2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Forex trading is a risky business. To reduce the likelihood of losing trades, traders use technical analysis tools. One of the tools is the Moving Average indicator.

The opinions of experienced players about the need to apply any additional constructions on the chart are contradictory. Some believe that the numerous lines, bands and histograms on the price chart field create confusion in the minds of the players. Such gurus advise to put aside all "turkeys" and work only with the price chart.

Other gurus remind us of the fable of the monkey and glasses and advise to thoroughly understand at least one simple technical tool, understand its positive aspects and test the theory with practical application.

One such simple and useful trade signal provider is the Moving Average indicator.

Formal definition

A moving average is the average price of an exchange-traded asset over a fixed period of time.

Parameter in useas a base when forming other indicators based on moving averages.

The time interval is counted in charting figures: candles or bars. The phrase "moving average with a period of 15" means that a line will be drawn on the chart from the average values for each consecutive 15 bars or candles.

Suppose the first 15 elements have formed. On their basis, the average price was calculated. When the sixteenth candle is formed, the first figure is discarded, candles from 2 to 16 are taken into account.

When the seventeenth candle is formed, the actions are repeated. And so the calculations are made for the entire graph array.

When trading on the terminal, indicative lines are not drawn manually. Line drawing is automated in the MT4 and MT5 trading programs. Therefore, there will be no mathematical calculations in the article. Interested parties can read the help information in the help section while there is free time between transactions.

In the program, you can choose any interval for calculating the average price of a currency pair. Periods from 5 to 50 are called short-term. To make an investment decision when buying or selling a currency, you should analyze periods from 120 and above, as the most indicative.

Types of signal lines

For example, a candlestick chart of an asset is shown with a blue moving average line with a short period of 20.

Candle reflects four price parameters:

- value at the time of opening;

- value at closing;

- minimum value for the formation period;

- maximum value.

Accordingly, you can set the construction of averages based on opening or closing prices, minimum or maximum values. You can even calculate the moving average of each candlestick.

Settings of the trading program take into account the aesthetic preferences of clients and give the opportunity to choose the thickness and color of the line, as well as the shape - solid, dotted or dotted.

Four types of moving average technical indicator are classified according to the mathematical method of construction. For brevity, we will denote the line with the MA abbreviation - from the generally accepted term in technical analysis Moving Average.

- Simple MA.

- Exponential MA.

- Linear weighted MA.

- Smoothed MA.

Classification occurs by assigning a rank to candles for performing calculations: the most significant and least significant candle.

Characteristics of commonly used Moving Averages

Let's take a closer look at four types of the indicator. Two moving averages are used consistently and effectively. The other two are rarely used.

Simple MA assigns the same importance to the first and last candles in the period. That is, at the interval of 15, the first candle is equal to the fifteenth in importance. For this reason, the reaction of a simple MA is slow, and at short distances, the moving average indicator is triggered with a large delay. Simple MA shows itself well on long periods.

Exponential MA smoothly awardsthe significance of candles in reverse order: the last one is the most significant, the first one is an outsider of calculations. So the line reduces its own sensitivity to price fluctuations at the beginning of the period and increases at the end. Therefore, the line reacts to the chart array faster than a simple MA.

The figure shows a chart of an exchange asset. The exponential moving averages are built on the chart: blue for short periods, red for long periods. At the point of their intersection, signals are formed to sell Sell Crossover and buy Buy Crossover.

Rare types of signal lines

Linearly weighted MA is similar to exponential MA by selection principle, but there are some nuances.

The exponent decreases the significance of the candles smoothly: n, n-1, n-2 … n-14, 0, for example, on the period 15.

Linearly weighted MA gives weight to each candle also in reverse order, but more sharply: 8n, 4n, 2n, n, n/2, …, and so on until the end of the candle array. This line is very dependent on the change in the price of the exchange asset.

Smoothed MA forms an interesting interval for calculations. Not only candles in the current designated period are taken, for example, 15 candles. Previous intervals are also taken into account. But for them, the significance decreases as the distance from the current time interval increases. Such a smoothed signal is appropriate to use only to determine long-term trends. But due to the large amount of calculations, the line is fixed, and it is rarely used, mainly for the study of technical analysis techniques.

All four types of indicator"Moving Average" are presented for general development. In practice, players use exponential MA to identify short-term trends; simple MA is suitable for long-term forecasting.

