Loans

Sberbank consumer loan: conditions, interest rate

Last modified: 2025-01-24 13:01

Sberbank has developed a number of consumer lending programs: for personal needs, for military personnel, for owners of household plots and secured by real estate. What is the percentage in Sberbank for a consumer loan, and what is needed for registration?

In which banks can I get a car loan without Casco?

Last modified: 2025-06-01 07:06

Car loans are the provision of money for the purchase of a car. Moreover, vehicles can be new or used. The bank issues funds after the approval of the application. At the same time, lenders assess their risks. Loans are secured by a car. Many banks issue them only when buying a CASCO policy. Is it mandatory? Is it possible to get a car loan without CASCO? The answers to these questions are presented in the article

Investment loan - the best solution

Last modified: 2025-01-24 13:01

Investment credit is the best solution for raising funds for the implementation of long-term projects. A prerequisite for the provision of such a loan is its focus on the development and expansion of production, the acquisition of premises and equipment, and major repairs. It can be issued by enterprises, legal and natural persons, private entrepreneurs

Assessment of the borrower's creditworthiness. Basic moments

Last modified: 2025-01-24 13:01

The article talks about methods for assessing the creditworthiness of a borrower - both a legal entity and an individual

Conditions for obtaining a loan in modern banking institutions

Last modified: 2025-01-24 13:01

Any novice entrepreneur faces the problem of insufficient financing of his own business. Currently, this problem can be solved by finding out the conditions for issuing a loan and taking the necessary amount from the bank. This method is the best for solving problems as such. Almost immediately after taking a loan, you will be able to start working by organizing your own company or filling out documents for yourself as a private entrepreneur

Loan for individual entrepreneurs. Concept, types and features

Last modified: 2025-01-24 13:01

This article tells not only what a loan for individual entrepreneurs is, but also what types of it exist. In addition, the article provides information about the features of this type of lending

Preferential car loans: list of cars, conditions

Last modified: 2025-01-24 13:01

In 2018, citizens of the Russian Federation are still offered preferential car loans. Within the framework of this state program, many unique subprograms have been developed. The article tells what kind of assistance is offered by the state, how to apply for a benefit, what requirements apply to borrowers and what cars you can buy

How to fix your credit history: useful tips

Last modified: 2025-01-24 13:01

Many people who have delinquent loans in the past are wondering how to fix their credit history. The article talks about all the possible ways to improve the reputation of the borrower. Possibilities for cancellation of some entries in the BKI are listed

Loan conditions at Sberbank for pensioners. Interest rate, age limit

Last modified: 2025-06-01 07:06

Sberbank of Russia, as the leader of domestic lending, has a developed socially oriented credit base for the population. For example, loans for pensioners have very favorable rates, a high age limit and other favorable conditions. In addition, in addition to consumer loans, pensioners can count on mortgage and car loans

Payment of the loan "Home Credit". Methods of payment for the loan "Home Credit"

Last modified: 2025-01-24 13:01

You can repay the Home Credit Bank loan in several ways. Each client has the opportunity to choose the most convenient payment option. We will consider the payment methods for the Home Credit loan in more detail

Tinkoff credit card: apply online

Last modified: 2025-01-24 13:01

Depending on the purpose for which the borrower needs funds, consumer lending is divided into several types. The most popular are credit cards. We will talk about them in more detail

Is it worth taking loans in 2014? Sberbank - all loans

Last modified: 2025-01-24 13:01

Why is it worth taking a youth loan for an apartment in 2014? Until the end of June 2014, lower interest rates are in effect - from 10.5% per year. What are the most popular Sberbank loans in 2014? Consumer loan with reduced interest rate - 14.5%

What is a loan? Detailed analysis

Last modified: 2025-01-24 13:01

The article talks about what a loan is, why they take it, and analyzes the topic of microcredit organizations that are popular in our time

What are overdraft cards? Overdraft, card

Last modified: 2025-01-24 13:01

The variety of plastic cards of various banking organizations is huge. Among them there are such as debit card, credit card, overdraft card. The advantages and disadvantages of each of them, what are overdraft cards, read below

How to get a loan for maternity capital in Sberbank?

