Banks

How to check the balance in Sberbank: methods, procedure

Last modified: 2025-01-24 13:01

Sberbank is the largest and most reliable Russian bank. Thousands of people in Russia use its services every day. This article will talk about how to check the card balance through Sberbank. What difficulties do citizens face in doing so?

Moscow Industrial Bank: rating of banks, services, bank president

Last modified: 2025-01-24 13:01

The banking sector has been actively developing in recent decades. Loans and other financial services are popular among the population. However, not all existing credit institutions are equally successful. Only the most famous and sought-after companies are included in the rating of banks. The Industrial Bank is one such organization. Let's find out more about it

How to apply for a loan in "Kaspiy Bank" via the Internet? Instructions, conditions and requirements

Last modified: 2025-01-24 13:01

How to apply for a loan in "Kaspiy Bank" via the Internet? What are the requirements for borrowers? What is the maximum amount and term of a loan in this bank? What is the Kaspi.kz application for? Where to download it and how to install it?

Mobile bank or how to transfer money via SMS to a Sberbank card

Last modified: 2025-01-24 13:01

In the digital age, smartphones have become so ingrained in our lives that we use them for a variety of purposes. Naturally, they did not bypass the sphere of banking operations. With the help of phones, we monitor the balance, open deposits and order cards. And gadgets make it very easy to transfer money between bank accounts

How to put money on a card through an ATM: procedure, check crediting

Last modified: 2025-01-24 13:01

Depositing funds through an ATM on a card is a simple operation that everyone can handle. But how to implement it? This article will talk about transferring money to a card through ATMs

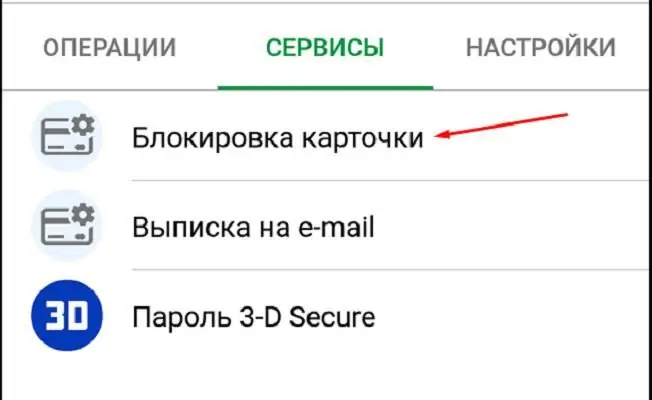

How to unlock a Belarusbank card: methods with instructions

Last modified: 2025-01-24 13:01

Belarusbank plastic cards are a convenient tool that can be used within your own country and abroad. They fit easily in your pocket, palm and purse. I went to the store, picked up various goods, swiped my card at the checkout, and paid. What could be easier? It's just that accidents happen sometimes. Yes, such that all the goods put in the basket have to be returned back to the store. This happens when the plastic does not work. How to unlock the card "Belarus

How to connect the Alfa-Bank mobile bank: basic methods, step-by-step instructions

Last modified: 2025-01-24 13:01

In the modern financial system, many organizations provide a very convenient, and at the same time modern service, which is called a mobile bank. It is required to obtain a password for transactions with a personal account, to pay for goods, replenish the balance of the phone, as well as to clarify information about the loan and its repayment period

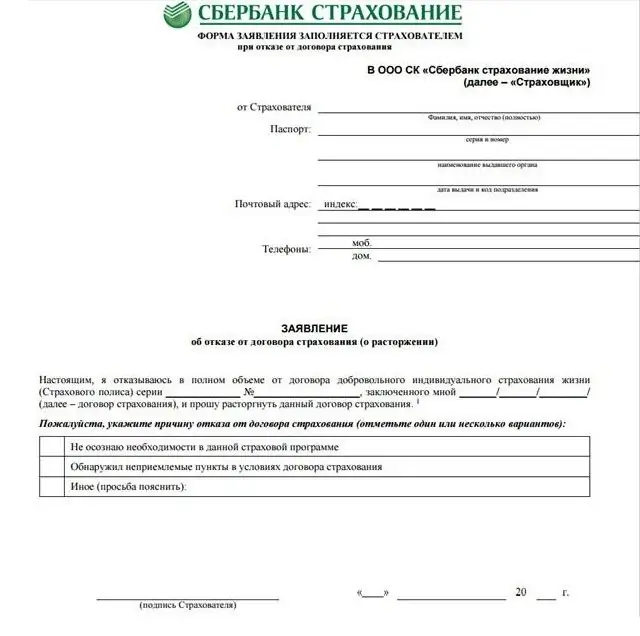

How to return insurance at Sberbank: types, procedures and a sample of filling out the form

