Taxes

Deduction of taxes when buying a car. How to get a tax deduction when buying a car

Last modified: 2025-01-24 13:01

Tax deductions are quite an interesting question that interests many. Of course, because you can get back 13% of the transaction! But is there such an opportunity when buying a car? And what is required for this deduction?

Documents for deduction for an apartment. Making a tax deduction when buying an apartment

Last modified: 2025-01-24 13:01

Tax deductions are what many citizens are interested in. After all, you can return to yourself a part of the funds spent after the completion of a particular transaction. How it's done? What documents are needed for deduction when buying an apartment?

Progressive tax is Progressive tax scale

Last modified: 2025-01-24 13:01

The first attempt to introduce progressive taxation was made in Russia in 1810. This was due to the exhaustion of the economy by the war with Napoleon. As a result, the exchange rate of the paper ruble fell sharply. The progressive tax system assumed an initial rate of 500 rubles, which gradually increased to 10% of net profit

Deadline for filing income tax return. What is required for income tax refund

Last modified: 2025-01-24 13:01

Income tax refund is very important for many citizens. Everyone has the right to return a certain percentage of the funds spent. But what documents are needed for this? And how long will they make the so-called deduction?

Deadline for filing income tax returns. tax report

Last modified: 2025-01-24 13:01

Tax reporting is something you can't do without. If you do not report to the state for the funds received and spent, you can get a lot of problems. What deadlines are set for citizens and organizations in Russia in this sense?

Income tax on wages with one child. Income Tax Benefits

Last modified: 2025-01-24 13:01

Today we will learn how income tax is calculated from a salary with one child. This process is already familiar to many citizens. After all, families often enjoy a variety of benefits. Why not, if the state gives such an opportunity?

What is the tax when selling a car less than 3 years old

Last modified: 2025-01-24 13:01

Tax on the sale of a car less than 3 years old is quite a common and legal matter. Citizens have long been accustomed to the fact that the tax system of the Russian Federation has many features. About them, but in relation to transactions for the sale of vehicles, we will talk. After all, it is always interesting what to prepare for. Maybe it's better to wait a while to make a deal at a later time? Of course, everyone decides for himself

How to calculate income tax: an example. How to calculate income tax correctly?

Last modified: 2025-01-24 13:01

All adult citizens pay certain taxes. Only some of them can be reduced, and calculated exactly on their own. The most common tax is income tax. It is also called income tax. What are the features of this contribution to the state treasury?

What is the tax on an apartment for pensioners

Last modified: 2025-01-24 13:01

Real estate is taxed. This is no secret to anyone. But what about retirees? In Russia, this category of citizens belongs to beneficiaries. They have their privileges in this matter. What exactly? What kind of apartment taxes should pensioners pay?

What is the property tax for retirees? Reimbursement of property tax for pensioners

Last modified: 2025-01-24 13:01

Taxes are an important obligation of citizens. Almost everyone has to pay. Some categories of citizens are completely exempted from these obligations, someone only receives a tax rebate. What can be said about pensioners?

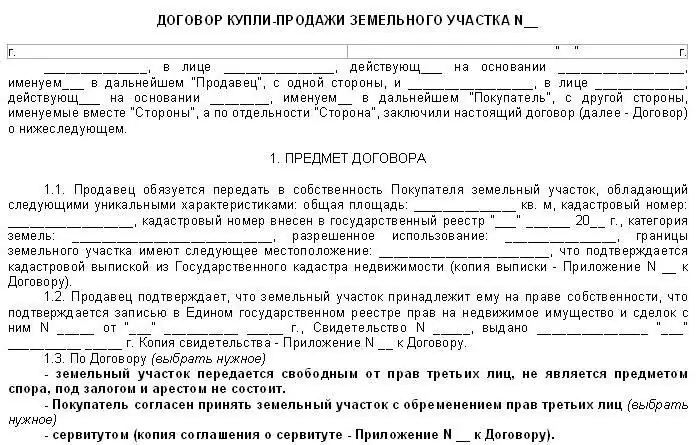

Tax on the sale of land. Do I have to pay tax on the sale of land?

Last modified: 2025-01-24 13:01

Today we will be interested in the tax on the sale of land. For many, this topic becomes really important. After all, when receiving this or that income, citizens must make certain payments (interest) to the state treasury. With only a few exceptions. If this is not done, then you can run into many problems

Transport tax in Bashkiria. Vehicle tax rate in 2014

Last modified: 2025-01-24 13:01

Transport tax is everywhere. And in Bashkiria too. How much and how will drivers have to pay in 2014? Is it possible to evade this tax?

Transport tax in the Samara region. Tax rates by region

Last modified: 2025-01-24 13:01

Transport tax is a huge headache for drivers and car owners. The main problem is that it is this pen alty in each subject of the Russian Federation that is established on an individual basis. Today we will learn everything about the transport tax in the Samara region

How to find out tax arrears. How to view "My taxes" in the taxpayer's personal account

Last modified: 2025-01-24 13:01

Don't know how to view "My Taxes" online? For action, the modern user is provided with a very good choice of alternative approaches. And today we have to meet them

Transport tax in the Krasnodar Territory. Transport tax: rates, calculation

Last modified: 2025-01-24 13:01

Taxes are an important moment in the life of every citizen. And it has many features. Today we will be interested in the transport tax in the Krasnodar Territory. How much should you pay for a car? How to keep count?

