2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:33

Today, a huge number of people use the services of this bank. The main advantage of a credit institution is that all operations, including application processing, can be performed via the Internet. This greatly simplifies the procedure for obtaining debit cards. But Tinkoff Bank does not have offices that you can contact if you have any questions. Receipt and deposit of funds is carried out through ATMs of partners of this financial institution.

In this regard, the question arises of how to block a Tinkoff debit card via the Internet, and it is also interesting to know whether it is possible to terminate the credit product. Such a procedure is indeed possible, but you need to consider all its features.

Possible reasons for blocking cards

Many users at least once faced with such a need. With the question of how to block a Tinkoff card via the Internet or telephone, clients of a financial institution are faced withseveral reasons. For example, a similar initiative came from the owner of a banking product due to the fact that the plastic carrier was lost or stolen. In this case, the attacker has not only the personal data of the client. Fraudsters can use the card and even withdraw cash from it.

Sometimes it happens that the user forgot his PIN code and entered it incorrectly three times using the services of an ATM. In this case, the aggregate simply absorbs the map. However, in this case, there is no need to worry. The fact is that if the secret code is entered incorrectly, the card is automatically blocked for 24 hours. During this time, the client, if he himself entered the password incorrectly, must contact the bank.

Bank-initiated blocking

A debit or credit card can also be suspended unilaterally by a financial institution. As a rule, this happens if the bank has suspicions that fraudulent operations are being carried out on plastic.

This can also happen if the user withdraws a large amount or transfers money abroad. If such operations are planned, then you should first contact a bank employee and warn him about your plans. This will prevent unwanted blocking.

But what if the client himself needs to stop the card?

Legal features of voluntary blocking

Before blocking the Tinkoff card via the Internet or withusing a smartphone, you need to clarify a few points. For example, the user has repaid the entire loan or wants to terminate the agreement with the financial institution. In this case, you need to make sure that there are no debts on the card, and all additional (usually paid) services are disabled.

If personal savings remain on the account, then before blocking the Tinkoff card via the Internet or in another way, it is necessary to withdraw them through an ATM or transfer them to another bank. The balance must be zero. If the money remains on the account, then they must be returned to the client at the time of termination of the contractual relationship. Usually they are transferred to a mobile phone or a card from another bank.

Important to know

Some customers forget to turn off the SMS alert option and try to block. It should be noted that this service is provided on a paid basis. According to the standard agreement, full account maintenance is terminated only after 45 days. During this time, a debt may accumulate for an undisabled option, on which interest will gradually begin to increase. Therefore, you need to check several times that all services are disabled before blocking the Tinkoff card via the Internet. After that, you can proceed to the procedure itself.

Locking Methods

There are several options for how to block a Tinkoff card: via the Internet using the card number, by sending SMS or by calling the call center. All these methods are simple and completely eliminate the need to visit a bank branch. Let's take a closer look at them.

Call the call center

You can use the services of the hotline by a single number. After connecting with a specialist, you must tell him the bank card number, your personal data and indicate your intention to suspend the plastic. Additionally, you will need to name a secret word and answer clarifying questions from a specialist.

Via telephone

This way is even easier. In this case, the blocking is done via SMS. To do this, send a short message "Block" to number 2273. You will also need to indicate the last 4 digits of the card number. However, this option is available only to those customers who use the services of the following mobile operators: Megafon, Beeline or MTS. This is the best and fastest method.

But it is worth noting that in this case only temporary blocking is possible. For example, this service is handy if the plastic has been lost. To completely close the account, you need to terminate the contract. You can do this by calling the call center.

Through the user's personal account

This option is suitable for those who are interested in how to block a Tinkoff credit card via the Internet. In this case, it is enough to pass authorization in your personal account of the bank. To do this, just enter the password and login that were generated at the time of registration in the system. If the user does not have these data, then you need to enter the information of the new client. Afterregistration or authorization, the user enters the bank's page. Here you should find the section that is responsible for managing payment instruments. After that, just click "Block" and confirm your intention.

In this case, the card is blocked for no longer than 10 minutes. However, despite this method, which explains how to block a Tinkoff card (via the Internet, by phone number), it is better to make sure that the contract has also been terminated. This nuance should be given special attention.

