2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:36

The tax on the sale of an apartment is paid by the seller from the proceeds from the sale of real estate. The fiscal fee is thirteen percent. Two years ago, the tax was paid on the sale of an apartment that had been owned for less than three years. The tax did not depend on the cadastral value of the object. Since then, there have been very important changes in legislation that affect almost all residents of the country.

The updated version of the law sets different time frames than before for people who can not pay fees, and introduced amendments that determine how much the sale of an apartment is taxed. The most significant change that took place in the field of taxation of funds received from the sale of residential real estate is associated with the replacement of the calculation base from the inventory value to the cadastral value of the immovable property.

The tax rate on the sale of an apartment is not adjusted, it remains thirteen percent. However, the shortest term will changeuse of real estate, in which it is not necessary to pay this fiscal fee. Two years ago, owning a property for a period of three years was enough to avoid paying tax. After the innovations, you must own the property for at least five years, and then the individual will be exempt from paying tax. The entry into force of the new law marked not only legal changes, but also financial ones: the size of the tax increased significantly. We will tell you all about taxes on an apartment and other changes in the legislation below.

The most important innovation

The implementation of the change in question began three years ago. It continues to this day and will continue for a long time to come. There is a problem on the way of 100% establishment of tax calculation based on the cadastral value of real estate, which consists in a significant difference between the inventory and cadastral value of the object. The cadastral price practically does not coincide with the market valuation, it is very high. Inventory value barely reaches a fraction of the property's market value.

The legislature is trying to stop illegal activities in the sale of real estate thanks to this innovation. Speculators and criminals will lose the ability to deliberately reduce the value of real estate, given how much the sale of an apartment is taxed now. When the law was based on inventory value, it was quite possible and easy to do so. Now the circumstances of the sale are different. The amount of the fiscal fee is calculated according tomarket value.

However, the innovation that determines what tax is paid on the sale of an apartment in a property has caused other problems:

- Difficulty selling housing that requires capital investment for repairs.

- Problems of selling when property owners are forced to reduce the value of their property due to any family problems in order to quickly sell it for income.

Full transition to the cost, according to the cadastre, in all regions of the country should take place in two years. Now the process is at an intermediate stage. It is assumed that, simultaneously with its course, legislative structures monitor various obstacles in the application of innovations and take measures to improve them. A lot has already been done in four years of legislative changes. During this time period, many regions were able to switch to the cadastral value of housing regarding what tax is paid on the sale of an apartment. However, many subjects of the country still continue to fully or partially calculate the tax at the cost according to the inventory.

Due to the transition to the cadastral valuation:

- Regulated events related to speculative (illegal) resale of housing.

- The influx of finances into the state treasury is increasing, because the cadastral value of housing is a value almost similar to that which operates on the real estate market. On the one hand, the elimination of all illegal schemes for the sale of housing will have a very positive effect.impact on the overall situation in the country.

- The welfare of the country's citizens is declining, because the owners are forced to pay a large amount of funds to the treasury, which negatively affects their welfare.

The desired tax collection requires a certain discipline from citizens of the country, owners of property

After the sale of residential real estate, residents of the country receive a notification from the tax office with information about what tax on the sale of an apartment in the property is due to be paid. If the notification is not received by the citizen, he needs to independently resolve the issue of obtaining details for payment, since the absence of a letter from the tax office does not relieve the taxpayer from liability for non-payment and fines.

Who pays tax when selling an apartment?

One of the most exciting issues for the citizens of our country has always been the problems associated with the taxation of taxpayers with fiscal fees in favor of the state budget. In order to avoid making economic miscalculations, people want to improve their financial literacy and find out what taxes to pay when selling / buying an apartment. In particular, they are concerned about the tax collection associated with the sale of real estate, which has recently undergone major changes related to the time of ownership, the settlement base and other inputs.

The income (profit) received after the sale of any type of residential property (apartment, house, room) is taxed. The seller always pays the fee. Citizens often ask whattax is taken from the sale of an apartment or any other immovable property? The rate is thirteen percent of the cost. It is worth saying that the fee is not imposed on the total value of the property, but only on the part that has increased over the period of ownership. An example is as follows:

- the cost of buying a home is eight million;

- selling price is ten million;

- object tax - thirteen percent of the difference between the purchase price and the sale amount.

How to reduce tax?

Taxes and expenses when buying and selling real estate can be legally reduced by reducing income by actually incurred expenses:

- The cost of the initial purchase of an apartment. This amount is allowed to reduce the profit from the sale of the object. Expenses must be documented (statements of money transfers made through a commercial bank; receipts of individuals; checks confirming the costs of repairing a residential facility (purchase of building materials, payment for workers' services).

- Costs associated with the construction of housing, buying a house or a share in real estate, land.

