2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

The wages paid to the worker belong to him by right of ownership. He can dispose of this money as he wishes. But in some cases, certain funds are withheld from wages. These include debts to the state, as well as to legal entities and individuals. For example, how to withhold alimony from salary (an example is attached), the following article.

Miscellaneous payroll deductions

There is a certain order of deduction of certain amounts from the remaining salary after taxes have been deducted from it. It looks like this:

- compensation for damage to human he alth;

- compensation for survivors;

- compensation for non-pecuniary damage;

- tax compensation (meaning fines, as well as additionally accrued amounts to fees);

- other deductions.

There arecertain rules on how to withhold child support from wages (an example is presented below in the article). It is especially important to understand the intricacies of the process when calculating payments in a fixed amount, since the accounting department at the enterprise where the alimony payer works must periodically index. In addition, it must be taken into account that new claims will be satisfied after the old ones are repaid.

Procedure for withholding child support and maximum amount

The fundamental document on the basis of which child support is withheld is a writ of execution. As a general rule, the maximum amount that can be deducted from wages is 50%. And if such a debt has formed that exceeds 50% of the monthly salary, then the balance is transferred to subsequent months.

If the money is withheld according to different documents, and the employee has been working in a new place for less than one month, then it is necessary to follow the order. In some cases, including with regard to alimony, a different restriction applies: 70%. This is the maximum salary equivalent amount that can be deducted from it. This is stated in paragraph 3 of Article 99 of Law No. 229-FZ. This is possible in the following cases:

- paid alimony debt for past periods;

- compensates for harm caused to he alth, as well as to persons who have lost their breadwinner;

- compensates for damage caused by the crime committed.

About how much child support andother compensation indicated above is clearly stated in the writ of execution, which is issued by the court after its decision. So, if there are several writ of execution with a 70% deduction, then the increased limit does not apply to the rest. For example, if a writ of execution issued under a court decision on compensation for harm caused to he alth provides for a withholding of 60%, then settlements on other writ of execution will be paid only after the full repayment of this compensation for harm caused to he alth.

Another fundamental document, according to which deductions are made from wages, is an agreement concluded between former spouses and certified by a notary. After the relevant documents are received by the accounting department, the corresponding calculation is carried out.

Basics of withholding child support by agreement of the parties

This agreement is between the former spouses on a voluntary basis. An indispensable condition for validity is its certification by a notary. The agreement provides for what amount or how many percent are withheld from the salary for alimony, the method of accruing money, the frequency, as well as the responsibility of the alimony payer for violation of his obligations. The document is transferred to the employer directly by the payer, the bailiff or the recipient of alimony. In addition to personal transmission, the agreement may be sent by mail. The following papers must be attached to the letter:

- application for alimony;

- copy of birth documentbaby;

- agreement (original);

- beneficiary's bank details.

Based on these documents, the employer is obliged to transfer the appropriate funds to the claimant.

Executive proceedings by bailiffs

The agreement, as well as the writ of execution, serves as a writ of execution, on the basis of which the bailiff initiates enforcement proceedings. The claimant should apply to the service at the place of residence with this document, presenting a passport and a certificate of the birth of a child. You should also provide information about the debtor (his address of residence, contacts and place of work).

In the future, the bailiff sends the following documents to the place of work of the alimony payer:

- copy of writ of execution or agreement;

- recovery order;

- memo to the accountant on the accrual of deductions from the salary.

After that, the responsibility for payment evasion, errors or late accrual of alimony falls on the management and accounting department of the alimony payer's employer.

Sources of income from which alimony is withheld and not withheld

It is important to know, not only about how child support is withheld from wages. There are a number of other incomes from which appropriate deductions are made. These include the following:

- remuneration to civil servants;

- fees to media staff and employeesart;

- Skill bonuses;

- surcharges for night shifts and overtime;

- premium;

- vacation;

- other benefits (such as scholarships and rental income).

This list is contained in RF GD No. 841. But in law No. 229-FZ, namely in Art. 101, it refers to the income from which alimony is not withheld. This is:

- financial assistance for the birth of a child, as well as marriage or death of relatives;

- pension payments;

- alimony;

- compensation.

Basically, alimony is transferred in favor of children under the age of majority. But in some cases, they are carried out in relation to parents and other relatives.

If an employee quits, the employer must inform the bailiffs. It is also the responsibility of the alimony payer and the employer (if such information is available) to provide information about the new job and place of residence.

