2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

In 2014, the type of payment orders for transferring funds to the budget changed. In particular, the paragraph “Reason for payment” (106) appeared in the document. Banks no longer control the correctness of filling in all fields. This responsibility rests with taxpayers.

Innovations

Any organization or individual entrepreneur becomes a taxpayer from the moment of state registration and assignment of a TIN. From the same moment, they have an obligation to pay taxes and file declarations with the Federal Tax Service. The following changes are registered in the new procedure for issuing payments:

- The exact number of characters in the lines "60" (TIN) and "103" (KPP) is clearly stated. The TIN of individuals consists of 12 digits, and of legal entities - of 10. The checkpoint consists of 9 characters. Both codes cannot start with "00".

- New requisite UIN can include 20 or 25 characters. KBK - 20 digits, OKTMO - 8 or 11. Moreover, none of the listed codes can contain only "0".

- A new obligatory payment requisite has appeared - "Basis of payment" (106). State duty, fine, pen alty and usualdebt repayments are listed under different codes.

A number of changes have affected the rules for filling in the "Type of payment" field (110). When paying taxes and fees, you do not need to fill in this requisite. But in the BCC, the code of the subtype of income should be reflected. It will be used to identify the payment:

- 2100 - transfer of interest;

- 2200 - payment of interest.

Let's take a closer look at all these changes.

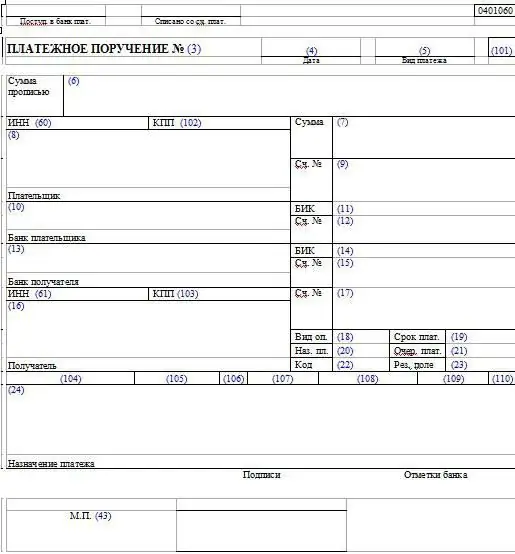

Payment order

This is a settlement document with which the payer transfers funds from his account. This document is used to pay for goods, services, taxes and fees. It is issued on paper or in electronic form, using the "Bankclient" system. The form of the document is approved by Regulation No. 383P "On the rules for conducting the transfer of funds in domestic currency on the territory of the Russian Federation." Information is entered into the payment in an encoded form. This is necessary for quick accounting of payments and automated document flow between all participants in legal relations. Let's take a closer look at the order in which each column is filled in.

Priority

St. 855 of the Civil Code of the Russian Federation provides for 5 sequences of payments. For clarity, we will present the information in the form of a table.

| 1 | Executive documents for harm to human he alth and life; on alimony. |

| 2 | Executive documents for severance pay, wages; contributor fees. |

| 3 | Documents on wages, taxes, fees, transfers to off-budget funds. |

| 4 | Other executive documents. |

| 5 | Other payment documents. |

Required details

In the upper right corner, the same number of the form form is always indicated - 0401060. Next, the serial number of the document is written. It is assigned by the bank, consists of 6 digits. Identification is carried out by the last three digits.

The date is entered in the format DD. MM. YYYY. If the document is sent via Internet banking, the system assigns the required format on its own. If the document is drawn up on paper, then it is important not to confuse the first two indicators.

The type of payment is written in the form of a code approved by the bank. The amount in words is indicated only in paper payments. Separately, the same information is duplicated in numbers. Rubles are separated from small change by a sign (""). If the amount is indicated without kopecks, then you can put the sign "=" (7575=).

In the "Payer" field, the legal entity indicates its abbreviated name. If the payment is sent abroad, then the address of the location is additionally prescribed. Individual entrepreneurs, individuals indicate their full name. (in full) and legal status. In the case of an international payment, the address of the place of residence is additionally indicated. Payment can be made without opening an account. In that case, inthe document prescribes the name of the bank and information about the payer: his full name, TIN, address. The payer's account must be 20 digits long.

The document contains the name of the sender's and recipient's bank, its address, BIC, correspondent account numbers, abbreviated name of the recipient. If the transfer is made through an account opened with another financial institution, then the client's account number is additionally indicated.

