2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

Many operations are performed daily at the enterprise. Accountants issue invoices to counterparties and send them money, calculate salaries, pen alties, calculate depreciation, prepare reports, etc. Dozens of documents of various kinds are issued daily: administrative, executive, primary. The last group is of great importance for the activities of the enterprise.

What are "primary documents"?

Each event of the economic life of the organization must be confirmed by paper. It is formed at the time of the operation or immediately after its completion. Drawing up postings, reporting is carried out on the basis of the information specified in the primary accounting documents. Their list is large. In the article we will consider the main, most commonly useddocuments.

Why do we need a primary?

Primary documentation is an integral element of accounting. As mentioned above, it is formed at the time of the transaction or immediately after the end of the transaction and is proof of the reality of one or another fact of the economic life of the enterprise.

The list of primary accounting documents for one transaction may include:

- Contract.

- Account.

- Cash receipt or other payment document.

- Consignment note.

- Act of completion.

Required details

Currently, there are unified forms of primary accounting documents. They are used to reflect information about different operations, respectively, the list of columns in them is different. Meanwhile, all primary documents contain uniform mandatory details. Among them:

- Company name.

- Document name (for example, "Cash voucher").

- Date of formation.

- Content of the operation on which the document is drawn up. For example, when filling out an invoice, the corresponding column may indicate "Transfer of materials for processing".

- Money and natural indicators. The first are used to reflect the cost, the second - quantities, weights, etc.

- Positions of responsible employees ("chief accountant", "storekeeper", etc.).

- Signatures of persons involved in the transaction.

Important moment

The primary document containing all the required details has legal force.

Please note that properly executed papers can be used in legal proceedings as evidence of the validity (or invalidity) of claims. Many documents are drawn up by contractors. It is necessary to carefully check the correctness of registration and in no case put signatures for suppliers (contractors, etc.) if they have not done so.

Primary documentation must be carefully preserved.

Do I need a primary seal?

In practice, many counterparties make claims about its absence on the TTN form and some other documents. Recall that since 2015, most organizations have been exempted from the obligation to have a seal. Such enterprises can use it at their own discretion. If it is, then information about its presence must be written in the accounting policy.

In the event that the counterparty insists on using the seal when registering the primary, and the company has the right not to put it on legal grounds, the counterparty must be sent a written notification with links to the regulations governing this issue.

Agreement

If the counterparty is a long-term partner, then it is quite possible to conclude an agreement for several transactions. In this case, it is important to clearly define the deadlines for fulfilling obligations, the sequence and procedure for calculating, and other nuances. The contract can be drawn up for the sale of goods, the provision of servicesor production work. It is worth saying that civil law also allows for the oral conclusion of an agreement. However, in business activities, as a rule, written forms of contracts are used.

Invoice

In this document, the supplier indicates the amount to be transferred to the counterparty for goods, services or works. When making a payment, by default, it is assumed that the subject agrees to the transaction.

The invoice must be present:

- Document name.

- Name of services (goods, works) for which payment is made.

- Cost.

- Total amount.

- Details for payment.

Currently, the entire list of accounting documents is contained in the 1C program, so they are processed automatically.

Please note that the invoice is of little value to regulatory authorities. In it, the seller fixes the set price. From the position of an accountant, an invoice is the most important primary document on the basis of which accounting entries are formed.

Invoice acts as a type of invoice. This paper contains a special line for specifying VAT amounts.

