2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:31

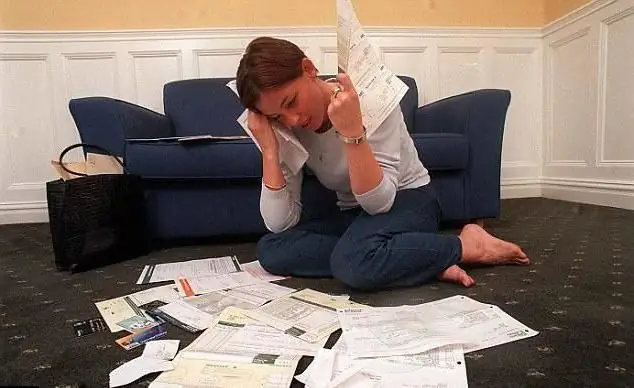

Tax debts themselves are a negative phenomenon in the economic activity of any payer. Firstly, the tax debt on the TIN once again attracts the attention of regulatory authorities to the business entity. Secondly, the entrepreneur bears additional costs associated with the obligation to pay a pen alty on the amount of the debt. Thirdly, you still have to pay taxes.

FSN service

Checking the tax debt by TIN can be carried out at any time on the website of the tax service. A special service allows you to see such information both by tax number and full name. However, the TIN continues to be the main identifier, since the last name, first name, patronymic may still be the same for several people, and the number is unique.

So, the TIN tax debt can be checked in two ways. The first- contact the district tax office, in which the entrepreneur is registered. Here the inspector will announce the amount of the debt and issue a payment for its repayment. The second option is the most convenient for business entities - check the tax debt by TIN on the website of the Federal Tax Service.

Scammers go out into the world

When typing the phrase "tax debt by TIN" in any Internet search engine, you can see a large number of sites providing this service. Some of them offer to view the specified information for a symbolic amount. If you are required to pay money for providing such a service, then in this case we are talking about scammers who create such sites. Payers just need to know that the specified information is provided free of charge.

There are other sites on the Internet that allow you to find out tax debt without a TIN. However, using only information about the full name, you can see not your own information, but someone else's, because there are namesakes, both patronymics and names can match.

And another type of scammers was discovered - websites have been created that allow you to find out what the tax debt is for the TIN by entering your data, after such an introduction, the payer will allegedly then be sent the result to the specified e-mail. Such sources of information cannot be trusted, since on the website of the Federal Tax Service data are issued online, i.e. immediately.

An example of such a scam isinformation about allegedly provided services for paying traffic police fines via the Internet. A sufficient number of citizens fell for this "bait" and made electronic transfers, despite the strange name of this Internet resource.

Official website of the FSN

To see the TIN debt, you just need to type "FSN" in the search engine and go to the official website of the tax service. On the right of the main page there is a corresponding electronic button, by clicking on which the user enters another window offering to register or log in. In this case, registration is carried out either online or at the nearest tax office. Thus, the payer will have access to the "Personal Account", it can be used at any time of the day.

Recommended:

Debt sold to collectors: does the bank have the right to do so? What to do if the debt is sold to collectors?

Collectors are a huge problem for many. What to do if the bank has contacted similar companies for debts? Does he have the right to do so? What will be the consequences? What to prepare for?

Payers of land tax are Taxation, terms of payment, amount of deductions

Payers of land tax are individuals and enterprises. The article describes how this type of fee is calculated. The terms for transferring funds for legal entities or citizens are given. Describes liability measures for non-payers

Tax counterparty. Problem partners. Federal Tax Service: counterparty check

The counterparty is one of the key participants in the transaction. He assumes obligations in accordance with the concluded contract. Each entity that signed the agreement will act as a counterparty to the other party to the transaction

Are you interested in cultivators? Reviews and opinions of those who have evaluated this technique will help you make the right choice

If the upcoming spring work scares you, makes you sad with memories of back pain or joint pain, buy assistants. The best of them are cultivators

Relief on transport tax for families with many children. What tax benefits do large families have?

Families with many children in Russia often receive a variety of benefits. For example, they can receive free textbooks in schools. And what about taxes? Are there any transport tax exemptions for families with many children? And if so, how do you arrange them?