2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

A loan is the money provided by the bank to an individual or legal entity for a specific period. The transaction is confirmed by an agreement under which the borrower must repay the debt. For many, a loan is the only way to get a large sum. Entrepreneurs also need funds to start or grow their own business.

Business lending is a convenient service for purchasing equipment and raw materials. Getting money is not as easy as it might seem. To complete a deal, you need to familiarize yourself with all the features. After all, when starting your own business, it is important to be sure of getting a positive result.

Banking products

Business lending is supported by the state. Credit institutions are issued quotas and instructions to provide money to organizations. If the company exists for more than six months, then there is the possibility of obtaining funds for development.

The more an enterprise works, the more likely it is to open a credit line and expand a commercial niche. It is almost impossible to do this on your own and not lose capital. To do everythingright, entrepreneurs turn to the bank, where there are financial products for all areas of activity.

Receive funds for small and medium businesses

With the development of your own business, you need money, so lending to small and medium-sized businesses is a necessary service. Money issued by the bank is used to improve the turnover and investment of the firm:

- acquisition and repair of equipment;

- improving turnover;

- opening a new field of activity.

Not all start-up businessmen use personal money, so they use borrowed funds. These are small amounts and do not require a report. If an entrepreneur takes a loan from a bank, he becomes his regular client. The possibility of a significant increase in profits gives business lending. Banks offer customers a variety of products with similarities and differences.

Urgent loan

For entrepreneurs, this is considered the most convenient service. The funds are transferred to the settlement account of the organization, which has the obligation to return the funds with interest within the prescribed period. Typically, banks do not need confirmation of the intended use of money, but require collateral or guarantors.

Business lending allows you to purchase the necessary equipment, transport, and improve turnover in a short time. As collateral provided:

- real estate;

- transport;

- equipment;

- product.

While the contract is concluded, the organization has the opportunity to change the collateral, but only with the consent of the bank. If the loan is taken for a long period, then it will turn out to take money for a large amount. And with a short term, there is an opportunity to save on interest.

Special conditions

Business lending has some peculiarities. Funds are issued in rubles, dollars and euros. The rate is determined by the amount, term and currency. For regular customers, banks reduce rates. Special conditions include:

- some organizations have a seasonal nature of work, so banks provide individual payment schedules for them;

- some entrepreneurs do not have property, and then banks require guarantors.

The decision to issue a loan is sometimes made by analysts based on a business plan. If he is a worker, then a positive response is given to the provision of money.

Credit line

Lending to medium-sized businesses is carried out using collateral. The bank determines the period of the loan, after which the company's account receives funds, but not in full, but as needed. Interest is charged only on spending. This type of lending is convenient for purchasing small quantities of goods.

The credit line has 2 parameters:

- withdrawal limit: the amount of funds during the life of the line, but some banks start interest on unused money;

- debt limit: the client is provided with a limitedthe amount above which money is not issued.

Benefits of a business line of credit:

- fast settlement;

- limit increase;

- use of funds for a long time;

- Pay interest only on funds used.

Overdraft

Lending to medium-sized businesses can be carried out using an overdraft. This service is available with a current account, and no collateral is required for this. Funds are provided on fairly favorable terms. The bank analyzes the movement of money in the account. As a result, the amount is set, which will be issued to the client if necessary. When the account is replenished with new funds, they are debt closed.

Funds work

There is a small business lending assistance fund, which greatly facilitates the situation of entrepreneurs. The organization acts as a guarantor, helping borrowers get a loan. Small business lending is facilitated through cooperation between funds and banks.

A businessman needs to apply for a loan, indicating that he has a desire to receive support from a government organization. The bank reviews the situation, taking into account the necessary details. After that, an agreement is drawn up, an application for a guarantee is sent to the fund. There is a signing of the document from three parties. The Small Business Loan Fund may charge a small percentage.

What do you need to know when contacting a bank?

It should be borne in mind that such a loan is issued at high interest rates. Therefore, you should contact the bank only if necessary. If you still need funds, then you need to draw up a contract carefully. In order for the decision to be positive, it is required to draw up a business plan in advance. It shows what money is needed for and how profit will be accrued.

The reputation of a businessman is important. You need to provide accounting documentation, which will increase the chance of receiving money. It must be completed correctly so as not to be rejected. Medium business inspires more confidence in the bank. Company funds, goods, property can serve as collateral.