Features of termination of the contract with the bank

As mentioned earlier, in some cases the card is only temporarily blocked. In order for it to completely cease to operate, you need to properly terminate the contract. After that, the bank manager must issue a statement to the client, which will reflect all the operations that were carried out on the card. If the user ordered plastic, but did not activate it, and therefore did not use credit funds, then an extract is not required.

There are also situations when a client applies for a loan, and then realizes that he no longer needs a loan. In this case, you need to notify the bank as soon as possible about this, until the conditions for daily use of funds come into effect. You need to terminate the contract, otherwise commissions and other interest rates, as well as paid services, may begin to operate.

It is worth noting that the cards of this bank are valid for a very long period of time. Therefore, you should not wait until the blocking comes.automatically upon expiration of the plastic. Better terminate the contract.

How to block a Tinkoff Platinum card via the Internet

This type of bank loan product differs in the method of its suspension. If the debit card is blocked without any consequences, then using a credit card can be difficult. For example, if its validity period is coming to an end, then the client may think that he has already paid off all the debts and does not need to perform any special manipulations to block. But then he receives calls from bank managers who talk about debt. This is not surprising, since the statement was not received.

First of all, you should go to your personal account via the Internet and check the debt on the account. Also on the site page, you can disable all services for which a fee is charged. But even this is not enough. You need to close your account. If we are talking about the Platinum loan product, then the application for blocking is considered for at least 1 month. Bank employees check payments and remaining debts of the client. If they are fixed, then this time is enough for repayment.

In closing

We looked at how to block a Tinkoff card through an Internet bank and in other ways. The procedure should not cause difficulties. Be sure to make sure that after closing the account there will be no debt left on it. Otherwise, interest will begin to accrue on it. This will lead to a rapid increase in debt and sanctions fromside of the financial institution.

Recommended:

How to pay for the Internet through a Sberbank card via the Internet, via phone?

The modern world has long been impossible to imagine without the Internet, it is no longer a luxury, but an indispensable assistant to a person, both in work and in personal life. But the services of an Internet provider are not free, you need to pay for them every month, and this procedure takes time, which a modern person has very little. Sberbank always thinks about the convenience of its customers and makes it possible to pay for the Internet through a Sberbank card

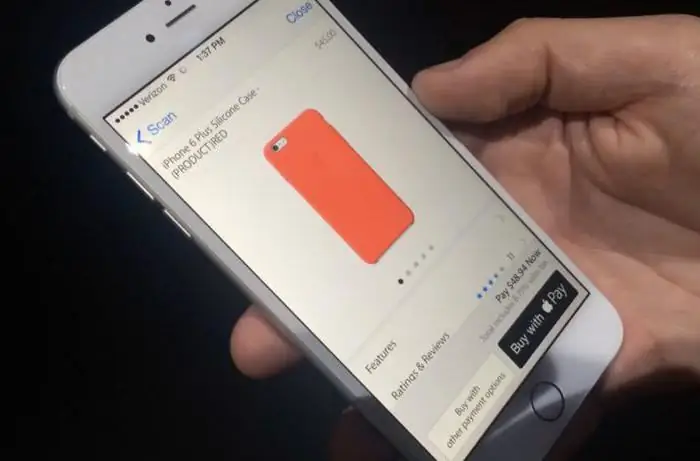

How to pay by phone in a store? Pay for purchases by phone instead of a bank card

Modern technologies do not stand still. They develop so fast that many people simply do not have time to understand them

How to check a Sberbank card: by number, phone, SMS and other ways to check the balance and the number of bonuses on the card

More than 80% of Sberbank customers have plastic cards. It is easy and convenient to use them, besides, they allow you to save time when performing transactions. To always be aware of the amount of funds on a credit card, you need to know how to check a Sberbank card

How to close the Tinkoff card? Is it possible to close a Tinkoff card via the Internet?

A credit card is a convenient financial instrument that allows you to quickly and at any time pay for purchases. One of the most popular cards today are plastic cards of Tinkoff Credit Systems bank. How to get and how to close this card, we will tell in the article

How can I find out my Visa card number? How can I see my Visa credit card number (Russia)?

Currently, payment systems are developing at a fairly fast pace. In this review, we will talk about what the Visa card number hides in itself