Banks

The most reliable bank in Russia. Bank rating

Last modified: 2025-01-24 13:01

How to choose a bank? Criteria for choosing a reliable bank for making a deposit, obtaining a loan and other purposes. TOP 10 most reliable banks in Russia

Non-equity securities: examples. Promissory note - non-issue security

Last modified: 2025-01-24 13:01

Non-equity securities are financial instruments that are mainly issued individually or serially. These include bills, checks, bills of lading, savings and deposit certificates, mortgages. Their issue and circulation are mainly regulated not by the law "On the RZB", but by the law relating to the types of bills, the Civil Code of the Russian Federation and the regulatory documents of the Central Bank of the Russian Federation

Credit and banking system of the Russian Federation

Last modified: 2025-01-24 13:01

Structural description of the Russian banking system. Work and functions of the Central Bank. Credit functions of commercial banks

Factoring scheme: description, types, operations

Last modified: 2025-01-24 13:01

What is factoring? What are its main functions? Who is involved in the process? Analysis of the classical factoring scheme, features of the stages of work. When is factoring necessary and when is it not possible? Key features and difference from lending. Existing types of factoring. Advantages and disadvantages of this service

Russian Standard Bank: reviews, loans, opportunities

Last modified: 2025-01-24 13:01

Russian Standard Bank, reviews of which everyone hears, can please us with its new lending conditions. In particular, the possibilities of credit cards

"Tinkoff Credit Systems": reviews and information

Last modified: 2025-01-24 13:01

One of the well-known Russian banks - Tinkoff Credit Systems - has been working for the benefit of the citizens of our country since 1994. The enterprise received its current name thanks to the main shareholder Oleg Tinkov, who owns 68% of the shares. Until 2006, the bank was called "Khimmashbank"

Bank deposit rate. Where are the best interest rates on deposits

Last modified: 2025-01-24 13:01

Today in Russia there are many banks that offer their customers various deposits. Each financial institution has its own rates and conditions for placing money

Bank "Russian Standard": deposits for individuals: conditions, rates

Last modified: 2025-01-24 13:01

Bank "Russian Standard" is perhaps an organization that is on everyone's lips. At the beginning of the 2000s, the bank gained wide popularity in many cities of Russia. Not always reviews of his work were positive. However, this is due to the fact that Russian Standard was one of the first to focus on mass consumer lending, which in a short time expanded its customer base to six-digit values

What is POS lending?

Last modified: 2025-01-24 13:01

Despite all known shortcomings, express loans are becoming more and more popular. Buyers are so accustomed to the benefits of the financial market that they want to get a loan right at the point of purchase. This is what POS lending is based on

Is it possible to transfer money from a credit card: transfer features, all available methods

Last modified: 2025-01-24 13:01

Along with debit cards, on which it is convenient to place your own funds so as not to carry large amounts of cash with you, and with salary cards, thanks to which you do not have to wait for the withdrawal of earned money through the cashier, credit cards are especially popular. But is it always convenient to use them on your own? Can I transfer money from a credit card?

What is differentiated payments: definition, formula and calculation examples

Last modified: 2025-01-24 13:01

In our time, few people have not de alt with obtaining bank loans, whether it be a mortgage, a loan to buy a car or just a sum of money for certain needs. But is it always when concluding an agreement with a bank that everyone carefully reads the conditions? Usually everyone agrees to an annuity. Do you know what differentiated payments are and how they help save borrower money?

How to put money on someone else's Sberbank card: basic methods and instructions

Last modified: 2025-01-24 13:01

Need financial help for a friend or want to send a cash gift to a relative? Decided to give a friend a loan or pay for someone's services? In the context of the huge popularity of the largest bank in Russia and the convenience of bank cards, for any of these actions you need to know how to put money on someone else's Sberbank card

How to send money to a Sberbank card. How to transfer money from a Sberbank card to another card

Last modified: 2025-01-24 13:01

Sberbank is truly the people's bank of the Russian Federation, which has been placing, saving and increasing funds of both ordinary citizens and entrepreneurs and organizations for several decades

Bank "Trust": customer reviews

Last modified: 2025-01-24 13:01

The history of the bank. Main directions of activity. Customer reviews. Additional bank service

Card "Viza" (Sberbank): customer reviews

Last modified: 2025-01-24 13:01

Sberbank is one of the largest financial institutions in the Russian market. Millions of people use its services every day. Today, like many other credit institutions, Sberbank is actively developing a variety of card products. This convenient service allows you to make purchases and receive cash not only in Russia, but also abroad

How and why does a bank liquidate?