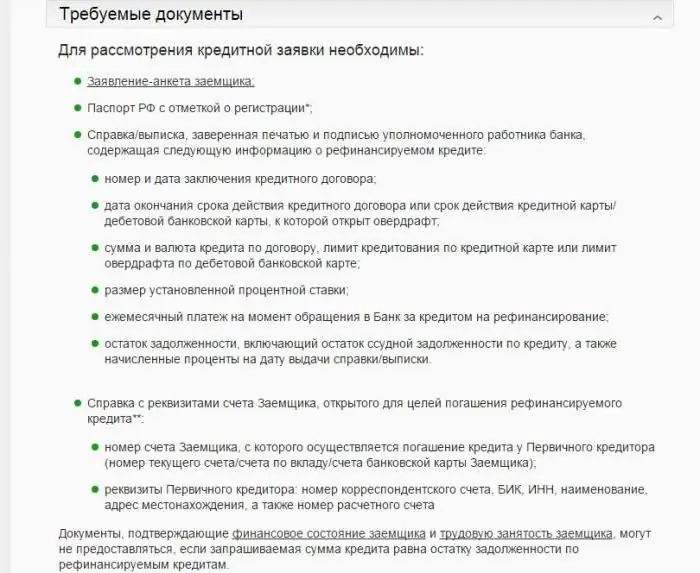

What documents are required?

Opening an account for legal entities is carried out on the basis of the documents provided:

- statement;

- copy of activity charter;

- copy of balance sheet;

- copy of memorandum of association;

- copy of license.

All originals must be certified by the leaders, and copies - by a notary. Other documents may also be required.

Evaluation of the borrower

There are 2 types of borrower assessment: objective and subjective. The first takes into account financial statements, and the second - the following aspects:

- control level;

- state of the industry;

- market situation;

- financial reports.

There are many risks with business lending. The bank has never worked with some organizations, which makes it distrustful. Every year the number of enterprises that usefinancial services.

Where to go?

For businesses, loans are issued by VTB 24. This banking product is called Kommersant. Businessmen have the opportunity to receive up to 1 million rubles for a period of 6 months to 5 years. The overpayment is charged in the amount of 21-29% and is determined by the maturity of the debt. VTB 24 offers businessmen the following services:

- "Overdraft" - the overpayment is 11%, the term is 1 year.

- "Revolving loan" - issued at 10.9%, period - 2 years.

- "Investment loan" - the rate is 11, 1%, term - 84 months.

Alfa-Bank also has these programs. The smallest amount is 3 million rubles, and the maximum is 5 million. The repayment period can be from 6 months to 3 years. Alfa-Bank issues cards to business owners with a limit of 500,000 rubles. UniCredit Bank provides funds for the improvement of small and medium-sized businesses. The amounts range from 500 thousand rubles to 25 million. Debt repayment time - from 6 months to 2 years. UralSib Bank issues loans to businessmen from 300 thousand rubles to 10 million. The repayment period is 1 year. You can contact Promsvyazbank, where customers are issued from 5 million rubles for 10 years. Here you need to pay a down payment of 20-40%. OTP-Bank has the most advantageous offer. The rate is 9.5%. You can take a maximum of 40 million rubles. Sberbank of Russia also provides business loans. Entrepreneurs can count on up to 200 million rubles. And the rate is 13.26%.

To take advantage of a profitable option, it is advisable to familiarize yourself with several offers, and then choose the most suitable one. It is best to apply to several banks to increase the chances of receiving funds. If there are several approvals, then there is a choice. To date, lending is developing quite successfully. Almost every organization can use the funds. If you repay debts in a timely manner, then banks provide more favorable conditions for their customers.

Recommended:

How to refuse business trips: business trip conditions, payment, legal methods and reasons for refusal, advice and recommendations from lawyers

When assigning business trips, the employer must comply with the legal framework, creating favorable conditions for workers to travel. The employee, in turn, must understand that cunning and deceit are punishable, and it is better to perform their professional duties in good faith. It is important to understand that if an employee refuses to sign a notice of assignment on a business trip, then this will be a disciplinary violation

On-lending at VTB 24: features of the procedure, documents and reviews

Looking optimistically into the future, the borrower seems to be able to handle a long-term loan. But sometimes unforeseen circumstances arise, due to which it is not possible to repay the debt. The solution to this problem is refinancing. VTB 24, like other banks, has a loan refinancing program. In the article we will consider its conditions in detail

On-lending consumer loans. On-lending consumer loans with arrears

Unfortunately, there are often situations when, having issued a mortgage or other loan for consumer purposes, the client after some time realizes that he cannot cope with his obligations. There can be several ways out of this situation - from trying to arrange credit holidays to selling collateral. But there is another way out of the situation, perhaps the least painful - this is the on-lending of consumer loans (it is also refinancing)

Types of mortgage lending. Mortgage Lending Programs

Mortgage lending is now very common. Many people see this as almost the only hope for acquiring their own housing. There are many types of mortgage lending, each of which has its own characteristics

On-lending in Sberbank loan, car loan: reviews. Is it possible to make on-lending at Sberbank?

Refinancing at Sberbank is a great opportunity to get rid of an "expensive" loan. What are the programs for on-lending at Sberbank today? Who can borrow and under what conditions? Read more about it