2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

For many years, Tinkoff Bank has been a leader in the financial and credit market. High popularity is explained by simple design and loyal requirements for potential customers. The system allows you to forget about the monthly payment of loans and utilities. However, if the details of the service user have changed or payments have ended, you need to know how to turn off Auto Payment in Tinkoff Bank in order to save money on the card. In the article, we will consider ways to independently carry out such an operation.

What is this?

Bank "Tinkoff" offers customers a number of convenient services that greatly simplify life. The option is designed to ensure that users make timely paymentsa certain amount for the provision of certain services.

For various reasons, customers sometimes refuse such opportunities and are interested in how to disable "Autopayment" in Tinkoff Bank and what is needed for this?

Key Benefits

The service is used by people who do not want to sort out bills every month and value their personal time. Consider the main advantages of such a service:

- timely payment in automatic mode;

- no need to recharge;

- possibility of auto-payment of fines;

- payment of utility bills and other bills;

- positive credit history due to the absence of delays and pen alties on payments;

- receiving an increased cashback point;

"Auto payment" from "Tinkoff" is a convenient and multifunctional service.

Using this service, cardholders will not forget to make a mandatory loan payment. Also, the function will be useful for paying for the Internet, mobile communications and utility bills.

Why do you need a service?

The main purpose of "Autopayment" is to help the client in making a payment. The program automatically makes a transaction on a given date and certain parameters. It is effective to use the service when making regular payments with the same amount. Examples include the following types:

- utility expenses;

- loan repayment;

- payment for Internet, cellular services;

- payment and repayment of debts for attending various circles and sections.

The service can be used completely free of charge, as the service is included in the online banking application. If the option works after the payments stop, then the clients' money may be lost. Therefore, it is important to know how to disable "Autopayment" from "Tinkoff" in order to exclude possible financial losses.

How to deactivate the option

There are several ways to disable this service. The client can call the technical support service, contact the office of a credit institution or independently deactivate the option in their personal account.

Personal account

The user will need to go to the official website of Tinkoff Bank and click on the "Login" button located in the upper right corner. Then you will have to specify personal data or enter a card and phone number. Within a few seconds, an SMS message with a one-time password will be sent to the mobile device.

After completing the authorization procedure, go to the "Manage payments" tab and go to the "Auto payments" section. The system will automatically generate a list of available operations for the client. Among them, you will need to select the one you need and click on the "Disable" button.

There is another way that will help users answer the question of how to disable AutoPay from Tinkoff. To do this, you need to goto the "Templates" section and view available payments. The letter "A" indicates the connection of the service of automatic transfer of funds. To disable the option, just move the slider in the opposite direction.

Support

Users who are interested in how to disable "Auto Payment" in Tinkoff can call the technical support service at the number listed on the company's official website. After the identification of the person, the specialist of the banking organization deactivates the service. If funds continue to be charged, please contact the call center again.

Mobile banking

This method is convenient and easy to use. How to disable "Auto payment" in "Tinkoff" using a mobile bank? To do this, you need to go to your personal account and select the "Favorites" subsection. Then you should view the services and select the "Auto payment" option. After that, just click on the "Turn off" button.

App deactivation

Auto write-off applies to users of mobile networks "MegaFon", MTS and "Beeline". How to disable "Auto payment" in "Tinkoff" if the need for such a service is gone? Subscribers can use a special utility with which they can refuse such an option.

The application is available for download in the App Store and Play Market. After installing the program,authorization is required. The management and interface of the application are identical to the personal account on the official website. The user will need to go to the "My Templates" section and move the slider to the "Off" position. Thus, you can easily disable "Autopayment" from "Tinkoff" on your phone through the application.

Deactivation via carrier

Many customers use this service to pay for their cell phone. If the balance reaches a certain threshold, then the funds are automatically debited to replenish the account.

How to disable "Auto payment" from the Tinkoff card through a telecom operator, if there is no need for such an option? The user will need to go through the authorization procedure on the official website of the provider and disable the service in a special section.

Summing up

Automatic write-offs allow people to save personal time on depositing funds through terminals. This is a real bonus for those who use cards and non-cash payments. After the transaction is completed, information about the financial transaction is entered into the expense statistics, which can be found in your personal account.

