Taxes

PIT taxpayers (income tax in Russia)

Last modified: 2025-01-24 13:01

Personal income tax is one of the most common taxes in Russia. It is paid by citizens who receive certain incomes - at work, as a result of contractual legal relations, at the expense of business. What are the main features of the relevant tax? What categories of citizens pay it?

Status of the taxpayer in the payment order

Last modified: 2025-06-01 07:06

When filling out a payment order for tax payment, you should indicate the status of the payer. A complete list is presented in the Tax Code of the Russian Federation and some orders of the President of the Russian Federation. Let's consider in more detail how to determine the status of a taxpayer

Luxury tax. List of cars subject to luxury tax

Last modified: 2025-06-01 07:06

The luxury tax… what is it? The question is interesting. It's a "rich" tax. People have to give a certain amount for the fact that they are we althy and buy expensive cars for themselves. Interesting system. It was introduced in Russia recently. And the list of taxable cars has already amounted to almost 300 models. What are they? How much do they cost their owners? What is this system anyway? Worth sorting out

Taxes and tax reforms in Russia: description, features and directions

Last modified: 2025-01-24 13:01

Since 1990, a large-scale tax reform has begun in the Russian Federation. In April, a draft law on fees from citizens of the country, foreigners and stateless persons was submitted for consideration. In June, a normative act on the issues of mandatory contributions to the budget of enterprises, organizations and associations was discussed

Tax risk: types, factors, consequences, analysis and optimization

Last modified: 2025-01-24 13:01

In the process of doing business, entrepreneurs often face all sorts of risks, on which success in business often depends. Such a strategy may well be justified, since the conditions of fierce competition require the timely introduction of new ideas and technologies. When deciding to take such a step, an entrepreneur must adequately assess the degree of risk and be able to manage it

Debt forgiveness and tax implications

Last modified: 2025-01-24 13:01

One of the grounds for the termination of contractual obligations between legal entities and individuals may be the forgiveness of the resulting debt. This opportunity is rarely used in business practice, since the nature of the transaction raises many questions related to the legality of actions and documentation. When faced with the solution of such business transactions, even specialists have difficulties with the calculation and payment of the necessary tax payments

How to pay tax on a privatized apartment?

Last modified: 2025-01-24 13:01

Taxes on privatized housing - this is what citizens are most interested in lately. But how do you know about debt? And how can I pay the tax for an apartment? This article will consider all options for the development of events

What is the decile coefficient?

Last modified: 2025-01-24 13:01

In the analysis of the effectiveness of public administration, the issue of the standard of living of the population is important. The authorities of the country exercise control over its useful resources, the content of the subsoil and the gross product of the population. It is the state that organizes the distribution of material we alth among citizens. Why, then, in some countries rich in minerals, people are not satisfied with their standard of living?

Tax deductions from wages: grounds and procedure

Last modified: 2025-01-24 13:01

The main, and sometimes the only source of income for most citizens is wages, which are considered by tax legislation as the profit of an individual. Salary deductions are made not only in Russia, but also in all countries with a developed tax system

What role do customs payments play in regulating the goods market?

Last modified: 2025-01-24 13:01

Customs payments are a fairly large revenue part of the state budget. They make up more than thirty percent of all receipts. Russian legislation establishes a certain mechanism for calculating such payments and the procedure for their payment

How to calculate personal income tax (personal income tax) correctly?

Last modified: 2025-01-24 13:01

Personal income tax (PIT) is familiar not only to accountants. Every person who has ever received income must pay it. Income tax (that's what it was called before, and even now its name is often heard) is paid to the budget from the income of both Russian citizens and temporarily working in the country. In order to control the correctness of the calculation and payment of wages, it will be useful to know how to calculate personal income tax

What is a tax deduction

Last modified: 2025-01-24 13:01

What is a tax deduction? Who can apply for it? The article discusses some types and the principle of calculating these deductions

Tax is The meaning of the term, types and role of taxes

Last modified: 2025-01-24 13:01

Taxes are all around us - they are everywhere. We do not always notice how we pay them. At first glance, everything may seem very simple or, conversely, too complicated. In fact, without going into details, the tax system is not that complicated

Standard tax deduction: sizes, terms of provision

Last modified: 2025-01-24 13:01

Russian legislation provides for a number of measures to reduce the fiscal burden on citizens. This is expressed in the reduction of the taxable base or the return of previously paid tax. This process is called tax deduction. Depending on situations, deductions are divided into standard, social, property

How to find out tax debt: instructions and tips

Last modified: 2025-01-24 13:01

Today we will find out how to find out the tax debt. Its occurrence is connected with the delay in tax payments. This situation brings with it a number of problems. For example, a person can be fined, so it is important to know everything about checking debts. To cope with the task is offered in different ways. We will talk about all possible layouts further. This is not the most difficult task of all the real ones

How to find out tax debts by last name?

