2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

According to the tax laws of our country, income from the sale of property is taxed. Moreover, both residents and non-residents must pay it. The first category includes citizens residing in Russia for more than 183 days. They must pay tax on the sale of real estate in the event that it is located in the country and abroad. The tax rate is 13%. Non-residents are people living in the Russian Federation for less than 183 days. For them, the tax increases to 30%. But they pay it if they sold property located only in the Russian Federation. The amount of real estate sales tax depends on several factors. Consider a few cases.

Property owned for more than three years sold

In this case, the citizen will not have a debt to the state. This property can be sold for any amount, the income received is not taxed. The date of entry into ownership is considered:

- Date of the certificate of registration of ownership, if the property was acquired under a contract of sale, exchange or donation, as a resultprivatization.

- Date of death of the testator, if the property was inherited.

- Date of payment of the last share - for cooperative apartments.

This must be kept in mind when making a contract. So, for example, if for many years you lived in an apartment thanks to a social contract. hiring, and immediately after the privatization decided to sell it, you will have to pay tax when selling real estate.

Property owned less than three years sold

Option 1: You cannot document your expenses when buying a property

In this case, you are given a tax deduction that reduces the taxable base. Its amount depends on the type of object.

1. For apartments, residential buildings, as well as land plots, garden houses, it is 1 million rubles. That is, if, for example, an apartment is sold for 1,200 thousand rubles, then only 200,000 will be taxed.

2. For other property (office, garage, warehouse…) the amount of the deduction is 250 thousand rubles.

It is worth noting that if the property is in common ownership, then the amount of the deduction is calculated in proportion to the shares.

Option 2. You can document your expenses when purchasing this property

If you bought property, for example, an apartment worth 4 million rubles, and a year later decided to sell it for the same money, you will not pay tax when selling real estate. This rule is subject to the condition that you have retained the previous sales contract andYou can submit it to the FTS. If the property is sold for more than the purchase price, then everything in excess of this amount is taxed.

When to pay and whether to pay at all?

Note that regardless of whether the tax will be charged on the sale of real estate or not, a declaration must be submitted to the tax office. When to do it? The next year after receiving income. When do you have to pay property tax? Let's say 2013 was the year you sold your house. Before April 30, 2014, you must submit a declaration to the Federal Tax Service, and before July 15, 2014 - pay the amount of tax, if any. Pay or not? It's up to you, of course. But remember that tax evasion is a criminal offense that entails very hefty fines and imprisonment.

Recommended:

Personal income tax accrual: calculation, calculation procedure, payment

In the framework of this article, the basic characteristics of personal income tax, the basis for its calculation, and the use of tax deductions are considered. Organization of accounting. Payment options are presented for both individuals and individual entrepreneurs

CASKAD Real Estate Agency: reviews. Country real estate in the suburbs

Buyers of low-rise real estate in the Moscow region leave numerous reviews about "CASKAD Real Estate" - a company thanks to which their life has become not only more comfortable, but also brighter. In this market segment, more than half of sales belong to her. "CASKAD Real Estate" - a well-established leader in the metropolitan real estate market

How to sell an apartment on your own? Tax for the sold apartment. Sale of real estate without intermediaries

Re altor services are expensive. There are situations when you need to save on them. How can I sell my home on my own? Different apartments: privatized, the one whose owner is a child, mortgage, donated - can be sold without the help of a re altor, putting effort and time into the transaction. This article describes all the steps of the transaction from setting the price to receiving the amount of money, and also provides useful advice on the dangers and intricacies of the process of selling an apartment

The tax on houses. Calculation of real estate tax for individuals

Taxes in Russia play an important role. Great attention in 2016 is paid to the property tax paid by citizens. We are talking about individuals. How to calculate property tax? What should citizens know about?

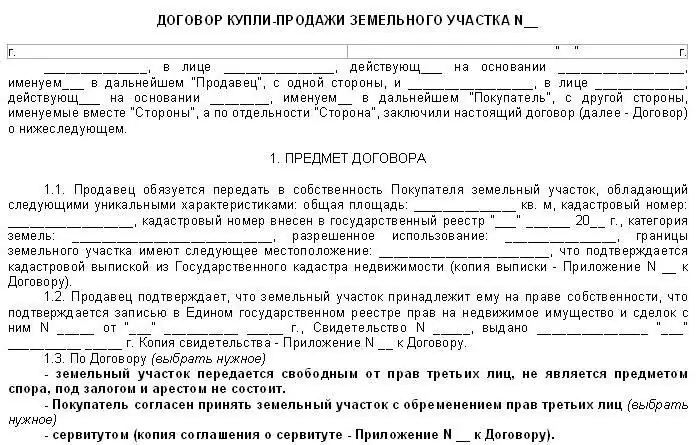

Tax on the sale of land. Do I have to pay tax on the sale of land?

Today we will be interested in the tax on the sale of land. For many, this topic becomes really important. After all, when receiving this or that income, citizens must make certain payments (interest) to the state treasury. With only a few exceptions. If this is not done, then you can run into many problems