2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

Derivative securities are financial objects that are not assets in the usual sense. That is, they do not embody part of the property of the enterprise and are not debt obligations. They do not represent the asset itself, but the right to buy or sell it. An investor or speculator does not acquire ownership of it, as happens when buying shares, but uses it exclusively for further resale.

What are

There is a special kind of financial instruments used by financiers and professional traders in the secondary market. These are derivative securities. These include such market objects as options, forwards, futures, etc.

Although the contract itself does not give ownership of the assets, moreover, if you do not sell it in time, it loses its value, investments and speculations with them are considered profitable. To understand how a trader can make money on these securities, it is necessary to consider in detail and study at least the main types of derivative securities and their characteristics.

Reasons for the secondary market

It all started in 1971, when there was first the liberalization of the currency, and then the stock and commodity markets. This led to an even greater freedom of movement of capital from one country to another, from one area of production to another. Along with freedom came the unpredictability of prices. This is what gave rise to the fear of losing part of the capital on the price and the desire of investors to somehow secure their investments.

For quite natural reasons, participants appeared on the market who decided to help especially fearful investors, and at the same time make money on them. And although derivative securities are still considered one of the most risky objects of exchange speculation today, there are no fewer hunters to use the situation that has developed on the market. The point is not only in high liquidity, but also in the simplicity (as experience shows is illusory) of using contracts for personal enrichment.

The main reason for the emergence of the derivatives market is the very device of the free market, when some companies are trying to hedge, others need funds now, they are ready to sell their contracts and assets in order to buy them out, but only a little later. Therefore, this market is considered secondary, since on it the transaction takes place not between two participants in the agreement (contract), but between third parties of the market: traders and brokers.

Another reason is an attempt to avoid the "collapse" of the economy as a result of another financial crisis, as it happened in1929, when technological progress led to the emergence of new agricultural equipment: tractors and combines. A record (by that standards) harvest due to the use of this agricultural machinery led to the fact that prices for agricultural products fell and most farmers went bankrupt. After that there was a sharp rise in prices, as the offer was sharply reduced. There was a collapse in the economy. To avoid a repetition of such a development of the event, the future harvest began to be sold under a contract, in which its price and volume were stipulated even before sowing.

Types of securities

According to the modern definition, the concept of derivative securities is defined as a document or contract that en titles its owner to receive an asset within a certain time or after a certain period. At the same time, before the transaction, he can dispose of this document. He can sell it or exchange it. The following types of contracts are used in business activities:

- Options.

- Futures.

- Spot contracts.

- Depositary receipt.

- Forwards.

In some scientific articles, a bill of lading is also given as derivative securities, but its inclusion in this type of paper is very controversial. The thing is that the bill of lading does not give the right to dispose of the assets being transported. That is, this is an agreement between the shipper and the carrier, and not between the shipper and the consignee. And although the carrier is responsible for the safety of the transported assets (cargo), he does nothas the right to dispose of them.

If the consignee refuses to accept the asset, the carrier will not be able to sell or appropriate it. However, the bill of lading itself may be transferred or sold to another carrier. This is what makes it similar to derivatives.

How such financial instruments are classified

In economic science, the classification of derivative securities according to the following parameters is accepted:

- by execution time: long-term (more than 1 year) and short-term (less than 1 year);

- by level of responsibility: mandatory and optional;

- by the date of the consequences of the transaction or the need to pay: instant payment, during the contract or at the end;

- according to the order of payments: the entire amount at once or in installments.

All of the above parameters must be specified in the contract one way or another. This determines not only what type it will be, but also how transactions will be made with derivative securities to which the contract applies.

Forwards

A forward contract is a transaction made by two parties, under the terms of which an asset is transferred, but with a delay in execution. For example, a contract for the supply of a product by a certain date. Such a transaction is carried out in writing. At the same time, the value of the acquired (sold) asset and the amount that he will be obliged to pay for it (market price) must be specified in the document.

BIf the buyer cannot pay for the contract for any reason or he urgently needs money, he can resell it. The seller has exactly the same rights if the buyer refuses to pay. In this case, an arbitrage operation is carried out, as a result of which the affected party can sell the contract on the derivatives exchange. In this case, the financial result of the transaction can be realized only after the expiration of the period specified in the contract. The price of the contract depends on the term of the contract, the value of the underlying asset, demand.

