2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

Due to the large number of different payment receipts, people cannot figure out exactly what and where to pay. The Federal Tax Service foresaw this fact and provided an opportunity for all individuals and legal entities to view their unpaid taxes by TIN. All information is provided online, you just need to go to a special website and enter your personal TIN. This is a very convenient service that simplifies the search for your own tax debt, eliminates the need to stand in line and beat the thresholds of tax inspections. The main thing is to have Internet access at hand.

In order to find out taxes by TIN, you need to go to the "Taxpayer's Personal Account" section on the website of the Federal Tax Service and enter information about yourself:

- last name, first name, patronymic;

- individual taxpayer number;

- region of residence.

After the personal account is created, you can get all the information on taxes. If an individual has debts, then a special window will display the amount payable. Furthermore,the program allows you to generate a payment order, which is a receipt with which you need to contact the bank to make a payment. This is how you can find out the tax by TIN, and immediately generate a payment document. The program is very easy to use, so even the most inexperienced PC user can easily cope with this task.

The service allows you to generate property, transport and land unpaid taxes by TIN, as well as taxes related to individual entrepreneurship. By the way, you need to be prepared to detect errors in the report, so you always need to double-check everything. Such a tax payment system is more accessible to taxpayers, it provides ease of use, thereby increasing the effectiveness of the fight against tax evasion.

Knowing your taxes by TIN is very important, since significant delays lead to various troubles: pen alties are charged daily, accounts are blocked, travel abroad is prohibited. No one needs such problems, so they can be avoided if everything is paid on time.

After all taxes on the TIN are recognized, payment can be made, including pen alties and fines. Payment is possible by bank transfer and cash. In the first case, the system offers to pay using bank accounts and payment terminals. True, not all banks are listed, but some of the most popular are Sberbank and Promsvyazbank.

It is better to deposit a slightly larger amount, since the datereport generation may not coincide with the day of your request. All paid receipts should be kept and not thrown away for (at least) three years. After 10 days after payment, you should check the information about the debts again. In any case, in the event of a dispute, all information in the form of paid receipts will be in your hands, which is indisputable evidence of the absence of debt.

Recommended:

Trendsetter is no longer unique. Now everyone can influence trends

Many have thought at least once in their lives about the question of where fashion trends come from, why this or that style of clothing becomes popular. Trendsetters are, of course, unique individuals. Such people, by personal example, experience and introduce into society new ideas that are widely known and spread around the world

Nuclear power plants. Nuclear power plants of Ukraine. Nuclear power plants in Russia

Modern energy needs of mankind are growing at a gigantic pace. Its consumption for lighting cities, for industrial and other needs of the national economy is increasing. Accordingly, more and more soot from burning coal and fuel oil is emitted into the atmosphere, and the greenhouse effect increases. In addition, there has been more and more talk in recent years about the introduction of electric vehicles, which will also contribute to the increase in electricity consumption

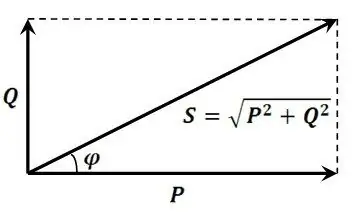

What is reactive power? Reactive power compensation. Reactive power calculation

In real production conditions, reactive power of an inductive nature prevails. The enterprises install not one electric meter, but two, one of which is active. And for the overexpenditure of energy “chased” in vain through power lines, the relevant authorities are mercilessly fined

Should I take out a mortgage now? Is it worth taking out a mortgage now?

Many Russians, despite the crisis in the Russian economy, decide to buy an apartment on a mortgage. How appropriate is it now?

Should I buy an apartment now? Is it worth it now to buy an apartment in Ukraine or Crimea?

Should I buy an apartment now? Of course, this question will always be relevant, since for a person owning his own living space is an essential condition for a happy family life