Last modified: 2025-01-24 13:01

Tax debt in Russia worries many citizens. This article will tell you how to check tax debts by last name or TIN

How to check tax debts?

Last modified: 2025-01-24 13:01

Every self-respecting citizen should know how to check tax arrears. This article will tell you everything about the implementation of the task in hand. What verification methods are in place?

Methods and ways to optimize taxation

Last modified: 2025-01-24 13:01

Every business wants to get the maximum possible profit. There are many ways to do this - increasing the range, market coverage, promoting a group of goods. Or the emphasis on efficiency and increasing the profitability of the organizational structure. And as you know, a significant amount of spending is tax payments. It would seem that there are no options. But it's not. And here the minimization/optimization of taxation is of interest

IFTS - what is it? Authority of the organization

Last modified: 2025-01-24 13:01

Different institutions of our country often have rather complex abbreviations that do not reveal the essence of the organization's activities. One of these abbreviations, which are often found in the media, is IFNS. What is this organization behind the complex cutbacks? What are the functions of this department?

Do you have a TIN tax debt? There is a convenient service for payers from the Federal Tax Service

Last modified: 2025-01-24 13:01

Tax debts themselves are a negative phenomenon in the economic activity of any payer. Firstly, the tax debt on the TIN once again attracts the attention of regulatory authorities to the business entity. Secondly, the entrepreneur bears additional costs associated with the obligation to pay a pen alty on the amount of the debt. Thirdly, you still have to pay taxes

Forms of tax control: classification and their definition

Last modified: 2025-01-24 13:01

Forms of tax control are ways of a certain expression in the organization of certain control actions. These may include: taking explanations from taxpayers, checking credentials, as well as inspecting territories and premises that can be used to generate income

St. 78 of the Tax Code of the Russian Federation. Offset or refund of overpaid tax, dues, pen alties, fines

Last modified: 2025-01-24 13:01

Russian legislation in the field of taxes and fees enables citizens and organizations to return or offset overpayments or excessively collected taxes. These procedures are carried out in accordance with separate articles of the Tax Code of the Russian Federation - 78 and 79. What are their key provisions?

Field tax audit: procedure, deadline, purpose

Last modified: 2025-01-24 13:01

Exit tax audit is an effective way of control. It can be planned or unscheduled. The article tells what the essence of this study is, what are the stages of its implementation, and also how the results of the process are formalized. Rules for selecting companies to be audited are given

Collection is Paying taxes and fees. Federal and local fees

Last modified: 2025-01-24 13:01

Today we will talk about fiscal fees as an instrument of the most important domestic mechanism aimed at replenishing the budget. We will learn about their functions, varieties, shortcomings, and also suggest ways to improve them

Taxation of deposits of individuals. Taxation of interest on bank deposits

Last modified: 2025-01-24 13:01

Deposits allow you to save and increase your money. However, in accordance with the current legislation, it is necessary to make deductions to the budget from each profit. Not all citizens know how the taxation of bank deposits of individuals is carried out

Clarifying VAT declaration: sample filling, deadlines

Last modified: 2025-06-01 07:06

If the declaration for the specified tax has already been filed, and the error in the calculations was discovered later, then it is impossible to correct it in the document itself. It will be necessary to submit an additionally specified VAT return (UD)

Classification of tax rates. Types of tax rates

Last modified: 2025-01-24 13:01

The rates for different types of taxes can be classified in a variety of ways. What are the relevant techniques that have become widespread in Russia? How can the current taxes in the Russian Federation be classified?