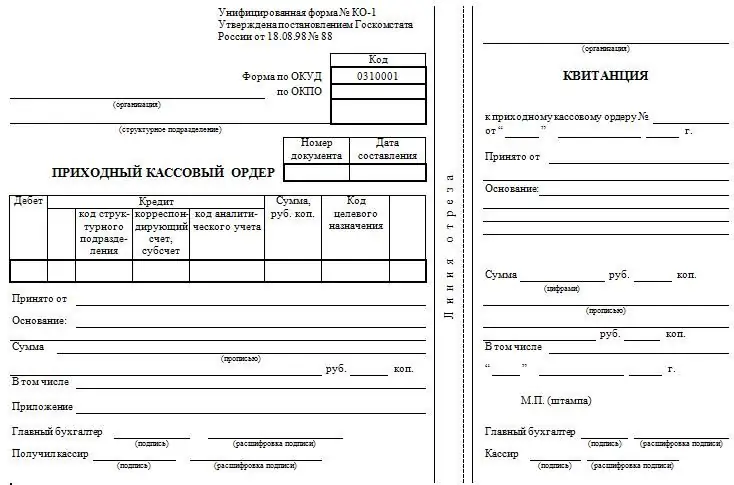

Payment documentation

You can confirm the fact of payment by a cash receipt or other similar document. Payment confirms the fact of payment for the supply of products, services, work. The specific type of document is selected depending on the methodpayment: cash or bank transfer.

One of the most popular settlement documents is a payment order. It is an order from the account holder for the bank to transfer funds to the specified account. The document can be used when paying for services, goods, for paying an advance, repaying a loan, etc.

In case of deductions to the budget, field 22 "Code" is filled in. In the payment order, this column indicates the UIN (unique identifier). Thanks to him, the fiscal authority recognizes the payer.

Field "Code" in the payment order can be filled in different ways. It depends on how exactly the subject fulfills his obligation to the budget: voluntarily or at the request of the regulatory authority.

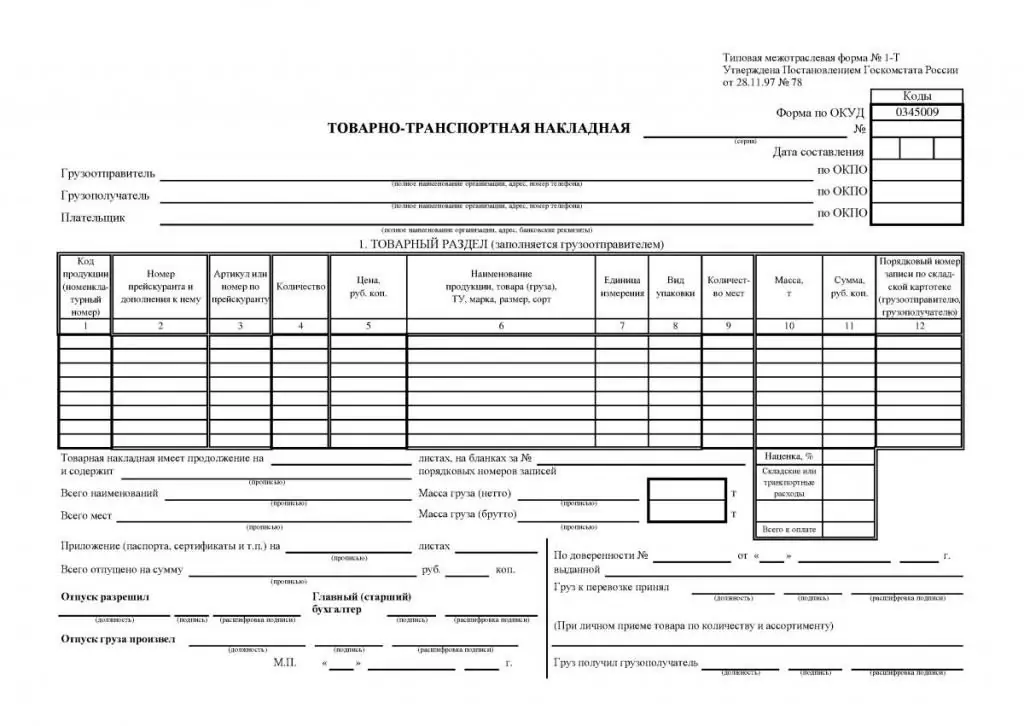

Consignment note

The TTN form is drawn up by the consignor. The bill of lading is the basis for the transfer of the goods to the recipient. The document is drawn up in 4 copies. According to the TTN, the seller takes into account the sale, and the buyer receives the delivery of the goods.

