2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:37

The state, in order to support the ongoing demographic policy, has enshrined in the tax legislation a kind of benefit: a tax deduction for personal income tax for children. Why is personal income tax or income tax taken? Because this is precisely the obligation that almost all citizens of the Russian Federation fulfill to the state, with the exception of pensioners - income is not withheld from pensions.

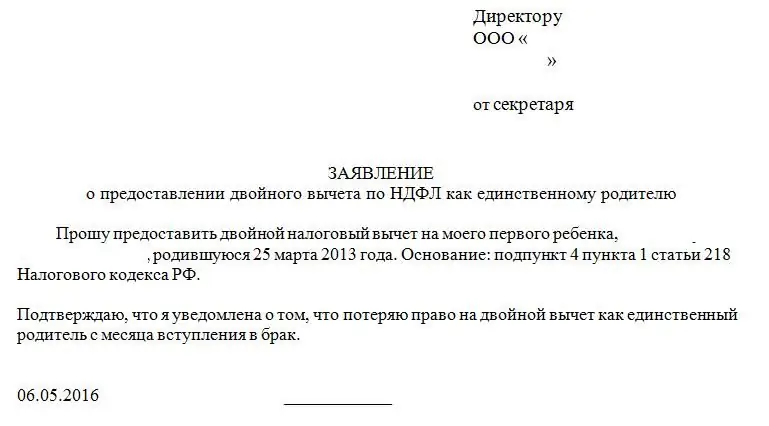

Application for tax deduction for children: sample

Like all other benefits, the provision of tax deductions is carried out exclusively through an application from the applicant. It must be written to the accounting department of the enterprise where the parent is officially employed. The tax deduction is equally granted to both the father and the mother in a single amount established by the tax legislation. If the upbringing of the child is carried out by one parent, then the deduction based on the submitted applicationwill be provided in double size.

Standard sample application for tax deduction for children can be obtained from the accounting department. Otherwise, the application can be made in free form, indicating the following details and personal data:

- name of the enterprise (tax agent) where the parent works;

- surname, name, patronymic of the parent;

- surnames, first names, patronymics of children for whom a tax deduction should be provided;

- age of children;

- for students over 18 years old - the name of the educational institution where the child is studying on a full-time basis;

- date and signature of the applicant.

Attention! Applications for granting a deduction are written annually! There is no deduction for a child over 24, even if they continue to study full-time!

Supporting documents

A parent must attach a package of supporting documents for a tax deduction for children to the application. These will be:

- copy paper birth certificates of all children;

- for students over 18 years of age, the original certificate from the educational institution the child is attending;

- copy of spouse's death certificate (for single parents raising children). Single mothers do not need supporting documents on marital status - information about it is provided to the employer (tax agent) during employment;

- if one of the children has a disability - the original certificate from doctors about herstock.

How much will the benefit be?

Deductions vary:

- for the first and second child - monthly 1,400 rubles per child for each parent;

- for the third and all subsequent children - monthly 3,000 rubles per child for each parent;

- if the child has a disability - 12,000 rubles a month until he turns 18. If he studies full-time, then until the age of 24;

- if a child with a disability is adopted, then monthly at 6,000 rubles.

I would like to note that these tax benefits are provided not only to biological parents, but also to any legal representative: guardian, foster parent, adoptive parent.

In order to determine the amount of the deduction for the second or third child, do not forget that all born and adopted children are taken into account, regardless of age. If the oldest of the three children is already 25 years old, then a deduction for the third child, who, for example, is 16 years old, will be provided in the amount of 3,000 rubles. Therefore, it is important for the applicant to list all children (regardless of age) in the child tax credit application. A sample of such information may not contain.

In closing

So, summing up all of the above, we note the following:

- Tax legislation provides certain benefits for families with children.

- Sample applications for a tax deduction for children can be taken from the accounting department or found on your own inInternet.

- To qualify for the benefit, all children must be listed on the application.

Recommended:

Tax deduction at birth of a child: application, who is en titled to a deduction, how to get

The birth of a child in Russia is an event that is accompanied by a certain amount of paperwork. Parents acquire special rights when replenishing the family. For example, for a tax deduction. How to get it? And how is it expressed? Look for the answer in this article

Tax deduction for mortgage interest. property tax deduction

Today, not every citizen has enough free cash to buy an apartment. Many have to use loans. Targeted loans give the right to claim a tax deduction for mortgage interest, provided that the documents are executed in the territory of the Russian Federation

Property tax on children: should minor children pay property tax?

Tax disputes in Russia are something that brings quite a lot of problems to both the population and the tax authorities. Payments for the property of minors require special attention. Should children pay taxes? Should the population be afraid of non-payment of the specified fee?

Property tax deduction for an apartment. Mortgage apartment: tax deduction

When buying an apartment, a tax deduction is required. It consists of several parts, but is invariably present and amounts to a significant amount. To work correctly with this aspect, you need to study its features

Tax rate for transport tax. How to find the tax rate for the transport tax?

Today we are interested in the tax rate for transport tax. And not only it, but in general taxes that are paid for the fact that you have this or that means of transportation. What are the features here? How to make calculations? What is the due date for paying transport tax?