2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

Volume is a measure of how much of a given financial asset was sold in a given period of time. This is a very powerful tool, but it is often overlooked because it is defined by the simplest indicator. Information about it can be found anywhere, but few traders or investors know how to use it to increase their profits and minimize risk in Forex. The indicator of buyers and sellers volumes can help with this without much effort on the part of the trader.

For each buyer, there must be a market participant who can sell him shares, and for the seller, respectively, a buyer so that they can make a deal. The confrontation between sellers and buyers for the best price in all different time frames creates a movement from which fundamental and technical long-term factors flow. Using volume to analyze stocks (or any financial asset) can increase returns as well as reduce risk.

Main guidelines for using volume

When analyzing volume, there are certain guidelines that you can use to determine strength ormovement weakness. Most traders tend to join strong trends and not take part in trades in which the movement is weak. However, these recommendations do not work in all situations, but can help in making trading decisions. Any indicator of the volume of Forex transactions can help in this.

Market interests and volume

Market growth should increase over time. Buyers demand more supply and demand to make prices better. An increase in value and a decrease in volume show a lack of interest, and this is a warning of a possible reversal. The essence of this phenomenon is that a price drop (or rise) on a small volume is not a strong signal. A decrease in value (or an increase) on high volume is a more significant signal that the situation has changed significantly.

Movement and volume in the market

In a rising or falling market, you can see the corresponding trends. These tend to be sharp moves in price coupled with a sharp increase in volume, signaling a possible end to a trend. Participants who expected changes and are now afraid of incurring losses will begin to make transactions en masse, and thus the number of buyers will increase dramatically. Falling prices end up driving a large number of traders out of the market, leading to volatility and increased volume. You can notice a decrease in volume after its rise in thesesituations, and its further changes over the next days, weeks and months can be analyzed using various charts and indicators of Forex trading volume. How does it work?

Bull trend

Using volume indicators in Forex can be very helpful in identifying bullish trends. For example, imagine that the volume increases when the price goes down, and then it moves higher, after which it comes back. If the value on the move back remains higher than the value of the previous low, and the volume decreases on the second decline, then this is usually defined as a bullish trend.

Change in volume and price

After a long price moves higher or lower, if it starts to fluctuate with little movement and high volume, it often indicates a reversal. Such a change can fix any volume indicator on Forex.

Volume and Breakouts vs. False Breakouts

On the initial breakout from the range, increased volume indicates a fast move. A small change or decrease indicates a lack of demand and a high probability of a false breakout.

Forex volume indicators

Volume indicators can be thought of as mathematical formulas visually presented on the most commonly used charting platforms. Each one uses a slightly different formula, so traders should use the one that best suits their personal market approach. Indicators are notrequired, but they can help in the decision-making process. Many of these tools are in use today, so the choice should be made after careful consideration.

VSA-Coloured Volume

Forex VSA volume indicators differ from other tools in that, in addition to the standard histogram, moving average indicators are also used. Moreover, the settings include several different time periods.

Thanks to these components, the tool is able to assist in determining market sentiment and price changes.

On-Balance Volume (OBV)

OBV is a simple but effective Forex volume indicator. Starting from an arbitrary number, volume is added and subtracted depending on the progress of the market. This displays the total amount and shows which shares accumulate over time. It can also show divergences (for example, when the price rises, but the volume increases more slowly or even starts to fall).

Chaikin Money Flow

This indicator is based on the following principle. A rise in prices must be accompanied by an increase in volume, so the calculation formula focuses on an increase in volume. When prices reach the upper or lower end of their daily range, a value is calculated for the corresponding strength. When the close is at the top of the range and volume is expanding, it will be high. When it is located at the bottom of it, the values will be negative.

This indicator can beused as a short-term instrument, as its performance is constantly fluctuating. It is most commonly used to monitor divergence.

Klinger Volume Oscillator

This tool works on the basis that the fluctuation above and below the zero line can be used to help other trading signals. The Klinger Volume Oscillator sums up the volumes of accumulation (buying) and distribution (selling) over a given period of time. For example, it can display a negative number that is calculated at the height of an overall uptrend followed by a rise above a trigger or zero line. The volume indicator will remain positive throughout the price trend, but falling below the trigger level will immediately display a short-term reversal.

