2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

Lithuania is among the countries with the most interesting history. No less fascinating is the process of formation of the national currency of this state - litas.

Lithuania: finance and history

Lithuania, as you know, has a very difficult history of its formation and development. In the Middle Ages, the territories of modern Lithuania were part of a powerful state - the Grand Duchy of Lithuania, which then united in a union with another great power - the Commonwe alth. But as a result of the division of this state at the end of the 18th century, the territory of modern Lithuania was ceded to Russia. The ruble has become the official currency in these lands.

During the First World War, the territory of Lithuania was occupied by the Germans. The local monetary system is also changing - the occupying authorities introduced a new currency in the form of the East German ruble. Due to the strongest internal political crisis and war, the Russian Empire in 1917-18 disintegrates. Lithuania gains independence.

In the first years of independent development, this B altic state continues to use the German eastern ruble. Historians have recorded precedents for commodity-money settlements in other currencies. Uncertainty in the sphere of money circulation forced the authorities of the countrygo for reform. Also, the post-war crisis contributed to the introduction of changes in the banking system. The first step in the transformation was the introduction of the German mark (in Lithuanian "auxinas"). It has been used quite successfully in monetary settlements. But soon a period of hyperinflation began in the economy of the young state (by the way, in post-war Germany itself, things were not going very well in the economy, which affected the rate of the mark). It became more and more difficult to carry out calculations under the condition of an ever-rising currency.

How lit appeared and disappeared

The Lithuanian Parliament made a radical decision. The authorities decided that since there is an independent Lithuania, the currency should also have its own. In 1922, the Central Bank of the State appeared, and almost immediately the country introduced its own monetary unit - litas. The situation in the economy has returned to normal.

Deutsmark has been successfully replaced by litas. An interesting fact is that banknotes, in accordance with the issuance policy of the Central Bank of Lithuania, were not printed in the country itself, but in England or Germany. In Lithuania, only coins were issued. In 1939, the B altic state again lost its independence, becoming part of the USSR. The currency of Lithuania has also changed: the B alts had to get used to the ruble and kopecks again.

Lit is back in circulation

After the well-known events of the late 80s - early 90s, Lithuania again becomes a sovereign state and refuses the ruble, as many economists and political scientists considered, at the first opportunity, as if emphasizing the readiness to pursue an independent economic policy. True, as soon as independent Lithuania reappeared on the political arena, the currency of this country was not immediately introduced.

The practical return to the litas was preceded by "general coupons", sometimes called by the people "vagnorks" (they were introduced with the direct participation of the country's Prime Minister Gediminas Vagnoryus). Only in 1993 did the litas return to the money circulation of the B altic state. They began to gradually replace "vagnorks" at the rate of 100 to 1. For some time, "general coupons" and litas were equivalent means of payment in Lithuania.

Banknotes and coins of Lithuania

Lithuanian, which has no analogues in other states, a banknote, but it consists, like a dollar, of 100 cents. Now in cash circulation there are banknotes with a variety of denominations - from 1 to 200 litas. In Lithuanian stores, you can find banknotes of one of two series - those that were issued before 1997, and those that were after. But they are very similar. In 2007, updated banknotes appeared, more protected from counterfeiting.

Lithuanian banknotes depict significant events in Lithuania's history, famous politicians and cultural figures, monuments, architectural structures. The State Mint issues, in addition to standard litas, also commemorative, commemorative samples of national banknotes. Such coins are minted from copper-aluminum alloys, cupronickel, brass combinations of metals, contain precious metals (gold, silver).

The subject of commemorative coins can be different. For example, coins were issued dedicated to a significant event - when John Paul II paid a visit to Lithuania. A series of coins was also minted in honor of the 60th anniversary of the record of the famous Lithuanian pilots Girenas and Darius, who crossed the Atlantic by air.

Lita exchange rate

In the period from June 25, 1993 to the end of January 2002, the exchange rate of the Lithuanian national currency was pegged to the US national currency. Lithuanian litas against the dollar began to be sold at a rate of 4 to 1. Since February 2002, however, the B altic currency was now tied to the single European one. The rate at which the Lithuanian litas was sold against the euro was 3.4528 to 1. This proportion has remained virtually unchanged since then.