Please note that the TTN is drawn up when transporting goods by the company's own forces. If transportation is carried out by a third-party company, a 1-T form is issued.

Another important point: the information in the TTN must match the information in the invoice.

Act of completed work

This document is drawn up between the customer and the supplier. The act is a confirmation of the performance of work, the provision of services at an agreed cost within the terms established by the agreement. Simply put, thiscontractor's report to the customer.

Currently, a unified form of the act has not been approved. The enterprise has the right to develop a form on its own and fix it in the accounting policy.

The main details of the act are:

- Number and date of registration in accounting records.

- Date of compilation.

- Details of the contract in accordance with which the act is formed.

- Term, volume, cost of work.

- Details of the account to be paid for.

- Name of customer and contractor.

- Signatures of the parties to the transaction.

The act is always drawn up in two copies.

Form M-15

This abbreviation is used to refer to an invoice for outgoing goods. It should be noted that this document is not mandatory, but is often used by enterprises.

Invoice for the release of materials to the side is issued if it is necessary to transfer valuables from the main (head) office to remote divisions or other companies (if there is a special agreement).

Form rules M-15

In the first part of the paper, a number is affixed, in accordance with the document flow of the enterprise. Here you should also indicate the full name of the company and OKPO.

The first table reflects the date of the document, the transaction code (if the corresponding system is used), the name of the structural unit, the field of activity of the enterprise issuing the invoice.

Similarlyinformation about the recipient and the person responsible for the delivery is indicated. The following is a link to the document in accordance with which the invoice is issued. It can be a contract, an order, etc.

In the main table, columns 1 and 2 indicate the accounting subaccount and the analytical accounting code for all materials to be written off.

Next, the following data is entered in columns 3-15:

- name of materials with individual characteristics, brand, size, grade;

- stock number (if it is not there, the cell is not filled in);

- unit code;

- name of unit of measure;

- quantity of goods transferred;

- information about the actual objects released from the warehouse (to be filled in by the storekeeper);

- total cost of materials;

- price without VAT;

- VAT allocated amount;

- total cost including VAT;

- material inventory number;

- passport number (if any);

- record number according to account card.

The invoice is signed by the accountant, the employee responsible for the release of valuables from the warehouse, and the recipient.

Advance reports in "1C"

The formation of reporting documents is one of the most common actions of an accountant. Many settlements carried out in cash are made out by advance documents. These include travel expenses, household purchases, etc.

Often, employees of the enterprise receive funds from the cash desk for household expenses. After acquiring the necessary valuables (for example, stationery), employees report and provide supporting documents to the accounting department.

The accountant, in turn, must record all expenses in the accounting system. You can open "Advance reports" in "1C" in the section "Bank and cash desk", subsection "Cashier". The introduction of a new document is carried out by the "Create" button.

At the top of the form are indicated:

- Company name.

- Warehouse where newly received valuables will be credited.

- Employee reporting on funds received against the report.

The document contains 5 bookmarks. In the "Advances" section, select the document for which the funds were issued:

- Money document.

- Expense cash order.

- Debit from account.

If goods were purchased with the funds issued, they are reflected on the tab with the same name. In the "Container" section, indicate information about the returnable container (for example, water bottles). The "Payment" tab reflects information about the cash paid to suppliers for the purchase of an object or issued against an upcoming delivery.

In the "Other" section, data on travel expenses are indicated: per diem, fuel costs, tickets, etc.

"Universal" form

In the list of primary accounting documents there is one paper that can be used in a variety of situations. It is used in the formation of both accounting andtax reporting. It's about accounting. The form is required, if necessary, to correct the mistake made. In addition, the document is required when performing operations that require explanations, reflection of the calculation, confirmation of transactions, if there are no other papers.