Personal income tax benefit: who is en titled? Documents for tax relief

Last modified: 2025-01-24 13:01

Individual income tax is commonly referred to as personal income tax. 2017 brought a number of changes for those who use tax credits. Rather, only certain categories of persons are affected. So, the amounts for deductions for parents with disabled children are changing. However, not only parents can receive tax benefits. However, you should provide a full package of documents, which will confirm the right to a tax deduction and a reduction in the tax base

For what you need an application for a personal income tax refund

Last modified: 2025-01-24 13:01

Every citizen receiving income must pay income tax to the budget. Tax legislation provides for benefits that give the right to return part of the transferred tax in connection with certain expenses

Procedure for calculating personal income tax

Last modified: 2025-01-24 13:01

Personal income tax is considered the most important fee in the Russian Federation. The article describes how personal income tax is correctly calculated, what tax rates are used for calculation, what deductions can be applied, and who exactly is involved in the calculations and transfer of funds. It is indicated when it becomes necessary to form and submit a 3-NDFL declaration

Tax preferences: concept, types, who is supposed to

Last modified: 2025-01-24 13:01

Tax preferences - benefits, benefits that are provided to individual enterprises, organizations for state support of certain types of activities. The article will tell about their features

How to calculate land tax? Payment terms, benefits

Last modified: 2025-01-24 13:01

As you know, one of the most important components of the budget of any state is taxes. They are local and national and fill the corresponding budgets. One of the obligatory taxes in the Russian Federation is the land tax. What is it and who is supposed to pay it? Are there land tax benefits for pensioners, disabled people and other categories of citizens? How to correctly calculate the amount of the fee and what does it depend on? Not every Russian knows the answers to all these questions

Compensation for buying an apartment. How to get a tax deduction for buying an apartment?

Last modified: 2025-01-24 13:01

Compensation for the purchase of an apartment is represented by a property deduction, which can be issued at the branch of the Federal Tax Service or at the place of work of the taxpayer. The article tells how to receive a payment, what is its maximum size, and what are the requirements for the recipient

Tax refund when buying an apartment: detailed return instructions

Last modified: 2025-06-01 07:06

Refund of tax when concluding certain transactions is an important and responsible process, but it can be de alt with in the shortest possible time. This article will tell you how to get a refund when buying an apartment. What should everyone know about this?

Taxation "Income minus expenses": features, advantages and disadvantages

Last modified: 2025-01-24 13:01

Income minus expenses taxation has many significant advantages for every entrepreneur over other systems. The article explains when this tax regime can be used, as well as how the amount of the fee is correctly calculated. The rules for compiling a tax return and the nuances of maintaining KUDiR are given

What are the taxes in Spain?

Last modified: 2025-01-24 13:01

If you are going to work or study in Spain, then you will certainly need to know about its tax system. Every year, everyone who lives in the country is required to file a tax return. You can read more about what taxes in Spain exist and how they can be reduced in this article

UTII formula: indicators, calculation examples, tips

Last modified: 2025-06-01 07:06

The popularity of the system is justified by its advantages over others: tax independence from business profitability, the ability to use deductions in the form of insurance premiums, ease of reporting, the ability to avoid paying a number of other taxes (VAT, personal income tax, income tax)

Is the pension taxable: features, law and calculation

Last modified: 2025-01-24 13:01

When retiring, a citizen expects to be released from most of the responsibilities imposed on him by society, in particular from taxes. But is the pension taxable? There are times when the answer to this question is yes. In addition, despite the well-deserved rest due to age, the citizen still has obligations under executive documents, as a result of which certain amounts can be deducted from the pension

What documents are needed for registration of SNILS: list, procedure for registration, terms

Last modified: 2025-01-24 13:01

SNILS is an important document that every resident of the Russian Federation should have. This article will show you how to arrange it. What is useful for obtaining SNILS? And what are the most common challenges people face?

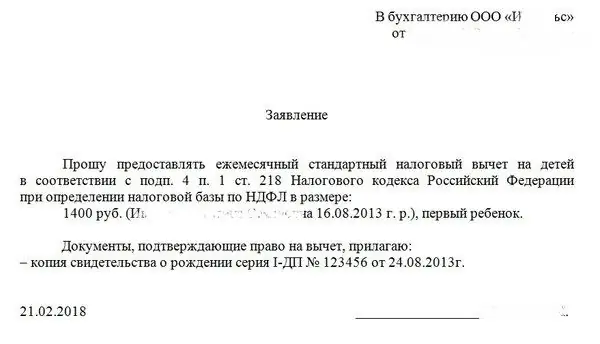

Tax deduction for a child: what is it and who is en titled to it?

