2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:32

Post Bank was founded quite recently, in January 2016. The new banking structure makes the most of the opportunities provided by its shareholders - Russian Post and VTB Bank. In this article, we will consider how to get a Post Bank credit card.

More about the bank

Despite the fact that the bank was created quite recently, it is gaining more and more popularity among the residents of the country. There are branches of the Russian Post even in the most remote corners of our state, which means that the card can be available to everyone. The bank specializes in issuing both credit and debit cards, as well as deposits. Naturally, there are many banking institutions that can offer similar services, but they cannot achieve such prevalence and ubiquity.

So, what do you need to apply for a Post Bank credit card?

Types of cards and conditions for obtaining them

Today, the bank provides several types of credit cards. The terms of receipt are quite loyal and acceptable. The most popular card options are:

1. Credit card "Green world". In cooperation with Passion Fruit Global, the banking structure provides assistance in the revival of Russia's forests. All commission funds received on this type of card are sent for the implementation of such a noble goal. The use of the card is carried out in accordance with the conditions established by the bank: payment for purchases without a commission, a full package of options and bonuses provided for the Visa Premium is provided, the annual interest on the loan will be 19.9%, the grace period for repayment of funds taken is 60 days. The loan limit is 500 thousand rubles, and after every third thousand rubles spent, one tree is planted.

2. Credit card "Post Bank" "Element 120". To obtain this type of card, you must fill out a special form on the company's website. The credit card will be mailed. The limit on the size of the loan is 300 thousand rubles. There is a discount program, a grace period of loan repayment up to 120 days, assistance if necessary at the time of being outside the country, insurance, an annual interest rate of 27.9%, and a minimum monthly payment of five percent of the principal debt. The terms of the Post Bank credit card seem optimal to many.

3. Postal Express card. This credit card does not charge interest. It is issued in five minutes at any Post Bank branch. The client can choose from three limits - 5, 10 and 15 thousand rubles. Depositing funds to the card is free. Supported by Visa payment system. Suitable for daily spending, bill payments and online purchases without commission.

It also makes sense to get a Post Bank credit card because when using them in partner stores, customers are provided with bonus systems and discounts. You can also pay with cards outside the country, and at a fairly favorable rate for the client.

How do I order a credit card?

On the Internet you can find a lot of positive feedback that this card can be obtained very quickly. You can also order it without any extra steps, just take the following steps:

- You need to register on the site and leave an online application for a credit card at Post Bank.

- After the card is made, you will be notified of its readiness. You can pick it up yourself at any branch.

Replenishment

Replenishment of the credit account is possible in several ways:

- Money transfer to the account.

- Autopay with debit card. Occurs with a commission of 1.9%, at least 29 rubles.

- Deposit funds through ATM "VTB 24".

Full or partial repayment of the debt is a necessary condition for the fulfillment of credit obligations. Regular and complete fulfillment of all conditions forms a reputation, creates the image of a conscientious borrower and causes a tolerant attitude towards him in the future.

Deferred payment

Using a Post Bank credit cardalso involves changing the date of repayment of the debt. A reprieve can be obtained from the 4th to the 28th. This service does not provide for the accrual of pen alties for late payment. Closing a credit card involves a personal appeal to a branch of a banking institution or to a sales counter at Russian Post offices. It is impossible to close the card without personal presence.

Features of use

So, getting a Post Bank credit card is easy.

Having received the funds, the client must be ready to fulfill certain conditions for the use and redemption of the money received:

1. Debt payments must be made monthly. Not only the borrower, but also a third party can pay the loan.

2. All amounts are monthly scheduled in the schedule, which is compiled and issued to the client along with a package of documents for a credit card upon first contacting the bank.

3. You can deposit amounts of any size, but not less than 5% of the debt at the time of deposit.

4. You can fund your card account with your own money. This can be done by transfer or cash deposit after the full repayment of the debt to the bank.

Prospects for development

Post Bank's popularity and demand continues to grow and will continue this trend in the near future. This is due, first of all, to the fact that the bank plans to open 15,000 branches throughout the Russian Federation. Taking into account the fact that you can also get a credit card at the post office, the customer base of Post Bank willexpand rapidly.