Last modified: 2025-01-24 13:01

Proposals for full or partial repayment of a consumer loan at the expense of maternity capital are found almost everywhere. Although today the commission of this action is considered illegal and is almost impossible. What is actually offered under the repayment of the loan, and how to get a loan for maternity capital in Sberbank?

Scoring model for assessing the borrower's creditworthiness

Last modified: 2025-01-24 13:01

Practically everyone who has ever been denied a loan has heard the following phrase from the manager: “The decision was made by the scoring system. Your credit scores as a borrower are not up to par.” What is this norm, what is scoring and how to pass the “credit detector” with “excellent”? Let's try to figure it out

Are there loans available for pensioners?

Last modified: 2025-01-24 13:01

If you are a pensioner, you may be granted a loan on special terms. There are many prejudices about the solvency of such social strata of the population as youth and pensioners. It is very difficult for them to get a job, since the former have little to no experience, and the latter do not have the skills required by the employer. Loans for pensioners are also reluctant to provide, as there are concerns about late payments, and even non-repayment of debt

Is bad credit a sentence?

Last modified: 2025-01-24 13:01

Credit history for banks is now even more important than a certificate of income. Few can boast of a perfect story. But what about those who have it bad? Is it possible to somehow regain a positive reputation and continue to communicate with reliable banks? Let's find out right now

Mortgage without down payment: how to get?

Last modified: 2025-01-24 13:01

Recently, such a banking service as a mortgage without a down payment has gained particular popularity. Unfortunately, in our country, there is still a high degree of distrust of the population in various kinds of credit institutions, so long-term loans are not very popular. However, real estate prices in large cities are so high that mortgage loans with no down payment are sometimes the only way to acquire your own home

How to apply for a loan to an individual?

Last modified: 2025-01-24 13:01

Today, lending is a popular and affordable way to solve your financial problems, buy the right thing, a new car, and even an apartment or a private house. A loan to an individual is issued by a variety of credit organizations - these are banks, microfinance organizations, credit cooperatives, etc

LLC "Home capital": types of loans, customer reviews

Last modified: 2025-01-24 13:01

Probably, every person has situations when a certain amount of money is immediately needed, but it simply is not there. There is a way out: you just need to contact Domashny Capital LLC. To date, the number of customers of the company is constantly growing

Rules for using a Sberbank of Russia credit card

Last modified: 2025-01-24 13:01

"Forewarned is forearmed!" - this is how you can briefly characterize the article, after reading which you can avoid many unpleasant moments caused by a misunderstanding of the conditions and rules for using credit cards of Sberbank of Russia

How to check your credit history yourself?

Last modified: 2025-01-24 13:01

Credit history is information about the use of credit funds for each citizen who applied to the bank. Before granting a new loan, financial institutions should check the credit history of a potential borrower

What happens if you don't pay the loan to the bank? How can you avoid liability?

Last modified: 2025-01-24 13:01

Sometimes there are situations when a person applies for a loan in a financial institution and there are problems with its repayment. In this case, the question arises of what will happen if you do not pay the loan to the bank

Types of consumer loans in Russia

Last modified: 2025-01-24 13:01

It's no secret that credit is a special kind of consumption. There are various types of consumer loans. Today, anywhere you can come across an offer to issue it in 5 minutes: furniture stores, equipment stores and even shopping centers

Commodity loans: traps for gullible borrowers

Last modified: 2025-01-24 13:01

Ten years ago, people had no idea what lending was. But the first major banks began to actively offer commodity loans. It has become very easy to buy any product you like without leaving the checkout. Commodity credits are now issued directly in the store

How to calculate interest on a loan: formula. Calculation of interest on a loan: an example