Last modified: 2025-01-24 13:01

Tax deductions are different. And they are provided to citizens on different conditions. For example, there is a deduction for a child. What's this? How and where to apply? This article will tell you all about claiming deductions for children in Russia

Maximum amount of tax deduction. Types of tax deductions and how to get them

Last modified: 2025-01-24 13:01

Tax deduction is a special government bonus. It is offered to some citizens of the Russian Federation and may be different. The article will talk about how to issue a tax deduction, as well as what is its maximum amount. What should everyone know about the respective operation? What difficulties can you face?

Taxes in the USSR: the tax system, interest rates, unusual taxes and the total amount of taxation

Last modified: 2025-01-24 13:01

Taxes are mandatory payments that the state collects from individuals and legal entities. They have been around for a long time. Taxes began to be paid from the period of the emergence of the state and the division of society into classes. How are the funds received used? They are used to finance government spending

How to get a duplicate TIN for an individual: documents and procedures

Last modified: 2025-01-24 13:01

TIN certificate is an important document that can be useful to every citizen. Unfortunately, not everyone has such a certificate. And some lose or spoil TIN certificates. This article will tell you how to recover the corresponding paper

In which case income tax is 13%?

Last modified: 2025-01-24 13:01

In which case income tax is 13%? Many are accustomed to believing that this is exactly what personal income tax should be. However, tax rates can range from nine to 35 percent. What does the law say about this? In which case is income tax 13 percent of wages? In this case, the type of income itself plays a role, and whether the citizen is a resident of the country

Tax and tax payments - what is it? Classification, types, concept and types

Last modified: 2025-01-24 13:01

Currently, the tax system is a set of taxes and fees established by the current legislation of the Russian Federation, which are levied in the budgets of different levels. This system is based on the principles provided by law. Let us consider in more detail the issues of essence, classification, functions and calculation of tax payments

How not to pay car taxes: legal ways

Last modified: 2025-01-24 13:01

Today you can use one of the legal grounds and not pay taxes on cars. How to avoid the annual fee for your four-wheeled iron "horse"? In addition, the Russian government has introduced fuel excises, which already include transport charges. Hence, it is quite logical to ask whether it is necessary to pay car tax twice?

Exemption of pensioners from taxes: a list of tax benefits, conditions for reducing the amount

Last modified: 2025-01-24 13:01

Why did the country introduce tax breaks for citizens of retirement age. What are the features of the current taxation system. What is required to receive benefits for various types of property of pensioners. Grounds for refusing to receive tax relief

Property tax in Spain: deductions to the budget for the purchase, sale, rent, sizing, timing

Last modified: 2025-01-24 13:01

Housing prices in Spain are very attractive for Russians. Living expenses in this country are considered the lowest in Europe. Therefore, the question of what are the property taxes in Spain is asked by many

How to get a tax deduction through an employer?

Last modified: 2025-01-24 13:01

Tax deduction is the right of many citizens. This article will talk about how to get a deduction through an employer. What it is? Under what circumstances is it allowed to issue a refund at the place of employment?

Taxes in Dubai for individuals and legal entities. Taxation in the United Arab Emirates

Last modified: 2025-01-24 13:01

Most countries in the world replenish their budget through taxes, which is considered the norm. But there are states where most taxes are absent, whether you are a resident or not. Where is this tax haven located? In the United Arab Emirates. Of course, it is impossible to completely stop paying taxes in Dubai, but not in such large amounts. What do you mean, now we will understand

Documents for property deduction: general information, required forms and forms

Last modified: 2025-01-24 13:01

Registration of a property deduction is a procedure that many citizens of the Russian Federation are interested in. This article will show you how to get it. What needs to be prepared? Under what conditions and to what extent can one claim a property type deduction?

How to switch from UTII to the simplified tax system: procedure, documents, terms

Last modified: 2025-01-24 13:01

Many entrepreneurs are thinking about how to switch from UTII to the simplified tax system. The article describes when the procedure can be performed, what documents are prepared for this, and also what difficulties one has to face. The pros and cons of such a transition are given

Do I need to pay tax when buying an apartment? What you need to know when buying an apartment?