- Paying interest on a loan or loan taken to buy real estate or build an object. The amount cannot exceed two million. This type of deduction is given to the taxpayer once in a lifetime.

Where and what tax is paid on the sale of an apartment?

To transfer the fiscal fee, the seller performs the following actions:

- fills out declaration;

- takes her to the tax officeinspection personally or sent by registered mail;

- receives receipt;

- pays the fee at a commercial bank branch.

What tax is charged on the sale of an apartment if the owner is a child? Parents pay for minors.

No tax return:

- When conducting a donation or barter transaction. The recipient does not pay tax. When donating, an apartment is given free of charge, and when exchanging, no one receives cash proceeds, since the exchange is recognized as equivalent.

- When selling an owned apartment for more than the minimum period required by law.

Terms of non-payment of tax

Russian legislation provides for conditions that allow you not to pay tax when selling real estate. They concern the period of ownership of the property until the time of sale and other methods of transfer:

- A real estate seller's earnings are exempt from duty when the home has been owned for at least the minimum statutory period of time. In other words, starting from 2016, when selling an apartment property for more than five years, the fee is not paid to the treasury. In other words, when a citizen has an apartment, house or rooms and has been their legal owner for more than five years and at the same time became its official owner after the establishment of new rules for calculating the fiscal fee for the sale of real estate, then he does not pay income tax from its sale.

- If the property was purchasedby paying dues. What tax will I pay on the sale of an apartment? A very common question of citizens who own shares. In this case, it is possible to avoid paying the fiscal fee after the expiration of the minimum period of ownership from the moment the right of ownership was established. Five years must pass after all registration documents are in the hands of the owner of the residential facility.

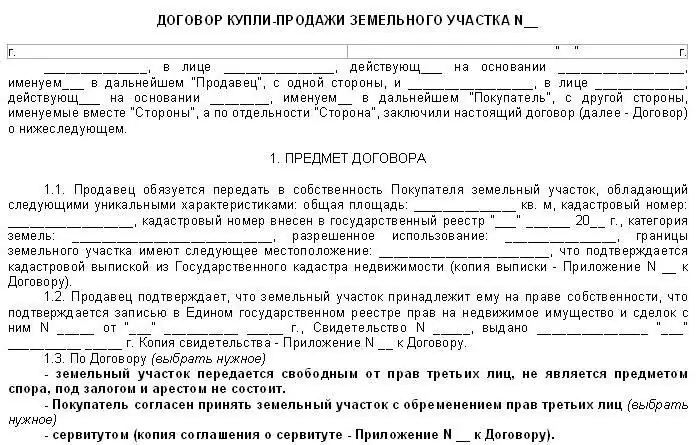

| Number of years | Property acquisition period relative to 2016 | |

| to | after | |

| Three | Tax being paid | |

| Three to five | Fiscal fee exemption | Tax being paid |

| More than five | Exemption from payment of the fee for the sale of real estate | |

Citizen can exercise the right to sell without paying tax due to the limit of the shortest period of ownership of real estate under certain conditions. One of them must be followed:

- Property appeared after privatization.

- The apartment (house) was inherited or received as a gift from a close relative (parents, children, full-blooded brothers and sisters).

- Property delivered by agreement with dependent for life maintenance.

- The minimum duration of a tax exempt property for a seller is five years.

So, the tax on the sale of an apartment is provided for by fiscal legislation. It can be avoided as follows:

- Waittenure of five years.

- Sell property at purchase price.

- Sell an apartment at a cost of not more than one million rubles. Provided that the amount of the sale will be at least seventy percent of the value of the cadastre. Otherwise, the income is equalized with the cadastral value, but with a correction factor. This indicator makes it impossible to avoid paying fiscal fees by significantly underestimating the value of real estate in the document between the seller and the buyer. One million rubles today is deducted from the total amount according to the contract of sale. If a person suddenly sells real estate for a million rubles, then he will not have to pay a fiscal fee to the tax office.

Real Estate

Receiving (accepting) an inheritance is a rather complicated process from a legal point of view, lasting at least six months. Many citizens of our country are interested in the question, what tax on the sale of an apartment by inheritance must be paid to the state treasury? The answer will not please those who hope to sell their inherited property (apartment, house or land) quickly, profitably and without unnecessary financial expenses. When selling a residential property, inherited or donated, it is also subject to income tax. Exemption from payment of tax on proceeds from the sale of real estate will come only after five years of ownership of an apartment or other object. There are a number of other legal restrictions:

- determining the price of an inherited residential property is calculatedfocusing on its value according to the inventory;

- there is a limit to the standard fiscal deduction of one million rubles.

These conditions of sale create problems for people who want to sell their inherited property quickly and easily, saving on the fiscal fee. If the buyer purchases another apartment to replace the existing one, then it is necessary to carefully calculate the profitability of the transaction when the minimum allowed period of ownership has not yet expired, because you will have to pay thirteen percent of the total amount, and not on the difference between the purchase and sale prices. Deciding to sell real estate and move on to buying other property, you can get a significant financial loss.