Last modified: 2025-01-24 13:01

Everyone faced the problem of lack of money to purchase household appliances or furniture. Many have to borrow until payday. Some prefer not to go to friends or relatives with their financial problems, but immediately contact the bank. Moreover, a huge number of credit programs are offered that allow you to solve the issue of buying expensive goods on favorable terms

Sberbank: early repayment of the loan (conditions, return of insurance)

Last modified: 2025-01-24 13:01

It often happens that, having taken out a loan for a decent amount, a client after some time is surprised to find that he has reinsured himself and is ready to repay the debt much earlier than the due date. Then again you have to go to a financial institution (say, to Sberbank). Early repayment of the loan, oddly enough, is not welcomed by any credit institution. And this is not surprising, because the sooner you repay the loan, the less profit the bank will receive

A private lender is a person with whom it is beneficial to cooperate?

Last modified: 2025-01-24 13:01

A lender is usually not only a banking institution. The state itself, as well as legal or natural persons can act as a lender

Expresscreditservice LLC: reviews. "Expresscreditservice": employee reviews

Last modified: 2025-01-24 13:01

Expresscreditservice LLC, reviews of which, as in most cases with financial-type organizations, are divided into positive and negative, specializes in providing loans

"Quick Money": feedback from employees and customers

Last modified: 2025-01-24 13:01

In recent years, many residents of Russia have managed to use the services of MFO "Bistrodengi". The popularity of the company is quite high. What do you think, what is it connected with? Let's try to find out how its customers and employees respond about the organization

"Credit Center", Kazan (Tatarstan)

Last modified: 2025-01-24 13:01

"Credit Center", (Kazan), which is located on Shurtygina Street, offers universal conditions for lending. You can take a loan in cash, on a card, mortgage lending programs are available. For registration of housing on credit, a larger package of documents is not required, in comparison with the requirements of banks. And almost everyone can get a cash loan on good terms

Interest-free loans as the cheapest cash loan

Last modified: 2025-01-24 13:01

Public lending is one of the most competitive areas of Russian banking institutions. When it comes to issuing a loan to buy a car or other vehicle, as well as electronics, household appliances or furniture, any borrower can get very confused about the interest rates and features of the programs offered

A loan is a great opportunity to get what you want

Last modified: 2025-01-24 13:01

The article will discuss the fact that a loan is a financial and legal operation with cash, as well as the differences between a loan and a loan

To whom are the tops, and to whom are the roots: how is the loan divided during a divorce?

Last modified: 2025-01-24 13:01

Many Russian families at the initial stage of their existence enter into such a responsible and long-term project as the purchase of housing in a mortgage. Quite often the cell of society disintegrates before the main credit of all life has already been given to the bank. How is a loan divided during a divorce and what outcome can you expect in different life situations?

Service "loan holidays": rules for registration, application, documents and reviews

Last modified: 2025-01-24 13:01

Unfortunately, in recent years, an increasing number of people who are not able to reasonably assess their own financial capabilities become debtors of banking institutions. The worst thing that a person in such a situation can do is to aggravate an already difficult situation by accumulating debts. Those who do not have the opportunity to immediately repay the entire amount can contact the bank and write an application for a loan holiday

Mortgage and credit: what is the difference, what is more profitable and easier

Last modified: 2025-01-24 13:01

There are many banking services that are available to different segments of the population. However, for those who do not understand financial instruments, it is incredibly difficult. It is not surprising that situations arise when clients, applying for a loan, do not know what the difference between a mortgage and a loan is. On the one hand, both services are identical. After all, in fact, and in another case, the borrower has to return the entire amount of the debt with interest. However, the difference may be hidden in the conditions

How to quickly pay off a loan: effective tips

Last modified: 2025-01-24 13:01

The rapid development of the banking sector has led to massive demand for lending services. Now almost every resident of Russia has a bank loan. Usually, the conditions of credit institutions are so unfavorable that after signing the contract, borrowers begin to look for ways to quickly pay off the debt. It is important to act consistently in order to understand how to quickly pay off loans

How to get a loan on a Sberbank card: necessary documents, procedure, payment terms

Last modified: 2025-01-24 13:01

Most borrowers prefer to borrow money on a bank card: it's fast, convenient and safe. The most popular in Russia are the cards of Sberbank, the largest bank in the country. Before applying, it is recommended that you familiarize yourself with companies where you can quickly get a loan on a Sberbank card

How to pay off a loan from Rusfinance Bank according to the contract number without commission?

