2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

On-call loan is a type of loan in which the borrower gets the right to use funds from a specially opened account at his own discretion. The amount is limited. An on-call loan is a loan provided by a bank with the right to demand a refund at any time.

Definition

So, what is an on-call loan? Let's take a closer look. Borrowing money is a need that often arises in the modern world both for individuals - citizens and individual entrepreneurs, and for medium and large enterprises, firms and companies. Borrowed funds are actively attracted both to meet personal needs and to solve financial problems in the process of business development.

Credit institutions today can offer a wide range of services in the field of lending and are able to meet the requirements of any client on acceptable terms. It remains only to choose the most suitable for yourself.

The on-call loan is one of the rare but interesting bankingservices. It is also called a demand loan. The term of the loan does not have a strictly established limit. This type of loan originated in England. Today, this approach is more typical of American banks.

In our country, such services are not widespread enough. Credit institutions in Russia prefer to set terms for the use of borrowed funds. In addition, according to the current legislation of the Russian Federation, if the terms of the loan repayment are not specified in the contract, the debt must be repaid within 30 days. This service is new and not yet widely used.

Features of an on-call loan

This type of loan has a number of differences from other types of loans. The main feature is that an on-call loan is a type of service in which a refund must be made at the request of the bank. Usually the client is warned about this 2-7 days in advance. During this period, the borrower must repay the debt. Early repayment of the debt is allowed, if it is provided for in the contract. No commission is charged.

Another distinguishing feature of an on-call loan is the opening of a special account. It has the characteristic features of both loan and current. It records all transactions and data on the mutual debt of the bank and the client. The borrower has the right to use the funds in the account at any time and withdraw them in any amount within the limit.

Monthly the client is obliged to pay interest on the loan, which are accrued strictly on the borrowedamount for the actual period of its use. The rate is much lower than for other types of loans. The client has the opportunity to repay the main debt at any time convenient for him in installments or in a lump sum payment. The account balance can be debit or credit.

Conditions and order of registration

To receive an on-call loan, you must first conclude an agreement with the bank. To this end, you must submit an application and fill out an appropriate form.

Then the bank will assess the solvency of the potential borrower. To do this, you must present a package of documents:

- Last year financial report and balance sheet data;

- insurance policy;

- documents confirming the ownership of real estate or a lease agreement;

- charter of the enterprise;

- certificate of registration of a legal entity.

The main condition of credit institutions for issuing a loan is a guarantee of loan repayment. In this capacity, mainly securities (stocks, bonds, bills), customer goods or equipment are used. It is necessary to present documents for collateral to the bank. The bank will evaluate it. Depending on the value of the collateral, the amount of funds that will be provided at the disposal of the client is determined.

After the above actions, an agreement is concluded between the lender and the borrower. When signing it, the client is advised to pay attention to the term for notifying the bank about the need to repay the debt. The longer it is, the less the risk of losing the pledged property.

For regular customers there is no requirement to provide evidence of solvency. It is enough to present documents for bail.

Then you need to open a bank account, which will receive the amount specified in the loan agreement. At the request of the bank, the debt must be repaid within a week.

Who can use the service

On-call credit is a popular type of loan among brokers who profit from the sale and purchase of securities used as collateral. Employees of stock exchanges or other owners of securities also use this service.

Commercial and industrial enterprises and companies use on-call lending as a source of additional funds for a major transaction. These are mostly regular bank customers who urgently need money.

Benefits for the bank

In order to expand the client base, credit institutions periodically expand the list of their services, providing their potential borrowers with a wide choice. Each of them has its own possibilities and limitations. All types of lending have positive and negative sides for both lenders and borrowers. An exception is no call loan. Consider its pros and cons in more detail.

On-call credit refers to the bank's financial products, which are the best opportunity to increase liquidity. This is due to the fact that inmost often, the client provides securities as collateral.

The bank's liquidity is also supported by the fact that on-call loans are short-term loans, despite the fact that the repayment of borrowed funds can take quite a long period of time.

A positive factor is the low risk of non-repayment of the loan, as it is secured by collateral

Benefits for the borrower

On-call credit is attractive because, being a demand loan, it provides for a lower interest rate than in other cases. In addition, the fee for the use of borrowed funds is calculated on the amount actually used and only for the period from the moment of their withdrawal to the return.

