2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Having a vehicle in the property makes life much easier. Some people use such property for personal convenience, while others use a car to earn money. In any case, the presence of a vehicle is not only a positive thing, but also an expense. For example, for maintenance and repair. Also, a citizen has to pay an annual power tax. It is called transport. It is about him that will be discussed further. Unfortunately, many people experience serious difficulties in the process of paying and calculating the corresponding tax charge. If you carefully study the current legislation, you can quickly clarify the situation. This is what we will do. The information presented to your attention will be useful for both experienced car owners, and beginners, and those who are just thinking about buying a car.

General characteristics

What is a power tax? In another way, it is also called transport. This is an annual accrual of a tax type that relies on a person owning a device for transporting people or goods on the roads, subject to mandatory registrationin authorized bodies.

Some types of vehicles are exempt from taxation, but not so many. We will talk about such benefits later. First, let's look at the relevant tax as a whole.

It is annual and regulated by the regional government. This leads to the fact that for the same transport in different cities you have to pay differently.

Why is it called a power tax?

Some wonder why the vehicle tax is also called "engine power". There is a logical explanation for this.

The thing is that the tax rate on a car directly depends on the engine power of the vehicle. The higher it is, the higher the bet will be. There is nothing difficult or incomprehensible about this.

True, the tax rates in all regions will be different. Moreover, they are reviewed annually. Therefore, more accurate information on the data for calculating the vehicle tax will have to be clarified in a particular city separately.

How to calculate - collect data

Calculating the tax on engine power is not as difficult as it seems. The main thing is to properly prepare for the corresponding process. Only then will a person not have any problems.

To achieve the desired result, you need to get some information about the transport and its owner. Otherwise, the calculations will be impossible to carry out. And this is quite normal.

At the moment, for the successful calculation of the vehicle capacity tax, it is necessary to clarify:

- engine powervehicle;

- tax rate for selected transport;

- value of the corresponding movable object;

- year of vehicle release;

- place of vehicle registration;

- number of months of car ownership (per calendar year).

Also, in some cases, it is recommended to clarify the so-called increase factor. It is required if the car owned is considered luxurious. This will also be discussed below.

Registration of the owner and registration of transport

How does engine power affect vehicle tax? As a rule, the more powerful the car, the higher its one horsepower will "cost". This means that you will have to pay less for low-power transport. This is quite a logical phenomenon.

Some are wondering what to do if the owner of a movable object is registered in one region, and his car is registered in another? How to calculate car tax under such circumstances?

Of course, it is better that the registration of the owner and the place of registration of the transport coincide. Otherwise, tax charges will be made at the rates of the region where the citizen has registered the car. Sometimes it's good, sometimes it's not.

Luxury vehicle concept

Tax on transport capacity, as already mentioned, can be calculated in different ways. An important role is played by the cost of transport. In some cases, cars available to citizens and companies are recognized as elite. They are covered by the improvedformula for calculating vehicle tax.

Luxury cars are movable property of the corresponding type, the average cost of which is three million rubles or more. It is important to remember that it is not the amount in the sale and purchase agreement that is taken into account, but the manufacturer's price.

From year to year, the list of elite vehicles is reviewed by the Ministry of Trade and Industry. Thus, sometimes ordinary cars fall into it, the cost of which simply reaches the indicator indicated earlier. At the moment, a jump in the dollar exchange rate has led to this phenomenon.

Bet-Power

Interested in car tax? The power scale of vehicles in Russia, along with tax rates in Moscow for 2018, is presented below. This is just a visual example that helps to understand the relationship between the power of cars and tax rates.

The corresponding list, as already mentioned, will be different in each region. And it is revised from year to year. As a rule, the capacity tax rates go up.

About odds

As already mentioned, sometimes in order to calculate the tax on the vehicle, it is necessary to clarify the increase coefficient. This is a special indicator that helps to increase the tax charge for luxury cars.

It is formed by the Ministry of Industry and Trade. Like the list of elite transport, it is reviewed annually. Therefore, the relevant data will have to be clarified together with the tax rates in the tax authority of a particularcities. Otherwise, the owner of the car runs the risk of making a mistake when calculating the tax due.

Formula for regular transport

The tax rate on car power, as emphasized earlier, depends on many factors. It is set in each region and differs from the capacity of transport. These are the rules.

Moreover, to find out what tax on engine power will have to pay in a given year, you can use different formulas. Let's start with the most common scenario.

It is about calculating the payment for an ordinary car, which is owned by an individual. In order to cope with such a task, you will need to perform the following mathematical operations:

- Divide months of vehicle ownership (per year) by 12.

- Multiply the tax rate by the number of "horses" in the engine.

- Multiply the first resulting digit by the second.

At this stage, the calculations can be completed. The citizen will see how much he will have to pay for a particular car in the selected region. But this is only one of several formulas available.

How to calculate the accrual for the elite?

Capacity tax in Russia, as mentioned, is calculated differently. We have already familiarized ourselves with one of the several available formulas. It is used in practice most often.

It happens that a citizen owns an elite car. To calculate the tax on the vehicle in this case, you must use an improved formula. But which one?

Toto achieve the desired result, you just need to multiply the amount received in the course of the above actions by the increase factor. This will be the luxury car power tax.

If the owner is a legal entity

And there is another rather interesting solution to the problem. True, in practice it is less common than the previously indicated formulas. We are talking about the calculation of taxes on auto organizations.

In this case, sometimes you have to try hard. The thing is that the calculation of the payment under study is possible in the course of the following actions:

- Multiply the engine power of the object by the tax rate.

- Multiply the resulting number with the share of the owner in the rights to the vehicle.

- Multiply by the number of months of vehicle ownership in a year, divided by twelve in advance.