Last modified: 2025-01-24 13:01

Money borrowed always imposes certain obligations on the borrower. Managers, making out a loan, explain in detail all the conditions. They tell how to pay off a loan at Rusfinance Bank or other convenient services

Where to urgently get 100,000 rubles on receipt in Russia

Last modified: 2025-01-24 13:01

Debt is different, it imposes an obligation on a person - to return the amount accepted for temporary use. When a person has received money, his lender must have a guarantee of return. According to the laws of the Russian Federation, an amount exceeding 10 thousand rubles must be in writing. If you need less money, then you can verbally agree on the conditions and terms of return

Debt novation: the essence of the procedure, the procedure for carrying out, the necessary documents

Last modified: 2025-01-24 13:01

Debt novation is a universal and popular legal procedure that allows you to update a deal and make it profitable for both parties. Its implementation is regulated by the legislation of the Russian Federation. The nuances of drawing up and concluding an agreement, the conditions under which it is considered legitimate are given in the article

Credit theories: classification of theories, characteristics, description, development history and functions

Last modified: 2025-01-24 13:01

During the long history of lending, banks have created various systems of grouping loans based on certain criteria in order to improve the efficiency of credit management. Loans have always been driven by certain theories that evolve over time

The concept and main types of accounts payable

Last modified: 2025-01-24 13:01

In the process of economic activity, the role of a performer or customer can be played by any association. Accounts receivable and accounts payable are formed on his accounts during settlements. The article deals with the concept and types of accounts payable, as well as aspects of each of the categories

Pros and cons of a car loan: programs, their features and conditions

Last modified: 2025-01-24 13:01

Purchasing a car with your own savings is not available to every citizen. A car loan will help solve the problem, the registration of which is not particularly difficult. To apply for a car loan, you need to choose the optimal program, collect a package of documents and take into account all the pros and cons

OneClickMoney: reviews, loan conditions

Last modified: 2025-01-24 13:01

Not everyone likes to borrow money from friends and acquaintances, and moreover, not everyone has such friends who could borrow a large amount. Banks do not issue loans if a person has a bad credit history. In these cases, MFIs help a lot, one of which is OneClickMoney. Reviews about this method of obtaining money are rather ambiguous. Let's analyze in more detail

How to make money on a credit card: the essence of earnings, cashbacks, terms of use and income calculation

Last modified: 2025-01-24 13:01

Surely many people would be interested to know how to make money on a credit card. Some, having heard about this, are unspeakably surprised: is it real? Quite. And what pleases - today almost every person has a credit card. That is why now we will talk about how you can use it to your advantage

What to do if they do not give a loan: reasons, tips and recommendations

Last modified: 2025-01-24 13:01

Everyone can face such an unpleasant situation as a refusal to issue a loan. Often this happens for unexplained reasons. What to do if they do not give a loan? How can I find out the reason for the rejection? How to fix your credit history and remove yourself from all blacklists? Let's try to find answers to these questions together

A contract loan is Types of bank loans. Current loan: pros and cons

Last modified: 2025-01-24 13:01

Contracting loan is a classic type of bank lending. The concept of a contract account is practically unknown to the average layman and has its pluses and minuses. Despite the fact that Russian banks do not issue counter current loans, such loans are in demand among entrepreneurs

