2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

This article will show you how to create a personal financial plan. It affects income, and people who do not plan their funds notice how they "leak through their fingers." In this case, a person can neither invest nor save for something worthwhile. Those who control their means can afford everything.

What is financial planning?

Financial planning starts with knowing your starting point. That is, you need to understand point A, where you are. It is impossible to guess, guess or take from the mind, it needs to be determined in only one way - to find out your numbers, that is, how much money and where you spend.

If you make a personal financial plan, you can't plan it without knowing what you have. It doesn't matter what purpose you are saving for: a car, an apartment or a trip - you need to organize and keep records of everything.

Personal financial planning

For referencefunds you will need to make 2 tables. You can keep a personal financial plan in Excel or some other program, or draw a table on a wide sheet of paper.

The first table will include your expenses. It needs to be divided into several columns. You can write in it every day or write down the number of the salary of each month (below is a sample table where the expense is calculated on the first day of the month), enter the categories of your expenses in the adjacent columns. You can not enter all the costs in the general "heap", because if you count the total expense, it will not give you anything. If you take specific categories, for example, how much you spent on cafes, on gifts and on clothes, then this will help to understand whether you are moving in the right direction or not.

So take the main categories (like household items, taxes, car maintenance, food, clothing, medicine, entertainment, children, tuition fees, and so on) and write them down in a spreadsheet. The last category will be Miscellaneous. This table may be slightly adjusted from month to month, perhaps you will remove or add some items.

Expense Accounting

After drawing a chart, start recording daily or monthly the amount of money spent in one category or another. For example, the personal financial plan below includes only 4 categories, which are a simple illustrative example. By the end of the month, you will be surprised at the resulting picture and understand where the money goes,why you don’t have enough for anything and you can’t save a certain amount to achieve a financial goal.

At the end of the month, you need to write down the total amount of spending for each category. Analyze it, understand whether adequate amounts are spent on various needs. Next, you need to write down the total expense for the month or year.

Revenue Accounting

Next, you need to make exactly the same table as with expenses, where you will record your income. Your task is to fix the profit, as your personal financial plan will come from this table.

You also create a table, write the date in the column. If income does not come to you every day, then write down the numbers after the fact. In the adjacent columns, write down the sources of income, such as scholarships, alimony, salary, part-time job, freelancing, and so on. Write down the amounts that come to you. At the end of the month, you need to calculate the total amount of your income.

Comparison

Next, you need to compare your spending with income. If the remaining funds exceeded the expense, then you have a certain amount. Further, the implementation of a personal financial plan continues as a tool to achieve your goal. Looking ahead, you should write down all your financial goals for the current year and distribute the remaining amount. You need to understand if this money is enough to achieve the goal.

If this amount is not enough, then you will return to the first table. You need to optimize your costs. Look at your list of expenses: maybe something can be cut orremove it without hurting yourself? In no case do not limit yourself in food, recreation and entertainment, just try to find more profitable options for you. Personal instructions are not attached to the personal financial plan. Everything needs to be compiled and edited individually, for yourself. Accordingly, if you reduce expenses, then the figure of the remaining money to achieve the goal increases.

Optimization

If you have optimized all your expenses and already live so optimally that there is nowhere else to go, there is only one option left - increasing your income.

The requirements for a personal financial plan are simple: you need to get more than you spend. Trust me, the opposite is also true. You can increase your income by increasing efficiency or by looking for an additional source of income:

- Increase in efficiency. This item requires self-organization and accounting for your time. Plan your day, get rid of external irritants if your rate depends on the amount of work done. Try to do more than usual, but don't overdo it.

- Search for extra income. You can find freelance work, take extra paid hours at work, or work elsewhere on weekends and free time if you have the energy and desire to do so.