Last modified: 2025-01-24 13:01

In Russia, the procedure for liquidating a credit institution is regulated by the Federal Law “On Banks and Banking Activity”, the Federal Law “On the Central Bank of the Russian Federation”. It can last for several years. The bottom line is this: a temporary administration is being introduced into the bank. If it cannot independently stabilize the activities of the organization or find sponsors, then the Bank of Russia will liquidate the institution, having previously revoked its license

Deposit deposit: conditions, rates and interest on deposits

Last modified: 2025-01-24 13:01

For those who have just begun to master financial instruments, first of all, a deposit is opened. It allows you to minimize the impact of inflation and ensure the safety of funds. What is this tool? What is it used for? What benefits does it provide us?

Depository - what is it and how does it work?

Last modified: 2025-01-24 13:01

What is a depository and depo account, what are they for? What services are provided and what types of depositaries are there?

Central European Bank (ECB). Functions of the European Central Bank

Last modified: 2025-01-24 13:01

The European Central Bank (ECB) is the most independent bank in the world, which determines and implements monetary policy in the EU, is responsible for maintaining an optimal level of inflation and price stability

Savings deposit: banks, conditions, interest rate

Last modified: 2025-01-24 13:01

Many people would like to have a magic wand that helps them increase their savings. But, alas, this is from the fantasy section. Before you can learn how to make states, you need to be able to at least save what you already have. And we will talk about one of the approaches in this direction, namely about savings deposits in banks

What profitable deposit can Rosbank offer to its clients?

Last modified: 2025-01-24 13:01

There are about 600 different banks in Russia. The list of the first 50 includes those who are trusted by the majority of our citizens. "Rosbank" is in 12th place. He, like any self-respecting financial institution, offers deposits. There are several tariffs - they are all good in their own way. However, they can be described in more detail

Refinancing at VTB: conditions and reviews

Last modified: 2025-01-24 13:01

Modern society can hardly imagine its existence without financial support from banks. And the more banks offer, the more demand from consumers. After all, the very possibility of taking a thing and not paying for it is of genuine interest. But, unfortunately, not always needs and opportunities can intersect. When it is not possible to repay the debt to the bank, you can use the services of refinancing. Refinancing at VTB 24 is a great way to solve problems that have arisen

Interest rates on deposits in Sberbank

Last modified: 2025-01-24 13:01

Despite the wide variety of banks in the financial market, Sberbank is more often chosen to store their savings. It is valued for its reliability, because all deposits made by individuals are insured by the state. However, interest rates on deposits are not leading among the higher offers of other banks. This does not prevent him from year after year to remain not only competitive, but also to stay on the first lines in the financial market. What conditions does Sberbank offer now?

Reviews about the bank "Vostochny": the opinion of employees and customers

Last modified: 2025-01-24 13:01

In order to withstand competition, each of the banks tries to offer its customers the most favorable conditions for consumer loans and credit cards. But not everyone manages to maintain a good reputation. Today we will consider reviews about the bank "Vostochny"

How to Participate in E-Trading: How to E-commerce

Last modified: 2025-01-24 13:01

Today, electronic trading is one of the most popular types of trading on the Internet. This way of concluding contracts for many market participants is the most attractive due to the fact that in order to participate in the auction, it is absolutely not necessary to be geographically close to the customer. In addition, in this way it is much more convenient to monitor the market of interest, tracking the newly emerging demand

Bank deposits. Bank deposits of individuals

Last modified: 2025-01-24 13:01

There really are a great variety of banking services. This article will talk about deposits, their types and how not to miscalculate and choose the right bank that will be your reliable financial partner

Deposits for legal entities: rates

Last modified: 2025-01-24 13:01

Banks offer financial services not only to individuals, but also to legal entities. They have the opportunity to open deposits. Moreover, each financial institution offers its own conditions. Deposits for legal entities are processed in many banks of the country. Read more about the service in the article

What is a nominal account? Appointment and opening of a nominal bank account

Last modified: 2025-01-24 13:01

From July 1, 2014, amendments to the Civil Code came into force, according to which Russians were allowed to open joint accounts with relatives. You will learn about the essence, prospects and conditions of service from this article

Travelers checks - what is it? How to pay with traveler's checks and where to buy?