"Centrofinance": reviews, features and services

Last modified: 2025-06-01 07:06

No one is immune from financial problems. When such difficulties arise in life, you can contact Centrofinance. This company is in the business of lending. A long history of existence, the presence of a huge number of positive reviews from Centrofinance are one of the advantages of the named Russian microfinance organization

Loans for young families: features, conditions, reviews

Last modified: 2025-01-24 13:01

Today, young families have access to special state programs that involve the allocation of subsidies for partial repayment of the mortgage. It is worth familiarizing yourself with the conditions of such benefits in more detail and learn the intricacies of lending

Which bank will give a loan with delays: conditions, loan programs, interest rates, reviews

Last modified: 2025-01-24 13:01

Unfortunately, not always a financial institution can approve the application of a potential borrower. The most common reason for refusal is bad credit history, which is formed due to late payments. As a result, a person begins to think about which bank will give a loan with delays

Who knocks out debts on loans from bank borrowers?

Last modified: 2025-01-24 13:01

Borrowers who default on loans may encounter representatives of collection agencies. These are those who knock out debts from malicious defaulters. A meeting with collectors means that the bank has terminated its obligations in terms of claiming debt on loans and transferred powers to another organization

What are loans for individuals: types, forms, the most profitable options

Last modified: 2025-01-24 13:01

The popularity of bank lending to individuals is growing every year. Financial institutions offer their customers all new products that are designed to meet the financial needs of borrowers. Often, even the fact of overpayment of interest does not stop an individual from obtaining a loan

"Alfa-Bank": loans, conditions for obtaining

Last modified: 2025-01-24 13:01

"Alfa-Bank" is the largest private financial institution in Russia, specializing in lending to the population. The current economic situation in the country is forcing citizens to increasingly seek help. Delayed wages, unforeseen financial expenses, repairs, construction or purchase of housing, payment for medical and educational services - all this and much more can be paid with loans from Alfa-Bank

The basic concept of a credit institution: signs, types, goals and rights

Last modified: 2025-01-24 13:01

The concept of credit institutions is that their activities are aimed at the implementation of functions that ultimately lead to the development and growth of economic relations in the country and abroad, improving the welfare of the population

How to repay a loan through an ATM? Description of the procedure

Last modified: 2025-01-24 13:01

After applying for a loan at the bank, it must be paid in a timely manner. There are several ways to do this. It is convenient to do this using ATMs. Payment procedures in each device are approximately the same. About whether it is possible to repay a loan through an ATM, is described in the article

Credit organization: concept and types, activities and licenses

Last modified: 2025-01-24 13:01

For the layman, the concept of "credit institution" is associated with banks, but other forms are fixed at the legislative level. In this article, you can learn about what you need to know to open this kind of enterprise, what rights and functions it has, and what the registration process includes

Banks loan from 21 years old: age norms, procedure for registration

Last modified: 2025-01-24 13:01

What is required to apply for a loan from 21 years old. How to choose a creditor bank, what documents should be prepared. What to look for in order to avoid problems with a loan in the future. Which Russian banks offer youth loans

Where can I quickly get a loan on a card and in cash?

Last modified: 2025-01-24 13:01

Where can I quickly get a loan? This is a common question. Let's take a closer look. Lending is one of the most sought after services offered by most financial institutions throughout Russia. Loans bring great profits to lenders, and also enable clients to fulfill their dreams, for example, to buy a car, an apartment, travel or make repairs

How to get a bank loan?