In the field "Type of operation" the code of the payment is written, in the "Purpose of payment" - what exactly is the payment for. If we are talking about budgetary payments, then the information from this field should supplement the "Basis of payment" (106). Pen alties and fines are paid with a unique code, while goods and services are paid without it. After filling in all the fields, the seal and signature of the responsible person of the bank are put.

These are standard details that must be present in any payment document. Now consider the additional fields that are filled in when transferring taxes.

OKTMO

The payment order contains the obligatory field "Basis of payment" (106), the decoding of which will be presented below. Also, according to the new rules, it is necessary to indicate OKTMO instead of OKATO. You can find out the code on the website of the territorial department of state statistics or through the FTS service of the same name. To obtain information, you need to select a region, indicate OKATO or municipality. The results may be presented in an abbreviated form. If OKTMO ends with "000", then the first 8 characters will appear as a result of processing. If OKTMO has the form 46534426636 (contains11 characters), then the code will be displayed in full.

Single BCC

Starting from 2014, BCC 39210202010061000160 should be used in payments for the transfer of insurance premiums for compulsory insurance. Payments for the formation of the insurance part of the pension are transferred using this code. The FIU will independently distribute funds on a quarterly basis.

PFR and FSS

In payments to the FIU, the field "101" indicates the value "08". Individual entrepreneurs without employees in this field indicate the status "24". In the line "108" you need to write the SNILS number (only numbers, without dashes). In this case, you must indicate the number assigned during registration of IP. In the lines "106-110" you should put down "0".

Types

Under the new rules, "Type of payment" is not filled. Previously, it indicated ciphers depending on what kind of debt the payer paid off: fine (PE), interest (PC), fine (PC), customs debt (ZD), taxes (0).

Payer status (101)

If the purpose of the funds is identified by the "Reason for payment" (106) attribute (106), the decoding of which will be presented below, then the data in cell "101" determines who makes the transfer. There are 26 payer statuses in total. Consider the most popular (see table below).

| 01 | Jur. face |

| 02 | Agent |

| 06 | Foreign economic activity participant - jur. face |

| 16 | Individual - participant of foreign economic activity |

| 17 | IP - FEA participant |

| 09 | Entrepreneur |

| 10 | Notary |

| 11 | A lawyer who has his own office |

| 12 | Head of the farm |

| 13 | Other physical - bank account holder |

| 14 | Taxpayer making payments to individuals. persons |

| 19 | Organizations transferring payroll deductions |

| 21 | Member of a taxpayer group |

| 24 | An individual transfers money to pay insurance premiums |

You also need to check that the transfer matches the status of the sender.

| Payment | Status |

| NDFL and VAT are paid by the tax agent (organization. IP) | 02 |

| Taxes are paid by the organization (IP) | 01 (09) |

| Insurance premiums are transferred by the enterprise, IP | 08 |

| IP transfers fixed contributions | 24 |

If an individual entrepreneur pays personal income tax from his income, then the transaction should be assigned the status "09". If an entrepreneur pays personal income tax on the income of employees, then he acts as an agent. In this case, the status “02” must be indicated in the payment order.

The status that is indicated when transferring land tax or income tax depends on the CCC. The table of details is presented in the letter of the Ministry of Finance No. 10/800. Before filling out the document, you should check the data with the table in order to avoid errors. If the BCC is incorrect, there will be a tax arrears.

Payments with different statuses are accounted for on different personal accounts. If this requisite is indicated incorrectly, in the internal accounting of the Federal Tax Service the amount will be credited to the account of the debt, which the individual entrepreneur may not have. The tax to which the payment was sent will remain unpaid, even if the requisite “Basis of payment” (106) is registered. Fines and pen alties will be charged on the amount of the resulting arrears. Most often, such situations arise in organizations that are both payers and agents.

Payment basis "106": transcript

Fine, interest and interest on debt can be repaid on time or in arrears. Based on the information provided in this field, you can understand by which document and for what period funds are transferred to the budget. The indicator "Basis of payment" (106) is interconnected with three more lines: period (107), number (108) and date (109) of the document.

Let's consider how to arrange monthly, quarterly andannual fees:

- Basis of payment (106): TP. Decryption: payment according to the current year's bills. In this case, the date of signing the document is indicated in the field "109", and "0" is put in "108".

- Basis of payment (field 106): ZD. Repayment of debts for expired taxes in the absence of a requirement from the Federal Tax Service, that is, at the taxpayer's own request.

- Basis of payment (field 106): BF. This is the current payment of an individual through a bank account.