Last modified: 2025-01-24 13:01

Taxes are the responsibility of all citizens. The corresponding payments must be transferred to the state treasury on time. Do I need to pay taxes when buying an apartment? And if so, in what sizes? This article will tell you all about taxation after the acquisition of housing

Taxation. UTII: advantages and disadvantages

Last modified: 2025-01-24 13:01

Taxation according to UTII is a special regime provided for individual entrepreneurs and organizations engaged in certain types of activities. Unlike the simplified tax system, the income actually received by the subject does not matter. The calculation of UTII for individual entrepreneurs and legal entities is based on the profit established by the state

Tax deduction for apartment renovation: calculation and registration procedure, documents, expert advice

Last modified: 2025-01-24 13:01

A tax deduction is a refund of some of the previously paid income tax. The largest and most significant is the return made when buying a property. It is called property, and is appointed both for the purchase of an apartment, and for the purchase of houses, land plots or rooms. Additionally, it is possible to issue a refund for the interest paid on the mortgage

Reconciliation with the tax: the procedure for reconciliation, drawing up an act, advice

Last modified: 2025-01-24 13:01

To know about the state of settlements with the budget, it is important to periodically reconcile with the tax office. We will tell you on what basis it is carried out, in what order, as well as what to do when discrepancies are revealed

Tax deduction when buying an apartment for an individual entrepreneur - step-by-step instructions for registration and recommendations

Last modified: 2025-01-24 13:01

Tax deductions are a government "bonus" that many citizens can count on. Including entrepreneurs. This article will talk about property deductions for individual entrepreneurs. How to get them? What will be required for this? What are the most common challenges people face?

Taxes when selling a house: rates, calculation features

Last modified: 2025-01-24 13:01

Transactions of purchase and sale of property have always worried the population. What to do if the owner sold the house or land? What taxes will you have to pay? This article will tell you everything about taxation when selling real estate

Land tax: tax base, terms of payment, benefits

Last modified: 2025-01-24 13:01

Land tax - an annual payment for the ownership of a piece of land by a person or organization. This article will talk about what it is. How to pay land tax? What benefits does it provide? How can the corresponding payment be calculated?

List of documents for mortgage tax deduction: procedure and conditions

Last modified: 2025-01-24 13:01

Everyone who plans to receive a refund on the basis of the purchase of real estate should know what documents for the mortgage tax deduction must be prepared. The article describes how the deduction is made, what papers are required for this, and also what difficulties taxpayers face

Taxes in Norway: types of taxes and fees, percentage of deductions

Last modified: 2025-01-24 13:01

Many have probably heard that in Norway the standard of living is high, as well as salaries in the most common areas of activity, not to mention highly qualified specialists. It is not surprising that so many people want to move to this cold, but prosperous country. Is it worth it to go there in search of a better life? First you need to find out what taxes exist in Norway and for what purposes they are levied

Write-off of receivables in tax accounting: write-off procedure, correctness of registration and examples with samples

Last modified: 2025-01-24 13:01

The write-off of receivables is a standard procedure in the life of any organization. Therefore, it is important to know about it, its order and reasons for conducting it. It is this knowledge that will help to avoid unpleasant consequences. The article will tell about the procedure

How to get a tax deduction for children: the procedure for providing, the amount, the necessary documents

Last modified: 2025-01-24 13:01

Fixing a tax deduction is a very time-consuming process, especially if you do not prepare for the operation in advance. This article will talk about processing the return of personal income tax for children in one case or another. How to cope with the task? Under what circumstances can a deduction be claimed?

Counter check of documents: terms, requirements and features

Last modified: 2025-01-24 13:01

Counter check is carried out in relation to counterparties of the company under study. Its main purpose is to find discrepancies in the documents of organizations. The article describes the deadlines for preparing papers by firms, as well as what are the main consequences of such a study

Forms of taxation for individual entrepreneurs

Last modified: 2025-01-24 13:01

There are several taxation systems in Russia. And each individual entrepreneur can choose his own option for paying taxes. What forms of taxation are in place? What should you pay attention to? How to choose the right tax system? Read this article for more tips and tricks

Income tax refund for tuition: payment procedure, required documents and reviews

Last modified: 2025-01-24 13:01

Almost every citizen can get a tuition tax deduction. But how to do that? This article will tell you all about the social deduction for study

Indirect taxes: types, payment, declaration

Last modified: 2025-06-01 07:06

Taxation is divided into direct and indirect. The latter has a fractional structure. Indirect taxation provides for a large number of articles. The fractional structure is justified in a practical and economic sense. Indirect taxes are often used by the state to replenish the treasury. At the same time, the taxation structure makes it possible to avoid sharp jumps in prices for services, goods, certain types of work, etc

Tax refund when buying an apartment: application, documents, terms of return

Last modified: 2025-01-24 13:01

Tax deduction - the right to receive part of the money for certain transactions. This article will talk about the return when buying real estate

What taxes does an individual entrepreneur pay?

