2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

By Order No. ММВ - 7/11/450, on October 14, 2015, the Federal Tax Service of Russia approved the reporting form: calculation of personal income tax in the form 6personal income tax, which was calculated and withheld from individuals in the reporting period. The declaration according to the approved form is required to be completed and submitted to the IFTS for all tax agents (companies, organizations, enterprises and individual entrepreneurs).

Report on form 6-NDFL: delivery regulations, structure

The 6NDFL report is submitted to the tax office quarterly. The deadline for submission is the last day of the month following the reporting month. If this date falls on a holiday, Saturday or Sunday, then the valid date for submitting the report is the next business day after the weekend or holiday.

In 2017, the calculation of the report must be submitted to the tax authority no later than:

- April 3rd, 2017 (annual calculation for 2016),

- May 2, 2017 (quarterly report for three months of 2017),

- July 31, 2017 (Semi-Annual Report 2017),

- 31st October 2017 (Nine Months Report 2017).

Report for 2017 must be submitted no later than April 2, 2018year.

Violation of reporting deadlines leads to sanctions from the tax authorities. A tax agent is punished with a fine of one thousand rubles for each overdue month, even if the delay was only one day.

Pen alties are provided for incorrect registration and errors in the calculation of 6 personal income tax. For inaccuracies discovered by the tax authorities, you will have to pay a fine of five hundred rubles.

This report provides information not on a specific individual, but in general on the accrued and transferred income tax for all individuals who received income in the organization.

The calculation of accrued and withheld amounts in the 6NDFL report has the following composition:

- basic information about the withholding agent: title page

- Total Estimates: Section 1

- details: section 2

It is important to know the rules for the formation of section 1, how to fill out section 2 of the 6 personal income tax report, title.

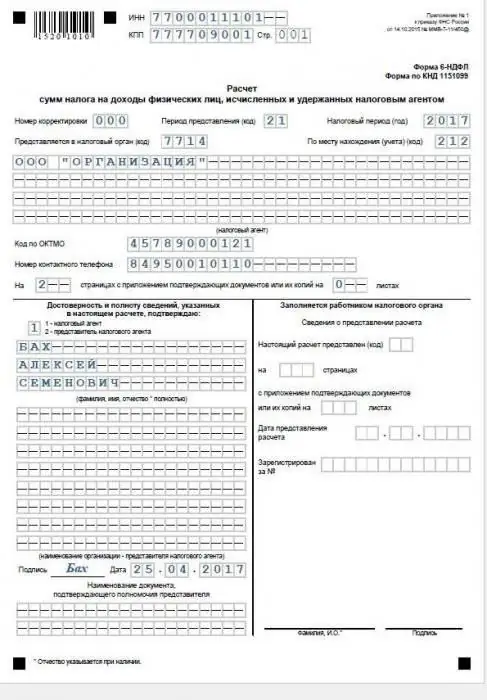

6NDFL report: title

On the first (title) page are indicated:

- registration data of the tax agent (name with decryption, OKTMO code, TIN, KPP, contact phone number);

- information about the submitted report (name of the form, KND code, provision code and year of the tax period);

- data on the tax authority (IFTS code).

The title page is certified by the head or his representative.

An example of filling out sheet No. 1 (title) is given below.

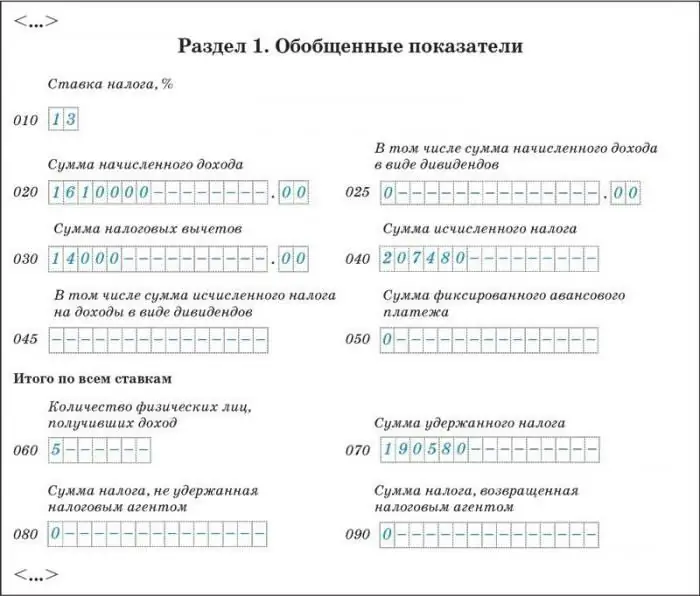

Form 6 personal income tax: totals

General indicators for calculating and withholding personal income tax in the reporting period are indicated in the first section.