Judicial Settlement

If the basis of payment (106) "TP" means voluntary repayment of overdue debt, then the following codes are used if the Federal Tax Service has sent a request to repay the debt.

| Base of payment (106) | Period (107) | Number (108) | Date (109) | |

| TR | Paying debts at the request of the Federal Tax Service | The deadline set in the document | Number and date of claim, decision on installment, deferment, restructuring | |

| RS | Paying installments | Date set by installment schedule | ||

| FROM | Paying deferred debt | Deferral maturity date | ||

| RT | Repayment of restructuring debt | Date set by restructuring schedule | ||

If the debt repayment case is referred to the court, how to fill in the payment order (field "106")? The basis for the payment will depend on at what stage of the judicial investigation the debt is repaid.

| Base of payment (106) | Period (107) | |

| PB | Paying debts during bankruptcy proceedings | Date of completion of the procedure |

| OL | Paying a debt suspended for collection | Suspension end date |

| AP | Payment of debt under the act | 0 |

| AR | Payment of debt under an executive document | |

This is how a properly executed payment order should look like (field "106": "Basis of payment"). The document must also indicate the number of the material and the date of the relevant court decision.

How else can a payment order be filled out (“Basis of payment”, 106)? A sample filling can be seen in the table below.

| Payment code | |

| TL | Repayment by the owner of the property of the debtor - enterprise debt during bankruptcy proceedings |

| TT | Paying current debt during bankruptcy proceedings |

If the field "Base of payment" (106)not filled out, Sberbank or another credit institution through which the payment passes, assigns the code "0". This means that the payment cannot be identified.

Tax period

We will separately consider how the requisite “107” is filled in during payments. In all listed transactions, the tax period is reflected as follows:

- transfer of insurance premiums - "0";

- transfer of taxes - 10-digit code of the Federal Tax Service in the format "SS. UU. YYYY".

The first characters of the code will decipher the payment period:

- "MS" - month.

- "KV" - quarter.

- "PL" - half a year.

- "GD" - year.

The fourth and fifth characters after the dot indicate the number of the period. If the tax is paid for January, “01” is entered, if for the second quarter - “02”. The last four characters indicate the year. These three groups are separated by dots. This scheme allows you to quickly decrypt payments. For example, VAT is transferred for February 2016, then in the requisite "107" you need to write "MS.01.2015". If there are several terms for the annual fee, and separate payment dates are set for each, then these dates are indicated in the period.

If funds are transferred not for the full reporting period, but only for a few days, then the first two characters will look like "D1" (2, 3). Depending on which figure is indicated, the tax is transferred for the 1st, 2nd or 3rd decade. If payment is made at the request of the Federal Tax Service, then a clear date of the act must be indicated. Specificthe period must also be indicated in the payment document if an error was found in the previously submitted declaration, and the taxpayer tries to independently charge the fee for the expired period. In this case, in the fourth and fifth characters, you must indicate for which specific period the additional fee is charged.

Details for payment of customs duties

The field "107" indicates the customs code, and "108" - the status of the payer. Let's look at the table again.

| Reason Code | Date | |

| DE | Declaration for goods | Declarations |

| CT | Cost Adjustment | |

| software | Incoming order | Customs warrant |

| ID (IP) | Executive document | Executive document |

| TU | Demanding payments | Requirements |

| DB | Documents of economic activities of customs authorities | Customs documents |

| IN | Collection document | Collections |

| KP | Agreement on interaction when making payments by a large payer | Engagement Agreements |

When carrying out other transactions, "0" is indicated in the "Basis of payment" field (106).

Individual data identifier (108)

Depending on which document was provided to identify the payer, this requisite is filled in. For example, if a citizen provided a passport with the number 4311124366, the field "108" indicates: "01; 4311124366". The table below shows the main identifiers:

| 1 | Russian Passport |

| 2 | Certificate from the registry office, an executive body of birth |

| 3 (4) | Identity card of a sailor (serviceman) |

| 5 | Military ID |

| 6 | Temporary Russian identity card |

| 7 | Certificate of release from prison |

| 8 | Alien passport |

| 9 | Residence permit |

| 10 | Residence permit |

| 11 | Refugee document |

| 12 | Migration card |

| 13 | USSR passport |

| 14 | SNILS |

| 22 | Identitydriver |

| 24 | Certificate of vehicle registration |

Document date (109)

Current payments indicate the date of signing the declaration by the representative of the Federal Tax Service. In case of debt repayment without notification, “0” is put down in this field. If payment is made at the request of the Federal Tax Service, then the date of the act or receipt should be indicated.

