2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-06-01 07:12:56

The cost of OPF tends to be passed on to finished products over a fairly long period. In some cases, it may cover several cycles. In this regard, the organization of accounting is carried out in such a way that it is possible to simultaneously reflect both the preservation of the original form and the loss of price over time. In this case, the average annual cost of the OPF is used as a key indicator. In the article, we will consider how it is determined and what indicators are used in this case.

General characteristics

Means (structures, buildings, equipment, etc.), as well as objects of labor (fuel, raw materials, and so on) participate in the output of products. Together they form production assets. A certain group of means of labor partially or completely retains its natural-material form over many cycles. Their cost is transferred to finished products as they wear out in the form of depreciation. This group is formed by fixed assets of production. They areare directly involved in the production process. Non-productive funds provide the formation of social infrastructure.

Classification

The main production assets include:

- Buildings are architectural objects designed to create working conditions. These include garages, workshop buildings, warehouses, etc.

- Constructions - objects of engineering and construction type used for the implementation of the transportation process. This group includes tunnels, bridges, track construction, water supply system and so on.

- Transmission devices - gas and oil pipelines, power lines, etc.

- Equipment and machinery 0 presses, machine tools, generators, engines, etc.

- Measuring devices.

- Computers and other equipment.

- Transport - locomotives, cars, cranes, loaders, etc.

- Tools and equipment.

Key values

The cost of OPF can be replacement, residual and initial. The latter reflects the costs of obtaining fixed assets. This value is unchanged. The initial cost of funds that come from the capital investments of certain companies can be established by adding up all the costs. These include, among other things, the cost of transportation, the price of equipment and installation, etc. The replacement cost is the cost of purchasing fixed assets in the current conditions. To determine it, funds are revalued using indexation or direct conversion method based on modern market prices confirmed bydocumented. The residual value is equal to the replacement value, reduced by the amount of depreciation. There are also private indicators of OS usage. These include, in particular, the coefficients of intensive, integral, extensive operation of equipment and shifts.

Loss of original properties

The average annual cost of OPF is determined taking into account depreciation and amortization. This is due to the fact that with prolonged use of funds in the technological process, they quickly lose their original properties. The degree of wear can be different - it depends on various factors. These, in particular, include the level of operation of funds, the qualifications of personnel, the aggressiveness of the environment, etc. These factors affect different indicators. So, to determine the return on assets, an equation is first compiled, according to which the average annual cost of the OPF is established (formula). Capital-labor ratio and profitability depend on revenue and number of employees.

Obsolescence

It means the depreciation of funds even before the physical loss of properties. Obsolescence can manifest itself in two forms. The first is due to the fact that the production process reduces the cost of funds in the areas in which they are produced. This phenomenon does not lead to losses, as it acts as a result of an increase in savings. The second form of obsolescence arises as a result of the appearance of such OPF, which are distinguished by high productivity. Another indicator that is taken into account is depreciation (the processtransfer of cost of funds to manufactured products). It is necessary to form a special cash reserve for the complete renovation of facilities.

Average annual cost of OPF: formula for calculating the balance sheet

To determine the indicator, you must use the data that are present in the balance sheet. They should cover transactions not only as a whole for the period, but also separately for each month. How is the average annual cost of OPF determined? The balance formula used is:

X=R + (A × M) / 12 - [D(12 - L)] / 12 where:

- R - initial cost;

- A - the rate of introduced funds;

- M - the number of months of operation of the introduced BPF;

- D - liquidation value;

- L is the number of months of operation of retired funds.

OS commissioned

As you can see from the above information, the equation that determines the average annual cost of OPF (formula) includes indicators that require separate analysis. First of all, the initial price of the funds is set. To do this, take the amount of the balance at the beginning of the reporting period according to the account. 01 balance sheet. After that, it should be analyzed whether any OS were put into operation during the period. If it was, you need to set a specific month. To do this, you should look at the revolutions in dB ch. 01 and set the value of the funds put into action. After that, the number of months in which these OSexploited, and multiplied by the cost. Next, the average annual cost of the OPF is determined. The formula allows you to set the value of the funds put into use. To do this, the indicator obtained by multiplying the number of months of use by the original price of the OS is divided by 12.

