Banks

Mosoblbank: feedback from employees and customers

Last modified: 2025-01-24 13:01

At present, the institution is functioning perfectly and bears the same name - Mosoblbank. Reviews on numerous information and economic portals make it possible to form a fairly positive opinion about the mentioned organization, which, by the way, is almost completely part of the Republican Financial Corporation. Its share in it is about 94%. Since 2009, Gennady Seleznev, the former speaker of the State Duma, has been the chairman of the board of the financial institution

Bank Renaissance: feedback from customers and employees

Last modified: 2025-01-24 13:01

Bank "Renaissance", reviews of which allow you to form a variety of opinions, how a credit institution appeared on the market of the Russian Federation in 2000, but received its current name only 3 years later - in 2003. From the very beginning, the owners planned to orient it only to meet the consumer needs of its customers and the issuance of appropriate loans

An example of a checking account. How many digits are in the current account, decoding

Last modified: 2025-06-01 07:06

A current account is opened for quick access to transactions with own funds: withdrawal and deposit without restrictions, transfer in the necessary directions within the available volume. A current account held by individuals is commonly referred to as a “demand account”. An example of a current account - a requisite of a Russian commercial enterprise - is proposed in the article

Letter of credit. Types of letters of credit and methods of their execution

Last modified: 2025-01-24 13:01

A letter of credit is a form of payment between a seller and a buyer when financial institutions act as intermediaries. The payer and the buyer of the goods transfer funds to the bank, which transfers them to the account of the issuing bank

For those who want to know which bank gives a loan from the age of 18

Last modified: 2025-01-24 13:01

Surely many will agree that money is especially needed in young years, because it is at this stage of life that a person seeks himself and prepares a platform in order to realize himself in the future. It is clear that all this requires quite serious financial investments, which not everyone has

What is a denomination? Will there be a denomination of the ruble in Russia?

Last modified: 2025-01-24 13:01

The question of what a denomination is can be answered in this way: it is a decrease in the nominal expression of banknotes issued by the state. It so happened that the exchange of money - the process is not so rare and mostly unpleasant. Since World War II alone, over six hundred denominations have been held throughout the world. If the country's economy is in a normal state, then this concept is purely technical

The dollar and the euro are showing strong growth. Why is the euro and dollar rising in 2014?

Last modified: 2025-01-24 13:01

To understand why the euro and the dollar are growing, and the Russian ruble is falling, you should analyze the political and economic situation in the world

"Leto Bank": reviews. JSC "Summer Bank" "Leto Bank" - cash loan

Last modified: 2025-01-24 13:01

Leto Bank was partly conceived as an institution designed to show Russians that credit institutions are not only strongholds of usury, but also structures that can be friendly and welcoming. Did the bank with such a positive name manage to implement these plans in practice?

Bank accounts: types and characteristics. How to open a bank account

Last modified: 2025-01-24 13:01

Today, few people imagine their life without plastic cards and deposits. All monetary transactions go through banking organizations for convenience and improving the quality of life. The main thing is to skillfully use accounts, and then a plastic card will become a powerful tool in your hands. There are many varieties of them, each of which, in fact, will be discussed in this article

How to find out the current account of a Sberbank card? Where can I see the current account of a Sberbank bank card?

Last modified: 2025-01-24 13:01

Anyone has seen a bank card. Almost everyone at least once used it to carry out any operations: paying for all kinds of purchases in stores, paying for services, money transfers, etc. It is very convenient. There are times when some transactions require a card account. This begs the question of how to find out

"Military mortgage": conditions for obtaining in various banks. Terms of Sberbank and VTB on "Military mortgage"

Last modified: 2025-01-24 13:01

If you are a member of the NIS and want to take advantage of the opportunity to purchase housing actually at the expense of the state, then you should like the Military Mortgage program. Conditions for obtaining a loan for military personnel are very favorable

What is a bank deposit? How to open a profitable deposit in a bank

Last modified: 2025-01-24 13:01

The most common type of investment in many countries of the world is a bank deposit, which is called a deposit in economic terminology. This choice is due to the rapid and rapid development of the economy and the investment sector. What is a bank deposit and why is it so popular?

How can I find out my Visa card number? How can I see my Visa credit card number (Russia)?