Sample personal financial plan

The table below is an example of a freelancer. Expenses such as a doctor, gifts, and so on are not taken as the basis, but you must include them. An example of a personal financial plan in Excel to doeasier, but you can use special paid or free programs.

| Date | Food | Clothes | Utilities | Entertainment |

| 1.01 | 10000 | 5000 | 3000 | |

| 1.02 | 9500 | 4500 | 3400 | |

| 1.03 | 11000 | 6000 | 5100 | 2900 |

| 1.04 | 8900 | 3000 | 4800 | 4800 |

| 1.05 | 9800 | 2000 | 5000 | 2000 |

| 1.06 | 9900 | 4500 | 2600 | |

| 1.07 | 11100 | 4600 | 5200 | 5900 |

| 1.08 | 12500 | 4100 | 4900 | |

| 1.09 | 8900 | 5000 | 4300 | 6900 |

| 1.10 | 9000 | 2000 | 5000 | 1700 |

| 1.11 | 9400 | 10000 | 5400 | 3890 |

| 1.12 | 15000 | 3500 | 4000 | 10000 |

| Total: | 125000 | 36100 | 56900 | 51990 |

Total amount: 269990.

Income plan

It has already been said above how to make a personal financial plan for your expenses. Now let's give an example of the income of the same freelancer, who spends 270 thousand rubles a year:

| Date | Articles in the article store | Permanent work | Scholarship |

| 1.01 | 3500 | 35000 | 5000 |

| 1.02 | 5600 | 35000 | 5000 |

| 1.03 | 2300 | 42000 (premium) | 5000 |

| 1.04 | 1200 | 35000 | 5000 |

| 1.05 | 3400 | 35000 | 9000 (Research Award) |

| 1.06 | 6500 | 60000 (vacation) | 5000 |

| 1.07 | 2300 | 35000 | 5000 |

| 1.08 | 7000 | 35000 | 5000 |

| 1.09 | 11000 | 35000 | 5000 |

| 1.10 | 3300 | 35000 | 5000 |

| 1.11 | 3900 | 35000 | 5000 |

| 1.12 | 5000 | 40000 (premium) | 5000 |

| Result | 54900 | 457000 | 64000 |

Total amount: 575900 rubles.

Achieve financial goal

As you can see, our freelancer has 305 thousand rubles left. If he wants an apartment for 1.2 million rubles, he only needs 4 years to reach his financial goal. A personal financial plan helps you not only monitor your income, but also optimize it significantly.

Realizing your goals

Once you decide to make things better with your money, your first step should be to sit down and make a list of the financial goals you would like to achieve. Review and add to your list until you are sure that these are the goals you really want to get.

AfterTo do this, make clear plans to achieve your financial goals. Break these plans down into concrete, actionable steps that will enable you to achieve your money goals and you're on your way.

The next step is to set some priorities. You will probably have a lot of money, but you won't be able to focus on all your financial goals at once. You may want to work on some fast ones first to build momentum. You can focus on one big money goal if it represents a dominant issue in your life (like getting a job or getting out of credit card debt).

How fast you want to get something done, no matter how small your income is, you have to start. You will never reach your financial goals without some real effort.

If your goals are clear and your action plan is defined, you know exactly what you need to do. The most important thing is to start. Each of these steps is of great importance, so do not skip them. Together they guarantee you financial success.

The path to success

Most people who decide to take charge of their financial independence take the leap and make some real progress early on. Over time, unfortunately, stagnation begins. We have so many interests in life that it is very easy to get distracted from our financial goals. We set ourselves tasks. We are taking some steps to achieve our financial goals. And we are delighted with our originalsuccess. But soon we find something to do elsewhere and little attention is paid to what, frankly, should be a priority. We focus on other activities and just don't think about plans.

And when we stop thinking about them, we begin to put them off. Then the things we really need to do, we just don't want to do! It does not make sense. But it's true.

It's true that much of the actual work we need to do to reach our financial goals is boring at best. You may not be enthusiastic about work of any kind, but you will have some satisfaction in doing it!

The second accepted practice is described in Brian Tracy's big book called Eat the Frog. The title of the book and its idea stem from the answer to the question: “What is the best way to eat a frog?” Answer: "Fast".

The most important idea is to optimize those tasks that really need to be done, or they will hang over your head until you do it. Do them quickly and first.