Section 1 is prescribed for each rate at which income tax was calculated. Typically, the company applies a rate of 13 percent.

Separately, for each rate, the first section shows data for the reporting quarter, calculated on an accrual basis for the entire tax period:

- total amount of calculated income (together with dividends) and separately the amount of dividends;

- applied tax deductions (total amount);

- the amount of calculated, withheld, not withheld, returned income tax by the employer;

- number of employees (individuals who received taxable income).

Attention: as a rule, the amount of income tax calculated is not equal to the amount withheld. The actual withholding of income tax is made at the payment of the final monthly settlement and often falls on the month of the next reporting period.

A sample of filling in section 1 of the report 6 of the personal income tax is given below.

The values of the indicators of the first section depend on how to fill out section 2 of section 6 of personal income tax.

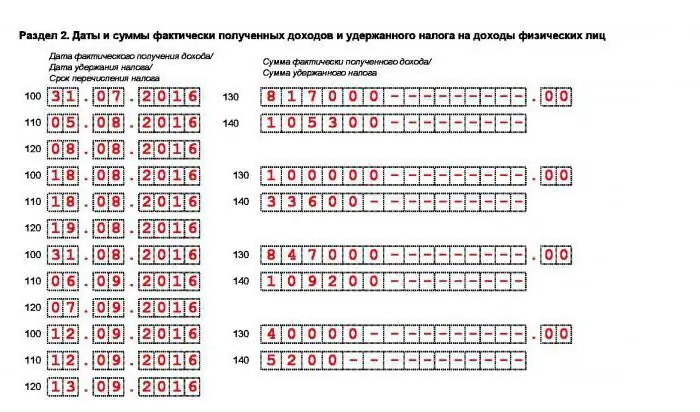

Second section 6 personal income tax: basic details

2 section 6 personal income tax - information table. It indicates in chronological order:

- all income accrual transactions that were paid in the reporting period (during the quarter) with the obligatory indication of the date of accrual;

- amount of income tax withheldfrom each paid income, indicating the date of deduction;

- actual date of transfer of income tax to the IFTS.

Information on each income received in the second section of the form is indicated in blocks:

- date and amount of income actually received by employees - gr. 100 and gr. 130 respectively;

- date and amount of tax withheld (from the amount specified in column 130) - gr. 110 and gr. 140 respectively;

- deadline for transferring income tax to the budget (for this type of income) - gr. 120.

Next, the block is repeated as many times as there were withholdings of income tax.

2 section 6 of personal income tax (sample filling in accounting) is presented below.

Basic rules for filling out the second section of 6NDFL

Some general tips on how to fill out section 2 of the 6 personal income tax declaration are given below.

Cash rewards paid in the reporting quarter, but not subject to income tax, are not shown in the report.

In the form of 6NDFL, the amount of income before tax is entered, that is, it is not reduced by the amount of income tax.

The information provided in the second section of the form does not match the information in the first section. Since the first section provides the growing results of the entire tax period, including the reporting quarter, and the second - the data of the reporting quarter only.

If on the same day incomes were received that have different deadlines for paying personal income tax to the budgetpersons, then in the form they are indicated in different lines.

Line 120 indicates the deadlines for transferring income tax established by the Tax Code of the Russian Federation. If the tax is transferred before the deadline, in gr. 120 reflects not the actual date of payment, but the maximum allowable NC.

Especially you need to be careful in a situation where the payment of income and the transfer of tax were actually made on the last day of the quarter. The date of payment of tax to the budget must be indicated in accordance with the Tax Code, and this will already be the date of the next reporting period. Therefore, the transaction should be recorded in the next quarter.

If the income at the enterprise was paid only in one quarter or once a year, then the report is submitted for the quarter in which the income was paid, and without fail in subsequent quarters of the current year.

And in such a situation, how to fill out section 2 of form 6 of the personal income tax - income was paid only in the second quarter? For the first quarter, the report can not be submitted (since it is with zero indicators), the report for the second, third and fourth quarters must be submitted. In this case, only the first section is filled in the report for the third and fourth quarter.