Last modified: 2025-01-24 13:01

Currently, payment systems are developing at a fairly fast pace. In this review, we will talk about what the Visa card number hides in itself

"Rost Bank": reviews. Loans, deposits, branches

Last modified: 2025-01-24 13:01

Before becoming a client of a particular bank, you should carefully study all the nuances of working with it, find out the rating, read the reviews of those who have already used its services. In this article, we suggest that you familiarize yourself with the Rost Bank organization. Reviews, rating, conditions for loans and deposits, as well as other information that is important for a potential client, will be offered and evaluated in the submitted material

Call collectors for other people's debts, what to do?

Last modified: 2025-01-24 13:01

Most likely, you have had to use the services of a credit system at least once in your life. But not everyone who took out a loan was able to repay it on time

VTB 24 salary cards: design and benefits

Last modified: 2025-01-24 13:01

How and where to get VTB 24 salary cards? How the overdraft service works, how to activate and deactivate it. You will learn about it from this article

Ilkka Salonen: biography and photos

Last modified: 2025-01-24 13:01

Ilkka Salonen is a Finn who has been living and working in Russia for many years. We will talk about his life and fate in the article in more detail

Tinkoff card replenishment: tips and tricks

Last modified: 2025-01-24 13:01

"Tinkoff" is a bank that does not have separate service terminals in Russia. But this does not prevent the use of cards from this financial institution. This article will tell you everything about replenishing Tinkoff cards

Review and feedback on "Alfa Cash"

Last modified: 2025-01-24 13:01

The Alfa Cash platform was created for the fast and secure exchange of virtual currencies. It allows you to create investment portfolios. At the moment, registration in the service is carried out by invitation

Credit card "Element 120", "Post Bank": reviews

Last modified: 2025-01-24 13:01

In recent years, credit cards of various banks have become very popular among the population. They gained such popularity because most people do not have the opportunity to make the desired purchases at any given time. Finding the amount you need can be difficult. Post Bank began offering its lending services relatively recently, but is already popular

International rating of banks in Kazakhstan

Last modified: 2025-01-24 13:01

Positions of the main banks of Kazakhstan in the ratings of international financial agencies. Analysts' forecasts and general trends in the country's banking sector. Reliability ratings of banks in Kazakhstan

Reviews about "Post Bank" on loans and credit cards

Last modified: 2025-01-24 13:01

"Post Bank" has been operating in our country not so long ago, but it is already quite popular. The creation of such a banking institution is a new milestone in the development of banking services in the Russian market. Embedding banking elements in the postal infrastructure creates opportunities for the use of financial services for all citizens of our large country, even residents of the most remote regions

Tinkoff ATMs in Moscow: addresses and features

Last modified: 2025-01-24 13:01

This article discusses the innovation of Tinkoff Bank - its own ATMs. The main advantages and disadvantages of the device from the leading online bank in Russia are described

"Metallinvestbank": feedback from employees and customers

Last modified: 2025-01-24 13:01

"Metallinvestbank" offers profitable services for individuals and legal entities. Feedback on the work of the institution can be heard mostly positive

Expert Bank: reviews of employees and customers

Last modified: 2025-01-24 13:01

"Expert Bank" is a financial institution with a rich history. The company attracts customers with a wide range of profitable services and a high level of reliability

Card "Magnet" from "Belarusbank": reviews, conditions, partners

Last modified: 2025-01-24 13:01

"Belarusbank" is a large universal financial and credit institution of the Republic of Belarus. This structure offers various types of banking products and services. One of the products of this financial institution is the Magnit card. We will learn more about it, and also find out what the bank's customers think about this payment instrument

Bank "Uralsib": reliability rating, place in the rating

Last modified: 2025-01-24 13:01

Every Russian has probably heard the name of Uralsib Bank. Which, however, is not surprising, because it is included in the rating of the best financial institutions in Russia. But this information is not enough to understand its quality and reliability. So it is worth delving into the topic and considering it in more detail

Privatbank credit card: reviews, review, conditions

Last modified: 2025-01-24 13:01

PrivatBank was founded back in 1992. Today, this financial institution is the leader of the Ukrainian banking market. There is an opportunity to choose not only a loan in PrivatBank, but also a plastic card for various purposes, and, moreover, at any price. Thus, both low-cost instant cards and Premium class are available to customers

Showcase of VTB collateral. The principle of the sale of collateral

Last modified: 2025-01-24 13:01

Showcase of pledged property or VZI VTB is a special bank program that gives people the opportunity to purchase property on special terms. With the help of this program, you can purchase lots from the showcase of such expensive items as cars, apartments, etc. at low prices. Almost every bank has similar programs

How to transfer money to a Sberbank card from a phone?