- Multiply the corresponding figure with a multiplier (if necessary).

- Deduct benefits from the resulting indicator, as well as payments according to "Plato".

That's it. As practice shows, it is better not to calculate the tax on the vehicle of organizations and legal entities manually. High probability of errors. And they can lead to tax debts, which will not have the best effect on the company.

In automatic mode

Fortunately, a solution to almost any problem can be found fairly quickly. Especially when it comes to calculating taxes in Russia. And transport including.

To quickly find out the amount of tax on a car by capacity, as well as save yourself from unnecessaryproblems with calculations, you can use specialized applications. It implies working with online calculators. These are services that calculate taxes based on the data entered in a special form.

You can find similar resources on various information sites. It is best to use a calculator from the Federal Tax Service of Russia. This is the best, safest and most reliable solution.

Do you want to calculate the tax on engine power in 190 "horses" or with another indicator? Then it is recommended to act like this:

- Go to the official website of the Federal Tax Service of the Russian Federation on the Internet. The site "nalog.ru" is implied.

- Switch to the "Services" tab.

- Click on "Tax Calculator" in the menu that appears.

- Squeeze the line "Transport tax".

- Carefully study the data entry form, and then provide the requested information. The fields, as a rule, indicate the place of registration of the vehicle, as well as the year of its manufacture, power, time of ownership (per year) and available benefits, if any.

- Check the correctness of the information entered.

- Click the mouse (cursor) on the button responsible for starting the calculation of the corresponding amount.

Next, you just have to wait. After a few seconds, the system will perform the necessary mathematical operations, and then display the amount due for payment.

Important: for security reasons, it is recommended to check the amount of car tax directly with the tax authority.

Timingmaking payments

As soon as the tax rate on the power of the car, as well as other necessary information about the vehicle is known, everyone will be able to calculate the amount of the tax payment. This is not enough to avoid problems with the FTS. You also need to make payments on time. But what?

In 2019, citizens must transfer funds to the state treasury before December 1. The very next day, a person will be considered a debtor, and some sanctions will be applied to him for the purpose of punishment.

Organizations have to pay until the fifth of February. As in the case of individuals, the next day the organization will be considered indebted. This means that certain measures of influence may also be applied to it in order to recover funds.

Important: in some cities there may be other deadlines for paying vehicle tax.

On benefits in Russia

Tax on car power, as emphasized earlier, is not always paid. Some vehicles are completely exempt from such charges, and at the federal level. What exactly can be attributed to the category of preferential transport in the Russian Federation?

As a rule, you can not pay for boats with oars or with an engine power up to 5 hp. With. Also, the tax is not charged on state and agricultural transport. For ships that are intended for the carriage of goods and the transport of passengers.

Does a citizen have movable property in the form of a car with a capacity of up to 100 "horses"? Then you can not pay for it, but only if one condition is met - the transport must beacquired with the support of services.

For cars of special services in Russia they do not pay tax, as well as for ships that were entered in the Russian register. Cars specially equipped for the disabled are another category of preferential transport.

In these cases, there is no need to specifically apply to the Federal Tax Service for registration of benefits. At the regional level, in some cities, certain categories of citizens are exempt from taxes on vehicle capacity, or they are en titled to a discount of fifty to ninety percent of the amount of charges.

If debt has formed

Transport tax canceled or not? This question is asked by the owners of the vehicle from year to year. Fake news about the abolition of the corresponding tax is to blame. It has not been canceled and will not be cancelled. In the coming years for sure.

What happens if a person is overdue with the corresponding payment? You will have to face certain sanctions. They include:

- accrual pen alties from the first day of delay in payments;

- fine (20 percent of the debt in the absence of intent, otherwise - 40 percent);

- seizing a person's property and bank accounts/cards;

- assignment of the status of travel restrictions (ban on leaving the Russian Federation).

In this case, the last two paragraphs apply when the debt case is transferred to the bailiffs. This can happen if the debt has reached three thousand rubles.

Transport tax canceled or not? If you want to avoid delaypayment and remain a conscientious taxpayer, you just need to clarify the information of interest in the local tax office. Only in this case will it be possible to avoid problems.

Recommended:

Classification of tax rates. Types of tax rates

The rates for different types of taxes can be classified in a variety of ways. What are the relevant techniques that have become widespread in Russia? How can the current taxes in the Russian Federation be classified?

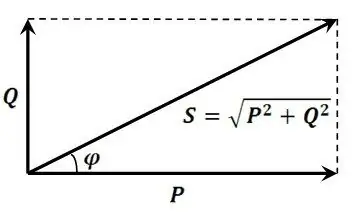

What is reactive power? Reactive power compensation. Reactive power calculation

In real production conditions, reactive power of an inductive nature prevails. The enterprises install not one electric meter, but two, one of which is active. And for the overexpenditure of energy “chased” in vain through power lines, the relevant authorities are mercilessly fined

For Dummies: VAT (Value Added Tax). Tax return, tax rates and VAT refund procedure

VAT is one of the most common taxes not only in Russia but also abroad. Having a significant impact on the formation of the Russian budget, it is increasingly attracting the attention of the uninitiated. For dummies, VAT can be presented in a schematic form, without going into the smallest nuances

Transport tax in the Krasnodar Territory. Transport tax: rates, calculation

Taxes are an important moment in the life of every citizen. And it has many features. Today we will be interested in the transport tax in the Krasnodar Territory. How much should you pay for a car? How to keep count?

Tax rate for transport tax. How to find the tax rate for the transport tax?

Today we are interested in the tax rate for transport tax. And not only it, but in general taxes that are paid for the fact that you have this or that means of transportation. What are the features here? How to make calculations? What is the due date for paying transport tax?