The number 15 is chosen for the example of a short period. In practice, other intervals are used, shorter or longer, for example, 8 candles or 21 candles.

On long intervals, a year is chosen to build the MA - 365 days, or half a year - 180.

Apply MA to trade

The purpose of analytical construction of additional lines on the price chart is to determine the breaking point of the trend. In the Forex market, the Moving Average indicator is the most intelligible tool.

Introduce the concept of "fast" for lines on short periods and "slow" - for lines on long periods.

Trend breaking occurs at the intersection of fast and slow MA. The figure shows an asset chart with the intersection of two middle lines, a fast one with a period of 50 days and a slow one with a period of 20 days.

The rules work in a trending market:

- Fast has crossed slow from top to bottom - you need to sell, the price will fall.

- Fast has crossed the slow one from the bottom up - you need to buy, the price will rise.

There is a lot of noise in high volatility markets, so the rule could stall.

It should be remembered that the lines give a delayed signal. Therefore, to enter a buy trade, the moving average crossover indicator should not be used.costs. Due to the late arrival of the signal, the trend may lose strength. The player will buy, and the price will rise by a little and go down, so that the market participant will not have time to react and hand over the burden in time. In order not to accumulate losses, the intersection should be used only for selling.

MA tilt angle

To decide on the strength of the trend, you can use the angle of the line. The angle is used on long periods, above 21. The longer the period, the steeper the angle, the more pronounced the strength of the trend.

The price of currency pairs on Forex is not only rising or falling, but is also in lateral movement. Evaluation of the moving average slope indicator helps to determine the trend towards sideways movement.

When trading on the strategies of crossing moving averages, adjust the MA Angle indicator. It is not used as a signal source for action, but as a picture it improves the perception of the situation on the monitor screen.

The benefits of using an angle

The indicator looks like a colored histogram with a central line, located below the chart. The color range of the histogram is standard:

- Green colors - growth.

- Red color - decrease.

- Yellow color - sideways movement, flat.

For example, consider the chart of the euro-dollar pair. The moving average is drawn in gold. Under the sliding one, in addition to the histonogram, the arrows of the angle of inclination are drawn and signed:

- green rising - growth signal;

- yellow flat - sideways;

- red falling - decline.

The more intense the growth of the price of an exchange asset, the higher the bar of the diagram, and vice versa, with a decrease in the growth rate, the height of the bar decreases.

The higher the growth rate of the price, the steeper the angle of the MA line, the stronger the trend - the player can hold a position or gain a position.

The lower the rate of price change, the smaller the angle of the MA, the weaker the trend.

When the angle tends to zero, you can trade only "for the rustle of nuts".

Trading systems for assessing the signal to make deals are adjusted to the angle value in the range from 15° to 35°. The moving average slope indicator can be adjusted for each exchange asset separately.

Dynamic Observer

Let's consider the daily chart of the price of the pound-dollar currency pair, hung with three moving averages: short 10 and 20, long 200. It can be seen that with a strong trend, the price cannot break through the lines, repels them, and the price trend remains. That is, the moving averages act as support and resistance lines. Moreover, the lines are dynamic, as they move with the price of the asset.

MAs can be used as stop loss levels. Place stops outside the lines. When approaching the current price, the stops are rearranged.

Again: don't use the crossover point of the fast and slow lines to buy either short-term or long-term trades. If you see an intersection, get out, the indicator tells you about it. Two moving averages crossed - this is a trend change.

If fast and slow crossed, the player closed the trade, and at this time the price crossed the average, you need to see how long the price will be above the resistance level or below the support level.

False breakdown is formed by one candle. If the price draws three or four candles above or below the average, then there is a high probability of a trend change. Why not one hundred percent confidence in the change? Because you need to look at the average period. The longer the period, the more likely the trend change during the breakdown. On small periods, the value of the moving average is also small.

Notification signals

World stock exchanges open at different times. There are periods of coincidence of hours of operation when you can pinch off a piece of profit from the currency pie.

News hours also vary. A stream of important events in each region is broadcast at a specific time.

The price can move in the direction the trader needs for several hours during the trading session.

These three reasons cause the player to stick to the monitor and waste time waiting.

Alert will help correct the situation - the sound notification function of the trading terminal.