Last modified: 2025-01-24 13:01

Sberbank allows you to transfer money from your phone to plastic cards. This article will tell you all about such an operation

"Mosoblbank": problems and reviews

Last modified: 2025-01-24 13:01

Brief information about Mosoblbank. Problems faced by the financial institution in 2014. How and where did the bank transfer money? How to return your money to Mosoblbank depositors? What problems did the nurse face? Customer Reviews

How to make a transfer from a Sberbank card to a Tinkoff card?

Last modified: 2025-01-24 13:01

Tinkoff is a large banking network in Russia. This article will talk about how to transfer money from a Sberbank card to Tinkoff plastic

Sberbank Teams - 900: all about using mobile banking

Last modified: 2025-01-24 13:01

Sberbank offers a rather interesting option called "Mobile Banking". What it is? How to use it? This article will talk about sending requests to the short number 900 from Sberbank

"Post Bank", credit card "Element 120": reviews, terms of registration

Last modified: 2025-01-24 13:01

Now many banking institutions offer their customers to issue a card. Each program has its own offers. According to reviews, the Element 120 credit card from Post Bank is in demand among users due to its main advantage - a long grace period. Read more about it in the article

Norilsk Nickel - pension fund: description, services, rating and reviews

Last modified: 2025-01-24 13:01

Non-state pension organization “Naslediye” has been operating for twenty-four years now, which was renamed twice before it was given this name. It all started with the Interros-Dignity organization, to which the NPF Norilsk Nickel was attached in 1996. Actually, under the name "Norilsk Nickel" the pension fund is best known

Sale of property of debtors by Sberbank - auctions, procedures and recommendations

Last modified: 2025-01-24 13:01

When applying for large loans, it is often required to provide collateral in the form of movable and immovable property. This object becomes the property of the mortgagee. In case of violation of the terms of the contract, the formation of debt, the bank sells such objects at attractive prices. How is the sale of property of debtors by Sberbank carried out?

Credit card of Trust Bank: reviews, terms of registration and use

Last modified: 2025-01-24 13:01

Credit cards of Trust Bank are popular due to the simple procedure for obtaining and a wide range of functions: electronic payments, the ability to withdraw cash, replenish an account, etc. These credit cards are available to a wide range of people. Among the bank's products, there are several offers with different tariff plans and terms of use

International money transfers from Russia to Belarus: features, conditions and reviews

Last modified: 2025-06-01 07:06

Many citizens of Belarus work in Russia. Usually this is done on a rotational basis. In order not to transport money immediately, many send them to relatives and friends. Money transfers from Russia to Belarus are carried out in different ways. Banks and systems are described in the article

How to enter Sberbank's personal account from a phone or PC?

Last modified: 2025-01-24 13:01

Sberbank's personal account allows you to manage finances and services provided to the client. This article will tell you how to get authorized in the personal account in one case or another

Master account "VTB 24" - what is it? Appointment how to use?

Last modified: 2025-01-24 13:01

VTB 24 clients often find themselves in a situation where they do not have access to the services they need. For example, not all banking products are available for remote account registration or in the online account. This means that a comprehensive service agreement has not been concluded and there is no VTB 24 master account. What is it and how to connect the service is described in the article

Sberbank, settlement and cash services: tariffs, features and reviews

Last modified: 2025-01-24 13:01

In order for financial transactions to be reliable and timely, it is necessary to choose a stable bank. After all, it will ensure the safety of storage of funds and fast speed of settlements. Such an organization is Sberbank. Settlement and cash services, the tariffs of which are very favorable, are carried out there at the highest level, as evidenced by numerous customer reviews. Read more about the service in the article

Ural bank - cash loan: conditions and interest. Ural Bank for Reconstruction and Development

Last modified: 2025-06-01 07:06

Today, many banks offer cash loans. Each institution has its own programs with different conditions. The Ural Bank also offers cash loans. The conditions and methods of their registration can satisfy the needs of any borrower. Clients are offered several programs from which they can choose the appropriate ones. And you can learn about them from the article

Sberbank salary project: instructions for an accountant. Sberbank banking products