Last modified: 2025-01-24 13:01

American Express traveller's checks are a convenient and reliable way to store cash in foreign currency. Possessing at the same time the qualities of cash (purchasing power and face value), they have all the advantages of financial receipts (they can be restored in case of loss, as well as bequeathed). The safety of money invested in traveler's checks when buying is guaranteed by the largest international corporation, whose history of existence goes back 164 years

"Mast-Bank": license revoked? "Mast-Bank": deposits, loans, reviews

Last modified: 2025-01-24 13:01

Mast-Bank, according to the rating agency, belongs to the category of stable banks. Despite the ban on accepting and replenishing deposits by the Central Bank of the Russian Federation, the financial institution has no problems with liquidity

Yield - what is it?

Last modified: 2025-01-24 13:01

Every economic activity has as its goal a profit (or a positive return). And what is it from an economic point of view? The answer to this question will be discussed in the article. Also, besides this, it will be discussed what the rate of return is and how to calculate it

Russian commercial banks: rating of the best

Last modified: 2025-01-24 13:01

Which financial institution should I contact to make a deal? First of all, you should familiarize yourself with the rating of the best commercial banks

Deposit "Seasonal" in VTB 24: deposit reviews for individuals, conditions

Last modified: 2025-01-24 13:01

How to choose the most profitable deposit and what to look for? Deposit "Seasonal" bank "VTB 24": conditions and customer reviews

Islamic banking in Russia. Islamic bank in Moscow

Last modified: 2025-01-24 13:01

Islamic banking intends to conquer the expanses of Russia. Despite significant differences in the banking structures of the states, they intend to find common ground in the field of commercial financing of a certain category of companies

Sberbank deposit rates

Last modified: 2025-01-24 13:01

Sberbank is trusted by Russian customers. Attracts a financial institution and interest rates on deposits. It is possible to conclude a deal on convenient terms

American banks: rating, basic information, historical background

Last modified: 2025-06-01 07:06

American banks are one of the most powerful financial instruments in the world, with which many similar institutions on the planet wish to cooperate. The article will provide basic information about US banks and their rating

What profitable deposit can Promsvyazbank offer to its clients?

Last modified: 2025-01-24 13:01

The name of such an organization as Promsvyazbank is on everyone's lips today, which is not surprising. After all, this bank is included in the list of 500 most reliable in the world. Many people trust him with their money by opening deposits. Tariffs at Promsvyazbank are favorable, profit is guaranteed. However, first things first

Bank mortgage loans: requirements, documents and reviews

Last modified: 2025-01-24 13:01

Every young family dreams of their own housing. And thanks to mortgage lending, now it is quite possible to fulfill this desire

Rosselkhozbank, loan refinancing: conditions, interest and bank programs

Last modified: 2025-01-24 13:01

Now a lot of people use lending services. However, at the time of signing, not everyone carefully studies the text of the loan agreement. As a result, the borrower is obliged to pay huge payments. But Rosselkhozbank can help with this. The refinancing offered by him will quickly get rid of the problem

AHML - what is it and why was it created?

Last modified: 2025-01-24 13:01

Housing is always a key issue in the life of almost any family, and sometimes this aspect becomes the cause of many disputes and conflicts. By order of the Government of the Russian Federation in 1997, a state organization was created to resolve this issue. And this is AHML, which stands for Housing Mortgage Lending Agency

Bank capital: definition, meaning and types. Commercial bank capital

Last modified: 2025-01-24 13:01

The term "commercial bank" originated at the dawn of banking. This was due to the fact that credit organizations then served mainly trade, and only then - industrial production

Which banks can refinance a mortgage in Novosibirsk?

Last modified: 2025-01-24 13:01

If you want to improve the conditions on your existing mortgage, use the refinancing program. Which Novosibirsk banks are ready to lend to mortgage clients and provide a low interest rate?