Last modified: 2025-01-24 13:01

In our time, credit institutions are actively trying to increase their profits in a variety of ways. One of them is the purchase by the client of the policy when applying for any banking service. In this regard, you need to know how to return Sberbank insurance in case of early repayment of the loan. In order to have a complete understanding of this program, you need to know what it is

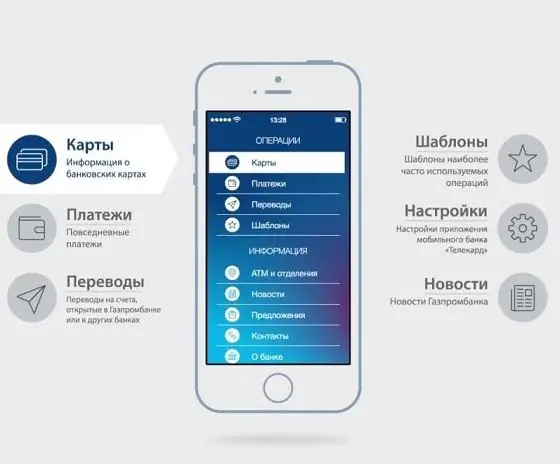

How to connect a mobile bank of Gazprombank via the Internet?

Last modified: 2025-01-24 13:01

Gazprombank is one of the credit institutions that keep pace with the times. It has recently been offering mobile banking services. This service is convenient for owners of portable mobile devices leading an active lifestyle. How to connect a mobile bank of Gazprombank? In what ways can this be done?

How to connect the "Mobile Bank" of "Rosselkhozbank": instructions, useful recommendations

Last modified: 2025-01-24 13:01

Modern opportunities are gaining popularity. This applies to almost all spheres of human activity. For example, in the banking sector, everything is created for the convenience of customers. The "Mobile Bank" service is especially popular, which allows you to make a considerable number of transactions, avoiding a personal visit to the office. It's convenient, simple and fast. After all, the client does not have to spend time visiting the operator to replenish the balance of the phone, pay for the order, etc

How to find out the pincode of a Sberbank card if you forgot: step by step instructions, recommendations and reviews

Last modified: 2025-01-24 13:01

The popularity of cash payments is gradually declining, and users prefer plastic cards. This is quite convenient, as it eliminates the need to carry money with you, and if you lose it, your savings will not be affected. After all, a bank card can be restored. Seemingly solid benefits

How to reset a credit history: procedure, required documents and examples

Last modified: 2025-01-24 13:01

In our society there is a serious problem - financial illiteracy. This is the reason why many people live their entire lives on loans. Sometimes payments exceed the average monthly earnings, and meanwhile the needs are growing. What to do? Our fellow citizens are looking for a way out, and specifically ways to reset a credit history (CI). Let's find out about this

Bank Tinkoff. How to pay a loan by contract number: instructions and methods

Last modified: 2025-01-24 13:01

"Tinkoff Bank" currently provides several types of loan services at once: credit cards with a limit, cash loans for debit plastic and mortgages through partner financial institutions. The product line of this structure is quite narrow. But lately, this company has gained a large client base (more than six million people), in this regard, the question of how to pay for a Tinkoff Bank loan is quite popular. Let's consider it further

How to calculate a differentiated loan?

Last modified: 2025-01-24 13:01

Loan products are popular among the population. Bank offices offer different conditions, but in any case, the potential client will have to return not only the loan amount, but also the accrued interest. On the one hand, it seems that everything is simple. However, not all clients know what the difference is between an annuity and a differentiated loan. Moreover, many do not delve into the terms of the contract and do not even know how payments are made. Let's set the difference

How to return a card from a Sberbank ATM on your own?

