2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:30

We all know that in order to feel financially comfortable, first of all, you need to try not to spend less, but to earn more. However, everyone's life develops differently: different society, initially different opportunities for earning, so it is important not only to be able to "make" money, but also to handle it wisely. So how do you save money the right way?

Food

If for an average European citizen the normal monthly cost of food is 8-12%, then for domestic citizens it can sometimes reach 40-50%. Often it is the cost item that does not allow you to update your wardrobe, purchase the necessary equipment or relax with your family. The cost of buying food will not be so burdensome for the family budget if you follow simple rules. So, for example, buy only the products you need - for this, before going to the store, you can make an appropriate list. It is better to buy products at wholesale bases or markets, do not forget about discounts and discounts in the evening hours in some stores.

Transportation

There are many ways to save on transport. If you use public transport, it makes sense to purchase a monthly pass. Short distances are even better to walk - both useful and economically profitable. If you have a personal car, then here the main funds are spent, of course, on its refueling. How to save fuel? Very simple. Turn off the engine in a traffic jam - and the air will be cleaner, and save extra liters of fuel. But on the quality of what the car refuels, you should not save. The possible damage from using low-quality fuel can significantly exceed the savings.

Utilities

Next, a little about how to save electricity and other resources for which utilities issue monthly bills. Firstly, install meters in your house (apartment) - this is much cheaper than a monthly subscription fee. In addition, this way you can control the consumption of resources yourself. With regard to electricity specifically, then, first of all, switch to the use of energy-saving light bulbs. Yes, they are a little more expensive than usual, but the term is many times longer. It will not be superfluous to refuse an electric kettle. If an electric stove is installed in the house, then, on the contrary, it is advisable to purchase an electric kettle.

Clothes

Everyone knows about sales in clothing and footwear stores. Information on how to save money and buy clothes at a discount often appears in groups on social networks, etc. It is also a mistake to think that clothes in second-hand stores are necessarily low-grade. Very often in such places you can buy branded items for almost nothing, which are sold after being seized at customs.

Cigarettes and liquor

Looking for another opportunity to save money? Perhaps the answer is literally right under your nose. It is easy to calculate how much bad habits cost each month. By giving up bad habits, you will save this amount every month, not to mention the huge he alth benefits.

Success in your endeavors.

Recommended:

Golden rules of money. How to earn, save and increase money

The current economic situation can be called unstable. Most people sooner or later begin to think about how to save money with a small salary. Indeed, in addition to mandatory expenses, a person wants to create a financial cushion for himself, entertainment is also needed. There is a lot of information presented as the "rules of money", or rather, their receipt, preservation and increase. And often these rules contradict each other. But some of them are worth paying attention to

How to save money with a small salary? How to save correctly?

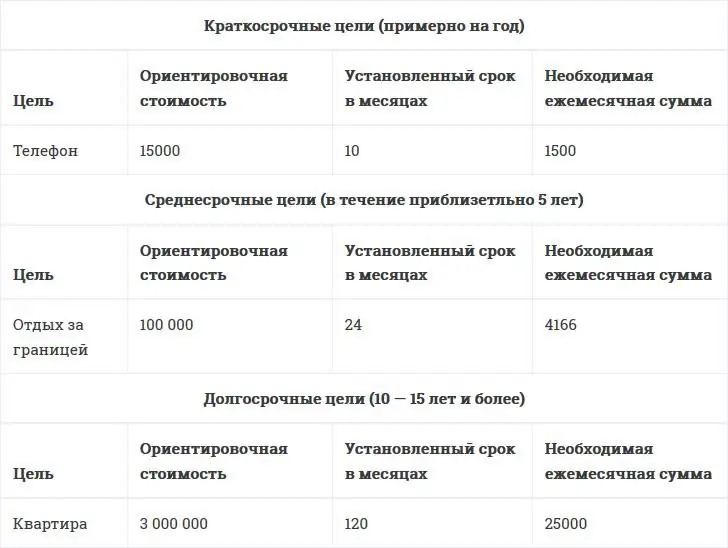

In addition to monthly expenses for utility bills, groceries and other expenses, I want to save up money for a long-awaited vacation, buying real estate or educating children. Unfortunately, not everyone succeeds, and some are so obsessed with savings that they cross the line on the path to outright stinginess. So how to save money with a small salary, while not infringing on the little things?

How to save money fast at 12? Real money options for teenagers

Modern teenagers are often looking for places to earn extra money. This article will talk about how you can earn income at 12 years old

How to plan a home budget and manage money wisely?

Understand how much money we really earn every month and how much we spend, everyone wants. How to plan a home budget and always have funds for the necessary expenses? Is it possible to learn how to save without denying yourself what you need?

Deposit "Save" (Sberbank): interest and conditions. What is the interest rate of the "Save" pension deposit in Sberbank of Russia?

Deposit "Save" is one of the most profitable deposit programs of Sberbank. There are higher interest rates for pensioners. Flexible partnership terms available