2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

Currency regulation in Russia appeared in 1843, when during the reign of Nicholas I, a fixed ruble exchange rate was established. In those days, the gold standard operated on the territory of almost all significant powers, which lasted until the beginning of the 20th century. For example, by the summer of 1914 (the beginning of the First World War), one ruble contained 0.77742 grams of gold and was exchanged at the rate of 1.9 rubles for the US dollar, 46 kopecks for the German mark, 9.4 rubles for the pound sterling and others

Today, currency regulation and currency control are designed to implement measures to stabilize the Russian currency market, support the stability of the national currency and ensure a unified state policy. The main regulatory points in this area are currently set out in Law No. 173-FZ (adopted in 2003, December 10). It defines the basic concepts related to the field of foreign exchange regulation - the Russian currency, internal (external) securities, special bank accounts, foreign exchange transactions,foreign currency. A list of persons who are recognized as residents / non-residents for the implementation of the above law is also indicated.

Currency regulation and currency control in our country are carried out by authorized bodies - the Central Bank and the Government of Russia (currency regulation function). They streamline transactions between residents, between non-residents, as well as settlements of residents and non-residents. Note that transactions with foreign currencies between residents are not allowed, with a number of exceptions. those. it is officially impossible to pay, for example, with dollars in an ordinary store in our country today.

In accordance with Article 4 of the Federal Law No. 173-FZ, the currency control bodies, in addition to the Central Bank and the Government of our country, include authorized structures of the federal level. And authorized banks are classified as agents exercising control over foreign exchange transactions. They also include tax and customs authorities, Vnesheconombank, etc.

Currency regulation and currency control, implemented in the legislation, determine the procedure for opening accounts by residents in foreign banks, as well as the procedure for registration of deposits and accounts by non-residents in Russian banks. Article 15 of Federal Law No. 173-FZ regulates how foreign coins and banknotes, valuables recognized as currency, securities can be imported and exported in Russia.

Currency regulation of foreign trade operations for the most partpartly due to the fact that, in accordance with Chapter 3 of Federal Law No. 173-FZ, residents must receive payment in foreign currency under certain agreements with non-residents, draw up a transaction passport and sell a certain part of foreign exchange earnings. Today, this part is 30 percent and is sold no later than seven working days from the date of receipt to the resident's account. Residents for this case are legal entities and individual entrepreneurs.

Currency regulation and currency control provide for certain obligations and rights for the participants in this process. In particular, residents and non-residents can compensate for the damage caused to them by the actions of the currency control authorities, and are also obliged to provide information and documents to the relevant authorities, keep records and comply with instructions if any violations are detected.

Recommended:

Banking and its regulation

The banking sector has a complex structure and is regulated by the state. The legislation provides for a number of requirements for obtaining a banking license. The Central Bank conducts regular supervision over the transparency of activities and the financial position of banks

Shift work method - what is it? Labor Code, regulation on shift work in Russia

Shift work is traditionally popular in Russia. What are the features of its legal regulation? What preferences for shift workers does the Labor Code provide?

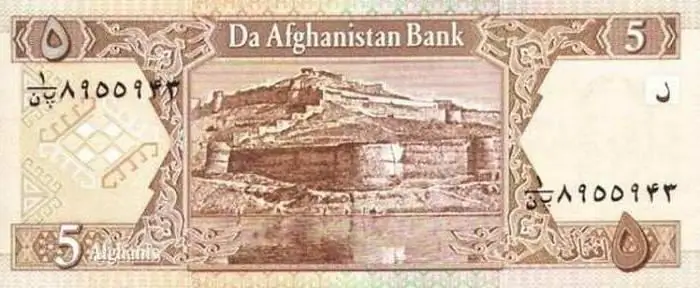

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

Public and non-public companies: law and regulation

In connection with the reform of corporate law, the classification of business entities has changed, which has become familiar over a fairly long period of existence. Now there is no OJSC and CJSC. They were replaced by public and non-public business companies. Let's take a look at the changes in more detail

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article