2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

The financial market borrowed many concepts from algebra, physics and geometry. Its analysis uses graphical constructions, and on the basis of mathematical calculations, a wide variety of technical tools have been developed, for example, such as:

- fractal indicator;

- MASD;

- stochastic;

- parabolic;

- trading signals;

- automated trading programs.

Each year, experts and professionals improve innovative technologies, which makes it easier for traders to trade, find the best entry points into the market and more accurately predict changes in movement, momentum and quotes.

Use of fractals in trading

Bill Williams is the founder and creator of several technical indicators and strategies. It was he who created the fractal indicator, as well as the exotictool "Alligator", and developed trading methods for them.

Bill Williams along with Charles Dow, Ralph Nelson Elliot and other analysts have made a significant contribution to trading. He wrote several books about him ("Trading chaos, a guide for traders"), which are considered not just educational literature, but also a complete guide for beginners in trading in the financial market. The famous analyst identified certain patterns that occur during trading, on their basis he created a theory and developed a fractal indicator based on them.

In the last century, trading was much more difficult. Traders did not have such a wide variety of instruments, the ability to open deals online, and independently predict market changes. In most cases, any analysis was delayed, and positions were opened with the help of intermediaries, most often by phone.

Currently, trading is much faster, more convenient and easier. For traders and analysts, there are great opportunities for analytical and statistical forecasting of market movements, the latest programs and a large selection of technical indicators that automatically calculate indicators. Speculators do not have to spend time doing mathematical calculations to analyze the market situation.

The fractal indicator is a tool for traders and experts that analyzes the market direction by quotes and candles and sets special symbols in the form of small triangles on the chart. Such charactersare called fractals, they are calculated automatically and set independently on the chart using an indicator.

Features and types

To profitably trade in the financial market using fractals, you need to study the features of this financial instrument. According to the classification, the fractal indicator by Bill Williams is determined by ranks. It analyzes five bars or candles.

There are two types of indicator:

- For an upward movement (bullish fractal).

- For the downward direction of the market movement (bearish fractal).

And it should also be taken into account that a completely unformed fractal can be redrawn, so you need to wait for it to complete and not rush to open a position.

Description of the fractal indicator

This technical trading tool analyzes every five candles. As soon as the desired pattern is created in the financial market, he draws it and marks it on the chart with a special label.

During the formation of a fractal, after analyzing five candles, the middle bar has an extreme. For an ascending market, the third candlestick will be a high, and after the candlestick configuration (pattern) closes, a fractal will appear on the chart.

For downward movements, everything happens in a similar order. In order for a fractal to be reflected on the chart, a pattern of five candles will also be analyzed, the average should have the smallest value and be at the very bottom of the combination.

The essence of working on fractals

In trading, it is very important to open a trade on time. Therefore, among traders, only the fractal indicator is valued without redrawing and delay. Professionals and experts of the financial market have developed a wide variety of trading strategies for working with fractals.

However, it should be borne in mind that this technical instrument was originally intended for the stock market, which is somewhat different in conditions, and not for Forex, and even more so not for binary options. Therefore, for trading, it is recommended to use the fractal indicator without redrawing in conjunction with tools that allow you to identify market movements, their strength and overbought/oversold zones. These include:

- Moving averages.

- Alligator.

- Stochastic.

- RSI.

- Other indicators.

The essence of the work:

- On the breakdown of the fractal - the position is opened immediately after the market quotes go beyond the fractal by one point. Usually, pending orders are used in Forex.

- On a rebound - as soon as a fractal is indicated on the chart, you need to open a position in the opposite direction.

Tool settings and parameters

This technical indicator has standard parameters. Experts do not recommend changing them. The fractal indicator with settings is available on many trading platforms, for example, on MetaTrader 4 and 5 versions, and to install it on the chart, you just need to click the mouse. AfterThis action will open a window in which all its parameters will be registered. In them, the user can choose the color scheme for fractals, bull and bear markets, as well as the style.

Fractal breakout trading strategy

To start the analysis using this tool, you need to study the information on how the fractal indicator works. In trading, there are several dozens and even hundreds of the most diverse strategies that use fractal theory.

Trading Breakout:

- To get started, you need to install the fractal indicator on the chart. In the settings, you can choose their color, which would correspond to the bull and bear markets.

- Analyze the market movement and find out in which direction it is moving.

- Select the desired time frame (from M-1 to D-1).

- You can use any trading asset.

- Opening a deal to buy - place a pending order to increase the price on the chart. The difference should be 1 point from the level of the last bullish fractal. As soon as the market reaches the required values, the transaction will automatically open. Set stop loss at the level of the second low fractal of the middle candle (low extreme).

- Opening a sell position - a pending order is set to lower the price, at a distance of one point from the last bearish fractal. The stop-loss level is placed on the line of the maximum value of the upper bullish fractal (extremum of the maximum).

Method of trading byfractals

A special strategy is used to work on the rollback of the market movement. A sell deal is executed immediately after the formation of a bearish fractal on the chart. The next candle should have an upward movement. Opening a position should be carried out immediately after closing it.

A deal to buy occurs by analogy. As soon as a bullish fractal forms on the chart, you need to open a position on the price increase on the rollback.

It is advisable to use the Alligator technical indicator as a filter. It will indicate the direction of the market movement and filter out false signals.