Last modified: 2025-01-24 13:01

When using a self-service device, there are situations in which it may not return a bank card. In the event that the ATM chewed up the plastic, what should the client do to adequately get out of the current situation and not panic? How to return a card from a Sberbank ATM?

How to close the Euroset Corn card via the Internet?

Last modified: 2025-01-24 13:01

This is a debit prepaid card with the possibility of opening credit limits. Such a card allows you to withdraw, replenish, transfer funds on fairly favorable terms. In addition, Euroset provides customers with bonus points that can be used through partners or in cellular retail

How to calculate the grace period on a credit card? What is the best credit card

Last modified: 2025-01-24 13:01

Credit cards have changed the perception of Russians about borrowed funds. Using a credit card is much more profitable than taking a consumer loan. Most bank limit cards have a grace period. By paying for purchases during this period and repaying the debt on time, the client does not pay interest to the bank. But few people know how to calculate the grace period on a credit card

How to replenish the Post Bank card: transfer methods, procedures, tips and tricks

Last modified: 2025-01-24 13:01

Bank customers actively use debit and credit cards. It's simple and convenient. However, not everyone knows how to replenish the Post Bank card. It is worth noting that credit institutions strive to make the most attractive service for customers, the use of which will not cause difficulties

Deposit insurance system: system participants, bank register and development in Russia

Last modified: 2025-01-24 13:01

The problem of ensuring the safety of cash deposits in banks is one of the main ones for the positive development of the country's economy. In order to ensure the stable functioning of the banking sector in Russia, a system of deposit insurance has been developed

The banking system of Russia: history, features and interesting facts

Last modified: 2025-01-24 13:01

The process of development of savings banks has become a turning point in the formation of the banking system of Russia. From them, a large financial organization, which we all know as Sberbank, traces its history. Its first cash desks were organized in two of the most significant cities of the state - Moscow and St. Petersburg. A significant event took place in 1842

How to get Sberbank credit cards: conditions and requirements for the borrower

Last modified: 2025-01-24 13:01

In our time, credit cards are increasingly integrated into the modern world. Now they can be used almost everywhere - you can pay with them in a grocery supermarket, an online store or pay utility bills. Almost all modern retail outlets now offer conditions for the convenience of paying for goods with a bank card. This article will discuss how to get a Sberbank credit card and what you need to present to the borrower

Deposit is Definition of concept, conditions, interest rate

Last modified: 2025-06-01 07:06

A deposit is a way of placing funds in a financial institution, which can be a commercial bank, an investment fund or a microfinance organization. Investments are made taking into account three main factors: safety, multiplication and transparency of the system. The conditions for placing a deposit are prescribed in a special agreement between a financial institution and an individual (legal) person

SMS does not come from Sberbank with a password to enter

Last modified: 2025-01-24 13:01

It often happens that SMS with a password from Sberbank does not arrive, although according to the rules, delivery should take no more than 2 minutes! There are many reasons why this might be happening. You can learn about them and methods of how to get the treasured message with random numbers in the proposed article

Settlement account of the bank and organization. What is the difference?

Last modified: 2025-01-24 13:01

Current account is a place of storage in non-cash form of free cash in ruble equivalent. It is opened to a legal entity, in some cases to an individual entrepreneur in a credit institution and is used for settlements with various counterparties

Control of cash operations of the bank. Overview of cash transactions control systems

Last modified: 2025-01-24 13:01

Since various kinds of fraud often occur in the field of cash register accounting, every year the control of cash transactions becomes more and more complicated, tougher and modernized. This article discusses the role of the cash desk in the enterprise, the rules of conduct, as well as methods and systems for monitoring operations

Credit from Sberbank

Last modified: 2025-01-24 13:01

It is impossible to effectively develop your business without additional investment, and here the "Trust" loan without collateral, which is provided by Sberbank, can help and can be the best way to solve financial problems

Sberbank credit card: user reviews

Last modified: 2025-01-24 13:01

Today, Sberbank offers citizens a huge selection of banking products. Credit cards are the most popular among them. What this card is, what it is for and how it works will be described in this article. Judging by the reviews, the Sberbank credit card for 50 days won its place in the hearts and wallets of the citizens of our country