How to fill in 6 personal income tax: lines 100-120

Information in lines 100-120 depends on the type of charge.

A table that allows you to determine how to correctly fill out section 2 of section 6 of personal income tax is given below.

| Type of income |

Date fact. payout income p. 100 |

Date held. income tax p. 110 |

Deadline for payment of withholding tax to the budget p. 120 |

| Salary, bonuses and bonuses |

Last. day of the month acc. payroll |

Payday |

Next day after day enum. or payout at the payroll |

|

Vacation, payment sheets unemployed. |

Holiday Pay Day and pay slips are easy abilities |

Vacation Pay Day, and pay slips disability |

Last. day of month payout vacation and sheets unemployed. |

|

Final settlement when leaving employee |

Layoff Day |

Payment end date calculation upon dismissal. |

Next day for happy payout final settlement |

|

Income in kind. shape |

Income Transfer Day in kind. form |

Close payment day other income |

Next day for happy payout income |

| Dais over limit | Last. day of month, to the cat. advance report issued |

Nearest. payment day other income |

Next day for happy payout income |

|

Material benefit from economy on % |

Last calendar. day of the month on which the contract is valid |

Next issue day other income |

Next day for afternoon distribution of income |

| Ex. non-wage income | Day received income, reward. | Day received income, reward. |

Day after income earning, reward. |

|

Reward. by service agreement contractor |

Day of enumeration to personal account or cash advance rewards contractor |

Day of transfer or cash advance reward. |

Next to payout reward day |

Compilation of the second section of 6NDFL: data for the report

How to fill out section 2 6 personal income tax? The calculation is presented according to the initial data of Lampochka LLC.

In the fourth quarter. In 2016, 14 individuals received income at the enterprise:

- twelve people working under labor contracts;

- one founder of LLC (not an employee of Lampochka LLC);

- one designer working in an LLC under a civil law contract for the provision of services.

The company employs people who have the right tostandard income tax deductions.

Two staff members received standard child allowance during 2016:

- Petrovoi N. I. - within 10 months from the beginning of the year for 1 child 1400 rubles x 10 months=14,000 rubles

- Morozov E. N. - within 3 months from the beginning of the year for three children - ((1400 x 2) + 3000) x 3 months.=17,400 rubles

- One employee during 2016 was provided with a standard deduction as a disabled person: Sidorov A. V. - for 12 months from the beginning of the year, the deduction amounted to 500 x 12 months.=6000 rubles.

To easily fill out section 2 of the calculation of 6 personal income tax for the fourth quarter. 2016, we will use the following auxiliary table. It reflects the amounts of payments, tax deductions, accrued and paid tax in the 4th quarter.

|

Date issues income |

Date actual get (charges) income |

Date hold NDFL |

Renewed date number NDFL |

Last deadline day list NDFL |

View received reward. (income) in rubles |

Amount income in rubles |

Amount tax deductions in rubles |

Retained NDFL in rubles |

| 11.10.16 | 30.09.16 | 11.10.16 | 11.10.16 | 12.10.16 |

Salary for September (end. calculation) |

300000 | 1900 |

((300000+150000) -1900))x13%= 58253, where 150000 already paid advance for 1 half of Sept |