There is an opinion among economists that forwards have low liquidity, although this is not entirely true. The liquidity of a forward contract depends primarily on the liquidity of the underlying asset rather than market demand for it. This is due to the fact that this type of contract is concluded outside the exchange. The parties to the contract are solely responsible for its implementation. Therefore, the participants have to check each other's solvency and the availability of the asset itself before concluding a deal, if they do not want to risk it again.

Futures

Future contracts, unlike forward contracts, are always concluded on the stock or commodity exchange, but the bulk of financial transactions with them are carried out on the secondary securities market. The essence of the transaction is that one party undertakes to sell an asset to the other party by a certain date, but at the current price.

For example, a contract was concluded for the purchase of goods at a price of $500, which the buyerThe contract should return in two weeks. If in two weeks the price has risen to $700, then the investor, that is, the buyer, will be the winner, because if he had not secured himself, he would have to pay $200 more. If the price falls to $300, then the seller of the contract still has nothing to lose, since he will receive the contract back at a fixed price. And although in this case the buyer is at a loss (he could buy a contract for $ 200 cheaper), futures make trading more predictable.

As derivative securities, futures contracts are highly liquid. The main advantage of such contracts is that the conditions for their sale and purchase are the same for all participants. Futures trading has its own characteristics (including pure speculation). So, with an open position, the person who performed this operation must deposit a certain amount as collateral - the initial margin. The size of the initial margin is usually 2-10% of the amount of the asset, however, by the time of the specified term of the contract, the amount of the deposit must be 100% of the specified amount.

Futures are one of the high-risk derivatives. After opening a position, market forces begin to act on the price of the contract. The price can either fall or rise. At the same time, there are temporary restrictions - the duration of the contract. To ensure market stability and limit speculation, the exchange sets limits on the level of deviation from the original price. Orders to buy or sell outside of these limits will simply not be accepted forexecution.

Options

Options are derivative securities with a conditional expiration date. And although options are recognized as the most risky type of transactions (despite some restrictions, which will be discussed in more detail below), they are becoming increasingly popular as they are concluded on different platforms, including the currency exchange.

When buying, the party acquiring the contract undertakes, for a premium, to transfer it at a fixed price to the other party after a certain period of time. An option is the right to buy a security at a certain rate over time.

For example, one participant buys a contract for $500. The contract is valid for 2 weeks. The amount of the award is $50. That is, one party receives a fixed income of $ 50, and the other - the opportunity to purchase shares at a favorable price and sell them. The value of an option largely depends on the value of shares (assets) and fluctuations in their prices. If the owner of the option first bought 100 shares at $250 each and sold them a week later at $300, he made a profit of $450. However, to receive it, he must complete this operation before the contract expires. Otherwise, he won't get anything. The complexity of option trading lies in the fact that you have to take into account not only the value of the option itself, but also the assets to which it applies.

There are two types of options: buy (call) and sell (put). The difference between them is that in the firstIn the second case, the issuer who issued the derivative security undertakes to sell it, in the second - to redeem it. That is, regardless of the situation on the market, he must fulfill his obligations. This is its main difference from other types of contracts.

Spot contracts

Derivatives also include spot contracts. A spot transaction is a trade that must take place in the future. For example, a spot contract for the purchase of a currency for a certain period of time and at a predetermined price. As soon as the conditions for the conclusion of the transaction come, it will be concluded. And although these contracts are not subject to trading, their role in exchange trading is great. With their help, it is possible to significantly reduce the risk of losses, especially in conditions of strong market volatility.

Hedging

Hedge is a risk insurance contract drawn up between an insurer and an insured. Most often, the object is the risk of non-return of payment, loss (damage) of assets due to natural disasters, man-made disasters, negative political and economic events.

An example is bank loan hedging. If the client cannot repay the loan, he can sell the insurance on the secondary market, with the obligation to buy it back within a certain time. If he does not do this, the asset becomes the property of the new owner of the insurance, and the insurance company will reimburse the bank's losses. However, such a system led to sadconsequences.

It was the collapse of the hedge market that became one of the most striking signals of the financial crisis that began in 2008 in the United States. And the reason for the collapse was the uncontrolled issuance of mortgage loans, under which banks bought insurance (hedges). Banks believed that insurance companies would solve their problem with borrowers if they could not pay off the loan. As a result of the delay on loans, a colossal debt was formed, many insurance companies went bankrupt. Despite this, the hedge market has not disappeared and continues to work.