Last modified: 2025-01-24 13:01

Taxes of an individual entrepreneur are completely dependent on the chosen tax regime. The article describes which systems can be chosen by businessmen, as well as what fees have to be paid when choosing OSNO, UTII, STS, PSN or ESHN

Land tax: rate, terms of payment, declaration

Last modified: 2025-01-24 13:01

Some owners or users of land must correctly calculate and pay land tax. This fee is transferred by both individuals and companies. The article talks about the rules for determining and transferring tax. The nuances of reporting and the assigned responsibility for violations are given

Types of taxation systems in the Russian Federation

Last modified: 2025-01-24 13:01

Every entrepreneur planning to open his own business should study all taxation systems. The types that can be used in Russia have many features. The article lists all modes, as well as the rules for their use, taxes paid and reports to be submitted

Calculation of corporate property tax

Last modified: 2025-01-24 13:01

Taxes are the basis of the state budget. The higher the tax, the richer the state. At the same time, we must not forget that too high tax rates can lead to the opposite effect: an outflow of investors and a drop in the performance of existing business entities. Such rules are also relevant for the tax on balance capacities of enterprises

Taxes from individuals: types, rates, terms of payment

Last modified: 2025-01-24 13:01

Everyone should understand what taxes are levied on individuals. The article tells about what fees are required to be paid in a given situation. Lists all types of objects of taxation, applicable rates and rules for paying taxes

Principles of building a tax system. The tax system of the Russian Federation

Last modified: 2025-01-24 13:01

In the taxation system, each of its elements - the payer (legal entity or individual) is obliged to pay rent or tax. This article will consider the principles of building a tax system or some samples that should be applied in relation to taxpayers and the state

Common taxation system: advantages and disadvantages, transition

Last modified: 2025-01-24 13:01

The general taxation system is considered the most complex regime in the Russian Federation. The article describes how you can switch to this system. All taxes that individual entrepreneurs and companies have to calculate and pay are listed. Various declarations and reports that need to be submitted to the Federal Tax Service on a regular basis are indicated

How and why to use a bulk registration address?

Last modified: 2025-01-24 13:01

One of the most significant criteria for a good legal address is its mass character. What is it and what threatens the address of mass registration of an enterprise? Why are such addresses created and is there a chance to protect ourselves from such a misfortune

Procedure and deadline for payment of transport tax by legal entities

Last modified: 2025-01-24 13:01

Tax is a mandatory gratuitous payment, which is forcibly levied by state authorities of various levels from enterprises and individuals to finance the activities of the state

Basic is Features of the general taxation system

Last modified: 2025-01-24 13:01

The general system is distinguished by a fairly large list of deductions that are obligated to an economic entity. Some enterprises voluntarily choose this mode, some are forced to do so

Advances on income tax. Income tax: advance payments

Last modified: 2025-01-24 13:01

Large Russian enterprises, as a rule, are payers of income tax, as well as advance payments on it. How are their amounts calculated?

Theory of taxes and taxation

Last modified: 2025-01-24 13:01

The theory of taxes has its roots in economic writings of the eighteenth century. What is she considering?

Tax control: bodies, goals, forms and methods

Last modified: 2025-01-24 13:01

Tax control is a special type of activity of specialized bodies. Employees of this service are authorized to conduct tax audits, as well as to supervise the financial activities of entities of all forms of ownership. How are tax controls and tax audits carried out? What are their goals and what types of these actions are there? Let's consider these points in more detail in the article

EGRN - what is it? Unified State Register of Taxpayers

Last modified: 2025-01-24 13:01

A significant array of information from the tax service is contained in the multi-level software and information systems "Unified State Register of Taxpayers" (EGRN) and "Unified State Register of Legal Entities" (EGRLE). What information do they contain and how can I obtain an extract from these registers? Let's try to figure it out

Social deductions for treatment, education: documents. Social tax deductions are provided

Last modified: 2025-01-24 13:01

The legislation of the Russian Federation provides for a very wide range of tax deductions for citizens. Among the most popular - social. What are their features?