Average annual cost of OPF: formula for calculating the balance sheet (example)

Assume that fixed assets at the beginning of the period amounted to 3670 thousand rubles. Funds were introduced throughout the year:

- for March 1st - 70 thousand rubles;

- for August 1st - 120 thousand rubles

Disposal also included:

- for February 1st - 10 thousand rubles;

- for June 1 - 80 thousand rubles

Solution:

- X=3670 + (120 × 5: 12 + 70 × 10: 12) - (80 × 6: 12 + 10 × 11: 12);

- X=3670 + (50, 0 + 58, 3) - (40, 0 + 9, 2)=3729, 1 thousand rubles

Disposal

In the analysis, in addition to the funds put into operation, written-off funds are determined. It is necessary to establish in which month they dropped out. For this, the turnovers are analyzed according to Kd cf. 01. After that, the cost of retired funds is determined. When writing off fixed assets during the entire reporting period, the number of months in which they were operated is established. Next, you need to determine the average annual cost of retired funds. To do this, their price is multiplied by the difference between the total number of months in the entire reporting period and the number of months of operation. The resulting value is divided by 12. The result is the average annualcost of OPF retired from the enterprise.

Final Operations

At the end of the analysis, the total average annual value of the OPF is determined. To do this, you need to add up their initial cost at the beginning of the reporting period and the indicator for the funds put into operation. From the obtained value, the average annual cost of fixed assets that have retired from the enterprise is subtracted. In general, the calculations do not differ in complexity and laboriousness. When calculating, the main task is to correctly analyze the statement. Accordingly, it must be written without errors.

Recommended:

Net sales in the balance sheet: string. Sales volume in the balance sheet: how to calculate?

Annually, enterprises prepare financial statements. According to the data from the balance sheet and income statement, you can determine the effectiveness of the organization, as well as calculate the main planned indicators. Provided that the management and finance department understand the meaning of terms such as profit, revenue and sales in the balance sheet

General concepts of the balance sheet: assets, liabilities, balance sheet currency

The balance sheet contains important information for assessing the company's financial results. Each section of the asset, liability, as well as the balance sheet currency is necessary to calculate many financial indicators

Formula of net assets on the balance sheet. How to calculate net assets on a balance sheet: formula. Calculation of net assets of LLC: formula

Net assets are one of the key indicators of the financial and economic efficiency of a commercial firm. How is this calculation carried out?

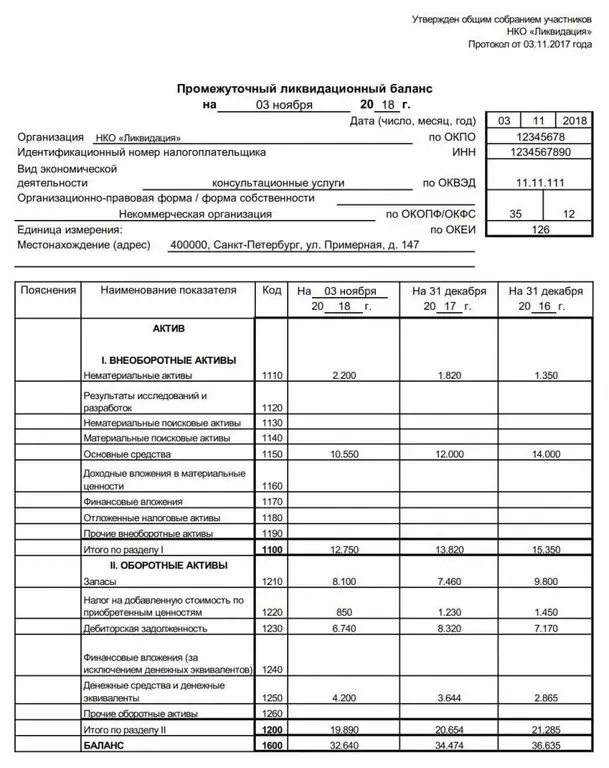

Liquidation balance sheet is Definition of the concept, approval, form and sample of filling out the liquidation balance sheet

The liquidation balance sheet is an important financial act drawn up during the closing of an organization. It can be intermediate or final. The article tells what is the purpose of these documents, what information is entered into them, as well as how and when they are approved and submitted to the Federal Tax Service

Balance: types of balance. Types of balance sheet

The balance sheet is the most important accounting document of an institution. What is it, what are the rules for filling it out, types and classification