case, you will not be able to claim a refund.

How long will the tax deduction be paid after submitting an application for this operation along with documents and a declaration? When organizing a desk audit, the funds must be reimbursed no later than the end of the audit or until the moment when this operation was supposed to be completed.

It follows,that the terms of payment of the tax deduction are increased by 2 months. During a desk audit, the funds are reimbursed within 3 months.

From place and time

However, all the information listed above is not exhaustive. In fact, there are other situations. Some tax departments believe that they can transfer funds in the form of a refund or deduction for more than 3 months. How much exactly?

Need a property tax deduction? Terms of payment of money can be from 1 month to 4 months. How did the second number come about?

The thing is that some Federal Tax Service believe that during desk audits they should only verify the authenticity of documents and make an appropriate decision. And after the taxpayer was informed of a positive response to the request, count 1 month for the transfer of money.

You should pay attention to the fact that many tax authorities refuse to accept documents for deduction along with the application. This is necessary in order to avoid unnecessary disputes over the timing of the return of funds. Initially, taxpayers are advised to submit declarations and documents for verification, then receive a response from the Federal Tax Service, and only then write an application for a deduction. In general, this procedure violates the established legislation of the Russian Federation.

Results and conclusions

Is there a tax deduction when buying an apartment? The timing of the payment of the money due is ambiguous. As a rule, it is necessary to wait for a response from the tax authorities on the reimbursement of funds. Funds should arrive within a month. Or after a background check. Only after that you can wait for 13% of spending.

Based on the foregoing, taxpayers come to the conclusion that the tax deduction is returned within 4 months. Three of them are document verification, one is time for banking transactions.

In fact, according to the law, the specified percentage must be reimbursed to the taxpayer after the end of the current month when submitting a corresponding written request, provided that there are no complaints about the proposed documents. But in practice, citizens usually just wait. They do not need extra judicial debate.

So what to focus on? The terms of payment of the tax deduction reach 4 months. And no more. But in some cases, the money can be reimbursed faster. This is done at the discretion of the tax authorities. Therefore, the topic under study has many controversial issues.

With all this, if the taxpayer complains about the actions of the tax, most likely, the court will take his side. More accurate information on the timing of the return of deductions is recommended to be specified in each Federal Tax Service separately. Only employees of these state bodies will be able to 100% answer the question.

Recommended:

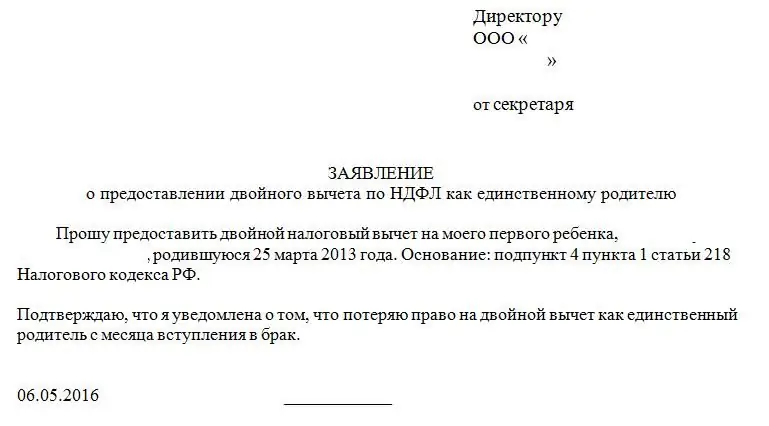

Tax deduction at birth of a child: application, who is en titled to a deduction, how to get

The birth of a child in Russia is an event that is accompanied by a certain amount of paperwork. Parents acquire special rights when replenishing the family. For example, for a tax deduction. How to get it? And how is it expressed? Look for the answer in this article

Payment for fuel and lubricants: contract execution, calculation procedure, rules and features of registration, accrual and payment

Situations often arise when, due to production needs, an employee is forced to use personal property. Most often we are talking about the use of personal vehicles for official purposes. Moreover, the employer is obliged to compensate for the related costs: fuel and lubricants (POL), depreciation and other costs

Tax deduction for mortgage interest. property tax deduction

Today, not every citizen has enough free cash to buy an apartment. Many have to use loans. Targeted loans give the right to claim a tax deduction for mortgage interest, provided that the documents are executed in the territory of the Russian Federation

Land tax: tax base, terms of payment, benefits

Land tax - an annual payment for the ownership of a piece of land by a person or organization. This article will talk about what it is. How to pay land tax? What benefits does it provide? How can the corresponding payment be calculated?

Property tax deduction for an apartment. Mortgage apartment: tax deduction

When buying an apartment, a tax deduction is required. It consists of several parts, but is invariably present and amounts to a significant amount. To work correctly with this aspect, you need to study its features