2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:31

In American history, there have been many financial crises and the collapse of large financial corporations that have had an impact on the economy of this country. One of the most recent and significant among them is the bankruptcy of Lehman Brothers, a bank that was previously considered one of the world leaders in the investment business and ranked fourth in this area in the United States. More details about the history of his success and bankruptcy will be discussed later.

Foundation

In 1844, Heinrich Lehmann emigrated from Germany to the United States. Here, in a small town in Alabama, he opened a grocery store. His clients were mostly local cotton merchants. Things were going very well, so in the near future the young entrepreneur saved up enough money to help two younger brothers move in with him. They helped him in business, and their company was already called Lehman Brothers. Often it was profitable for customers to pay them with finished products. At the same time, when receiving cotton, the brothers underestimated its value, and later sold it at market prices, earning onthe same item twice. In 1855, Heinrich Lehmann died, after which his brother Emanuel took over the company, who three years later opened a branch in New York. During the Civil War, the firm actively helped the southern states. After graduation, the business connections they made helped the brothers organize the issuance of Alabama bonds.

Commodity Exchange

In 1870, the New York Cotton Exchange was established. Lehman Brothers took a direct part in its foundation. The story of an investment bank earning fabulous profits began around this time. The sphere of interests of the enterprise at that time included not only cotton, but also other profitable products, such as oil and coffee. The firm also invested in securities of companies that were just starting out. It should be noted that many of them still exist today.

Success

In 1906, the company was headed by Philip Lehman, who organized more than one emission for the largest corporations that traded consumer goods. His son Robert in 1925 became the last representative of the dynasty at the head of the institution. His Yale education, along with his well-prioritized operations, helped him not only save Lehman Brothers from the Depression crisis, but also make it one of the largest financial institutions in the country. As of the early twenties of the last century, the bank invested in the aviation industry,radio, film industry and retail chains. Under the leadership of Robert Lehman, the company reached its highest level of development and became one of the most influential in the United States.

Preconditions for a crisis

In 1969, Robert Lehman died. From that moment on, a power struggle broke out within Lehman Brothers. In 1975, the bank became the fourth investment financial institution in the country. Despite this, in the early eighties of the twentieth century, many bankers quit. The fact is that they could not do anything with stock market players who increased their premiums unilaterally. In 1984, American Express took advantage of the situation within the bank by making Lehman Brothers a part of one of its subsidiaries. Ten years later, the company changed its policy and launched the process of public sale of shares. Thus, the bank became independent again, and its capitalization grew up to bankruptcy.

Collapse

In early 2007, rumors began to circulate about the institution's problems. His brokers began issuing random over-the-counter contracts, offering to buy back interest on future mortgage bonds to anyone who wanted to. It was a very risky game. It fully justified itself while the mortgage market was on the rise. However, as soon as the situation changed, the contract owners began to present their demands to Lehman Brothers. The bank had neither funds nor securities to meet its obligations. As a result, after the firsthalf of 2008, the company announced its losses amounting to 2.8 billion dollars. Moreover, creditors filed claims for compensation, the total amount of which amounted to 830 billion dollars. Proposals to settle the situation through nationalization did not find support in the government. Thus, officials showed that the state does not intend to pay for the mistakes of top managers.

On September 15, 2008, the bank's management filed an application with the court to declare it bankrupt. The financial institution's liquid assets in the US, Europe and East were bought out by Barclays and Nomura Holdings.

Recommended:

The most successful businessman: success story and interesting facts

Now it's the 21st century - the time of new discoveries and the furious development of the IT industry. Some have gloriously succeeded in this and become successful millionaires at a fairly young age. Your attention is presented a list of "The most successful businessmen in Russia under 40". Of course, the leader in this area is Pavel Durov, but there are several more people who managed to make their multi-million dollar fortune before the age of 40

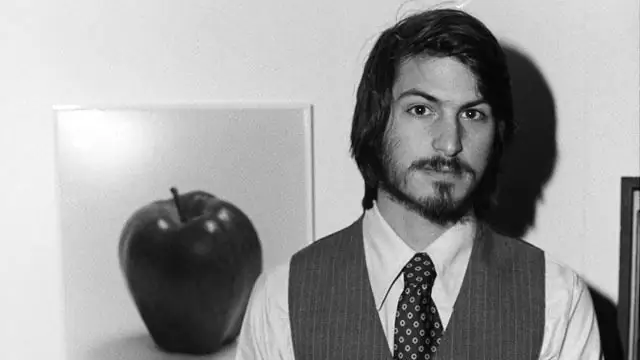

Steve Jobs: the story of the life and creation of the most famous Apple corporation

Steve Jobs was born in 1955. It happened on February 24 in the sun-kissed state of California. The biological parents of the future genius were still very young students, for whom the child was so burdensome that they decided to abandon him. As a result, the boy ended up in a family of office workers named Jobs

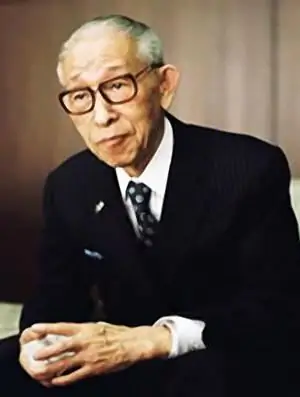

Konosuke Matsushita: short biography and success story

In management, one can rarely meet unconditional authorities, but there is a person who, without exception, causes only admiration and respect for everyone - this is Konosuke Matsushita. The “principles of success” formulated by this Japanese entrepreneur are still basic for businessmen all over the world today. He lived an amazing life that was filled with tireless work, victories and failures, and endless optimism and faith in people. Let's talk about how a boy from a poor family managed to become a founder

Ray Kroc: biography, family and children, education, success story

Raymond Albert Ray Kroc (October 5, 1902 – January 14, 1984) was an American businessman. He joined California's McDonald's in 1954, just months after the McDonald brothers left their own company. Kroc turned their brainchild into a nationwide and eventually global corporation, making it the most successful fast food corporation in the world

Oscar Hartmann: biography and success story of the Russian billionaire and philanthropist

Oscar Hartmann is one of Russia's most successful and we althiest entrepreneurs and a prime example of how you can achieve incredible goals from scratch. To date, the businessman owns more than 10 companies, the total capitalization of which is over $ 5 billion. Such people delight, and their success stories inspire and motivate. Therefore, now we should briefly talk about Oscar and how he started and what he was able to come to