Last modified: 2025-01-24 13:01

How to get the right loan? This is a common question. Let's take a closer look. To date, a loan is one of the most common ways to improve their financial situation and solve many financial problems, and the citizens of our country have begun to actively use this opportunity

Money on credit in a bank: choosing a bank, lending rates, calculating interest, submitting an application, loan amount and payments

Last modified: 2025-01-24 13:01

Many citizens want to get money on credit from a bank. The article tells how to correctly choose a credit institution, which interest accrual scheme is chosen, and also what difficulties borrowers may face. The methods of repayment of the loan and the consequences of non-payment of funds on time are given

How is the recalculation of the loan in case of early repayment

Last modified: 2025-01-24 13:01

Is it profitable to recalculate the loan in case of early repayment? What conditions do banks set for recalculation and how does this process differ in VTB24 and Sberbank? More details in the article

How to get a loan with a bad credit history: banks, methods, reviews

Last modified: 2025-01-24 13:01

Credits and loans have firmly entered our lives. At least once, but everyone resorted to bank loans. What to do if there is a need for a loan, but no one gives it? Analyze your credit history

How to get a loan for an individual entrepreneur: step by step instructions

Last modified: 2025-01-24 13:01

Various loans are often required for individual entrepreneurs. The article tells what types of banking products are offered to businessmen, what requirements are imposed on individual entrepreneurs, what documents are needed from them, and what nuances you may encounter. The main reasons for refusal to lend are given

Interest payments. Fixed interest payment. Monthly loan payment

Last modified: 2025-06-01 07:06

When it becomes necessary to apply for a loan, the first thing a consumer pays attention to is the loan rate or, more simply, the percentage. And here we are faced with a difficult choice, because banks often offer not only different interest rates, but also a different method of repayment. What are they and how to calculate the monthly loan payment yourself?

Where to get money: 15 easy ways

Last modified: 2025-01-24 13:01

In the life of every person, sometimes there comes a moment when a large amount of money is required, but there is none. Moreover, situations are different: it is one thing when time allows you to save, but it is completely different if funds are needed urgently. Where to get money will be discussed in the article

Mortgage housing loan: features, conditions and requirements. Restructuring of a mortgage loan

Last modified: 2025-01-24 13:01

The article will tell about the peculiarities of mortgage lending in the Russian Federation. This program is one of the most popular banking programs. What is its essence?

Where to get a certificate of income: an algorithm of actions

Last modified: 2025-01-24 13:01

When applying for a loan or social assistance, calculating a pension, and in many other cases, the package of documents submitted must necessarily include a certificate of income. It displays the level of a person’s earnings, his solvency, makes it possible to form an objective picture of his financial condition

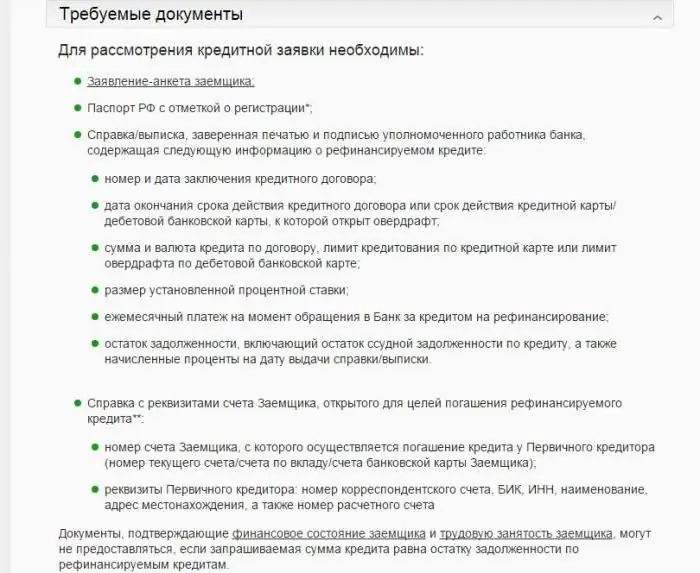

On-lending in Sberbank loan, car loan: reviews. Is it possible to make on-lending at Sberbank?

Last modified: 2025-01-24 13:01

Refinancing at Sberbank is a great opportunity to get rid of an "expensive" loan. What are the programs for on-lending at Sberbank today? Who can borrow and under what conditions? Read more about it

What is loan refinancing

Last modified: 2025-01-24 13:01

The article provides brief information about what loan refinancing is, what are its features and in what cases it is beneficial

How to get a loan from a bank with a bad credit history and low interest

Last modified: 2025-01-24 13:01

Most of the population is now in a vicious circle. Taking into account the growth of the dollar, the decrease in the level of wages and the increase in the unemployment rate, it has become more difficult for the population to fulfill debt obligations. What can be advised in such a situation?