| 20.10.16 | 31.10.16 | 11.11.16 | 11.11.16 | 12.11.16 |

Advance payment for 1 polo- blame October |

150000 | ||

| 20.10.16 | 20.10.16 | 20.10.16 | 31.10.16 | 31.10.16 |

Benefit by time unemployed |

24451, 23 |

3183 (24451, 23х13%) |

|

| 25.10.16 | 25.10.16 | 25.10.16 | 25.10.16 | 31.10.16 |

Reward. under contract prov. services |

40000 |

5200 (40000х13%) |

|

| 11.11.16 | 31.10.16 | 11.11.16 | 11.11.16 | 14.11.16 |

Salary fee for second half. October |

317000 | 1900 |

((317000+150000) -1900)х13% 60463 |

| 11.11.16 | 11.11.16 | 11.11.16 | 30.11.16 | 30.11.16 | Vacations | 37428, 16 |

4866 (37428, 16x13%) |

|

| 20.11.16 | 30.11.16 | 09.12.16 | 09.12.16 | 12.12.16 |

Earn. fee for the first one half November |

150000 | ||

| 09.12.16 | 30.11.16 | 09.12.16 | 09.12.16 | 12.12.16 |

Salary for the second one half November |

320000 | 500 |

((320000+150000) -500)x13%= 61035 |

| 20.12.16 | 30.12.16 | 11.01.17 | 11.01.17 | 12.01.17 |

Salary for the first one genders. December |

150000 | ||

| 26.12.16 | 26.12.16 | 26.12.16 | 26.12.16 | 27.12.16 | Dividends | 5000 |

(5000x13%) 650 |

|

| 27.12.16 | 27.12.16 | 27.12.16 | 27.12.16 | 28.12.16 |

Gifts in non cash form |

35000 |

28000 (4000х7) |

910((35000-28000) x13%) |

| TOTAL | 1528879, 39 | 32300 | 194560 | |||||

The table shows New Year gifts given to seven employees.

In 2016, these employees did not receivefinancial assistance and other gifts.

An example of filling out the second section of 6NDFL

According to the information indicated in the table above, consider how to fill out section 2 6 of personal income tax:

First block:

- p. 100 - 2016-30-09 line 130 - 300000;

- p. 110 - 2016-11-10 p.140 - 58253;

- p. 120 - 12.10.2016.

Second block:

- p. 100 - 20.10.2016 p.130 - 24451.23;

- p. 110 - 2016-20-10 p.140 - 3183;

- p. 120 - 31.10.2016.

Third block:

- p. 100 - 25.10.2016 line 130 - 40000;

- p. 110 - 25.10.2016 p.140 - 5200;

- p. 120 - 31.10.2016.

Fourth block:

- p. 100 - 25.10.2016 line 130 - 40000;

- p. 110 - 25.10.2016 p.140 - 5200;

- p. 120 - 31.10.2016.

Fifth block:

- p. 100 - 31.10.2016 line 130 - 317000;

- p. 110 - 11.11.2016 p.140 - 60463;

- p. 120 - 2016-14-11.

Sixth block:

- p. 100 - 2016-11-11 p.130 - 37428.16;

- p. 110 - 2016-11-11 p.140 - 4866;

- p. 120 - 2016-30-11.

Seventh block:

- p. 100 - 2016-30-11 line 130 - 32000;

- p. 110 - 09.12.2016 p.140 - 6103;

- p. 120 - 12.12.2016.

Eighth block:

- p. 100 - 26.12.2016 line 130 - 5000;

- p. 110 - 26.12.2016 p.140 - 650;

- p. 120 - 27.12.2016.

Ninth block:

- p. 100 - 27.12.2016 p.130 -35000;

- p. 110 - 27.12.2016 p.140 - 910;

- p. 120 - 28.12.2016.

2 section 6 of personal income tax: form, sample of filling out a zero report

The 6NDFL report is required to be provided by tax agents: enterprises (organizations) and individual entrepreneurs that pay remuneration for work to individuals. If during the calendar year an individual entrepreneur or an enterprise did not accrue or pay income to employees and did not conduct financial activities, then the zero calculation of the 6NDFL form can not be submitted to the IFTS.

But if an organization or individual entrepreneur provides a zero calculation, then the Federal Tax Service is obliged to accept it.

Inspectors of the IFTS do not know that the organization or individual entrepreneur in the reporting period did not conduct financial activities and were not tax agents, and are awaiting calculation in the form of 6NDFL. If the report is not submitted within two weeks after the deadline for submission, then the Federal Tax Service has the right to block the bank account and impose pen alties on the individual entrepreneur or organization that did not submit the report.

In order to avoid trouble with the IFTS, an accountant has the right to submit a 6NDFL declaration (with empty values) or write an information letter to the IFTS.

A sample of a report prepared for delivery with zero indicators is shown below.