Last modified: 2025-01-24 13:01

Practically all modern enterprises pay wages to employees in a non-cash way. It is considered convenient for everyone. The employer reduces the labor costs of cashiers and the cost of obtaining cash in the required amount. And employees save time on visiting the cash desk and receive banking products on favorable terms. The most popular is the salary project of Sberbank. Instructions for the accountant will allow you to properly conduct the activities of the enterprise. More about this is described in article

Electronic registration of a transaction in Sberbank: reviews, pros and cons, terms

Last modified: 2025-01-24 13:01

Sberbank is considered one of the most popular organizations among the population, because it provides many financial services. This is due to a wide list of products, a high share of state participation. To date, electronic registration of the transaction in Sberbank is available to customers. Reviews testify to the convenience and reliability of the service. Read more about it in the article

Cor. an account is an important component of bank settlements

Last modified: 2025-01-24 13:01

Correspondent, or the so-called "correspondent account", is an account on which all types of operations of one bank, performed in accordance with a correspondent agreement, are recorded and subsequently displayed. In other words, this concept is used to form reserve funds or various transfers made by the aforementioned structure

Depositor is an economic category

Last modified: 2025-01-24 13:01

A depositor is a depositor, an entity that has deposited a thing or deposited various valuables in a deposit of a certain state institution. For the first time this word appeared in the second half of the 19th century in the German language in the meaning of "to postpone"

How much money can I withdraw from a Sberbank ATM? How to transfer money through a Sberbank ATM?

Last modified: 2025-01-24 13:01

If you own Visa Electron or Maestro cards, then ATMs will give you no more than fifty thousand rubles per day. By the way, it is not always possible to pay with these cards abroad and on the Internet. And how much money can I withdraw from a Sberbank ATM with Visa Classic and MasterCard Standard cards? You can get only eighty thousand per day and 2.5 million per month

What is a checkpoint in the details of an organization?

Last modified: 2025-01-24 13:01

Most Russian entrepreneurs indicate the checkpoint when concluding contracts. As a matter of fact, why?

How to withdraw money from the Piggy bank of PrivatBank? "PrivatBank", Ukraine

Last modified: 2025-06-01 07:06

Many of us have thought about saving money for a rainy day, but what is the best way to do it? Money has to work, so keeping it at home under your favorite pillow is not practical. It is most profitable to put free funds on a deposit at a high percentage. And here a problem arises, and even two

What is the card security code? How to use Visa card security code?

Last modified: 2025-01-24 13:01

If you have ever made purchases via the Internet, then most likely you have encountered the need to enter a security code. Everyone should know this parameter. So what is a card security code? That's what he's talking about

Where is the card number on a plastic card?

Last modified: 2025-06-01 07:06

An article about what a card number is, where it is located on a plastic card and why it is needed. Also information about why it is better not to disclose it to unauthorized persons

What is bank resolution? Bank sanction: what to do for depositors

Last modified: 2025-01-24 13:01

What is bank resolution? How, when and by whom is it carried out? What is the difference between bailout and bankruptcy? The results of the recovery of the "B altic Bank". What is bank group resolution?

Why banks refuse loans: reasons

Last modified: 2025-01-24 13:01

Currently, the question of why banks are refusing credit is a topical issue for many. It would seem that it is difficult to get borrowed money from the above institutions, which actively advertise lending programs and assure citizens that they can easily lend funds, and the registration procedure will take only 20 minutes?

Bank "DeltaCredit": reviews. "DeltaCredit" (bank): branches, addresses, customer opinion

Last modified: 2025-01-24 13:01

"DeltaCredit" is a relatively young, but quite dynamically developing bank. Its activity is completely concentrated on the mortgage market. What are the features of the loan programs of this bank? What is the specifics of its interaction with borrowers?

Credit Agricole Bank

Last modified: 2025-01-24 13:01

The Russian banking structure "Credit Agricole CIB" is the "brainchild" of a well-known French credit organization with the same name. Its field of activity in the domestic market is to serve not only large companies in our country, but also foreign commercial institutions that are doing successful business in Russia

Bank "Moscow Lights": reviews. Reliability of the bank "Lights of Moscow"

Last modified: 2025-01-24 13:01

In April of this year, it was announced that the acceptance of deposits in "Ogni Moskvy" was suspended. The bank attributed the problem to technical difficulties

"B altic Bank": problems with the "Central Bank" (2014)

Last modified: 2025-01-24 13:01

History of creation and development of CB "B altic Bank". Problems faced by the financial institution in 2014. Why did the Central Bank start the reorganization procedure? Who is leading the process? Customer reviews about "B altic Bank"