Besides, in this case, the targeted use of finance is not required. The borrower has the right to spend the funds received at his own discretion, without reporting to the lender.

The big advantage is the ability to receive money and repay the debt at any convenient time and in a convenient way: in installments or in a single payment. Insurance when applying for a loan is not required, as collateral is provided in the form of securities.

Regular customers can count on certain benefits: an increase in the size of the loan or additional discounts on interest for using the loan. Such borrowers can apply for an on-call loan for a year or even longer. But this may also turn out to be a disadvantage, since over a long time the bank's policy may change, not always for the better. BUTin this case, it may suddenly become necessary to return funds in a large amount in a fairly short time.

Bank risks

The most significant disadvantage of on-call lending is the inability to plan and predict the profit from such loans. The reason for this is the client's right to repay the debt at any time, including before the expiration of the contract, and withdraw the collateral.

Borrower risks

On-call loan - what is it? This is a demand loan. Therefore, a negative factor for the credited is that the bank has the right to inform at any time about the need to repay the debt on the loan. The risk lies in the possible lack of funds at that time in full from the borrower. In this case, the collateral property will become the property of the bank. Since securities may have high liquidity, their loss will bring significant financial losses to the borrower.

In the case of using such a bank service in order to reduce risks, it is recommended to take funds exclusively for their intended purpose and always be prepared for the fact that the bank may require their return.

Recommended:

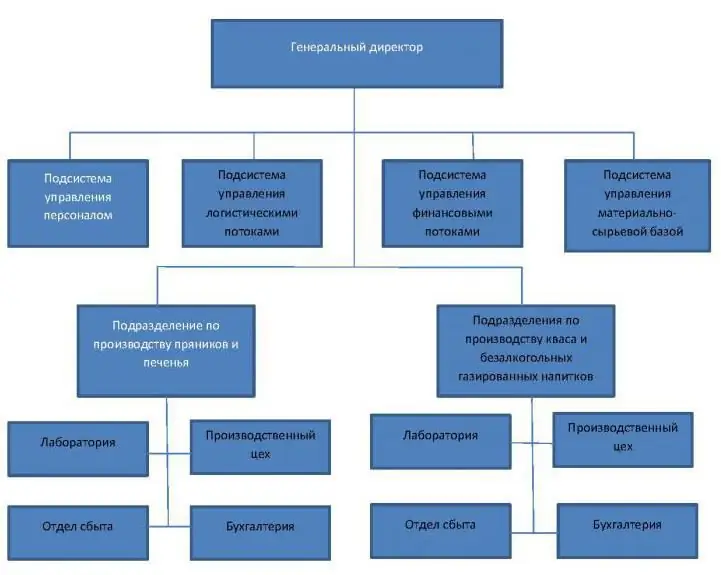

The organizational structure of an organization is Definition, description, characteristics, advantages and disadvantages

The article reveals the concept of the organizational structure of an enterprise: what it is, how and in what forms it is used in modern enterprises. The attached diagrams will help to visually illustrate the use of different types of organizational structures

"Direct Credit": reviews, conditions, features, advantages and disadvantages

Review of the modern system "Direct Credit". The main direction of the company. How did the system of formation and issuance of loans online. What are the terms of the partnership? Used technologies for partners and clients of the company

Compressor units: definition of the concept, advantages and disadvantages

Compressor units are used to operate pneumatic equipment. There are many types of models. They differ in design and parameters

Working on your own gazelle: advantages and disadvantages, requirements and conditions

Working on your own gazelle is one of the most popular areas in the field of small business. To start doing it, you need to take into account a lot of nuances, including the size of the initial investment, as well as the amount of free time. After all, cargo transportation can be considered not only as the main employment, but also as a side job opportunity

Self-insurance is Definition, basic principles, advantages and disadvantages

What is self-insurance? What are its features, main forms? Historical development of the phenomenon. Characteristic features of self-insurance. How are reserve funds formed? When is self-insurance necessary? Its development today: who will benefit, why is it not common on the market?