2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:28

The average per capita income of a family is represented by a certain amount of money that falls on each member of such a family. The need for such an indicator may arise in different cases, but most often it is required when registering the status of a low-income family. This status allows you to use various measures of support from the state. Therefore, citizens should understand how to calculate the average per capita family income. This process can be performed independently using the appropriate formula, and you can also use special online calculators that are freely available on the Internet.

When do you need to calculate the indicator?

Calculation of the average per capita income of a family may be required for various reasons. These include:

- citizens want to determine how much money each family member has;

- the status of the poor is being issued;

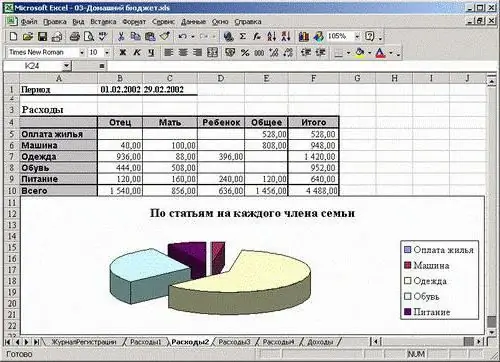

- people want to competently and effectively plan their family budget.

Mostoften the need for this indicator arises if people receive a small income, so they want to receive support from the state. In this case, it is necessary to prove that they are classified as poor citizens. If there is too little money for each member of the same family, then people can count on different benefits and preferences. Therefore, they should know how to calculate the per capita income of a family.

Amount of income for applying for benefits

To take advantage of various social preferences designed exclusively for low-income citizens, it is important that one family member account for less than the subsistence minimum multiplied by 1.5.

The cost of living is set by the regional authorities of each city, so it may vary slightly in different regions. For example, in the capital, this figure is 16,160 rubles. In order for citizens to be able to apply to the social security authorities for various benefits and preferences, the income per family member must be less than 24,240 rubles.

Calculation rules

The average per capita income of a family is individual, so this figure is significantly different for each citizen. It depends on him whether any person has the right to apply to representatives of the social security authorities for registration of various preferences. The amount of these benefits may vary by region.

When calculating the indicator, the following parameters are taken into account:

- important to take into account all cash receipts infamily;

- even scholarships received by students are taken into account, as well as a pension paid to elderly family members;

- calculation can be done independently in advance to determine the possibility of applying for social security;

- Social services staff make their own calculations based on documents received from applicants, and they also request bank or tax statements to reveal any hidden income.

If people use any tricks to apply for various support measures, then if it is revealed that they have submitted fictitious documents, all types of assistance will be canceled, and the deceivers will also have to pay a significant fine.

Who can belong to the same family?

Before you calculate the average per capita income of a family, you should decide who exactly is in this family. This includes the following individuals:

- official housekeeping spouses;

- their children;

- other relatives living in the same territory and leading the same household;

- other persons who do not have family ties, but under certain conditions they can be recognized as members of the same family.

The exact definition of persons who are members of the same family is contained in Art. 2 UK and Art. 31 LCD. All citizens must live in the same property, and they must also have a residence permit in this territory.

Who is not part of the family?

The following persons are not included in the family:

- children who are adult citizens with their own household, so they have a residence permit at a different address;

- parents deprived of their rights to children;

- citizens in military service;

- people serving sentences for various crimes in prisons;

- children supported by the state.

People living in a civil marriage are not legally members of the same family. Therefore, they will not be able to count on state support even if they are engaged in joint farming.

What is included in the average per capita income of a family?

When calculating this indicator, all cash receipts to the family are taken into account. They can be obtained by grandmothers, parents and even children. All incomes that citizens can have for personal purposes are taken into account. This includes the following cash receipts:

- salary from official jobs of citizens;

- compensations that are paid to persons involved in the implementation of public duties;

- various social benefits represented by unemployment benefits, pensions or maternity transfers;

- severance pay paid when a citizen is laid off at the place of employment;

- temporary disability benefits;

- alimony;

- scholarships awarded to students in different universities;

- surcharges, allowances, bonuses and fees;

- interest,received due to the presence of a bank deposit;

- profit that comes to the family as a result of doing business;

- money and property received by inheritance;

- funds donated to a family member;

- Rent for real estate or car rental.

During the calculation, taxes paid from the received funds are not taken into account. Only knowing information about all incomes can one determine the average per capita income of a family in Moscow or another region.

What cash receipts do not count?

There are some incomes that should not be used during the calculation. According to the law, the average per capita income of a family does not include the following receipts:

- money earned by adult children living separately from their parents;

- funds paid by the state to children in public care;

- payments assigned to a spouse in the process of studying in any military institution.

Citizens must notify social security officers of the presence of such income, but these receipts do not increase the average per capita income.

For what period is the calculation performed?

Before calculating the average per capita income of a family, it is important to understand over what period of time this process is carried out. According to a single methodology, information for three months is used.