It is worth remembering that the minimum period of ownership of inherited property starts from the moment the inheritance is opened, that is, from the date of death of the former owner of the property, and not from the moment of acceptance of the inheritance (registration of real estate in state bodies).

In this case, when released, a period of three years is taken. Under the new law, which came into force in 2016, thirteen percent of the sale is charged. Pensioners and disabled people do not pay this fiscal fee. They belong to the preferential category of taxpayers.

Deals between relatives

When conducting transactions between relatives who are close, the buyer (gifted) loses the right to receive a fiscal deduction. Real estate received as a gift from close relatives is legally exempt from tax collection.

Tax deductions from sales

Tax when buying an apartment and tax deduction are described in the RF Tax Code. Citizens of the country who are obliged to pay tax on earned income can claim the right to a deduction when selling a residential property. Receiving a property benefit helps to significantly reduce the base for calculating the fiscal fee, and sometimes save a citizen from paying taxes. Consider:

- how much taxpayers can get when selling real estate;

- what special conditions are provided by law to confirm the right of a citizen to a property deduction.

The deduction can be used by any citizen who sells a property that does not belong to the privileged category of tax-exempt citizens. The conditions for exemption from the fee, from the need to claim the right to a fiscal benefit, changed significantly two years ago:

- For objects purchased before the innovations, the conditions are different. When selling an apartment, the property is less than 3 years old and no tax is paid (there is no need to even file a tax return with the IFTS).

- Three years of own use of a property acquired before legislative innovations give the right not to pay a fiscal fee on income from the sale, if the housing was received free of charge, under a rental agreement or in the process of privatization.

- Five years from the date of registration of the right to an object acquired after changes in the law exempts from paying tax on sales income.

If the property has been owned for less than three or five years, the law requirescalculation and payment of tax on profits from the sale at a rate of thirteen percent. In such financial situations, applying for a fiscal deduction is required, because it allows citizens to receive financial benefits by reducing the fee to zero. Earned income of a citizen from the sale of real estate is taxed according to general rules at a rate of thirteen percent. Income should be understood as the difference between the price of acquiring and selling an object of property, or the price of an object acquired through non-monetary transactions (inheritance, donation, exchange).

If the sale price is less than or equal to the purchase price, the fee is zero. However, tax inspectors can check the validity of the value indicated in the document of sale in order to detect illegal cases of deliberate underestimation of the value. To calculate the truthfulness of the price, an indicator of the value of real estate according to the cadastre is used. If the profit from the sale does not exceed seventy percent of the specified figure, the inspectors will require that the market price be used instead of the contract price.

You can get a deduction when selling an apartment in the year following the date of the sale. To do this, you must submit a declaration and independently calculate the fiscal fee, taking into account the amount of the deduction.

If the property owner sells the property before the deadlines described above, he will need to pay the fee indicated in his declaration. To check compliance with the specified deadlines, the date of registration of purchase and sale transactions is used. The necessary information is contained in the documents on the registration of real estate and the register of rightsfor real estate. If the owner of the property being sold needs to report income to the tax office and pay tax, the specifics of providing a fiscal benefit must be taken into account:

- Eligibility for deduction is voluntary (taxpayer application required). To do this, you need to indicate the right to a benefit in the declaration of earned income.

- The essence of the fiscal benefit is to reduce taxable income by the amount specified in the legislation. This year, real estate sellers are limited to a tax deduction of no more than one million rubles. In addition to selling apartments, the same maximum limit applies to transactions involving rooms, houses and building plots. When asked what tax on the sale of a share in an apartment, the answer is the same: as for rooms, houses, and so on. For a number of other objects, the largest possible deduction amount will be two hundred and fifty thousand rubles. The procedure for applying the fiscal relief in the required amount is as follows. Earned income is reduced by a million rubles, and tax is calculated from the balance. If the price of real estate sold does not exceed a million, submit information to the inspection, you do not need to pay tax. The amount of the property deduction applies to all housing sales transactions made within one year. When selling two or more properties, you can only use the standard deduction of one million once. If it is used for the first transaction, the calculation of the amount of the fiscal fee for the second and next apartment (house) will becarried out without benefits. If the residential property was in shared ownership, each of the equity holders is en titled to a benefit on their own if they sold their share under a separately drawn up contract of sale. The granting of the deduction will be done on a per shareholder basis, i.e. two or more tax returns will be filed.

- Instead of receiving a tax deduction, you can reduce the amount of earned income received from the sale of a real estate object by the proven costs of acquiring or building a property. The taxpayer needs to calculate the most appropriate course of action.