When child support is transferred from advance payment

To figure out how to withhold alimony from a salary, an example is presented below, you need to understand what these payments are. According to Art. 98 of the RF IC, advance payments include payments in the form of a part of wages transferred every month. The calculation base is determined by the employer based on the results of the past month. If the advance payment is 50%, while the payer's deduction is 70%, then the main part of the salary will not be enough to pay off the debt. In this case, part of the sumwill have to transfer from the advance.

An example will help you understand how to withhold child support from your salary. Money in the company is issued twice a month: on the 15th and 5th in the ratio of 50/50. The employee's advance payment is 20,000 rubles. But an executive document was received for him, according to which the amount of deduction is 100,000 rubles. In this case, the calculation of deductions will be as follows:

- 40 000 rub. - 13%=RUB 34,800;

- 34 800 rub.70%=RUB 24,360

In this case, 24,360 rubles. - this is the maximum amount of alimony that can be withheld from the salary.

Since the amount received is higher than the salary that the employee receives in the 2nd half of the month, part of the amount is withheld from the main salary, and the rest from the advance payment for the next month. Such a rule in the company should be followed until the entire debt is paid.

This order of transfer is most appropriate in cases where deductions are above 1/3 of earnings. Thanks to this, there will be no situation in which the employee will not have any means of subsistence at all.

Deductions for minor children

Basically, both the payer and the recipient are interested in the question of how child support is withheld from wages in favor of a minor child. Usually, the executive documents indicate the percentage of income received by the debtor on a monthly basis. As a rule, it is provided from 20 to 30%.

In addition, alimony can be set at a fixed rate. Then this amountcorrelates with the living wage, and the accounting department will have to periodically index the money in accordance with changing conditions. Even if the executive document does not specify the need for indexation, this should be done according to the general rules contained in Art. 117 RF IC. It is noteworthy that in the case of a decrease in the living wage, indexation is not carried out.

It will help you understand how to withhold child support from your salary and other deductions, an example that is presented below. The employee pays child support in the amount of 2 living wages. The family lives in the Moscow region. The writ of execution was issued at the end of 2014. For the 1st quarter of 2015, the amount was increased from 6,455 rubles. up to 6 580 rubles The following formula will help calculate the maximum retention for this period:

645526580/6455=13160 rubles

This amount is subject to withholding until the administration decides on a new revision of the living wage.

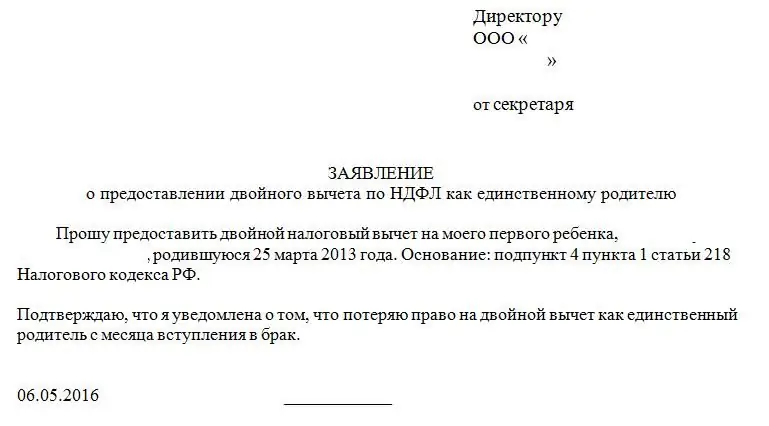

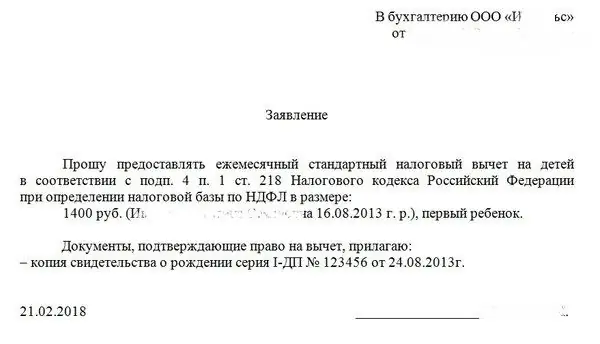

Alimony payer's right to tax credits

Alimony payers have the right to count on the deduction of personal income tax. An application is submitted to receive it. In this case, the annual income should not exceed 280 thousand rubles. From the month when the limit exceeds the established amount, the deduction is not valid. The right is confirmed by documents for the child, a divorce certificate, as well as an executive document on the basis of which payments are made.