This principle applies to most of life, but financially it means not paying bills or anything, putting it off just because you're afraid of it. It's amazing how much pressure these tasks take off your mind and how much joy it brings. It is worth repeating to yourself: “Eat this frog. Eat this frog. Eat this frog. Then move on to the task that needs to be done and just do it. Consider taking one financial step at or near the top of your list.her and get what she wants from the very beginning. If you do this, your financial success will be almost guaranteed because your daily accomplishments will stimulate unwavering motivation to keep going.

Motivation

Suppose, for example, that you want to save 3,000 rubles a month or add an additional 3,000 a month to pay for a credit card. Instead of including this exact amount, give yourself a range of, say, $2,500 to $3,200 per month. According to Maura Scott, assistant professor of marketing at Florida State University, having a range is more motivating because we perceive it as achievable and challenging. There are two psychological forces that underlie our motivation to stick to a long-term goal. The more difficult it is to achieve the goal, the more we will be rewarded with a sense of satisfaction if we succeed. But it is also more likely that we will fail and be disappointed.

But that's the beauty of it. "If it's too easy, it doesn't feel like a goal, but at the same time, the goal has to be set within the limits of the person's ability," Scott says. And if you work harder to hit the top of your target range, you'll get a greater sense of accomplishment.

Here's what works in real life. Now you know how to implement a personal financial plan. Set out a list of financial goals with written plans to achieve them. Write down a list of important tasks each day, includingwhat you intend to do on this day to increase your finances. Then make a clear commitment to do what's on your priority list, in order of importance, and take action immediately, even if it means you have to "eat that frog"!

Recommended:

Plan of financial and economic activities of a budgetary institution: an example of compilation, items of expenditure and income

In accordance with the legislation of the Russian Federation, budgetary institutions must draw up plans for financial and economic activities. What are the features of solving this problem?

Recreation center business plan: an example with calculations, features and recommendations

Recreation centers are becoming more and more popular, because most people prefer to rest in Russia rather than abroad. After all, there are many beautiful scenic spots and natural attractions. This business needs a lot of investment, but with the right approach, it will bring high income

Financial plan of a business plan: prerequisites for drawing up

The largest and most important step in preparing for a business is the financial plan of the business plan. The information contained in this section is the basis for providing it to business partners, investors

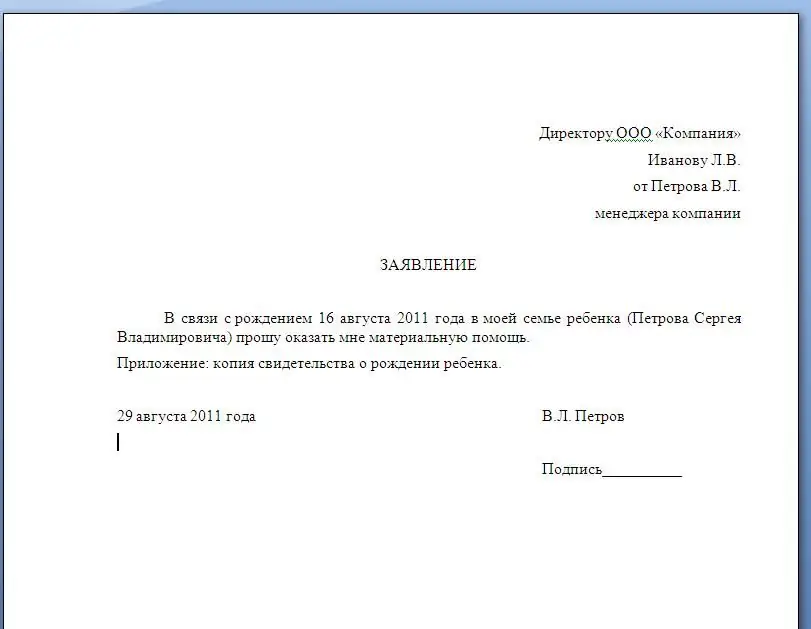

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer

The effective interest rate is Definition, calculation features, example and recommendations

As part of the analysis of a loan (or investment), it is sometimes difficult to determine its true value or profitability. There are different terms that are used to describe rates or profitability. For example, we can talk about annual percentage yield, effective and nominal rate, etc