Taxpayer steps

We answered the question about what tax is paid on the sale of an apartment. Next, we describe how to claim the right to deduct. To use the right to a deduction when acquiring real estate and paying tax on the sale of an apartment, what documents are needed:

- It is necessary to submit a declaration to the inspection at the place of registration at the end of the calendar year.

- It is required to prepare supporting documents on the transaction (purchase and sale contract, act of acceptance and transfer of a residential facility, extract from the register of real estate rights).

- Collect documents on receipt of income from the sale of a residential property.

- It is necessary to prepare documents on the costs incurred for the acquisition or construction of a residential property to reduce the fee (document of sale, receipt or order for the transfer of funds, extract from the register, certificate of ownership).

- Provide all of the listed documentsfor inspection by April 30th.

- Not later than the twenty-fifth of July, pay the amount of tax calculated taking into account the deduction.

The amount of money received from the buyer must be equal to the price of the apartment (house) in the contract.

The decisive factor for obtaining a deduction and for calculating what taxes must be paid when selling a home is the correctness of the provision of reporting forms and documents. If there are insurmountable difficulties in calculating the deduction or fiscal fee, it makes sense to consult a financial specialist, seek help from the tax inspectorate. The final package of documents should contain the following reporting forms:

- Tax return.

- Contract of sale, acceptance certificate.

- Confirming documents on the receipt of funds under the contract (statements, payment orders).

- Passport of a citizen of the country.

Unlike a tax deduction when buying a property, declaring income from the sale of property is not related to the return of tax on income of an individual from the budget. In this regard, it is not required to attach account details for the return of paid income from the treasury. How to apply:

- personal inspection visit;

- appeal through a representative;

- sending documents by mail with attachment description;

- filling out the reporting form on the inspection website through a special software resource.

Tax inspectors have the right to conduct a desk audit if they have any doubtsin accordance with the price of the property being sold, its cadastral value. They check how much income tax was actually due on the sale of the apartment.

The seller may be asked for additional documents justifying the calculation of the cost of selling real estate. If the inspectorate has no doubts about the submitted data and the calculated amount of the deduction, then the taxpayer is sent a notification with the required data. It remains for a person to pay to the budget the amount of tax calculated in the tax return, taking into account the deduction provided.

Responsibility for tax evasion

So, understanding what taxes the seller and the buyer pay when buying and selling real estate is very important. For non-payment of the fiscal fee, liability is provided in accordance with civil and criminal legislation. The violation is treated as false testimony and tax evasion. The magnitude and severity of the punishment is weighty.

The offender is threatened with a fine of up to one hundred thousand rubles or restriction (imprisonment) of liberty for up to three years. It does not matter whether the taxpayer understood or did not understand who should pay tax when selling real estate. It is easier and safer to submit a tax return to the inspection and pay the due fiscal amount. If the taxpayer misses the deadline for fulfilling obligations, then pen alties for late payment begin to accrue.

If tax specialists fail to resolve the issue of payment directly with the taxpayer, they will filea lawsuit and will document how much the sale of the apartment is taxed from.

Recommended:

Is it possible to sell a non-privatized apartment? Non-privatized apartment and share in it: features of division and sale

Most citizens living in municipal housing are faced with the question of whether it is possible to sell a non-privatized apartment. They are interested in this in order to improve living conditions. The legislation on this matter says quite specifically that individuals do not have the right to make purchase and sale transactions with apartments that have not been privatized. If earlier a citizen did not exercise his right to such an action, now he has such an opportunity again

What does the “net sale” of an apartment mean: features, conditions and recommendations

Apartment is one of the most popular objects for transactions. Thousands of apartments are bought, sold, mortgaged or rented out every day. Selling your home takes patience. Buyers often ask to lower the price of a property, but the seller is unwilling to do so. Today, real estate agents very often use the term "net sale". Undoubtedly, this concept draws attention to the apartment. From the article you will learn what the net sale of an apartment means

Tax on the sale of an apartment: features, calculation of the amount and requirements

Each person must figure out how to correctly calculate and pay tax on the sale of an apartment. This article explains how to avoid having to list a fee. To do this, the period of ownership, the ability to use the deduction and the need to use the cadastral price of the object for calculation are taken into account

What is the difference between an apartment and an apartment? The difference between an apartment and an apartment

The residential and commercial real estate market is incredibly vast. When offering housing, re altors often refer to an apartment as an apartment. This term becomes a kind of symbol of success, luxury, independence and we alth. But are these concepts the same - an apartment and an apartment? Even the most superficial glance will determine that these are completely different things. Consider how apartments differ from apartments, how significant these differences are, and why these concepts should be clearly distinguished

Tax on the sale of land. Do I have to pay tax on the sale of land?

Today we will be interested in the tax on the sale of land. For many, this topic becomes really important. After all, when receiving this or that income, citizens must make certain payments (interest) to the state treasury. With only a few exceptions. If this is not done, then you can run into many problems