Asia-Pacific Bank: reviews of bank customers on loans, deposits

Last modified: 2025-01-24 13:01

"Asia-Pacific Bank" is a universal bank that has been providing a full range of services to individuals and businesses for more than twenty years. It is a member of the deposit insurance system. The commercial bank is confidently included in the top hundred in terms of high financial performance of banking activities. The branch network of the credit institution is located in most regions of our country

Savings bank account: conditions, advantages and disadvantages

Last modified: 2025-01-24 13:01

This article describes such a relatively new banking product as a savings account. Readers will learn about the advantages of such accounts and their differences from the usual time deposits. In addition, the article reveals the advantages of a savings account over deposits

Debit cards "RosBank": types and reviews

Last modified: 2025-01-24 13:01

Additional privileges and banking services make debit cards even more attractive for customers. RosBank, along with other financial organizations, offers individuals to issue a payment document on favorable terms. In the article, we will consider tariff plans for card products and customer reviews about the level of service

Visa Platinum plastic card: privileges, discounts, additional services

Last modified: 2025-01-24 13:01

For those who want to get an extended service and become a VIP client of the bank, the Visa payment system offers Gold, Platinum and Infinite service programs. Each of them is an indicator of prestige, convenience and comfort anywhere in the world. But the Visa Platinum card, which will be discussed in the article, will receive special attention

On-lending at VTB 24: features of the procedure, documents and reviews

Last modified: 2025-06-01 07:06

Looking optimistically into the future, the borrower seems to be able to handle a long-term loan. But sometimes unforeseen circumstances arise, due to which it is not possible to repay the debt. The solution to this problem is refinancing. VTB 24, like other banks, has a loan refinancing program. In the article we will consider its conditions in detail

Bank cards with interest on the balance of own funds

Last modified: 2025-06-01 07:06

It is convenient and profitable to accumulate funds using deposit and savings accounts. True, you can’t take this money into account: they become available only after a certain period of time. To ensure that the funds were always at hand, and even increased, bank cards were developed with interest on the balance. Otherwise, they are called profitable. We learn about the percentage of popular debit cards and the conditions for their use from the article

How to repay a loan early at Sberbank: a description of the procedure and recommendations

Last modified: 2025-01-24 13:01

Sberbank allows, if desired, to repay the entire amount of the debt or part of it. To carry out the operation, the borrower will need to visit the service office and contact a specialist in lending to the population

Banking services package "Supercard" ("Rosbank"): reviews, conditions, tariffs

Last modified: 2025-06-01 07:06

"Supercard" from Rosbank is not just a debit card in its classic form, but a large package of services, which includes many interesting offers. According to the financial institution, the holders of such plastic receive "super benefits". What is so unusual that the bank offers its potential and current customers? Rosbank described "Sverkhkarta" as a profitable product for users with above-average income

Currency deposit of Sberbank for individuals

Last modified: 2025-06-01 07:06

Sberbank of Russia offers individuals an impressive number of deposit programs. You can open an account both in rubles and in foreign currency. Most deposits are in euros or US dollars, but it is possible to save less common banknotes - francs, yen and pounds sterling

Terms of use of the Sberbank credit card: description, instructions and reviews

Last modified: 2025-01-24 13:01

To use a loan on the most favorable terms for yourself, you should know the rules for using a Sberbank credit card

Sberbank: deposits. Pension deposit on favorable terms

Last modified: 2025-06-01 07:06

Sberbank of Russia is one of the most stable financial institutions in the country. This is confirmed by statistics: about 50% of depositors chose this particular bank to store and accumulate their funds. The deposit policy here is based on three products: "Save", "Manage" and "Replenish". There is also a pension contribution from Sberbank of Russia, as well as short-term deposit programs for the elderly

Debit card "Tinkoff Black": reviews of the owners. Terms, rates

Last modified: 2025-06-01 07:06

In the article, we will consider the conditions for obtaining it and the package of services provided by the bank with Tinkoff Black. Customer reviews about the card will allow the potential user to form a real idea about it and make the right choice for themselves

IIS in Sberbank: reviews, opening conditions, rules for depositing funds and profitability

Last modified: 2025-01-24 13:01

Since 2015, it has been offered to open an individual investment account, which provides a good profit. In fact, this is a depository contribution to brokerage accounts, the income from which can be received in the form of tax deductions, as well as in the form of interest due to competent cash management

