2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

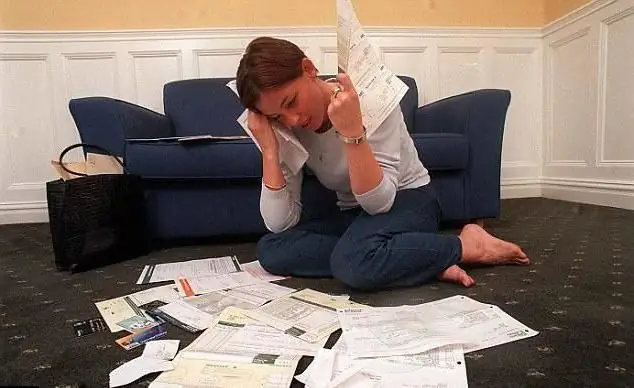

Everyone tries to keep a record of their own funds. Whether he does it successfully or not depends on worldly wisdom, the ability to foresee the development of events and financial intuition. At the same time, it is difficult to find a person who does not have to borrow money. The need to find a source of funds among friends and relatives, as well as the need for explanations, disappears if you have an overdraft. What it is? Is it different from a loan? Knowing the answers to these questions will increase financial self-confidence and economic literacy. Let's do that.

Sounding so similar to the German word "overdraft" is actually a tracing paper from English, and it means "short-term loan". It is provided to the most reliable clients of the bank in the amount of a predetermined amount.

This leads to legitimate questions, provided that you agree to take an overdraft. What kind of loan is this? What are its conditions? Is it beneficial? How is a credit overdraft different from a credit card?

In the banking sense, an overdraft is not even a loan. This is an opportunity for the cardholder to takebank to loan some cash, subject to limits, until the next paycheck.

The unused overdraft amount is always on the holder's bank card. Of course, borrowing money is not free. The debt is red in payment, and with a percentage determined by the agreement. Usually it is much higher than that of the usual for our understanding of loans.

Another difference is that the debt is repaid in a single amount (including interest) at the time the next salary is credited to the card. Whereas credit card debt is usually broken down into a series of equal, interest-free payments over a specified time period.

Most often, the size of a debit card overdraft depends on the size of the average monthly credits and usually does not exceed this individual figure for each owner. Thus, the next receipt of funds fully repays the debt to the bank.

Please note that a non-credit card holder can easily become a borrower by accident. For example, if payroll is delayed, and the client, unaware of this, makes the necessary purchases, paying off the funds provided under the overdraft agreement. That this purchase cost more than expected, the cardholder may find out only a month later.

Calculation on a credit card a priori cannot be random for a client.

The most serious drawback of an overdraft is the credit trap. Very often a person does not fit into the amount allotted by wages. Having drawnoverdraft funds once, subsequently does not have time to repay the debt on time. This amount of debt is transferred from month to month, leaving the bank with the required interest.

If you decide, when you find out everything about the overdraft, that this offer of the bank is not profitable for you, just refuse it. But there are force majeure circumstances when it is very necessary. Just be aware of the pitfalls of an overdraft and use it wisely.

Recommended:

Overdraft credit is Overdraft conditions for legal entities

An overdraft loan is a specific type of loan that is offered on debit cards or credit cards. The article describes how such a function is connected, how the debt is repaid, and also how this loan is turned off. The negative consequences of using an overdraft for individuals are given

Purchase of debt from individuals and legal entities. Buying property with debt

What is buying and selling debt? Features of the purchase of debt under the writ of execution. Cooperation with collectors. Purchase of debt from individuals and legal entities. What to do if you bought an apartment with debts?

Debt sold to collectors: does the bank have the right to do so? What to do if the debt is sold to collectors?

Collectors are a huge problem for many. What to do if the bank has contacted similar companies for debts? Does he have the right to do so? What will be the consequences? What to prepare for?

What are overdraft cards? Overdraft, card

The variety of plastic cards of various banking organizations is huge. Among them there are such as debit card, credit card, overdraft card. The advantages and disadvantages of each of them, what are overdraft cards, read below

Overdraft card - what is it? What does an overdraft bank card mean?

All individuals and legal entities that have a bank account can, if they wish, apply for a loan in the form of an overdraft. The word "credit" is clear today even to a schoolboy, but not everyone knows what an overdraft account means and why it cannot be called a loan