The Bottom Line Volume

Extremely useful tool as there are many ways to use it. There are basic guidelines that can be applied to evaluate the strength or weakness of the market, as well as to check whether the volume confirms the price movement or signals a reversal. Some experts claim that this is the best Forex volume indicator.

Better Volume

Compared to the above, this tool is improved, as it works on the basis of tick volume. Immediately after the launch, the indicator evaluates the current volume, as well as the spread of the candle, by comparing them with previous indicators. The results are displayed as signals showing the spread andvolume. Red lines indicate high volume. As a rule, it appears at the beginning and end of growing trends or during the correction of a downtrend.

White lines indicate high volume, characteristic of a bearish trend (its beginning and end), and also sometimes occurs during an uptrend correction.

Yellow lines indicate low volume and green lines indicate high volume at low spread.

Closing word

Indicators can be used to help a trader make decisions. In short, volume is not an accurate entry and exit tool, but with indicators, entry and exit signals can be captured by looking at price action.

However, the price can suddenly stabilize and therefore Forex volume indicators should generally not be used in isolation. Most of them give more accurate readings when used in conjunction with other signals.

Recommended:

Best support and resistance indicator for MT4

This article will tell you what support and resistance level indicators are, and why it is better to determine them yourself

Volume indicator: description, classification, setting and use

Technical indicators are indispensable tools in trading. A special role is played by instruments showing volumes, for example, the Volume indicator. We will talk about its characteristics, features, varieties, as well as how it can be used in trading and for analyzing the financial market

Good Forex indicators. The best Forex trend indicators

Forex indicator is an important currency market analysis tool that helps traders make optimal trading decisions

ADX indicator. ADX technical indicator and its features

ADX-indicator is a unique trading tool that allows you to determine the strength of a trend. It gives clear signals to traders about the time to enter and exit the market

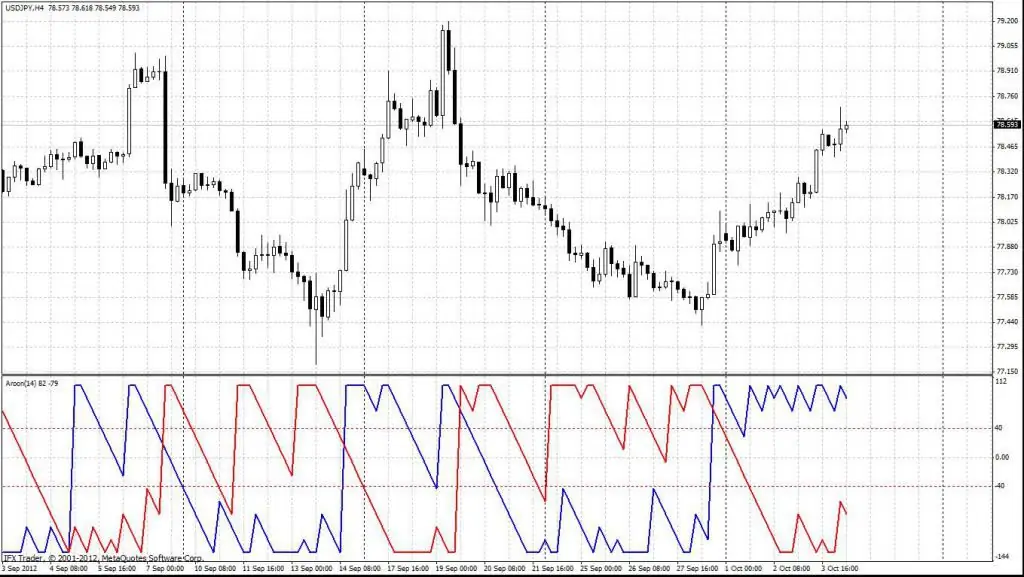

Indicator Aroon: description of the indicator, application in trading

The Aroon indicator is a great tool that every trader should have in their arsenal. It is a visual representation of the market movement that can be easily interpreted to make decisions according to price direction and momentum. You can also significantly increase the chances of a profitable trade if you build a trading technique around Aruna in combination with a breakout strategy or any other based on price movement