Depository services for individuals: tariffs, reviews. Banking services for legal entities

Last modified: 2025-01-24 13:01

Depository services are a type of commercial services that are associated with the storage of securities, as well as operations to change their owner. An organization that has a license to carry out depository activities enters into an agreement with a shareholder who transfers his assets to it for storage

Reviews about Tinkoff Bank: customer opinions

Last modified: 2025-01-24 13:01

Even if the reviews about Tinkoff Bank are bad, it doesn't change anything - it continues to exist successfully. And are such attacks directed at him really objective? Read about the activities of the bank below

Oleg Tinkov: photo, success story, condition. Biography of Oleg Tinkov

Last modified: 2025-01-24 13:01

The biography of Oleg Tinkov is very interesting and informative. In this article we will talk about the life of a famous entrepreneur, his business and success story

National Russian Commercial Bank: services, reviews and offers

Last modified: 2025-01-24 13:01

The National Russian Commercial Bank is considered one of the first organizations in Russia to start lending to residents of the Crimean peninsula. Many banks are still afraid to issue such loans. They require proof of income and various certificates. RNCB offers loans and deposits for all categories of citizens at the most optimal interest rates and conditions

How to get a "Mnogo.ru" card: step by step instructions, documents and reviews

Last modified: 2025-01-24 13:01

Bonus programs are very popular among the population. One such program is Mnogo.ru. The article describes the types of cards, how to obtain and activate them. What gifts can be received for the accumulated bonuses and in what way. The reviews of users and members of the club "Mnogo.ru" are given

Who is en titled to compensation for deposits in 1991?

Last modified: 2025-01-24 13:01

Compensation on deposits is still happening today. To each depositor who lost all his savings in 1991, the state undertakes to compensate for the losses. A special scheme has been developed for this, all you need is just to contact Sberbank

The best deposit in the best bank in Moscow

Last modified: 2025-01-24 13:01

Financers who have a serious approach to economic strategies are guided by the rule: money can multiply when it works

What is an online checkout and how does it work?

Last modified: 2025-06-01 07:06

According to the law, all those who are engaged in retail trade and sell something must have a cash register. However, more recently, a new concept has appeared - online cash registers. Changes in the Federal Law since 2017 oblige all retailers to replace a conventional device with an Internet cash register

Targeted loan - affordable housing

Last modified: 2025-01-24 13:01

A targeted loan will help you buy your own home. Many banks today offer various lending programs. What is the difference?

What is the bank interest?

Last modified: 2025-01-24 13:01

It should be borne in mind that bank interest is a fairly broad concept. There are at least three of its varieties: interest rate on deposits and deposits; on loans; on interbank loans

State bank. Banks with state participation

Last modified: 2025-01-24 13:01

State banks - the "fifth wheel" of the economy or a necessary financial institution? What are the features of the work of these institutions in Russia?

Interbank settlements and their importance in the banking system

Last modified: 2025-06-01 07:06

Interbank settlements take place when the recipient and the payer are account holders in different banks. All transactions between financial institutions through correspondent accounts are organized in two ways: using centralized and decentralized systems

Security. Types and brief description

Last modified: 2025-01-24 13:01

You can invest capital in completely different areas of activity and objects. One of the popular areas for making a profit is such an economic category as a security. There are many types of them, so it is quite difficult to understand this issue. It is impossible to place a detailed description of each paper within the framework of just one article, therefore, only brief descriptions are presented in this material

What are uncertificated securities? Russian securities market

Last modified: 2025-01-24 13:01

The financial market includes several sectors. One of them is the stock exchange. The securities market is a source of receipt and redistribution of funds. Investors buy shares of promising companies and banks, accelerating their growth. There are documentary and non-documentary securities in circulation here. The features of their functioning will be discussed in the article

Systemically important banks: list. Systemically important banks in Russia

Last modified: 2025-01-24 13:01

The Central Bank of the Russian Federation has formed a list of systemically important banks in Russia. What are the criteria for classifying financial institutions as such institutions? Which banks are included in the respective list?