Transport tax in the Rostov region. Transport tax for legal entities

Last modified: 2025-01-24 13:01

Transport tax is a payment that worries many drivers. What amounts and in what order should residents of the Rostov region pay for their car? Can the payment be avoided?

How to check car tax? How to find out the debt?

Last modified: 2025-01-24 13:01

Many citizens are wondering how to check the car tax. This is quite normal. After all, different payments tend to get lost at the most inopportune moment. And all taxes and other receipts have to be paid on time. Otherwise, there will be a lot of problems. So today we will find out everything related to the transport tax: what it is, how to find out, how to calculate, what are the payment methods. This information is very useful for drivers, especially beginners

Retirement property tax benefits. tax code

Last modified: 2025-01-24 13:01

The Tax Code is an important document that regulates the rules for making payments to the state treasury. It prescribes all the rules, terms and benefits in relation to certain citizens. What can retirees expect in terms of taxes? What is provided for them in Russia?

When will the transport tax be canceled in Russia, will it be canceled?

Last modified: 2025-01-24 13:01

Taxes are a huge problem for many. And some of these payments are promised to be cancelled. Will this proposal affect transport tax in Russia?

Who is exempt from paying transport tax (2014)?

Last modified: 2025-01-24 13:01

Taxes is a word that can intimidate even the most courageous person. No one can hide from them. Many modern citizens drive cars. They have to pay road tax. Who is exempt from paying?

Tax rate for transport tax. How to find the tax rate for the transport tax?

Last modified: 2025-01-24 13:01

Today we are interested in the tax rate for transport tax. And not only it, but in general taxes that are paid for the fact that you have this or that means of transportation. What are the features here? How to make calculations? What is the due date for paying transport tax?

How to pay the transport tax. Transport tax rate

Last modified: 2025-01-24 13:01

Transport tax is a huge problem for many taxpayers. How to pay for it? How to correctly calculate the payment amount? And who has the right not to pay for it? About all this - more

Fine is additional revenue to the budget

Last modified: 2025-01-24 13:01

Fee is a certain amount of money that is payable by a taxpayer who has not repaid his debts on time. This payment is regulated by the relevant tax legislation (Article 75 of the Tax Code of the Russian Federation)

Gifts between close relatives are tax free or taxable?

Last modified: 2025-01-24 13:01

A donation agreement between close relatives plays an important role for many. In particular, due to the fact that real estate is not divided under the appropriate agreement (even if people are married). That is, if parents give a married child, for example, an apartment, you can not be afraid that after a divorce it will be jointly acquired property. Giving is a kind of confidence in the future

Tax on donation of real estate to a non-relative: features

Last modified: 2025-01-24 13:01

Gift - the most common form of transfer of property from one person to another. And this process has a huge number of features. For example, paying taxes. What are the features here? Who and in what amounts should pay the corresponding tax?

Sold the car, do I need to file a declaration? Machine sale declaration

Last modified: 2025-01-24 13:01

What to do when you've sold your car? Is it necessary to file a declaration for such a transaction? How to do it if needed?

How to pay taxes online? Everything is very simple

Last modified: 2025-01-24 13:01

Practically all entrepreneurs and businessmen are well aware of how inconvenient and impractical the procedure for paying taxes in our country, invented in the era of socialism. I have to “knock down” the thresholds of officials myself, stand in long lines, fill out a lot of receipts … And finally, the situation has changed. Officials have developed an electronic public services service, and now it is possible to pay taxes using the World Wide Web

Taxation - what is it? Objects of taxation

Last modified: 2025-01-24 13:01

Each business entity in the course of operating activities is faced with the practice of taxation. Therefore, in order to successfully conduct business that does not contradict the current legislation, it is necessary to clearly understand not only the essence of this concept, but also to conduct a competent fiscal planning policy

The tax system is an effective instrument of public policy

Last modified: 2025-01-24 13:01

The tax system is a set of taxes and fees that are levied on business entities and ordinary citizens in accordance with relevant legislation (for example, the Tax Code). The need for its existence is due to functional state tasks, and the stages of development depend on the historical features of the evolution of statehood

How to get a tax refund on the purchase of an apartment? All the nuances of a property deduction

Last modified: 2025-01-24 13:01

Every working citizen of his country is obliged to pay taxes. Thanks to this, the state can provide people living on its territory with free medicine and education, as well as protect the borders and maintain order inside. True, citizens are given the opportunity to return the tax on the purchase of an apartment in case of payment for tuition and expensive treatment. It is only necessary to collect the documents on time and correctly