"TransKapitalBank": customer reviews, description, services, deposits and loans

Last modified: 2025-01-24 13:01

This article will tell you what "TransKapitalBank" is. What services does it offer? Are customers satisfied with the service? What features of the company should every client be aware of?

Mortgage refinancing, Gazprombank: reviews

Last modified: 2025-06-01 07:06

Mortgage has become one of the types of loans with which you can buy your own home. Today, almost all financial organizations offer mortgages on the most favorable terms, and such an operation as mortgage refinancing has also become common

Compensation for deposits of Sberbank of the former USSR. Features of receiving compensation

Last modified: 2025-01-24 13:01

At the moment, the payment of compensations on Sberbank deposits to citizens of the country who made deposits before the collapse of the USSR continues. All accounts that are subject to protection and recovery under the laws of the country are gradually paid by the Savings Bank of the Russian Federation. The law on compensation to citizens for damages was adopted in 1995

Unified register of bank guarantees. Register of bank guarantees: where to look?

Last modified: 2025-01-24 13:01

Bank guarantees are the most important component of the public procurement market. Recently, a register of bank guarantees has appeared in Russia. What is this innovation?

Financial ratings: the best banks in Russia and organizations that are gaining popularity

Last modified: 2025-01-24 13:01

In our time, almost every person uses banking services. He can receive a salary on a card, take out loans, mortgages, open deposits … today there are many opportunities and services! Just like the banks themselves. You can really get lost in their names. But it is very important to know which bank you can trust today. Well, the most popular banks in Russia should be listed - national ratings are reliable sources for this

Types of deposits: how to use them correctly

Last modified: 2025-01-24 13:01

Main types of bank deposits, their characteristics and key aspects. Which deposit is better to choose in certain cases, what you should pay attention to when choosing

Reserves of banks and their formation. Required bank reserves and their norm

Last modified: 2025-01-24 13:01

Bank reserves ensure the availability of funds for the uninterrupted fulfillment of payment obligations regarding the return of deposits to depositors and settlements with other financial institutions. In other words, they act as a guarantee

Which bank has the maximum interest on deposits? The maximum percentage of the deposit in the bank

Last modified: 2025-01-24 13:01

How to save and increase your savings without risking your wallet? This question is of increasing concern to all people. Everyone wants to earn income without doing anything on their own

What are bank deposits for? What are refillable deposits?

Last modified: 2025-01-24 13:01

The article discusses questions about who needs bank deposits, what are interest and terms on them, and why this banking service is in great demand among the population

How to open a demand account?

Last modified: 2025-01-24 13:01

Any deposit of money in a bank is not only a way to safely store finances, but also an opportunity to receive passive income. It should be noted right away that the profit on deposits is quite small and is expressed as a percentage that is charged on the balance of money in the account. But the income will be stably accrued only until the time the agreement for the placement of funds on the deposit is valid or until the depositor closes the deposit on his own

Bank card "Pyaterochka" from "Post Bank": reviews, conditions and features

Last modified: 2025-01-24 13:01

The Pyaterochka card, the main purpose of which is to help save money when shopping in the supermarket chain of the same name, is a Visa Classic debit card. She is unnamed. Its main advantages are points accrued to the buyer, as well as monthly interest on the balance of the card account, which can be considered as additional profit

Refinancing at Post Bank for individuals

Last modified: 2025-01-24 13:01

Refinancing a loan is a good financial instrument. But only if you approach this process correctly, that is, calculate the options in advance, choose the best program and bank. An active marketing policy at Post Bank offers favorable conditions for individuals in Russia. The declared rate for on-lending here is from 14.9% per annum, with the ability to reclaim part of the interest paid

Sberbank savings certificate: interest. Sberbank bearer certificates

Last modified: 2025-01-24 13:01

One of the areas where you can invest free money is a savings certificate. This is a security that certifies the obligation of the bank to pay an individual a certain amount. Issue it in any credit institution. Savings certificates of Sberbank of Russia, the interest on which is higher than on all other deposits of the organization, are in demand in the market

