2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:30

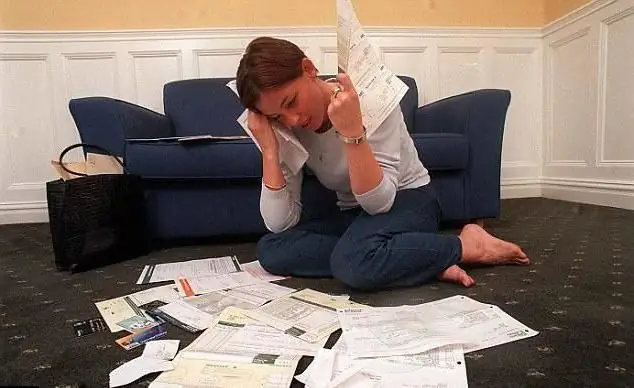

A large number of people think about how to repay the debt. Perhaps there are few people who did not lend money to their acquaintances, friends or relatives, with a subsequent return. At the same time, a tendency was noticed - the closer friends or relatives are, the longer they are in no hurry to repay debts and the more difficult it is to ask the lender to repay the debt. In this case, there is a psychological aspect - you do not want to spoil relations with relatives or friends.

How to repay the debt you have lent? The question is, how did you formalize your relationship with the borrower - did you draw up a loan agreement and when transferring money did the borrower write a receipt or not.

If you still intend to lend money - correctly draw up a receipt, which the borrower must write with his own hand in your presence.

Often, to draw up a receipt, the parties turn to a notary office. In this case, the notary explains that the receipt is not required to be notarized.

The receipt must contain the word "receipt", which has the heading

document, then it is indicated who borrows money from whom and under what conditions. In the data of the borrower and the lenderthe surname, name, patronymic in full, passport data, place of residence and address of registration are indicated. The following indicates the period for which they borrow money and when they undertake to repay. The return date must be specifically specified. At the end of the receipt, a signature is put, a transcript of the signature and, of course, the date of compilation. In the event that the receipt is issued incorrectly, but it is at least somehow executed, it can also be used in court as evidence of a loan, however, the court may have a lot of questions.

Close relatives or friends are given a lot of money on credit without formalizingany documents, under the word of honour. They gave money on credit, the deadlines for repaying the money have already passed, a logical question arises - how to return the debt without a receipt?

Any written documents can serve as evidence in court - preliminary correspondence with the borrower, proof of sending your claim to him and his response to it. Other written evidence can be all documents related to the loan: acts, certificates, business records.

In addition, if a question arises about how to repay a debt, the documents for which you do not have, you can submit the following evidence to the court. Any audio and video recordings can serve as evidence, in this case it is necessary to explain: how, when, under what circumstances and by what technical means the recording was made.

When the question arises of how to repay debts, documents from the police can serve as serious evidence. It's donein the following way. You file a complaint with the police. On your application 100% you will receive a refusal to initiate a criminal case. Your task is to ensure that the employee of the body of inquiry reflects in the explanation that he will take from the debtor that he recognizes the very fact of receiving money from you in debt.

In the future, so that you do not have a question about how to repay the debt, despite any close relationship, document everything.

Recommended:

How to make a person repay a debt: ways and tips

Are you in an awkward situation? Did someone you know borrow money from you and never pay it back? Not only very gullible and soft-hearted persons may face such a situation. You could lend money to a friend, and at the same time did not expect that the person would forget about his promise to pay you back in the week. How to force a person to repay a debt? Read about it below

How to repay a loan early at Sberbank: a description of the procedure and recommendations

Sberbank allows, if desired, to repay the entire amount of the debt or part of it. To carry out the operation, the borrower will need to visit the service office and contact a specialist in lending to the population

Purchase of debt from individuals and legal entities. Buying property with debt

What is buying and selling debt? Features of the purchase of debt under the writ of execution. Cooperation with collectors. Purchase of debt from individuals and legal entities. What to do if you bought an apartment with debts?

Debt sold to collectors: does the bank have the right to do so? What to do if the debt is sold to collectors?

Collectors are a huge problem for many. What to do if the bank has contacted similar companies for debts? Does he have the right to do so? What will be the consequences? What to prepare for?

How to repay a debt if there is no receipt and witnesses: recommendations and practical advice

How often do we take a receipt from those to whom we borrow? Almost never. What to do in the case when the debtor does not want to give back the money, and the amount of debt is not at all small?