If there is a payment of deferred, restructured, suspended debt, carried out based on the results of inspections, according to executive documents, information is entered in this field depending on the decision made:

- installment plan - RS;

- delay - OS;

- restructuring - RT;

- suspension of collection - OL;

- check act - AP;

- decision of the arbitral tribunal on the introduction of external control - VU;

- initiation of enforcement proceedings - AR.

Refund

In order to avoid situations when tax arrears arise, you need to submit an application to the Federal Tax Service to clarify the payment. A copy of the payment must be attached to the document. If the status is incorrect, the funds will still go to the budget and to the correct current account. But at the Federal Tax Service, this amount will reflect the repayment of another tax. Only on the basis of an application can it be transferred to pay off real debt.

Before the redistribution of funds, the Federal Tax Service will reconcile the calculations of enterprises with the budget. If a positive decision is made, then the inspectorate will cancel the accrued pen alties. About accepteddecision of the taxpayer will be informed within 5 days. You can do otherwise:

- transfer the tax again using the correct details in the payment order;

- then refund the overpaid tax.

In this case, the company will only avoid the accrual of fines. The pen alty still has to be paid. Consider a sample application.

STATEMENT

about a mistake

g. Irkutsk 2016-16-07

In accordance with paragraph 7 of Art. 45 NK JSC "Organization" asks to clarify the payment. In the requisite "101" of the receipt dated July 16, 2016 No. 416 for the transfer of VAT (specify BCC) in the amount of 6000 (six thousand) rubles, the status "01" was incorrectly indicated. The correct status is "02". This error resulted in non-transfer of tax to the budget of the Russian Federation to the account of the Treasury. Please clarify the payment and recalculate the pen alties.

WIN

"Unique accrual identifier" includes 23 characters. This field is just as important as the Basis for Tax Payment (106). The UIN is written in the field "22" and in the "Purpose of payment". Example: "UIN13246587091324658709/// Payment of a fine …".

There are situations when there is no UIN. For example, when transferring taxes calculated by legal entities and individual entrepreneurs independently on the basis of declarations, the payment identifier is the CCC, which is indicated in the requisite "104". UIN, according to the new rules, is not formed in such cases.

Individuals who pay taxes on notification from the Federal Tax Service receive a notification in the form of "PD". The document is filled in by the Federal Tax Service using softwareequipment automatically. UIN is immediately formed in it. This code must be indicated in the payment order.

If the payer wants to transfer tax to the budget without notifying the Federal Tax Service and a completed notice, then he forms the document on his own. This can be done through the electronic service on the website of the Federal Tax Service. UIN in the receipt will be assigned automatically.

Taxes can be paid through the bank's cash desk. In this case, the notice "PD4sb" is filled out. If the operation is carried out through Sberbank, then the UIN is not indicated. In this case, the full name must be written in the document. payer and address of his place of residence.

Filling out payments by third parties

NK provides for the possibility of payment of fees by third parties. Separate rules have been developed for such situations. The document indicates the full name. and TIN of the person whose obligation to pay the fee is being fulfilled. In the requisite “Purpose of payment”, the TIN and KPP of the contractor and full name are indicated. payer. The latter is separated from the main text by the sign "". The status of the person whose obligation to pay the tax is being fulfilled is also indicated.

Conclusion

The correctness of filling out the payment order depends on the type of operation and the recipient of funds. When paying taxes, a number of details are additionally filled in: from the organization code to the status of the payer. If the field "Reason for payment" (106) is not filled in, then the Federal Tax Service will independently attribute the payment to one of the categories based on the results of the quarterly report. UIN is registered only in budgetary payments. If athe current account number is incorrectly specified, the document will not be posted at all.

Recommended:

Commodity matrix: definition, rules of formation, basis for filling with examples, necessary programs and ease of use

The art of forming a commodity matrix, the rules and the basis for its filling. What is the drogerie product matrix, how to manage the product matrix of stores of other formats. Analysis of turnover using a commodity matrix. Product groups and product matrix samples

Payment of contributions for major repairs: calculation of the amount, payment rules, terms and benefits

Paying maintenance fees is the responsibility of every apartment owner in an apartment building. The article describes how the fee is set, what benefits are offered to different categories of the population, and what are the consequences of not paying

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

Samples of filling out a consignment note. Rules for filling out a consignment note

In order for the company's activities to fully comply with the requirements of the law, when filling out the documents, you must follow the established instructions. This article discusses samples of filling out a consignment note and other accompanying documents, their purpose, structure and meaning in the activities of organizations

Samples of filling out payment orders. Payment order: sample

Most enterprises pay various taxes and fees to the budget. Most often this is done with the help of payment orders. How to compose them correctly?