How to find out how much money is on a Sberbank card. Five options for solving the problem

Last modified: 2025-01-24 13:01

The question of how to find out how much money is on a Sberbank card arises for many in the process of using a card account

Rating of Russian banks in terms of reliability, assets and loans issued

Last modified: 2025-01-24 13:01

Any person who applies for certain services to a bank would like to be sure that this bank is reliable. In order to have a complete picture and make the right choice, you can pay attention to the rating of banks. The article presents the ratings of Russian banks according to various criteria, such as the degree of reliability, stability, popularity, profit margins, loans issued, and so on

A settlement account is Opening a settlement account. IP account. Closing a current account

Last modified: 2025-01-24 13:01

Settlement account - what is it? Why is it needed? How to get a savings bank account? What documents need to be submitted to the bank? What are the features of opening, servicing and closing accounts for individual entrepreneurs and LLCs? How to decrypt bank account number?

Problems of Mosoblbank: license revocation. What will happen to the bank?

Last modified: 2025-01-24 13:01

Mosoblbank's problems have affected many citizens of the Federation, because about 300 thousand people have invested in it. But, before withdrawing deposits, you need to figure out what the situation is in the bank and what will happen to it in the future

Functions and risks of the acquiring bank

Last modified: 2025-01-24 13:01

Contactless payments have taken root in the lives of Russians in recent years. The technology allows consumers who do not have paper money to make purchases. Let's take a closer look at the acquiring process and all participants in this scheme

Deposits of banks in Kazakhstan. Interest and terms of deposits

Last modified: 2025-01-24 13:01

The economy of Kazakhstan is currently in a state of growth. Experts predict further growth in the standard of living in Kazakhstan. Therefore, such a way of additional income as a deposit can be very relevant and interesting

Sberbank client code: how to get it through an ATM and how to use it?

Last modified: 2025-01-24 13:01

Sberbank client code is a convenient combination that not all citizens know about. This article will show you how to get it

How old do you have to be to get a bank card? Youth cards. Debit cards from 14 years old

Last modified: 2025-01-24 13:01

More than a third of parents regularly give their children pocket money for personal expenses, another third do it from time to time. Schoolchildren and students up to 17 years of age receive most of the funds in the form of cash, but very few use plastic cards

Sberbank - deposit for a child under 18: conditions and features

Last modified: 2025-01-24 13:01

Sberbank of Russia offers many different programs for different categories of customers. Caring parents can make a deposit for a minor child. Thanks to this service, you can receive monthly passive income. More about this in the article

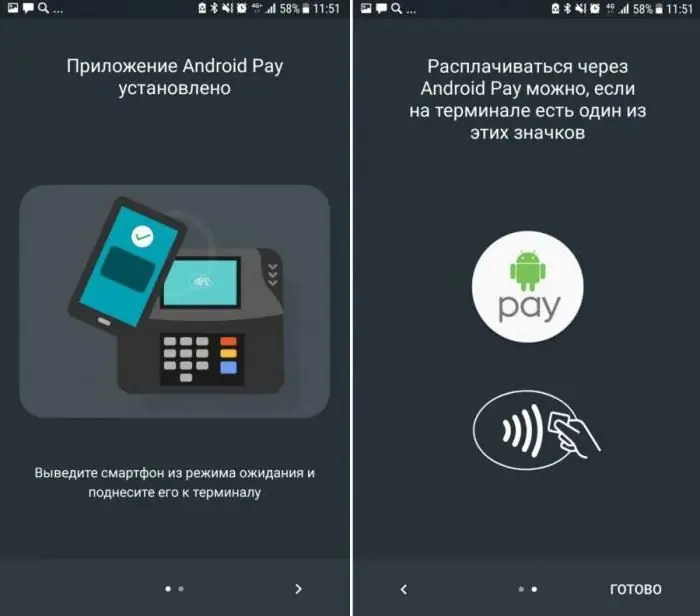

Android Pay electronic payment system in Russia. How to use Android Pay

Last modified: 2025-01-24 13:01

Android Pay is a unique opportunity that has recently appeared in Russia. Only a few can use it. This article will tell you everything about Android Pay

How to activate a VTB 24 card via the Internet - a step-by-step description and recommendations

Last modified: 2025-01-24 13:01

VTB 24 is a popular bank in Russia. This article will talk about how you can activate the plastic of this financial institution

How to check the balance of a bank card via the Internet - a step-by-step description and recommendations

Last modified: 2025-01-24 13:01

You need to be able to work with bank cards. One of their main functions is to check the status of the account. This article will tell you how to check the balance of a bank card

How a debit card differs from a credit card: highlights

Last modified: 2025-01-24 13:01

Bank cards are different. This article will describe the main differences between debit plastic and credit cards. What to pay attention to first of all?