Opening Bank: deposits for individuals

Last modified: 2025-01-24 13:01

A wide variety of Otkritie bank deposits for individuals allows customers to choose the most optimal investment option. Consider interest rates on deposits, is it possible to replenish or withdraw some part of the funds, and also how to increase income by issuing an investment product along with a deposit

Deposit replenished with a high percentage. Which bank to invest in

Last modified: 2025-01-24 13:01

Today everyone is trying to earn more to survive in the economic crisis. Bank deposits can be a source of additional income. Before making a deposit agreement, it is necessary to choose a reliable structure that guarantees the payment of all accumulative funds in case of reorganization

What coins does Sberbank accept? Dispelling the myths

Last modified: 2025-01-24 13:01

Currently, there are many rumors that Sberbank and other banks accept various numismatic trifles. The article tells what coins the Savings Bank of our country actually accepts

Types of plastic cards and ways to personalize them

Last modified: 2025-01-24 13:01

Today it is impossible to imagine your life without plastic cards. We use them when withdrawing cash from ATMs, when paying for purchases, to receive discounts, etc. What types of plastic cards exist and how do they differ from each other?

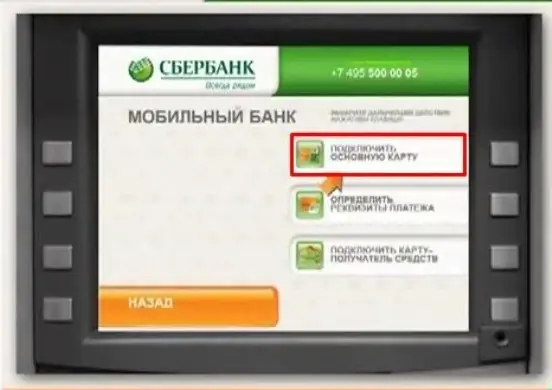

How to connect "Mobile Bank": instructions, useful recommendations

Last modified: 2025-01-24 13:01

"Mobile banking" - an option that allows you to manage bank cards using your mobile phone. This article will show you how to connect it

Banking houses. "Banker's House", St. Petersburg. CJSC "Banking house"

Last modified: 2025-06-01 07:06

CJSC "Bankirsky Dom" is a successful enterprise providing a wide range of services to the population and legal entities. His areas of interest include: lending, deposits, currency transactions, settlement and cash services, leasing safe deposit boxes and other services. Banking houses have become equal members of the Russian banking system

Safe boxes. Bank cell rental

Last modified: 2025-01-24 13:01

What are safe boxes? Why are they rented? How much does it cost? What guarantees do banks provide to customers?

Favorable savings deposit with the possibility of replenishment

Last modified: 2025-01-24 13:01

Every person of our time can hardly imagine a time when money was accumulated in glass jars, and not in financial institutions that were transparent and close to people. To date, there are quite reliable and prosperous organizations that offer various services, for example: obtaining a loan; issuance of a credit card; opening a card account; registration of a deposit (accumulative deposit with the possibility of replenishment)

Reviews. "RosinterBank": deposits, loans

Last modified: 2025-01-24 13:01

In this article you will find reviews about RosinterBank, learn about its problems, as well as options for solving them. Here you will also see information about the bank itself, its history of origin and brief information about loan programs and deposits

Sberbank: property insurance. Reviews

Last modified: 2025-01-24 13:01

The article will tell you how property insurance programs work at Sberbank, including credit insurance, including mortgages

Sberbank mutual funds. Reviews of mutual funds of Sberbank

Last modified: 2025-06-01 07:06

If it's time to think about where to invest the accumulated or earned any amount of money, and the word "investment" says almost nothing, then you have reason to rejoice. Mutual funds of Sberbank of Russia are the best investment option

How to buy a silver bar in Sberbank of Russia

Last modified: 2025-01-24 13:01

Investing in bullion is one of the ways to invest temporarily free funds. At the same time, banking metals are more valued. For more information on how and under what conditions you can purchase ingots at Sberbank of Russia, read on

How to get a Sberbank card on the most favorable terms?