Calculation of deductions including tax deductions

Alimony is transferred to the recipient's accountwithin three days after the issuance of wages. According to Art. 109 of the RF IC, the costs of the transfer are borne by the alimony payer. If the details of the payee are unknown, the company must notify the executive service and transfer the funds to the deposit account in time.

For example, an employee receives a salary of 30,000 rubles. He wrote an application for a standard deduction in the amount of 1,400 rubles. To figure out how to withhold alimony from a salary without a writ of execution or with one, you need to use the following calculation.

- First, personal income tax is calculated taking into account the deduction: (30000 - 1400)13%=3,718 rubles

- After that - the amount of alimony, the calculation principle of which is indicated above. In this case, the amount will be 13,160 rubles.

Calculation by 1С

A novice accountant may have a question about how to withhold alimony from salary in 1C 8.2. This is done as follows:

- Go to the Payroll tab.

- Find the Holds directory.

- Find the desired "Writ of execution hold".

- The "Other" tab contains information on accruals to the settlement base.

- Add Extra Charge for Extended Work.

- Count everything again.

Pen alties for violations

If certain violations are revealed during the calculation of alimony, the accountant faces a fine of 2,500 rubles. This is stated in Art. 431 Code of Civil Procedure of the Russian Federation. In Art. 17 of the Code of Administrative Offenses of the Russian Federation refers to the accrual of the following fines if the requirements for the writ of execution are not metor the document itself is lost:

- from 2,000 to 2,500 rubles. for physical persons;

- from 15,000 to 20,000 rubles. for officials;

- from 50,000 to 100,000 rubles. for legal persons.

If a malicious non-execution of a court decision is recorded, then the following sanctions are provided:

- 200,000 RUB or the amount of earnings for eight months;

- deprivation of the right to work in a certain position for five years;

- compulsory work 480 hours;

- arrest for six months;

- imprisonment up to two years.

Start payouts

Alimony must be withheld from the moment the writ of execution is issued. For example, if a company received a notification on September 12, then from this date earnings should be calculated, that is, for the month of September - from September 12 to September 30.

If during this period the employee received bonuses for the previous quarter, then deductions from this amount are not made. This is explained by the fact that the remuneration was paid for the period when the alimony was not yet in effect.

Termination of maintenance obligations

The RF IC provides that alimony is terminated if the recipient or payer dies, after the expiration of the term of the executive document or by court decision in the following cases:

- child turned 18;

- child adopted or adopted;

- no need for help anymore;

- support recipient remarried.

The following example makes it convenient to see howWithhold child support for the month in which the child turns 18. For example, a boy reached the age of majority on 2017-25-10. Then deductions are made:

- from wages accrued from 1 to 25 October;

- premiums for the last quarter, accrued before October 25;

- annual premium from the beginning of the year until October 25.

Conclusion

These are the basics of how to withhold child support. A fixed amount, if there is not enough salary, or whether payments are withheld as a percentage of earnings, it does not matter. All points are provided by law. Having studied them, the payer and the recipient of the alimony will be able to check the correctness of the transfers, and the accounting department will not make mistakes.

Recommended:

Tax deduction at birth of a child: application, who is en titled to a deduction, how to get

The birth of a child in Russia is an event that is accompanied by a certain amount of paperwork. Parents acquire special rights when replenishing the family. For example, for a tax deduction. How to get it? And how is it expressed? Look for the answer in this article

Tax deduction for a child: what is it and who is en titled to it?

Tax deductions are different. And they are provided to citizens on different conditions. For example, there is a deduction for a child. What's this? How and where to apply? This article will tell you all about claiming deductions for children in Russia

Escorting a child to and from school. How to choose a nanny to accompany a child?

Human life is always priceless. Especially the life of a child. When the child is near, parents are calm. But the little man grows, becomes more independent. Along with his independence, anxiety about him increases. Mom and dad do not have enough time to accompany the child to and from school, they work. In such a situation, it is worth considering a nanny

How child support is calculated. Formula and example for calculating child support for one and two children

Helping loved ones who cannot take care of themselves on their own is reflected in the legislation of the Russian Federation. The state created alimony as a protection mechanism for low-income relatives. They can be paid both for the maintenance of children and other close relatives who cannot take care of themselves. Read more about how child support is calculated

How to find out the child support debt?

Today, for most citizens, withholding alimony causes a lot of difficulties. Some are trying to get away from their duties, hide their income, play for time. In such cases, the recovery has to be carried out through bailiffs. For more information on how and where to find out alimony arrears, read further in this article