The benefits of the tool

Among the positive characteristics of indicators based on fractals, one can single out a convenient definition of the direction of market movement. This tool helps to identify trends and allows you to increase profits up to 80% by opening additional positions.

Example: A trader using fractals and other indicators or graphic constructions determined the direction of the market movement. He was convinced that the emerging trend would continue for some time. In this situation, he can open additional trades. To avoid financial risks and minimize them, he uses pending orders, which he places after each fractal at a distance of one point.

Besides, it is very convenient to use their tops to set up support and resistance lines, trend channels and determine the general global market direction. fractals alsohelp to find and determine the most promising points for opening deals.

Negative sides

The biggest disadvantage of this indicator is its redrawing. To avoid false signals, it is recommended to use additional instruments as confirmation.

It is advisable to filter each signal using the Alligator indicator. It is based on three moving averages with different periods and allows you to fully analyze the market movement, filter out dubious signals and confirm the trend in the market.

During the flat, all Alligator lines will be intertwined, which is a confirmation of the absence of impulses or trends. When market volatility increases, the moving averages will begin to diverge in different directions. This is regarded in trading as the beginning of a trend movement and an increase in bidders.

Conclusion

The fractal technical indicator is a universal and classic trading tool. The strategies created on its basis, when properly applied, bring good profits for traders and investors.

It is important to always remember that any trading method must have mandatory confirmatory tools to filter and filter out false signals. Before the start of each trading day, it is necessary to conduct an analytical market forecast using analytics and statistical data. The correctness of opening positions and further profit will depend on the accuracy and fidelity of the analysis.

Recommended:

The concept and types of organizations: definition, classification and features

The first organizations began to emerge in antiquity with the appearance of the first communities and tribes. They consisted of small groups, were very simple in structure and did not have complex goals. Now they have fully entered our lives, and without them there would be chaos and disorder everywhere. In the article we will consider in detail the types of organizations and how they operate

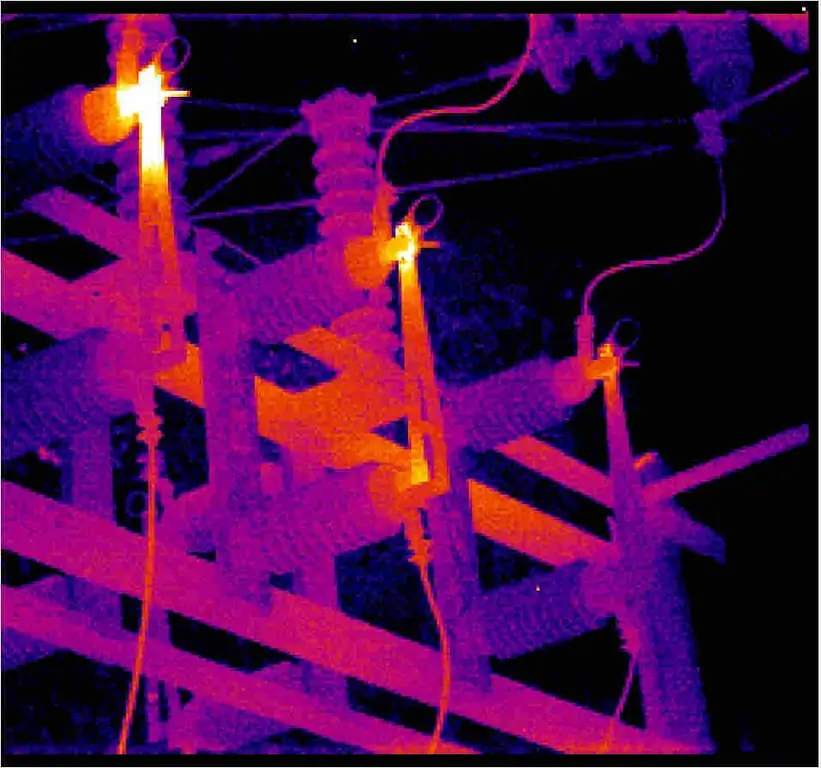

Thermal imaging control of electrical equipment: concept, principle of operation, types and classification of thermal imagers, features of application and verification

Thermal imaging control of electrical equipment is an effective way to identify defects in power equipment that are detected without shutting down the electrical installation. In places of poor contact, the temperature rises, which is the basis of the methodology

Electric locomotive 2ES6: history of creation, description with photo, main characteristics, principle of operation, features of operation and repair

Today, communication between different cities, passenger transportation, delivery of goods is carried out in a variety of ways. One of these ways was the railroad. Electric locomotive 2ES6 is one of the types of transport that is currently actively used

Low pressure heaters: definition, principle of operation, technical characteristics, classification, design, operation features, application in industry

Low pressure heaters (LPH) are currently used quite actively. There are two main types that are produced by different assembly plants. Naturally, they also differ in their performance characteristics

Railway track is Definition, concept, characteristics and dimensions. Train dimensions and features of track facilities operation

Traveling by train through cities and towns, you can learn a lot of interesting and amusing things about the world of the railway. More than once, traveling people have asked themselves questions about where this or that railway track leads? And what does the engineer who manages the train feel when the train is just starting off or arriving at the station? How and from where do metal cars move and what are the ways of the rolling stock?