Last modified: 2025-01-24 13:01

Sberbank has been trying to please its customers with loan products for many years. The most popular of them are cards for various purposes. It can be a debit or credit card. When the choice is made in favor of one or the other, it remains to figure out how to issue a Sberbank card

Financial issues: the most profitable investment. Raiffeisenbank: all the most interesting about popular tariffs

Last modified: 2025-01-24 13:01

Many people, having decided to make money on their savings, turn to Raiffeisenbank to open a deposit there. This is the right decision, as the organization is popular and known as a reliable bank. She offers potential clients several offers. About those that are most in demand, you can tell in more detail

Sberbank Gold Card: terms of use, pros and cons

Last modified: 2025-01-24 13:01

Using a Sberbank gold credit card gives its owners the opportunity to use a larger cash limit than ordinary card holders. In addition, golden plastic allows you to use the service of automatic payments, mobile banking services and replenishment of the card according to the schedule. In general, the use of such a card greatly simplifies the life of its owner

Modern payment systems: user reviews and ratings of the best

Last modified: 2025-01-24 13:01

With the constant active promotion of modern technologies, new payment systems appear, reviews of which are different. But in general, such systems facilitate and simplify financial transactions. What are the best payment systems on the Internet? TOP-5 from regular network users

Operational leasing – why is it profitable?

Last modified: 2025-01-24 13:01

What is operational leasing, why this type of activity can be more profitable and better than financial, features and aspects of operational leasing in general

What is a bank in modern life

Last modified: 2025-01-24 13:01

Not everyone knows what a bank is, what is its main activity and how it differs from other financial and credit institutions. What are the main operations typical for commercial banks?

What are the operations of the Central Bank

Last modified: 2025-01-24 13:01

The central bank performs important functions through certain operations. Their volume and structure depend on the objectives of the entire credit and monetary policy, they are reflected in its balance sheet

CVV-code - the key to the card, inaccessible to scammers

Last modified: 2025-01-24 13:01

The growing prevalence of online shopping is accompanied by an active growth of fraud. There is a need to come up with new ways to protect bank cards from access to them by ill-wishers. One of the latest measures taken by payment systems was the CVV code

The currency position of the bank as a guarantee of its reliability

Last modified: 2025-01-24 13:01

Did you know that the efficiency of banking activities largely depends on the dynamics of exchange rates? However, an increase in the exchange rate is not yet a guaranteed profit, because an open currency position can be short. So let's figure out what a currency position is

How to get a loan at Post Bank of Russia: reviews

Last modified: 2025-01-24 13:01

The bank acts as a universal retail enterprise established last year by VTB and Russian Post. The key goal of Post Bank is the desire to increase the availability of financial services provided to residents of Russia. This financial institution is currently developing a large-scale network based on Russian Post

The purpose of the creation and opening of the Asian Development Bank

Last modified: 2025-01-24 13:01

The Asian Development Bank (ADB) is engaged in one of the most important areas of modern development - the fight against poverty. It operates in a region of about 700 million people on less than $1 a day and 1.9 billion people (more than a quarter of the world's population) on less than $2 a day

Card with sample signatures and stamp. Registration procedure

Last modified: 2025-01-24 13:01

To open a bank account, you need to provide a package of documents, which includes a card with sample signatures and a seal. The main requirements for the registration procedure established by law are reflected in this article

How is a Sberbank card blocked?

Last modified: 2025-01-24 13:01

At first you might think that blocking and unblocking a card is a very simple operation that anyone can handle in a few minutes. But in fact, not everything is so easy. What is required in order for a Sberbank card to be blocked?

Sberbank blocked the card. What to do?

Last modified: 2025-01-24 13:01

There are only two reasons why you may be denied access to a bank card. Let's understand the nuances of why the Sberbank card is blocked and how to lift the ban

Credit and debit is the basis of accounting

Last modified: 2025-01-24 13:01

Debit and credit are two terms that are specific to the job of an accountant. Moreover, the study of accounting science just begins with an explanation of the basics of double entry. Debit is the column on the left and credit is on the right. At first it looks very simple, but in reality it turns out to be much more complicated. From a university accounting course, students usually remember only that debits are debts that will soon be returned to us

Details of individual entrepreneur, bank, account - let's figure out what's what

Last modified: 2025-06-01 07:06

We encounter the concept of "requisites" in various areas of life and business. Individual entrepreneurs (IP) and commercial organizations, banks and accounts in them have them. In each individual case, this term refers to various kinds of information. "Details" is a rather broad concept, but its meaning boils down to one thing: the identification of a subject in economic and legal relations

How to transfer money to a Sberbank card: the most convenient ways

Last modified: 2025-01-24 13:01

Replenishing the balance of a bank card is of interest to every client of a financial institution. This article will talk about the best methods for transferring money to a Sberbank card

Who does not want to know a lot, or Which bank does not check credit history

Last modified: 2025-01-24 13:01

We receive money with a black mark in the dossier: which bank does not check credit history? Where can you find such a lender, and where does nothing shine for you?