Nuance

It is worth saying that an enterprise has the right to confirm the completion of transactions that do not require the execution of standard (standard, unified) forms, not with the help of a certificate, but through independently developed primary accounting documents. Their list, however, should be fixed in the financial policy of the company.

Rules for compiling a certificate

A single unified form has not been approved for this document. Accordingly, specialists can compile it in a free form or use templates developed at the enterprise. Among the mandatory information that the certificate should contain, it should be noted:

- Information about the enterprise.

- Date and reasons for compiling.

- Primary accounting documents and accounting registers, to which a certificate is attached.

- Signature of responsible employee.

You can write on a regular white A4 sheet or on company letterhead.

When compiling, you must be very careful not to make mistakes. The more detailed the reference, the fewer additional questions the inspectors have.

The document should, of course, contain only reliable information. If, duringspelling errors will be identified, it is more expedient to draw up a certificate again.

Storage Features

Everything that relates to primary accounting documents must be kept at the enterprise for at least 5 years. The calculation of this period begins from the end date of the reporting period in which the papers were issued.

Extra

Primary can be issued in paper or electronic form. Recently, more and more enterprises prefer electronic document management. This is understandable: it takes much less time to process and send papers.

Electronic documents must be certified by a digital signature (enhanced or regular - by agreement between counterparties).

Responsibility

Primary documentation is the most important element of the business life of an enterprise. In its absence, the company will face serious sanctions from the regulatory authorities. Pen alties will also be imposed in case of detection of errors in the primary documentation, inaccurate information.

Violation of the regulations is punishable not only by the Tax Code, but also by the Code of Administrative Offenses. If there are grounds, the perpetrators may also be prosecuted.

Conclusion

A variety of documents can be used in the work of an enterprise. At the same time, some of them may have a unified form, and some may be developed independently by the company. Regardless of this, however, all required details must be present in the documents.

Some businesses practice the use of combined documents. Speechwe are talking about unified forms, supplemented in accordance with the specifics of the organization's activities.

It is important to reflect the selected types of primary documentation in the accounting policy of the enterprise. In the course of the company's activities, the need for new documents may arise. If they are developed by the enterprise, then they should be mentioned in the accounting policy.

Please note that the counterparty can also independently develop certain forms of securities. It is necessary to indicate in the financial policy that the company accepts such documents from counterparties.

To record many transactions, organizations may not use unified forms of primary documentation. However, if we are talking about cash transactions, then they are executed exclusively by approved orders and other payment documents.

Recommended:

Accounting documents are The concept, rules for registration and storage of accounting documents. 402-FZ "On Accounting". Article 9. Primary accounting documents

Proper execution of accounting documentation is very important for the process of generating accounting information and determining tax liabilities. Therefore, it is necessary to treat documents with special care. Specialists of accounting services, representatives of small businesses who keep independent records should know the main requirements for the creation, design, movement, storage of papers

Primary accounting documents: list and rules of execution

Primary accounting documents are used in every enterprise. All of them are important in their own way, and must be taken into account in the work. They are drawn up according to the forms of primary accounting documents of accounting registers. A complete list of them and the rules for registration are presented in this article

Processing primary documentation: requirements, example. Primary accounting documentation

The activity of any enterprise is closely connected with the maintenance and processing of primary documentation. It is necessary for reporting, calculating tax payments, making management decisions

Primary accounting documents: types, processing and storage

Carrying out accounting at enterprises of various forms of ownership is impossible without documentary reflection. Not a single procedure, not a single project, not a single business transaction is carried out without a correctly executed document, regulated by the internal orders of the enterprise and external legislative norms. Each action performed by an employee is reflected in the documentary base, which is based on a list of primary documents

Accounting and tax accounting at a manufacturing enterprise: definition, maintenance procedure. Normative accounting documents

In accordance with PBU 18/02, since 2003, the accounting should reflect the amounts arising from the discrepancy between accounting and tax accounting. At manufacturing enterprises, this requirement is quite difficult to fulfill. The problems are related to the difference in the rules for valuation of finished goods and WIP (work in progress)