Demand deposit: advantages, disadvantages, design nuances

Last modified: 2025-01-24 13:01

Keeping money at home is not safe - this statement is an axiom for many. But making a bank deposit is also not always convenient, because there are situations when at any time you may urgently need part of the amount (or all). Many people solve this problem by opening a demand deposit: the money is safe and you can withdraw it at any time

Sberbank certificate: what it is

Last modified: 2025-01-24 13:01

At the moment when a person has free money, he wants not only to keep it, but also to increase it. Now we will talk about what a Sberbank certificate is and how it differs from deposits. So what is a savings certificate?

Promissory note: the essence of the paper, sample filling, maturities

Last modified: 2025-01-24 13:01

Promissory note is a kind of security designed to determine the financial relationship between business entities. The bill was introduced into circulation in ancient times. As a universal settlement tool, it is still actively used in the circulation of financial resources

Payroll projects of the bank

Last modified: 2025-01-24 13:01

You get your salary on the card. Did you know that before that, your employer entered into a special agreement with the bank, in which he instructed the banking institution to make payments to your card account? This service is called payroll

Types of bank deposits and their characteristics

Last modified: 2025-01-24 13:01

Do you want to have a financial airbag in our unstable time? Time to make a deposit in the bank! Find out what bank deposits are and find the best way for you to save and grow your money among a variety of financial offers

Demand deposits are Peculiarities of demand deposits

Last modified: 2025-01-24 13:01

Demand deposits are instruments that enable customers to use the funds placed on them at any time according to their requirement. Their main advantage is high liquidity along with the possibility of their use as a means of payment. The disadvantage is a rather low percentage in comparison with urgent counterparts

"Asia-Pacific Bank" in Ulan-Ude: branch addresses and opening hours

Last modified: 2025-01-24 13:01

This bank is one of the largest in the Siberian and Far Eastern districts and is in the top 100 banks in the Russian Federation. It has been operating on the territory of the Russian Federation for 26 years - since February 1992, changing its name many times. In 2006, along with all organizational and legal changes, this bank was renamed to "Asia-Pacific Bank", which still exists

Banking remote service - use and development

Last modified: 2025-01-24 13:01

Remote servicing is included in the list of services provided by 80% of Russian banks. Banking remote service is a technology developed specifically for remote work with a bank. Banking remote service involves several different types of services. The formation and development of RBS in Russia is somewhat different from banking systems in other countries

Term deposit is one of the safest ways to save money

Last modified: 2025-01-24 13:01

One of the most reliable options for storing savings is a term deposit opened in a time-tested bank. The main difference between such deposit programs and the rest is that the contract clearly specifies the period of their validity. At the same time, it is precisely on term bank deposits that the client is offered the maximum interest

"Platinum Bank": reviews. "Platinum Bank": how to get a loan?

Last modified: 2025-06-01 07:06

How to choose the right bank? You should probably pay attention to the reviews. "Platinum Bank" is discussed on the network quite often, it makes sense to analyze the opinions of customers and draw conclusions

Good bank with the best interest on deposits

Last modified: 2025-01-24 13:01

For everyone who has certain savings and would like to increase them, it is important to find a good bank with favorable interest rates on deposits. Considering the conditions offered by Russian banks, attention should be paid to many nuances: terms, rates, the possibility of replenishment or debit transactions, capitalization

How to make a transfer through 900 to a Sberbank card

Last modified: 2025-01-24 13:01

Sberbank allows you to transfer money from card to card and from phone to plastic using a mobile device. This article will tell you how to conduct the corresponding transaction through the number 900

Reviews about Sberbank customers and employees

Last modified: 2025-01-24 13:01

Sberbank today openly competes in the banking services market with other commercial credit institutions. The bank keeps up with the times of financial and technological changes. Judging by the reviews about Sberbank, it not only constantly introduces modern banking trends, but also outstrips many of its competitors along the way

Gold Bar - Invest Wisely

Last modified: 2025-01-24 13:01

Increasingly, gold bars in our time are becoming an investment object. However, not everyone understands that when buying a gold bar, it is important to take into account many nuances

Consumer loan in "OTP-Bank" - features, conditions and reviews

Last modified: 2025-01-24 13:01

Consumer credit today is one of the most popular products of banking organizations. This is very convenient for bank customers, since they have the opportunity to timely purchase any goods and services on favorable terms, without waiting for wages or other cash receipts

Sberbank: how to get a card for a pensioner?