There are many banking organizations in Russia offering a similar range of services. However, the recently created Post Bank is striving to occupy its niche and stay on the credit services market. Its uniqueness lies, first of all, in the fact that it is based on the basis of an already existing, very widespread and universally known organization. This service is convenient, first of all, for pensioners who often use the services of post offices. The bank plans to expand its capabilities and create new options to make the service even more convenient and profitable. But even now its infrastructure is quite competitive and reaches the level of other eminent and popular banking institutions.

Credit Post Bank - reviews

Despite the fact that the bank opened recently, there are already heated discussions on the Internet. Credit cards are especially discussed. Customer opinions are diametrically opposed. Someone praises the competent service and the speed of the employees. For many, the use of credit cards does not cause problems. However, there are also negative reviews. Summarizing them, we can draw the following conclusions.

A credit card is convenient. Cash is always at hand. There is a grace period when you don't have to pay interest. But on the other hand, it's a temptation. It is always easier to spend someone else's than to return your own later. This must be taken into account before issuing a card.

Also, from the negative points, people highlight the highinterest on the use of loans. The result is a very large overpayment. Also, due to the fact that the card is a revolving line of credit, it is quite difficult to repay this loan in full. First, a person makes a minimum payment, and then spends again. It turns out a vicious circle. You need to have iron discipline to close the debt.

We looked at how to open a Post Bank credit card. This is not difficult at all.

Recommended:

How to get Sberbank credit cards: conditions and requirements for the borrower

In our time, credit cards are increasingly integrated into the modern world. Now they can be used almost everywhere - you can pay with them in a grocery supermarket, an online store or pay utility bills. Almost all modern retail outlets now offer conditions for the convenience of paying for goods with a bank card. This article will discuss how to get a Sberbank credit card and what you need to present to the borrower

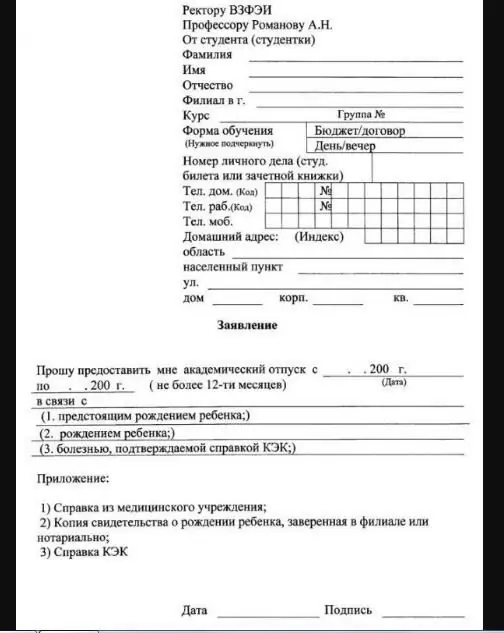

Academic leave at work: the procedure for registration, conditions and requirements, help and advice from lawyers

You can't take academic leave from work. However, usually, when looking for an answer to this question, they actually mean not academic, but student leave. It's just a change in concept. In the article, we will understand what is the difference between them, and why confusion occurs

Ventilation of industrial premises: types, requirements, design and control

Designing industrial premises ventilation is quite a difficult task. The creation of schemes is carried out taking into account the specifics of the enterprise. The main task of the ventilation system of industrial premises is to promptly "capture" all impurities and remove them

Foundations for equipment: special requirements, types, design, calculation formulas and application features

Equipment foundations are a necessary part of installing large installations. It is important to understand here that there is a big difference between the foundation for residential buildings, for example, and for various industrial units. Their arrangement and design also proceeds according to different methods

What you need to work in a taxi: necessary documents and requirements, regulations and legal aspects. Feedback and advice from taxi drivers, customers and dispatchers

According to many passengers, the job of a taxi driver is the easiest. You sit, listen to pleasant music and drive back and forth. And they give you money for it. But this is only the outer side of the coin. The reverse is much less rosy. We will talk about it in this article. And we will also highlight what you need to work in a taxi