Transferring money to a Sberbank card: all methods

Last modified: 2025-01-24 13:01

Transferring funds to a bank card is a process that everyone can face. But how to bring it to life in the case of Sberbank? This article will talk about the replenishment of Sberbank plastic

How to find out the balance of a Sberbank card via phone?

Last modified: 2025-01-24 13:01

Sberbank is a popular Russian bank. This article will tell you how to find out the balance of a plastic card from this financial institution

How to find out the balance of a Sberbank card via SMS?

Last modified: 2025-01-24 13:01

Obtaining information about the status of a Sberbank card account is the main function that every client of a financial company should be familiar with. This article will tell you how to request a bank plastic balance

How to check the balance of the Sberbank card correctly

Last modified: 2025-01-24 13:01

To check the balance of the Sberbank card, there are a sufficient number of ways. At the same time, each client chooses the easiest and most convenient option for himself, based on the possibilities, desire, and frequency of using the card

Vladimir Kogan: biography, photo of Kogan Vladimir Igorevich

Last modified: 2025-01-24 13:01

Biography of Kogan Vladimir Igorevich. The early years of a famous businessman, senior government positions

Belarusian banks: addresses, phone numbers, rating and reviews

Last modified: 2025-01-24 13:01

Do you want to know which are the most reliable Belarusian banks? You will find all the answers in this article. Here you will find ratings, reviews, addresses, phone numbers and other information about these banks

Bonuses "Thank you from Sberbank". Where to spend?

Last modified: 2025-01-24 13:01

Did you decide to become a member of the "Thank you from Sberbank" bonus program? Where to spend the accumulated points? Do not know? You should not worry, because there are a large number of outlets that are partners in this project

Grace period for lending. How to use it wisely

Last modified: 2025-01-24 13:01

More and more people use bank cards. The grace period for lending is an interesting opportunity for their owners, the main thing is to use it wisely. You can learn about what it is and how to get a loan from a bank without interest from the article

Correspondent account is something without which banks cannot work

Last modified: 2025-01-24 13:01

Correspondent account is a link for building relationships with foreign banks. Banks can open their accounts with foreign credit institutions. The latter, in turn, can do the same in domestic financial institutions

Profitable deposits in Rosselkhozbank: features and conditions for opening

Last modified: 2025-01-24 13:01

Every Russian has heard of such an organization as Rosselkhozbank. Which is not surprising, because it is one of the largest banks in our country. And he is also included in the highest reliability group in the ranking of the hundred best banks according to the well-known Forbes magazine. Many people open deposits in it

Mission of the bank: definition, features of formation and goals

Last modified: 2025-01-24 13:01

What is the bank's mission? What is it for and is it important? You will find answers to these questions and other interesting points in this article

Payoneer payment system: user and employee reviews

Last modified: 2025-01-24 13:01

Payoneer payment system: user reviews, features and benefits of this system, service capabilities

Checking a bank guarantee under 44-FZ. Unified Federal Register of Bank Guarantees

Last modified: 2025-01-24 13:01

How to verify a bank guarantee issued under a government order? What should be included in it so that the customer does not reject it? The article will help suppliers avoid fraud when obtaining a bank guarantee for purchases under the law 44-FZ

Non-cash money - what is it and how does it work?

Last modified: 2025-01-24 13:01

What is non-cash money, their types, functions of non-cash money, their advantages and disadvantages. How non-cash money works

Rosenergobank: reliability rating and interesting facts

Last modified: 2025-01-24 13:01

Surely many people have heard about such an organization as Rosenergobank. She is famous. Many people use her services. But before contacting the department, they find out its reliability rating. That's what I would like to talk about now