What is Sberbank Online, why is it needed and how to use it?

Last modified: 2025-01-24 13:01

Sberbank Online is an extremely useful service. But what is he? How can I connect it? How to use Sberbank Online?

Raiffeisenbank's partner banks: full list

Last modified: 2025-01-24 13:01

Clients using Visa and MasterCard received from Raiffeisenbank can make ruble transactions without additional costs in the partner network of the analyzed CFU. The register consists of eight banks, according to information from the official website on 10/29/2017, allowing you to withdraw money without commission. Two banks from the list allow the replenishment of plastic consumers of services "RFB"

Credit card from "Raiffeisenbank" - "110 days": reviews, conditions, tariffs

Last modified: 2025-01-24 13:01

"Raiffeisenbank" is the largest financial institution operating in the vastness of our country. This bank always offers a high-quality and competitive product. The bank's employees have developed a whole line of various financial products, among which the 110 Days card appeared not so long ago. It is quite capable of becoming a competitor for the cards of other banks. The advertising slogan of this financial product is as follows: "Some can wait"

What is an identifier in Sberbank Online - description, conditions and requirements

Last modified: 2025-01-24 13:01

"Sberbank Online" is a popular and very convenient service. In this article we will talk about all the nuances of registering on this portal, as well as about its use

Debit card of Sberbank "Platinum" - reviews, review, description and conditions

Last modified: 2025-01-24 13:01

The article describes the features of the Sberbank platinum card. The advantages and disadvantages, as well as the conditions

Are there anonymous bank cards?

Last modified: 2025-01-24 13:01

This article discusses such a phenomenon in the economy as anonymous bank cards. The following aspects are indicated: obstacles to the anonymity of the Visa card, the positive aspects of the anonymization of accounts, the features of the Russian market of anonymity, as well as an international example

Credit card "Tinkoff Platinum" - "120 days without interest" - reviews, conditions and features

Last modified: 2025-01-24 13:01

This summer, Tinkoff actively promoted its credit card, luring customers with promises to repay existing loans in other banks, while receiving a unique grace period of 120 days. This promotion did not cause much excitement, because for a minute video it did not show the main thing: the benefit is valid only if the condition is met - the card user needs to activate the "Balance Transfer" service

Card "Freebie", Sovcombank: user reviews

Last modified: 2025-01-24 13:01

"Freebie" from Sovcombank - a card that appeared in Russia recently. Why is she needed? How to get "Freebie"? What do customers say about this product?

Bank "Opening" - refinancing of consumer and mortgage loans: conditions, reviews

Last modified: 2025-01-24 13:01

The article describes the features of the refinancing program at Otkritie Bank. The advantages and disadvantages of the service are considered

Where is the best place to get a credit card - features, conditions and recommendations

Last modified: 2025-01-24 13:01

Credit cards are very convenient, because there is no need to accumulate money for the desired purchase for months, constantly take out new consumer loans, and you can also pay off the debt without interest, well, and unlike a large stack of money, it can easily fit into wallet, and in case of its loss there will not be a catastrophe of a universal scale

How to unlock Sberbank Mobile Bank services: step by step instructions and recommendations

Last modified: 2025-01-24 13:01

"Mobile bank" is a popular service of Sberbank. For some reason, the option may be disabled. It can be reactivated at any time. But how?

Card "Cosmos" from "Home Credit": reviews, conditions, benefits

Last modified: 2025-01-24 13:01

The terms of the Cosmos card from Home Credit look attractive. If the reviews are to be believed, the service is also excellent. Should I trust this bank with my money?

Term deposits are Definition, features, interest and reviews

Last modified: 2025-01-24 13:01

In modern banks, customers are offered various services. One of them is term deposits. This allows clients to earn income through personal funds. Often the money is invested for 1-2 months, after which they can be taken along with the profit. According to reviews, this type of banking service is very profitable. Read more about the service in the article

Credit card "Conscience": reviews, is it worth opening, terms of use

Last modified: 2025-01-24 13:01

Credit cards are issued annually by different banks. Qiwi recently offered a Conscience credit card. What it is? Is it worth ordering it? What do the holders say about the "Conscience" credit card?