Tax on "parasitism" in Belarus: who pays and who is exempt from tax

Last modified: 2025-01-24 13:01

President of Belarus Alexander Lukashenko on April 2, 2015 introduced a special fee, which is popularly known as the "parasitism" tax. If a person does not have a permanent job for six months, he must pay this type of fee to the treasury. A citizen who decides to evade payment obligations may receive an administrative arrest with forced labor

In what cases is income tax refund possible

Last modified: 2025-01-24 13:01

Is income tax refund real? Definitely yes. Any working citizen of Russia who pays income tax can get back part of the money spent on education, treatment or buying an apartment

Which organizations are VAT payers? How to find out who is a VAT payer?

Last modified: 2025-01-24 13:01

In the early 90s. of the last century, market reforms began in the Russian Federation. All spheres of the society's economic activity underwent transformation. Special attention was paid to tax relations. VAT was one of the first mandatory deductions that were put into practice

Excises on fuel in Russia

Last modified: 2025-01-24 13:01

Excise taxes on motor gasoline and diesel fuel are a type of tax levied on entrepreneurs and organizations

Tax subjects: concept, types

Last modified: 2025-01-24 13:01

Among the main elements of the tax is the subject. What is the specificity of its legal nature? In what statuses can a subject of tax legal relations act?

Object of taxation: basic concepts and essence of its definition

Last modified: 2025-01-24 13:01

The object of taxation is a list of certain legal facts that determine the obligation of a business entity to pay tax for the implementation of the sale of goods. Also, the taxable object includes the import of goods into the Russian territory, the presence of property in personal possession, the receipt of an inheritance and simply income

Tax optimization: schemes and methods. Legal tax optimization

Last modified: 2025-01-24 13:01

The goal of any business is profit. However, taxes must be paid on the same profit. No entrepreneur is exempt from taxes as such. But every entrepreneur has the right to choose such methods of calculating taxes, in which the final amount payable will not hit your pocket hard

KBK - what is it: questions and answers

Last modified: 2025-01-24 13:01

CBK - this is how accountants and financial workers call budget classification codes in their professional jargon. Experts began to actively apply them in the form in which they exist now in the early 2000s. The Ministry of Finance of the Russian Federation approved them by its order and annually adjusts them based on the needs identified during the budget process

USN "Income minus expenses" - rate, accounting and calculation

Last modified: 2025-06-01 07:06

A significant incentive in the development of SMEs is the taxation system. Its reform in Russia began in the 90s (the Soviet system simply did not imagine such a business). This constructive process was started in 1996 by the Federal Law "On the Simplified Taxation System". STS "Income minus expenses" and, as an alternative, STS "Income" were proposed as options for easing the tax burden for start-up entrepreneurs

Resort tax in Russia

Last modified: 2025-01-24 13:01

Most Russians prefer to go to resorts during their holidays. And to this day resorts of the south of Russia are popular. The introduction of a resort tax is a hot topic today. We talked about her not too long ago. The instruction to introduce this type of tax was given by the President of the Russian Federation V. V. Putin

UST is Accrual, contributions, postings, deductions, interest and calculation of UST

Last modified: 2025-01-24 13:01

In the article we will tell you about one of the elements of the tax system of the Russian Federation - the unified social tax (UST). We will try to tell in detail about the very essence of the UST, accruals, contributions, taxpayers and other things that in one way or another relate to the UST

Tax deduction when buying a home with a mortgage

Last modified: 2025-01-24 13:01

Today we will be interested in the tax deduction when buying a home. What it is? And how can you request it? To understand all of these issues and not only we have to in the article below. It's not as difficult as it seems. Especially if a person studies the legislative framework

Taxable base and its components

Last modified: 2025-01-24 13:01

The taxable base is the payments and remuneration that accrue to workers recognized as objects of taxation during the pay period, and to those who were not subject to

Registering cash registers: step by step instructions

Last modified: 2025-01-24 13:01

Under the new requirements, registration of cash registers is required. To do this correctly, you need to familiarize yourself with some of the nuances

Code of taxpayer category: designation. Country code, IFTS code on the title page of form 3-NDFL

Last modified: 2025-01-24 13:01

Citizens who report on income tax provide a declaration form 3-NDFL. Taxpayer category code - a digital designation that is indicated on the title page

Difference between collection and tax: basic concepts

Last modified: 2025-01-24 13:01

Such concepts as taxes and fees are used almost everywhere in the economy. They involve the payment of a specific amount to the budget. The concept of tax and collection is enshrined in legislation. There is also a difference between a tax and a fee

What are the types of tax rates?

Last modified: 2025-01-24 13:01

There are 4 types of tax rates on the basis of which the modern tax systems of all countries of the world work