Depositary receipt

With the help of this financial instrument, you can purchase assets, stocks, bonds, currencies that for some reason are not available to investors from other countries. For example, by virtue of the national legislation of a country, which prohibits the sale of assets of certain enterprises abroad. In fact, this is the right to acquire, albeit indirectly, the securities of foreign companies. They do not give the right to manage, but as an object of investment and speculation, they can bring quite good profits.

Depository receipts are issued by the depositary bank. First, he buys shares in enterprises that do not have the right to sell their shares to foreign investors. It then issues receipts secured by these assets. These receipts can be purchased on foreign derivatives markets and on the local currency market. The issued securities have a face value - this is the name of the companies and the number of shares under which they are issued.

Receipts are issued when a certain company wants to list already traded securities on a foreign exchange. They are sold either directly or through dealers. Usually they are classified according to the country of manufacture. This is how depository receipts are distinguished as Russian, American, European and global.

Pros of using such financial instruments

The listed derivatives often share several types at once. For example, when entering into a futures or option, one of the participants may try to reduce the risk of loss by simply insuring the trade. As long as the contract is in effect, he can sell the insurance policy (hedge). If the other party fails to fulfill the terms of the contract for any reason, then the policy owner (the last one who bought the insurance) will receive insurance payments.

Despite the fact that these financial instruments are imperfect, they still enable businessmen to reduce risk, introduce some certainty into the relationship between market participants, and get more or less predictable financial results from the transaction.

Recommended:

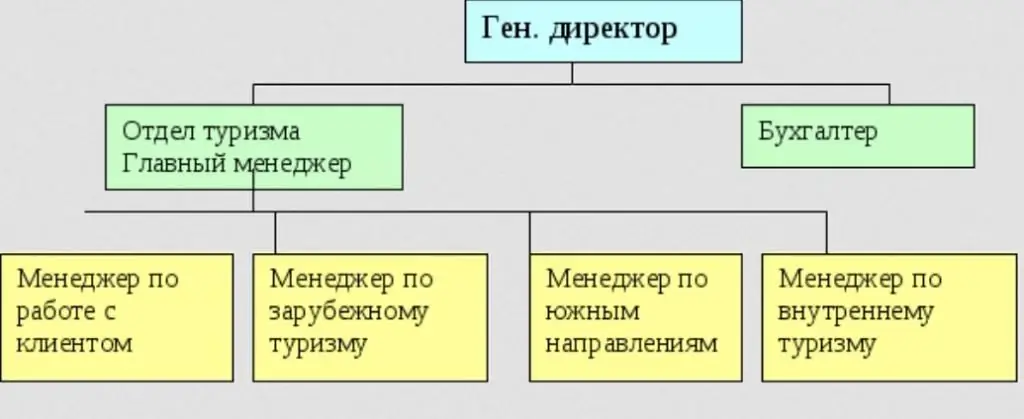

Types of tour operators and their characteristics. Functions and features of the activities of tour operators

The tour operator provides a wide range of travel services and simplifies the reservation of services in other cities and countries, taking on these tasks. In the field of tourism services, it occupies a special niche. In the article we will consider the types of activities of tour operators

What are uncertificated securities? Russian securities market

The financial market includes several sectors. One of them is the stock exchange. The securities market is a source of receipt and redistribution of funds. Investors buy shares of promising companies and banks, accelerating their growth. There are documentary and non-documentary securities in circulation here. The features of their functioning will be discussed in the article

Non-ferrous, precious and ferrous types of metals and their characteristics

Metals are a large group of simple elements with characteristic features such as high thermal and electrical conductivity, positive temperature coefficient and more. To properly classify and understand what's what, you need to deal with all the nuances. Let's try with you to consider such basic types of metals as ferrous, non-ferrous, precious, as well as alloys. This is quite an extensive and complex topic, but we will try to put everything on the shelves

Securities and the loss in the price of securities

Existing types of securities. Work with securities, regulation of relations in this type of activity. What determines the loss of the price of securities

Investment qualities of securities. The concept of the securities market. Main types of securities

Recently, more and more people choose to invest in securities as a way to invest. This leads to the development of the securities market. A competent choice of investment instruments is possible only after a thorough assessment of the investment qualities of securities