2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

You can invest capital in absolutely different areas of activity and objects. One of the popular areas for making a profit is such an economic category as a security. There are many types of them, so it is quite difficult to understand this issue. Putting a detailed description of each paper on just one page is not possible, therefore, only brief descriptions are presented in this material.

Definition

Let's start with the fact that a security is a kind of document that indicates the presence of a property right of its owner. One important point is the mandatory and strict observance of the forms and details that are established by the current regulatory documents. A security can only appear as a result of an issue. This process is a certain sequence of actions of the issuer (these are authorities, a legal entity that bear certain obligations to the owners of these documents forsecuring the rights directly assigned to them) by posting these documents.

The law of the Russian Federation regulates all relations arising as a result.

Security. Classification

It should be noted that the issue under consideration has its own classification. So, allocate bonds (they can also be government), a bill, a check, certificates of deposit, as well as a variety of shares and other securities. With most of them, work is carried out by banking institutions. It should be noted that there are different classification features. For example, all securities, depending on who issued them, are divided into banking, government, and also issued by legal entities. A security is often issued on a specialized form of a standard form. It must contain the name, issue date, face value, full name and location of the issuer, maturity date, and type of yield. As for the last point, the owner can claim interest, discount. There are also interest-free securities.

Bonds

This is another building block of the issue at hand. They are a debt obligation, which is issued either by an enterprise or by the state when they issue an internal loan. The bond en titles the holder to claim income in the form of interest.

Promissory note

Security with this name indicates the presencean unconditional debt obligation of the bank to pay the agreed amount to its holder in due time.

Check

This species is no less common than those discussed above. It contains an order to a banking institution to issue a certain amount to its owner.

Certificates of Deposit

They are also called savings. They certify the amount that its holder has deposited in the bank. In addition, the certificate of deposit confirms the right of the depositor to receive the amount he deposited earlier with the established interest.

Promotion

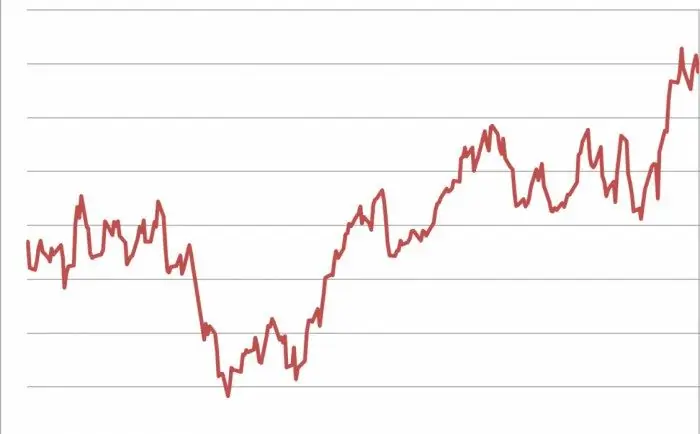

This security is issued by an enterprise whose organizational and legal form is a joint-stock company. Its owner has the right to claim a certain percentage of profit in the form of dividends. In addition, the shareholder can take part in the management, as well as receive part of the property of the enterprise, which will remain in the event of its liquidation.

In closing

Today, shares are the most effective investment of money (if we are talking about the securities of large enterprises and corporations). They are quite accessible to individuals.

Recommended:

Hamam in Samara: addresses and brief description

In Russia, banya is one of the most popular types of recreation. Our compatriots like not only the Russian steam room and the Finnish sauna, but also such an exotic thing as a hammam. So called public baths in Turkey, Azerbaijan, Iran and some other countries of the East. To visit an exotic bath, Russians do not need to go anywhere, because many complexes provide their visitors with such a service. Where to find a hammam in Samara? Addresses and a brief description of the establishments are presented in this article

The salary of a security guard in Moscow. Working conditions as a security guard in Moscow

Many want to get a job as a security guard in the capital of Russia. Consider the level of salaries of such specialists. What determines the salary level? Is it true that only employees with a license and a permit to carry weapons are hired?

What are the duties of a security guard? Job duties and responsibilities of a security guard

The profession of a security guard is quite popular today. And all because more and more stores and shopping centers are opening these days, in which it is necessary to ensure the safety of both employees and customers, as well as goods and money, at the proper level. In addition, factories, various municipal institutions and a host of other facilities are constantly in need of security guards. We offer today to find out in detail what is included in the duties of a security guard

History of porcelain: a brief history of development, types and description, technology

Ceramic products are the oldest kind of craft from all the skills mastered by man. Even primitive people made primitive utensils for personal use, hunting decoys and even earthenware utensils like hut ovens for cooking. The article tells about the history of porcelain, its types and method of obtaining, as well as the distribution of this material and its path in the artistic work of various peoples

What is the card security code? How to use Visa card security code?

If you have ever made purchases via the Internet, then most likely you have encountered the need to enter a security code. Everyone should know this parameter. So what is a card security code? That's what he's talking about