2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:38

In the cities of regional significance, a sales tax has been introduced since 2015. You need to pay it in case of registration for the use of the object of trade in one of the types of activities. Next, let's talk about when and how to transfer the trading fee, payment details will also be indicated.

Payers

So far, the trading fee, the details for payment of which are presented below, is paid only by persons engaged in trade in Moscow. The amount depends on the location of the object:

- stationary - 10, 5-81 thousand rubles;

- trade in a hall up to 50 sq. m - 30-60 thousand rubles;

- trade in a hall with an area of more than 50 square meters. m - 600-1200 rubles. for 1 sq. m from the first 50 + 450 rubles. for each subsequent sq. m);

- delivery trade - 40.5 thousand rubles.

Timing

Funds should be transferred to the budget before the 25th day of the month following the quarter. You do not need to provide a payment to the FTS. But in order for the sales tax to be received as intended, the details for payment should be found outin advance.

When should I register?

Not before trading starts. Taxpayers have 5 days to submit documents from the moment the outlet opens. If the activity will be carried out through a real estate object, then it should be registered at the location of the store, and in other cases - at the place of registration of the office.

Filling out the payment card

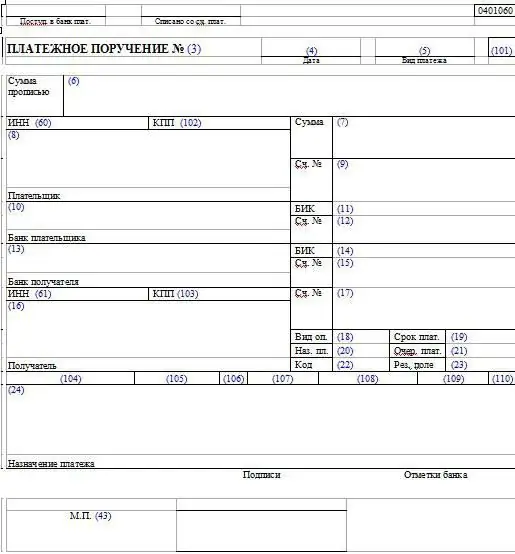

Details for the transfer of funds are filled in in the standard form No. 0401060. When filling out the document, it is important to correctly specify a number of parameters.

Based on who pays the trading fee, in the “payer status” field, enter “01” for organizations or “09” for individual entrepreneurs.

OKTMO code corresponds to the territory in which the activity is carried out. Their full list is presented in the All-Russian classifier of territories of formations. You can also find out the code through the service of the same name on the website of the Federal Tax Service.

Special occasions

If the sales tax in Moscow is paid for a real estate object (for example, a store), then the taxpayer must register with the Federal Tax Service at the location of the object. What if the trade is conducted through several objects located in different parts of Moscow? It is necessary to register at the location of the object, which is indicated first in the notification. However, the OKTMO code (p. 105) should indicate the one that corresponds to the place of activity. Additionally, on line 16, the abbreviated name of the Federal Tax Service should be indicated.

Example 1

Entrepreneur ships goods through 5 stores located in differentpoints in Moscow. In this case, you need to generate 5 documents to pay the trading fee. The payment order for each store will contain its own unique OKATO number and the name of the FTS branch. The account of the UFC in all documents will be the same - 40101810800000010041.

Example 2

The entrepreneur ships the goods through 5 stores located in one municipal district of Moscow. In this case, you need to create one order to pay the trading fee. The payment order will contain the OKTMO code of the Federal Tax Service, on whose territory the points are located, and one abbreviated name of the inspection.

Period, document date

The fee is paid quarterly. The specific period should be specified in the payment. If it is necessary to pay the sales tax from July 2017 for the 2nd quarter, then in field 107 you should enter Q.03.2017. Additionally, in the “Purpose of payment” field, you should indicate that the funds are transferred for the 2nd quarter of 2017. In the fields “Number” and “date” of the document, put “0”.

Package trade

Trading from any vehicle is charged according to a separate program. Entrepreneurs should transfer 40.5 thousand rubles once a quarter. to the budget. Even if the wheel is removed from the van, it will still be assigned to a separate group of objects. A building is recognized as stationary if it has a foundation and an inseparable connection with the ground.

Separate exceptions for the All-Russian Exhibition Center are also not established by law. The exemption applies only to specialized, regional and fairsday off. Regardless of the venue, participants in such events do not pay the fee.

Non-stationary objects

If the sales tax in Moscow is paid for a non-stationary object (car shop, tent, etc.), then you need to register at the location of the enterprise (IP residence). If the organization is registered in Yekaterinburg, and operates in Moscow, then the reports must be submitted in Yekaterinburg. How do I complete the payment in this case? You should indicate the OKTMO code at the place of trade in Moscow, and the name of the recipient - at the place of registration in Yekaterinburg.

In such a situation, you should additionally clarify the details with the Federal Tax Service. After all, the funds will go to the regional budget, and the fact of payment will be checked by the Federal Tax Service in Yekaterinburg.