Which bank has the best credit cards?

Last modified: 2025-01-24 13:01

Where do you get the best credit cards? This article discusses the offers of the most popular banks

Promissory notes of commercial banks: features, accounting. A bill of exchange is

Last modified: 2025-01-24 13:01

Promissory note is considered one of the main instruments of credit and settlement operations. Its appearance is associated with the need to transfer money from one region to another and to exchange coins for foreign currency. After reading today's article, you will delve into the main features of a promissory note loan

How to get an education loan

Last modified: 2025-01-24 13:01

How can you currently pay for tuition without significant damage to your personal budget? There is only one way out - to get a loan for education! Under this program, the bank will transfer funds directly to the university - and you are a student

Consumer loans from Sberbank of Russia

Last modified: 2025-01-24 13:01

Sberbank of Russia is currently one of the most stable banks in the country. He with dignity survived the difficult years of the crisis, when financial institutions became bankrupt every day. What turned out to be disastrous for some, allowed others to become stronger and develop stronger

Where is it more profitable to take a loan - we calculate the options

Last modified: 2025-01-24 13:01

Where is the best place to get a loan? This question is relevant today more than ever. Modern society has long accustomed itself to bank loans, but the culture of using them has not yet been formed

Consumer loan: repayment ahead of schedule or according to the contract?

Last modified: 2025-01-24 13:01

The scope of lending is wide and capacious. Some banking products are well advertised and popular with customers, while others are known to few

Loan interest is the payment for a loan

Last modified: 2025-01-24 13:01

All borrowers, when choosing a loan, look primarily at the interest rate. This is the very characteristic on which the main costs will depend. How is this value calculated, what factors affect it?

Where can I get a loan without refusal? Can pensioners apply for loans?

Last modified: 2025-01-24 13:01

The article tells about where a pensioner can get a loan. The banks that are least likely to refuse loans are considered

Sberbank: car loans for Russian citizens

Last modified: 2025-06-01 07:06

Today Sberbank is one of the largest state-owned banks in the Russian Federation. However, it should be noted that the share of issuance of highly specialized loan programs in it is very small and amounts to about 5% of the total mass

Need a loan? Rosselkhozbank will provide it

Last modified: 2025-01-24 13:01

Lending has recently been one of the fastest growing sectors of the financial market. Having survived the first wave of the financial crisis, many banking organizations have grown stronger and significantly expanded their field of activity. Now you don't have to puzzle over where and how to get a consumer loan

ID debt - what is it and how to get it?

Last modified: 2025-01-24 13:01

Many people, faced with court cases, ask: "ID debt - what is it?" Of course, here we are talking about papers or some sheets. ID is an executive document issued by the court

Cash loan at Uralsib Bank: loan "For friends", cash without collateral, terms of registration

Last modified: 2025-01-24 13:01

Uralsib Bank offers a wide range of loan products to its regular and potential customers. Loans are quite profitable, easy to apply. The most convenient and cheapest of them is the "For Your Own" program

Student loans: myth or reality?

Last modified: 2025-01-24 13:01

Deals like student loans are not new these days. Many banks offer to issue goods to students in installments or take a thing on credit

Loan for small business development. Getting problems

Last modified: 2025-01-24 13:01

The weak development of entrepreneurial activity is a consequence not only of the administration and regulatory policy in this area, but also of problematic access to borrowed funds

Where is it better to apply for credit cards from the age of 19: by passport, online application, without certificates

Last modified: 2025-01-24 13:01

The development of lending has made it possible to obtain a loan in a few minutes. Banks do not require income statements, guarantors, they quickly check documents and set minimum requirements for clients. Today, even credit cards are issued from the age of 19, that is, students who do not have a permanent source of income. For more information on how to apply and receive them, read on

Is a loan a yoke or a helping hand?