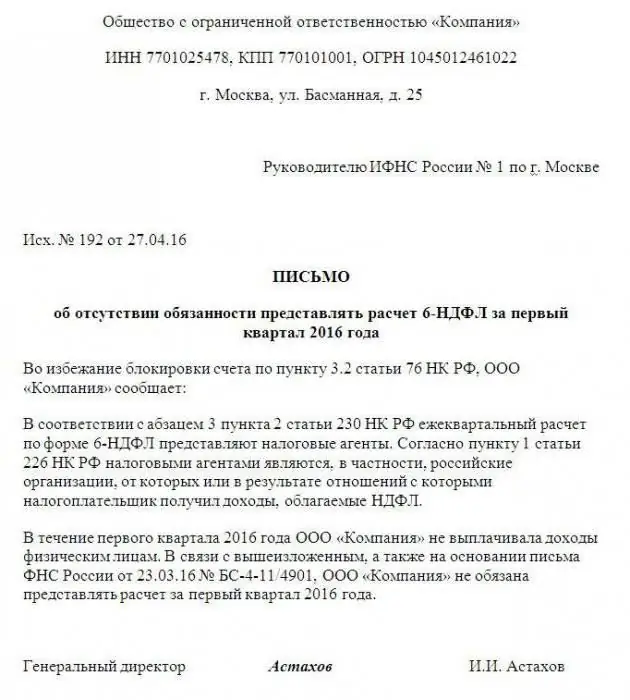

A sample letter to the IFTS about the zero report can be seen below.

Filling out 6 personal income tax: an algorithm of actions

To facilitate the work of filling out the second section of the calculation of 6NDFL, you need:

- Pick upall payment orders for the payment of personal income tax in the reporting quarter.

- Collect all payment orders for the transfer of income to employees and cash orders for the issuance of income from the cash desk, arrange them in chronological order.

- Create an auxiliary table according to the example described above

- Fill in information for each type of income in the table according to the information given in the section: "How to fill out 6NDFL: lines 100-120".

- From the completed auxiliary table, take information for section 2 of the calculation of 6 personal income tax.

Attention:

- Line 110 indicates the day on which the employee's income was actually paid (even if the salary or other income was paid later than the date established by the Tax Code).

- Personal income tax is not withheld when paying an advance.

- In line 120, the deadline date for transferring tax to the budget by type of income is entered, and not the actual date of income tax transfer (even if the tax is transferred later than the date established by the Tax Code).

- In line 140, the amount of the calculated income tax from the paid income is entered (if the income tax is not transferred in full or not transferred at all, then the tax that should have been transferred is still entered).

Second section 6 personal income tax. Situation: Impossible to withhold tax

How to fill out section 2 of 6 personal income tax when it is not possible to withhold income tax from an employee?

An individual has received income in kind (for example, a gift), but has no further cash payments.

Uthere is no possibility for the employer to withhold and transfer to the budget the income tax from the income given in kind.

How to fill out section 2 of 6 personal income tax in this situation is indicated below:

- p.100 - day of issuance of income in kind;

- p.110 - 0;

- p.120 - 0;

- p.130 - income in kind (amount);

- p.140 - 0.

The amount of income not withheld is indicated in the first section of the declaration on page 080.

Conclusion

Declaration 6 personal income tax - new report for accountants. When filling it out, a large number of questions arise, not all the nuances are considered and reflected in the recommendations given by the tax authorities. Explanations and clarifications on controversial issues are regularly given in official letters from the Federal Tax Service of the Russian Federation. In 2017, there are no changes to the reporting form and the rules for filling it out. This article reflects how to fill out section 2 of section 6 of personal income tax in the most common situations, the above algorithm for compiling the second section of the calculation is successfully applied in practice.

Good luck with your submission!

Recommended:

How to make the transition to the simplified tax system: step by step instructions. Transition to the simplified tax system: VAT recovery

The transition of IP to the simplified tax system is carried out in the manner prescribed by law. Entrepreneurs need to apply to the tax authority at the place of residence

Advances on income tax. Income tax: advance payments

Large Russian enterprises, as a rule, are payers of income tax, as well as advance payments on it. How are their amounts calculated?

Deadline for filing income tax return. What is required for income tax refund

Income tax refund is very important for many citizens. Everyone has the right to return a certain percentage of the funds spent. But what documents are needed for this? And how long will they make the so-called deduction?

Income tax on wages with one child. Income Tax Benefits

Today we will learn how income tax is calculated from a salary with one child. This process is already familiar to many citizens. After all, families often enjoy a variety of benefits. Why not, if the state gives such an opportunity?

How to calculate income tax: an example. How to calculate income tax correctly?

All adult citizens pay certain taxes. Only some of them can be reduced, and calculated exactly on their own. The most common tax is income tax. It is also called income tax. What are the features of this contribution to the state treasury?