Last modified: 2025-01-24 13:01

The article tells how to get a card for a pensioner at Sberbank. And also about how to get a loan there for those who, due to old age, are denied in many other credit institutions

Sberbank credit card - features of choice

Last modified: 2025-01-24 13:01

Are you old fashioned and don't trust plastic progress? Is cash more important to you than just a bank account? Pay a little attention to this article and your stereotypes about credit cards will completely evaporate

What is a banking product

Last modified: 2025-01-24 13:01

A specific banking product of a bank is a way to satisfy a client's needs. Currently, there are about 200 different ways to make the latter satisfied

Which bank is more profitable to open a deposit: interest rates, conditions

Last modified: 2025-06-01 07:06

Few keep their savings at home these days. And why, if there are a huge number of banks offering their potential customers to open a deposit in their organization and get profit from their amount in the form of interest charges? It's tempting. But everyone wants to get the most favorable conditions. Well, for starters, you should familiarize yourself with the most popular offers, and then make a decision regarding where exactly you can apply

How to get a credit card and in which bank

Last modified: 2025-01-24 13:01

How and where to get a credit card, citizens are wondering both those who have debts to banks and those who are thinking about taking a loan. Citizens are regularly faced with offers to borrow, and someone, on the contrary, is constantly denied for each of their appeals

Bank transfer - money delivery with comfort

Last modified: 2025-01-24 13:01

Each of us at least once in our lives faced with the need to transfer money to someone or receive a money transfer from someone. The first solution that comes to mind and turns out to be the most convenient is a bank transfer. It allows you to quickly and, most importantly, securely send money to another person. What types of transfers does Sberbank offer its customers?

How to quickly transfer money: all ways

Last modified: 2025-01-24 13:01

Fast money transfers are very much loved by society and easily entered into everyday life due to their convenience and ease of execution. This article discusses the best and most reliable methods of transfers using bank cards and online transactions, as well as simple transfer schemes that everyone can handle

Blockchain technology: what is it and who needs it

Last modified: 2025-01-24 13:01

Blockchain is a public database of transactions made in the Bitcoin system. With its help, each user can find out how much Bitcoin was at a particular address in a given period. Read more about what Blockchain technology is

Operating day - part of the working day of a banking institution. Bank working hours

Last modified: 2025-01-24 13:01

A transaction day is an accounting transaction cycle for the corresponding calendar date, during which all transactions are processed. They should be reflected in off-balance sheet and balance sheet accounts through the preparation of a daily balance sheet

Lehman Brothers: the story of the success and failure of the famous bank

Last modified: 2025-01-24 13:01

In American history, there have been many failures of large financial corporations. One of the most recent and significant among them is the bankruptcy of Lehman Brothers, a bank that was previously considered one of the world leaders in the investment business and ranked fourth in this area in the United States

What is a savings bank? In what year did the first savings bank appear?

Last modified: 2025-01-24 13:01

Today, the phrase "savings bank" is no longer widely used, and we don't even think that the country's leading bank - Sberbank - grew out of this phenomenon. Where did this financial phenomenon come from and how does it work? Let's talk about the year in which the savings bank appeared, who was the first to come up with this mechanism, and how the savings banks evolved into modern credit institutions

What you need to know to open a bank account

Last modified: 2025-01-24 13:01

Today, both a legal entity and an individual can open a bank account. Moreover, there is no information on restrictions in this regard in any legislative act of the Russian Federation

And which banks do not check credit history?

Last modified: 2025-01-24 13:01

Why do you need to know which banks do not check credit history? Everything is simple here. This is usually needed by borrowers who have past due on their obligations in the past. By the way, for some lenders, this is not too important. But it also happens the other way around

What are and how bank cards differ from each other

Last modified: 2025-01-24 13:01

For a long time bank cards have become an essential attribute of a modern person. There are several varieties of them, which are quite seriously different from each other in the first place

Your account number: where to see what happens and so on

Last modified: 2025-01-24 13:01

In our time, the account number is a category known to everyone. Everyone has at least one such identification code, consisting of a certain number of digits. And most of the time it's related to finances

How does a sole proprietor's bank account open

Last modified: 2025-01-24 13:01

Today, opening a bank account for an individual entrepreneur is a procedure verified to the smallest detail, and therefore does not take much time. You should follow certain steps so that everything goes smoothly

