2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

Unfortunately, not all bank customers who use various loans and installments understand the difference between annuity and differentiated loan payments. Therefore, when a person is offered to make a choice of a scheme when making a next transaction, he relies on the opinion of a bank employee or (even worse) acts at random. As a result, the borrower often simply does not understand what exactly he is paying, why such an amount, from where he has an overdue debt.

Annuity payment scheme

If a person draws up an installment plan for the purchase of goods (consumer credit) in a shopping center or supermarket, he is unlikely to be offered differentiated payments. The fact is that the annuity repayment scheme allows you not even to create a schedule for the contract. Payments for the entire loan period are calculated using a special formula so that they are equal. Only the last sum can differ, and as inlarger or smaller.

This scheme is used by banks due to the fact that servicing an annuity loan does not require additional resources, everything happens automatically. The client knows what his payment is and makes a monthly repayment. If we consider this scheme from the position of the borrower, then it is considered less profitable than a differentiated loan payment. In fact, if interest is charged on the residual amount of the debt (and this is possible regardless of the chosen schedule), then one cannot speak of the financial benefit of one or another option. It’s just that with an annuity repayment of debt by the client, the loan amount is repaid more slowly, therefore, the final overpayment will be greater. On the other hand, it is much easier for a borrower to pay off the bank, knowing clearly the monthly payment amount. Especially if the contract provides for early fulfillment of obligations, no one bothers him to pay more than indicated in the schedule.

Differentiated Schema

It is also called classic. As a rule, credit experts recommend that clients choose it. The fact is that the calculation of differentiated payments on a loan is carried out more simply and transparently. Each borrower, using the usual calculator, can do this on their own. In this case, it is the body of the loan that is divided into equal amounts (by the number of months of lending), and interest is charged onremaining debt. Thus, a time-decreasing graph is obtained. The differentiated payment on the loan each next month will be different from the previous one. This is its main drawback. That is, the client, before depositing money into the cashier or terminal, must either check his schedule or clarify the amount with a specialist.

Differentiated payment on a loan is not very convenient because the first installments differ significantly upwards. And this means that this scheme may simply not be affordable for the borrower.

How to choose

People who do not have the time and opportunity to go to the bank every time to clarify their payment, most likely an annuity will do. And if you pay it off ahead of schedule, then the overpayment will not be so high. For those borrowers who are accustomed to strictly following the schedule, the classic repayment scheme is undoubtedly more suitable. Of course, if they are not afraid of the first payments. So both the differentiated schedule and the annuity have their positive and negative points.

Recommended:

What is a differentiated loan payment: description, calculation procedure, payment terms

The popularity of loans among the population is beyond doubt. Loans are taken for different purposes. Someone buys real estate, someone - vehicles. There are also those who buy the latest model iPhone with borrowed funds and pay off the loan for it for a long time. However, this is not about the purpose of obtaining a loan, but about the methods of its repayment. Not all clients, when receiving a monthly payment schedule, are interested in what types of loan payments exist

Loan repayment methods: types, definition, loan repayment methods and loan payment calculations

Making a loan in a bank is documented - drawing up an agreement. It indicates the amount of the loan, the period during which the debt must be repaid, as well as the schedule for making payments. The methods of repayment of the loan are not specified in the agreement. Therefore, the client can choose the most convenient option for himself, but without violating the terms of the agreement with the bank. In addition, a financial institution can offer its customers various ways to issue and repay a loan

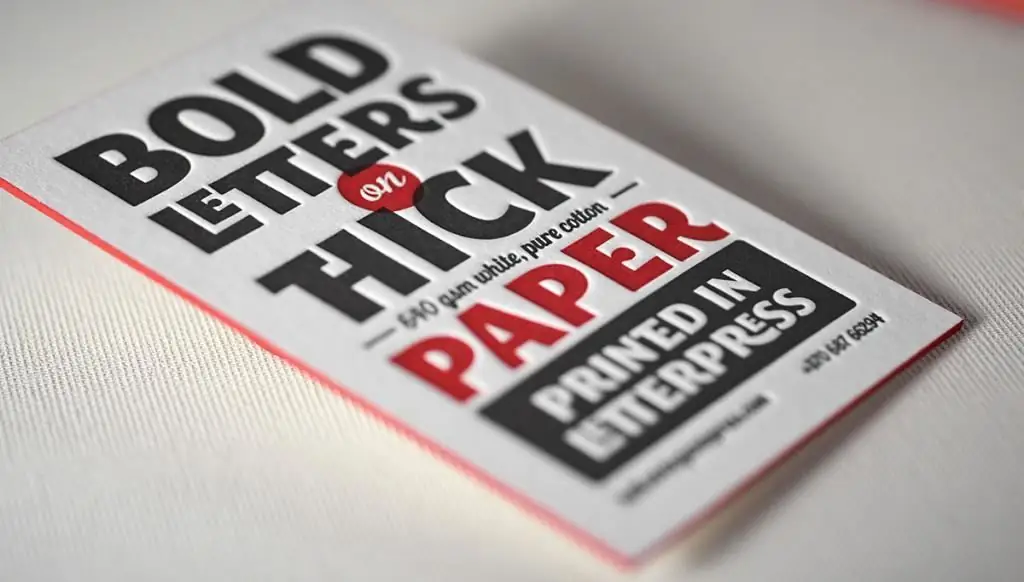

Letterpress is Letterpress printing technology, modern stages of development, necessary equipment, advantages and disadvantages of this type of printing

Letterpress is one of the typical methods of applying information using a relief matrix. The elements that protrude are covered with paint in the form of a paste, and then pressed against the paper. Thus, various mass periodicals, reference books, books and newspapers are replicated

Payment of the loan "Home Credit". Methods of payment for the loan "Home Credit"

You can repay the Home Credit Bank loan in several ways. Each client has the opportunity to choose the most convenient payment option. We will consider the payment methods for the Home Credit loan in more detail

Differentiated loan payment: calculation formula, benefits

Bank loans have become so accessible and popular that now you will not surprise anyone with them. However, despite its wide popularity, few people have minimal knowledge in the field of cash loans. For example, even regular customers of banks do not always know what an annuity payment and differentiated payment are, the difference between these two terms is even less obvious. Let's fix the situation and find out what it is, let's look at the features of each method of repaying debts