The most profitable bank deposit. The most profitable bank deposits

Last modified: 2025-01-24 13:01

Deposits are one of the most demanded services offered by modern financial institutions. Deposits are the simplest form of investment. All that is required of a person is to choose a suitable financial partner in the face of a large bank, take their savings and put it into an account

"VTB 24" - deposits for pensioners: conditions, interest rates

Last modified: 2025-01-24 13:01

The article describes the features of deposits for pensioners in the bank "VTB 24". The conditions for receiving interest from the deposit are considered

What are "Thank you" bonuses from Sberbank for: features, conditions and validity period

Last modified: 2025-01-24 13:01

Bonus programs from different banks pleasantly surprise customers. For example, there is an offer called "Thank you" from Sberbank. This article will describe all the features of the program

What is the card "Conscience" and how to draw it?

Last modified: 2025-01-24 13:01

Bank cards in Russia are different. For example, recently a plastic called "Conscience" began to be produced. What it is? How can I get a card?

Installment credit card "Conscience": owner reviews, conditions and features

Last modified: 2025-01-24 13:01

Almost every modern person has a credit card. All of them offer different conditions and opportunities. Recently, a credit card called "Conscience" has appeared. What it is? How good is the product?

Refinancing, Sberbank: conditions and reviews

Last modified: 2025-01-24 13:01

Refinancing is one of the most popular services in Sberbank, which not only allows you to shorten the loan repayment period, but also reduce the payment. It minimizes loan repayments

What is the refinancing rate of the Bank of Russia and what is its size?

Last modified: 2025-01-24 13:01

The refinancing rate should act as a lever in the management of Russia's monetary policy, an instrument for regulating the volume of funds. In fact, it only affects the country's fiscal policy

"Sberbank Premier" - what is it? Interest on deposits, customer and employee reviews

Last modified: 2025-01-24 13:01

Sberbank of Russia offers its customers such a service as Sberbank Premier. What it is? Let's try to understand in more detail. The service is essentially a specialized service format that is available only to we althy clients of the largest bank in the country

Bank "Yugra": problems. Bank "Ugra": reviews

Last modified: 2025-06-01 07:06

Bank "Yugra" not only has no problems due to the crisis, on the contrary, it is at the peak of its development. Recognized by the Deposit Insurance Agency, it is on a par with Sberbank of Russia

What is a metal account in Sberbank. How to open an unallocated metal account in Sberbank

Last modified: 2025-01-24 13:01

A metal account with Sberbank is a great alternative to dollar and ruble deposits. Compulsory medical insurance are considered highly liquid programs, the profitability of which is directly related to the situation on the international market

Gold and foreign exchange reserves of Ukraine: statistics and structure

Last modified: 2025-06-01 07:06

Ukraine's gold and foreign exchange reserves have been declining since 2011. The falling trend indicates the inability of the state to maintain the national currency and the unsatisfactory state of the country's economy

"VAB Bank": feedback from depositors, deposits, problems

Last modified: 2025-01-24 13:01

"VAB Bank" is currently declared insolvent by the NBU. Negative feedback from depositors - these were the first heralds of problems that thousands of people all over Ukraine had to face

Bank "People's Credit": problems. Bank "People's Credit" is closing?

Last modified: 2025-01-24 13:01

Bank "People's Credit" in 2014 faced low liquidity. The interim administration and the curator recorded the conduct of illegal operations and the insufficiency of assets to fulfill obligations, which led to the liquidation of the license

Bank "Financial Initiative": reviews. "Financial Initiative": feedback from customers and employees

Last modified: 2025-01-24 13:01

Bank "Financial Initiative", despite good advertising and an extensive network of branches, has a far from ideal reputation. Numerous reviews testify to this

"Terra Bank": customer opinion, reviews. "Terra Bank": problems

Last modified: 2025-01-24 13:01

Terra Bank, like many financial institutions, almost went bankrupt in 2015. The study of the prerequisites for the problems highlighted to the public the fact that the bank uses the financial resources of the institution for its own purposes

Bank "Finance and Credit": problems. Bank customer reviews

Last modified: 2025-01-24 13:01

Bank "Finance and Credit" today has serious problems associated with the lack of funds to pay deposits. The management of the structure promises to rectify the situation and fulfill all obligations, despite the risk of default