CBK

The classification code is indicated on line 104 of the instruction. It starts with the numbers “182 1050501002 . Further details depend on the purpose of the payment:

- 1000 110 - payment of the trading fee for the current month;

- 2000 110 - payment of interest;

- 3000 110 - repayment of the fine.

Other details

Banks write off funds to pay taxes in the order indicated in line 21 of the payment order. According to the rules set out in 21 of the Civil Code, when paying taxes, you must specify the code 5.

UIP in field 22 is not filled in when paying current fees. The identifier should be indicated only if it was approved by the recipient and brought to the attention of the payer.

No matter who paystrading fee, on line 106 “the reason for payment”, according to the general rules, “TP” is indicated.

“Payment type” (page 110) is blank.

2017 Changes

From the current year, accounting for sales tax is carried out according to new rules.

Firstly, the list of benefits has been increased. Individual entrepreneurs whose main activity is the sale of newspapers and magazines are exempted from paying the fee, provided that:

- revenue from the sale of these goods exceeds 60% of income;

- more than 60% of the area is allocated for the demonstration of magazines;

- calculations are made using online cash registers.

Secondly, the new deflator is 1.237. This factor increases the collection rate set for retail markets. That is, the maximum collection rate is 550 x 1, 237=680 rubles.

Fee included in taxes

Organizations paying sales tax have legal grounds to reduce their income tax. If a simplified system with the “income” object is used, then only the tax on income from trade is reduced by the amount of the fee. If the organization is engaged in several activities, in order to take advantage of the deduction, you will have to keep separate accounts of income. This rule does not apply to the simplified tax system with the type “income - expenses”.

The amount of the fee also depends on the area of the trading floor. The latter is calculated according to the rules of the patent system. In order not to overpay money, you should indicate in the plan, the lease agreement the area of the hall without utility rooms and storagepremises. The Federal Tax Service will be guided by these documents when making calculations.

Special occasions

Each member of the partnership pays the fee for himself. The amount is calculated in proportion to the contribution of a particular participant:

Fee=Member Share / Floor Area x Rate.

If trade is carried out at gas stations, then the amount of the fee is determined based on the area of the pavilion or the number of objects.

Responsibility

If an organization does not register as a fee payer, this will be regarded as illegal conduct of activities. For this offense, a fine is provided - 10% of income, at least 40 thousand rubles. If a notice of registration is not submitted, then the organization or individual entrepreneur will not be able to reduce taxes on the amount of the collection.

For late or incomplete payment of the fee, a fine of 20% of the tax amount is provided. If it is proved that the violations were committed intentionally, the fine will increase to 40%. Therefore, in order to transfer the trading fee, the details for payment should be obtained from the Federal Tax Service in advance.

How to get my reputation back?

If a company got on the pen alty list by accident, it can remove itself from it on its own. How to do it?

The first step is to check if the company is listed on the Department of Economic Development website. It contains data on 6,000 outlets that were not registered. Next, you need to write a letter with a request to exclude the organization from the list of debtors. The complaint may be upheld if the noticeregistration information was sent with a delay or the company does not trade at a particular facility.

To appeal, the company has 20 days from the date of being included in the list. Otherwise, the data on the taxpayer will be transferred to the Federal Tax Service. The inspectorate will calculate the amount of the fee and issue a demand for its payment. You can challenge this act within 180 days. To do this, you must write a complaint to the Department, but according to the model presented on the website of the state institution. Supporting documents should also be attached to the application (a copy of the notice, lease agreement, cadastral extract with information about the outlet).

You can send documents by e-mail or by mail. The Department takes 30 days (in some cases - 60 days) to make a decision. If a decision is made in favor of the company, it will be removed from the list and the act will be updated. Immediately after that, the Federal Tax Service will cancel the accruals.

Recommended:

Trading strategy: development, example, analysis of trading strategies. The Best Forex Trading Strategies

For successful and profitable trading on the Forex currency market, each trader uses a trading strategy. What is it and how to create your own trading strategy, you can learn from this article

Payment order: filling order, purpose

The payment order is mentioned in the Regulation of the Central Bank No. 383-P of 2012. This settlement document is created in a banking institution to make a partial transfer of funds

Samples of filling out payment orders. Payment order: sample

Most enterprises pay various taxes and fees to the budget. Most often this is done with the help of payment orders. How to compose them correctly?

UIP - what is it in a payment order? Unique payment identifier

Since 2014, the UIP is an important requisite that must be filled in if it is provided by the seller, and also if this identifier should be considered as a UIN when it is indicated in payment documents for paying fines, pen alties for taxes and fees . This code is indicated in the field of the payment order at number 22. It can be filled in both manually and using special software tools, the main of which is "1C: Enterprise"

Fee for late payment of tax: useful information

When does the pen alty for non-payment of tax start? How can I calculate the pen alty amount myself? All this is covered in this article