How to set a reminder

There are two ways to install a notifier in the trading terminal:

1. On the screen with the traded currency pair, select the "Trade" menu, and in it the "Alert" option and move the cursor to the price line. The notifier is installed instantly.

2. At the bottom of the screen, select the "Alerts" tab, select "Settings" and fill in the dialog box. The program offersa choice of 3 conditions for triggering the notifier:

- price approached Bid level;

- price approached the Ask selling level;

- come of the specified time.

When an alarm is triggered, the following actions can be configured:

- beep Sound;

- file activation File;

- sending a letter to Mail;

- sending correspondence to the mobile terminal Notifications.

Convenient to use an alert when planning an entry or exit point. Many programs have been developed for the moving average indicator with an alert. In addition to the graphical display in the form of arrows above or below the intersection of the middle lines, the user receives a sound signal.

When trading on Forex, an indicator with an alert is used for short periods and with a pronounced trend, because sideways movement produces a lot of false positives, and for long periods of half an hour, the signal arrives with a delay.

A final word

In conclusion, we would like to note: before starting work on a real account, check any theory of technical analysis, even with the most positive reviews, on demo accounts. Having learned the lesson and completed the test, the user can start enriching in the foreign exchange market using simple and useful moving averages.

Recommended:

Trading sessions indicator for MT4. Trading platform for "Forex" MetaTrader 4

Trading session indicators for MT4 in trading is one of the most important parameters. Each time period has its own characteristics, characteristics, market liquidity and volatility. The future profitability or loss for a currency speculator depends on all these parameters. Therefore, traders and experts have specially developed tools for certain market phases and trading sessions

What are moving services?

The article contains a decoding of the concept of moving, analyzes the development and prospects of the moving market in Russia

Slow-moving assets: solvency analysis methodology

The value of slow-moving assets is the most important indicator in the analysis of the company's solvency. How are these assets determined? How are they used to evaluate the effectiveness of business management?

ADX indicator. ADX technical indicator and its features

ADX-indicator is a unique trading tool that allows you to determine the strength of a trend. It gives clear signals to traders about the time to enter and exit the market

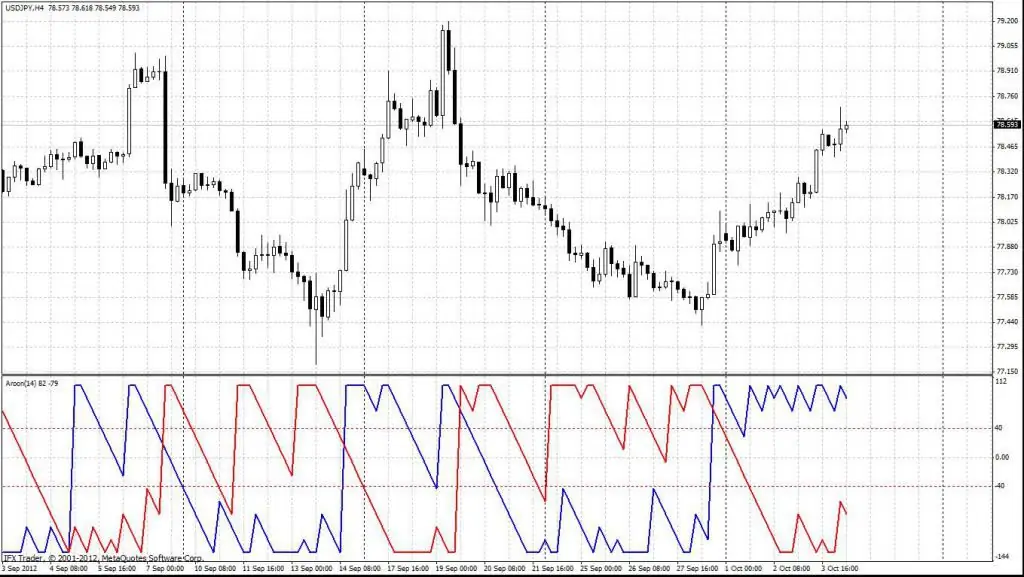

Indicator Aroon: description of the indicator, application in trading

The Aroon indicator is a great tool that every trader should have in their arsenal. It is a visual representation of the market movement that can be easily interpreted to make decisions according to price direction and momentum. You can also significantly increase the chances of a profitable trade if you build a trading technique around Aruna in combination with a breakout strategy or any other based on price movement