Preparation for Lithuania's entry into the Eurozone

In the late 2000s, the financial authorities of Lithuania began to make active attempts to replace the national currency with a single European one. At the same time, it is not easy to get into the zone of action of one of the most powerful world currencies - the euro. It is necessary to comply with the so-called Maastricht criteria, under which the country's budget expenditures should not exceed revenues by more than 3% of annual GDP, and public debt should not exceed 60% of the country's GDP. Inflation in the economy should not be more than 1.5% relative to the average of the three countries in the Eurozone, characterized by the smallest price increase.

Lithuania took decisive steps towards the Eurozone at the beginning of 2014, when the country's financial authorities developed a plan towhich the strategy for joining the Eurozone should be carried out within several levels.

It was assumed that in the spring of 2014, experts from the EU countries that are members of the Eurozone will assess the progress of Lithuania's preparations for the introduction of a single European currency, analyze the readiness of the economy to meet the Maastricht criteria. In the event of a positive assessment from the European partners, the B altic states had the final say, everything depended on what Lithuania itself would say: the currency should still be its own, or you can enter the Eurozone.

Arguments against the Eurozone

Expert opinions regarding the prospects for Lithuania's entry into the Eurozone were different. Some analysts considered that this step was reckless, arguing that there are still crisis phenomena in the European economy. In addition, supporters of this point of view believe that integration within the Eurozone can significantly reduce the economic sovereignty of Lithuania. The example of some states that are now members of the euro zone, but cannot pursue their own monetary policy, confirms, according to analysts, this thesis.

Lithuania, as some experts believed, it would make sense to pay attention to the Czech Republic: it is a country with a post-Soviet past, it is part of the EU, like Lithuania. This Slavic country has its own currency, and the monetary policy is independent - it is conducted by the national Central Bank.

A number of experts questioned the ability of the Lithuanian economy to withstand the Maastricht criteria for inflation. There were theses that the financial authorities might be tempted to artificially lower the figures, althoughLithuanians themselves assured the community that they would not resort to such methods.

Arguments for the Eurozone

At the same time, there were also optimistic assessments of the prospects for Lithuania's entry into the Eurozone. Some economists have expressed the opinion that the state will receive, just the same, more economic sovereignty than now, when the litas is pegged to the euro. In their opinion, after joining the Eurozone, the country will have the opportunity to actively participate in setting the priorities of the financial policy of the European Central Bank.

What did the European partners decide?

In July 2014, the EU Council of Ministers decided to allow Lithuania to join the Eurozone from January 1, 2015. What should the exchange rate be at the time of the transition of the B altic country to the euro? The Lithuanian litas now corresponds to the euro in the proportion of 3.4528 units to 1. And it was decided to fix this rate. Lithuania will thus become the third former Soviet republic in the B altic region, following Estonia and Latvia, to join the eurozone.

Recommended:

The currency of Finland. History, appearance, currency exchange rate

In this article, the reader will get acquainted with the currency of Finland, its history, appearance, and some other characteristics. In addition, you will find out where you can exchange money in Finland

The EU currency is the euro. Course history. Introduction of the currency

The EU currency is the euro. The introduction of the monetary unit. Initial quotes of the new currency and existing national symbols of the EU countries

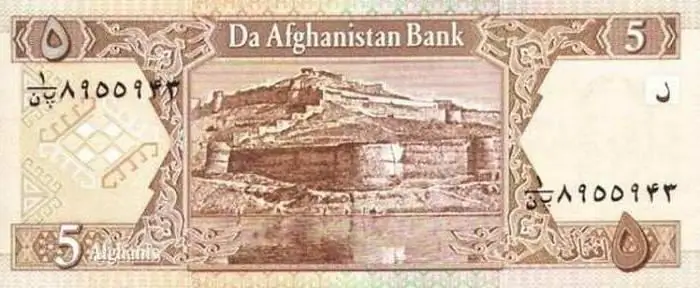

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article

The dual-currency basket in simple words is The rate of the dual-currency basket

The dual-currency basket is a benchmark that the Central Bank uses to set the direction of its policy to maintain the real ruble exchange rate within the necessary limits