Last modified: 2025-01-24 13:01

What is a loan? Under what conditions is it issued? How to choose the right bank? How much credit is needed for your family? In this article, you will not only find answers to these questions, but also learn about little tricks when applying for a loan

Where can I get a credit card? Bank rating, interest rates and reviews

Last modified: 2025-01-24 13:01

Among the citizens of our country, loans offered by banks on different conditions are in demand. Now you can get a credit card with a certain limit. It is issued by many financial institutions. Where can I get a credit card? This will be discussed in the article

Cons and pros of credit

Last modified: 2025-06-01 07:06

Loans have long been a part of almost every person's life, and at the moment it is one of the most common banking services that can be offered not only to individuals, but also to legal entities, in order to help them solve their financial problems . Getting a loan today is not a big problem. You just need to provide a minimum of necessary documents, submit an application to the bank, and the terms for approval of such an application, as a rule, are not long at all

Consumer credit: types and features

Last modified: 2025-01-24 13:01

Consumer lending is currently the most common program in the vast majority of banking organizations in the Russian Federation

Loan without income statement: which banks issue and under what conditions

Last modified: 2025-01-24 13:01

Lending has become an integral part of modern life. Everything is taken on credit: houses, apartments, cars, furniture, clothes, education and even vacation packages. All this, for the most part, became possible due to the fact that almost all banks offer loans to customers without income statements, collateral and guarantors

Calculation of interest on a deposit

Last modified: 2025-01-24 13:01

Investing free cash in bank deposits is a normal practice of saving money in today's world. Calculation of interest on a deposit is an important step in choosing the most suitable deposit for you

Credit card with an interest-free period: bank conditions

Last modified: 2025-01-24 13:01

Credit card with an interest-free period: how the interest-free period is calculated, bank conditions, the length of the grace period

Microloan - what is it and how to get it?

Last modified: 2025-01-24 13:01

Money in debt is provided not only in the bank, but also in microfinance organizations. The first option is more profitable, but if you urgently need funds, you can apply for a microloan. This is one of the types of modern financial services. More about this in the article

Where to get money right now, or How to get out of a difficult financial situation

Last modified: 2025-01-24 13:01

Most people experience financial hardship at least once in their lives. It seems that soon the next salary, but at the moment there is no money. What to do and where to get money right now? The answers to these questions can be found in this article

I can't pay my loans, what should I do? Loan debt restructuring

Last modified: 2025-01-24 13:01

In a world full of crises and chaos, everyone wants to live with dignity. And if earlier it was not possible to just go and buy the necessary thing, then with the advent of loans, almost every person has it. But the joy of buying does not always last long, because the euphoria quickly passes when the period for paying debts comes

Is a car loan profitable: features, conditions and recommendations

Last modified: 2025-01-24 13:01

Speaking about whether a car loan is profitable, you first need to understand that there are no loyal financial institutions. Both banks and the car dealerships themselves, offering to take a loan from them, pursue one single goal - making a profit. The article talks about the features of car loans, which are worth paying attention to. The main issues of concern to car owners are considered

Scoring is Credit scoring

Last modified: 2025-01-24 13:01

Probably, today there is no such person who has not used a loan at least once in his life. Sometimes bank employees can make a decision on issuing a loan within 15-20 minutes after your application. They do not do it themselves - the decision is made by an impartial computer program - a scoring system. It is she who, based on the entered data, evaluates the level of reliability of the client

What good is a mortgage loan without a down payment?

Last modified: 2025-01-24 13:01

Most borrowers today want a mortgage loan without a down payment in 2013 to be implemented safely. In this situation, a lot depends on what kind of person he is. It also plays an important role what decision will be made by a certain financial institution on an application for a mortgage loan