Don't know how to check the balance of a Sberbank card? It's very simple

Last modified: 2025-01-24 13:01

Most of the holders know how to check the balance of a Sberbank card. As you know, this action can be performed in several ways. Ideally, you should know all of them. Thanks to this, you will never experience inconvenience if one of the methods is not available

What information do we get from the terms of the loan

Last modified: 2025-01-24 13:01

To receive the required amount of money in a banking institution, you must fulfill all the conditions of the loan. They concern not only the solvency of the borrower, but also his education, property in possession, and so on

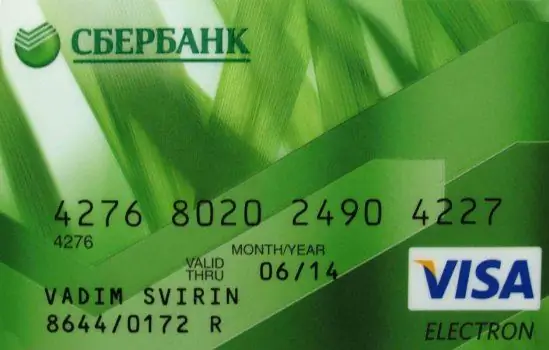

Where to look for a bank card number and why does the holder need it at all?

Last modified: 2025-01-24 13:01

Agree that it is very difficult not to notice the bank card number. At the same time, not everyone understands its main purpose. Moreover, these sixteen digits are often confused with a card account, which is completely wrong

Settlement account for individual entrepreneurs: a necessity or a nice addition?

Last modified: 2025-01-24 13:01

Due to the rapid growth of support for small businesses, more and more often, aspiring entrepreneurs face the question of how to open a current account for individual entrepreneurs. Some even prefer to do without it, but you should know that in some situations you simply cannot do without RS:

PayPal payment system in Russia, Ukraine and Belarus: reviews

Last modified: 2025-06-01 07:06

What is the PayPal payment system? What are the features of opening an account? Restrictions on the use of the system by citizens of Russia, Ukraine, Belarus. How to withdraw funds from PayPal in Ukraine? Reviews and recommendations from experienced users

A current bank account will save you from many problems

Last modified: 2025-01-24 13:01

Surprisingly, but a current bank account can save you from many problems: constant search for change, money theft, etc. Opening a current account is an opportunity to pay with a bank card in all corners of the world

Sberbank ATM - how to use?

Last modified: 2025-01-24 13:01

Each owner of a plastic bank card sooner or later has to use an ATM. Let's talk in this article about Sberbank ATMs. What do you need to use a Sberbank ATM?

How, where and how much is a Sberbank card made?

Last modified: 2025-01-24 13:01

Sberbank is one of the most popular banks in Russia and some CIS countries. Accordingly, the range of services is appropriate, any citizen has the opportunity to become a bank client instantly by issuing an instant card, or become the owner of a personalized debit card

Grace period credit card

Last modified: 2025-01-24 13:01

Any self-respecting bank today issues credit cards to its customers. Their main feature is an interest-free or grace period for using the institution's money, or grace-period

Bank plastic: how to find out the card account number

Last modified: 2025-01-24 13:01

Few bank plastic holders know how to find out the card account number. There are several ways to find out this information. You just need to understand where to look and who to contact

What are bank details?

Last modified: 2025-01-24 13:01

The article talks about the concept, meaning and components of bank details, as well as where you can find the necessary information

Several ways to find out the personal account of a Sberbank card

Last modified: 2025-01-24 13:01

One of the most common banks is Sberbank. However, many people have not yet fully understood the system of its work

Credit line: the main advantages of this form of borrowing

Last modified: 2025-01-24 13:01

In the standard sense, the term "loan" is perceived as a one-time issuance of a certain amount of money to the borrower, followed by their return, taking into account the interest that acts as a payment for the use of the provided resources. However, recently in banking practice, such a form of borrowing as a credit line has become widespread

International money transfers: description, list of systems, implementation features

Last modified: 2025-01-24 13:01

What are the ways to transfer money to other countries? How to make a transfer through a bank account? Features of filling out a payment order. Restrictions for sending money. What are the translation systems? How to choose the right translation company? How to return the translation and correct the error in it?