Despite the undeniable convenience and advantages of the option, there are situations in which it is urgently necessary to deactivate it. The issue of deactivation is especially relevant when terminating the contract with the service provider, changing the details and mobile operator.

Service"Auto payment" from Tinkoff Bank is a multifunctional service that allows you to make the necessary payments in a timely manner. This is a fairly convenient and fast calculation method that saves time. The presented article provides a detailed answer to the question of how to disable "Autopayment" in "Tinkoff" if this service is no longer needed.

Recommended:

Payment for fuel and lubricants: contract execution, calculation procedure, rules and features of registration, accrual and payment

Situations often arise when, due to production needs, an employee is forced to use personal property. Most often we are talking about the use of personal vehicles for official purposes. Moreover, the employer is obliged to compensate for the related costs: fuel and lubricants (POL), depreciation and other costs

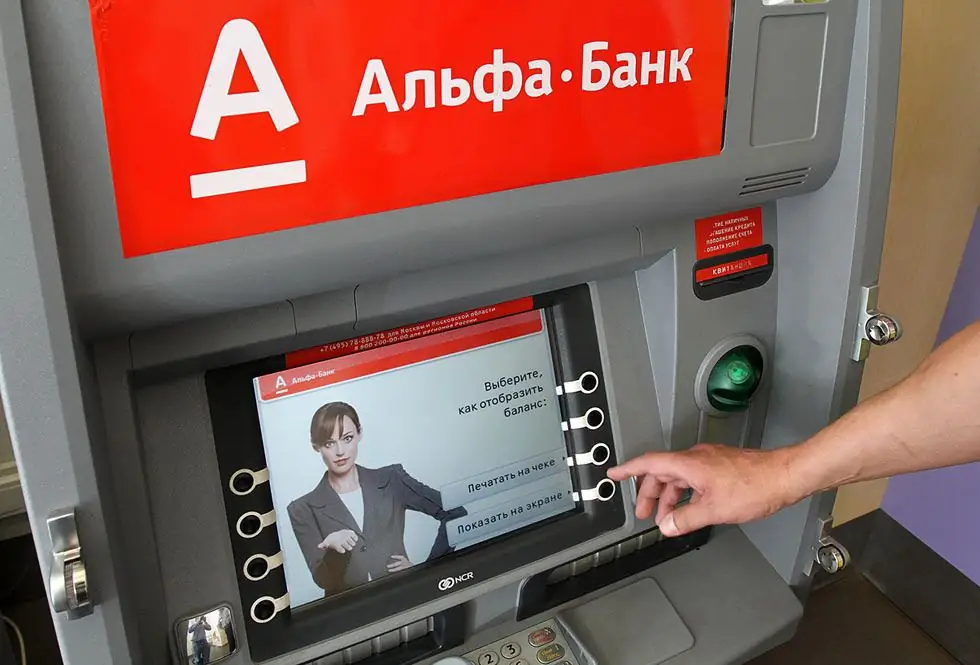

How to put money on the Alfa-Bank card? The main ways to replenish the Alfa-Bank card

The holders of this payment instrument have several options for how to put money on an Alfa-Bank card. Due to the variety, the user can choose for himself the most convenient and profitable way to replenish. You can deposit funds to your account by contacting the offices of this financial institution or a branch of another bank, using an ATM or self-service terminal, as well as using the possibilities of online services

How to check a Sberbank card: by number, phone, SMS and other ways to check the balance and the number of bonuses on the card

More than 80% of Sberbank customers have plastic cards. It is easy and convenient to use them, besides, they allow you to save time when performing transactions. To always be aware of the amount of funds on a credit card, you need to know how to check a Sberbank card

How to cancel a payment at Sberbank: ways to return funds

Sberbank services are used by more than 70% of Russian citizens. A wide network of branches and ATMs, popular online banking allow Russians to make payments at a convenient time and with a minimum commission. At the initiative of the client, you can cancel the payment within 24 hours: Sberbank offers several options for refunds

How to find out the details of a Sberbank card: the main ways

Plastic cards of "Sberbank" have long ceased to be only a means of payment. With the help of the bank's products, customers regularly make millions of transactions to transfer funds to their relatives and friends. In most cases, senders use Mobile Bank or Sberbank Online to transfer cash from a card. But sometimes it is not possible to use mobile applications. In such cases, you must provide the details of the bank card "Sberbank"