If any citizen receives a salary or other income in the form of foreign currency, then recalculation is made. ForFor this, the exchange rate valid on the date of calculation is used.

What formula is used?

The procedure for calculating the average per capita income of a family involves the use of a simple and understandable formula:

Income per family member=total family income / 3 months / number of family members.

If the main purpose of the calculation is the appointment of a subsidy, then information on income for six months, not three months, may be required. In this case, instead of the number 3, the formula uses 6.

Calculation example

To understand how to calculate the average per capita income of a family, it is recommended to use approximate calculations. For example, spouses, two children and a grandmother are registered and live together in one apartment. A man and a woman are officially employed, and their total salary is 48 thousand rubles.

Grandmother receives a pension of 19 thousand rubles. One child studies at a university on a full-time basis and on a budgetary basis, therefore, receives a monthly scholarship in the amount of 1.8 thousand rubles.

Based on these data, the calculation is made: average per capita income=(48000 + 19000 + 1800) / 3 / 4=5733 rubles. The resulting figure is compared with the subsistence minimum established in the region where citizens live. If the income per person is less than the existing minimum, then you can contact the social security department to apply for various preferences, since the family is recognized as poor.

Understanding how to calculate the average per capita income of a family is actually verysimply. Thanks to this, it is possible to determine whether citizens can count on state assistance.

Calculate with an online calculator

If citizens do not want to use the standard formula for various reasons, they can get the necessary information using a special online calculator. Such programs are freely available on the Internet.

For the calculation, you need to enter the necessary information in a special form. They are represented by the number of family members, income received and the number of months for which the calculation is made. With the help of such a program, you can quickly get the desired indicator.

How to apply for low-income status?

Information on how to calculate the average per capita family income is required in order to determine whether citizens can count on various types of state assistance. If their income is less than the subsistence minimum, then they can apply to the social security authorities for registration of numerous preferences. To do this, they prepare the following documentation:

- personal documents for each family member, represented by passports or birth certificates;

- an extract from the house book confirming that specific people are indeed registered in the same property;

- certificates from places of work containing information about the salary of each adult family member;

- marriage certificate;

- certificates from the PF, if citizens receive pensions or benefits from this fund;

- documentation from the tutorialinstitution, which contains information about the amount of the scholarship received by the student;

- certificate from the employment center, if an adult is registered with this organization;

- extract from the USRN, including data on all real estate belonging to the family;

- other documents that can be used to confirm other receipts of funds, and this includes the 3-NDFL declaration, bank account statements or individual entrepreneur declarations based on the applicable taxation regime;

- Bank statements.

If necessary, other papers may be needed. All of them must be original documents. It is not allowed to forge the information contained in these papers in any way.

Responsibility for providing false information

Before calculating the average per capita income of a family, it is necessary to collect documentation confirming the receipt of money by citizens. Often, when contacting the social security authorities, people deliberately hide any income in order to receive the status of the poor.

If such a violation by citizens is detected, then this leads to the following negative consequences:

- people are deprived of the right to use various benefits, benefits and preferences;

- they pay a heavy fine;

- required to return all previously received funds from the state.

Additionally, people can be prosecuted. Therefore, if citizens wish to receive assistance from the state, thenthey must hand over to the social security representative only the original documents regarding the income they receive.

Conclusion

In order for citizens to receive state assistance, they must prove that the family is classified as poor. To do this, you need to understand how to calculate the average per capita income of a family. The procedure can be performed independently using a special formula or through online calculators. Assistance is assigned if the income per citizen is less than the subsistence level.

Employees of the social security authorities independently carry out calculations on the basis of official documents received from the applicant. With the help of the results obtained, various preferences and support measures are assigned.

Recommended:

Average monthly income: calculation formula. Documents confirming income

Average monthly income from work is not the same as the average wage. Unlike the average salary, which is used for statistical surveys, the average salary is used for practical purposes. How does an employer find out the average monthly income of an employee?

Formula of net assets on the balance sheet. How to calculate net assets on a balance sheet: formula. Calculation of net assets of LLC: formula

Net assets are one of the key indicators of the financial and economic efficiency of a commercial firm. How is this calculation carried out?

Family income and expenses - calculation features and recommendations

Maintaining a family budget is not an easy question. You need to know how to properly carry out this operation. What can help? How to budget? How to save and even accumulate it? All the secrets of this process are presented in the article

How to calculate income tax: an example. How to calculate income tax correctly?

All adult citizens pay certain taxes. Only some of them can be reduced, and calculated exactly on their own. The most common tax is income tax. It is also called income tax. What are the features of this contribution to the state treasury?

How to calculate the insurance premium - features, calculation procedure and recommendations

At the beginning of 2017, changes were made to the legislation regarding contributions to the Pension Fund. In this article, we will figure out how to calculate the insurance premium