Tax control is an effective instrument of tax policy

Last modified: 2025-01-24 13:01

Tax control is a professional activity of authorized bodies, implemented in certain forms to obtain information on compliance with the relevant legislation, followed by verification of the timeliness and completeness of payment of obligations by payers

How to calculate interest on taxes? Let's figure it out together

Last modified: 2025-01-24 13:01

What are pen alties? This is the amount of money accrued to the taxpayer who pays the debt later than the deadline established by law. How to calculate pen alties with and without changing the tax refinancing rate, you will learn from this article

Taxes and their types: full information

Last modified: 2025-01-24 13:01

Every person who wants to run his own business should know what taxes are and their types. You can learn about what a tax in the Russian Federation is from the eighth article of the first part of the Tax Code. Here, this concept is revealed as a gratuitous payment of a mandatory nature, which is taken from organizations and individuals in cash in order to ensure the activities of state and municipal entities

What is VAT? How to deduct VAT?

Last modified: 2025-01-24 13:01

Value Added Tax, or VAT, was first used in France. The famous French economist M. Lore used this phrase as early as 1954. Four years later, this type of tax became mandatory for all citizens of this country

Tax residents of the Russian Federation are What does "tax resident of the Russian Federation" mean?

Last modified: 2025-01-24 13:01

International law widely uses the concept of "tax resident" in its work. The Tax Code of the Russian Federation contains fairly complete explanations of this term. The provisions also set out the rights and obligations for this category. Further in the article we will analyze in more detail what a tax resident of the Russian Federation is

Deductions to the budget. Tax on childlessness in the USSR

Last modified: 2025-01-24 13:01

Tax should be understood as a gratuitous obligatory payment. It is levied by state authorities of various levels from an individual and an organization. Taxes are divided into indirect and direct. For example, among the latter was the tax on childlessness in the USSR. What it is? What was it for? Does this type of collection exist today? More on this later in the article

List of cars subject to luxury tax. How to get acquainted with it?

Last modified: 2025-01-24 13:01

Currently, officials are trying in every way to replenish the state treasury with additional income. Increasingly, Russian society is talking about the fact that we althy people should pay to the country's budget more than others, because they have expensive apartments, planes, cars, yachts

Is it possible to get income tax refund when buying a car? Documents for income tax refund for education, treatment, purchase of housing

Last modified: 2025-01-24 13:01

Any officially employed person knows that every month the employer transfers income tax from his salary to the Federal Tax Service. It makes up 13% of income. This is a necessity, and we have to put up with it. However, it is worth knowing that there are a number of cases when you can return the paid income tax, or at least part of it

An example of an indirect tax. tax code

Last modified: 2025-06-01 07:06

VAT is a classic example of an indirect tax. In addition, the method of its correct determination requires professional audit knowledge. The more traditional indirect tax is the excise. This article is devoted to their review

How to find out the transport tax debt?

Last modified: 2025-01-24 13:01

If you own a personal vehicle, you must pay the appropriate taxes on time. However, most citizens think little about this and remember them when a certain and already rather large amount of overdue obligations is discovered. Therefore, conscious and responsible residents of the state should independently check their "financial tails" from time to time

What taxes do sole proprietors pay? What taxes are subject to I?

Last modified: 2025-01-24 13:01

The question of what taxes are paid by individual entrepreneurs, of course, worries all people who want to do business. Indeed, information must be collected in advance, even before the start of direct business, because the size of payments will significantly affect financial success. The article describes in detail what taxes are subject to individual entrepreneurs, how to calculate them and how often to pay

Simplified tax system for LLC. taxation law

Last modified: 2025-01-24 13:01

Currently, for every entrepreneur, the types of taxation for LLCs are a rather difficult issue. In this regard, you should make the right choice. No matter how entrepreneurs want to register with the tax service, they will have to do this and make monthly payments. You can’t do without it if you don’t want to be held accountable in accordance with the current legislation

How to find out the tax debt of individuals by TIN?

Last modified: 2025-01-24 13:01

In the modern world, every citizen must make timely payment of taxes and all kinds of fees. Responsible residents of the state carry out this procedure on their own without any reminders from the relevant services. However, the majority may not be aware that they have a certain amount of obligations

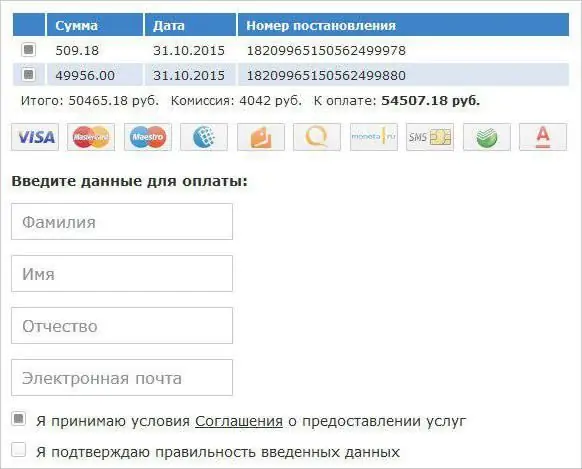

How to pay taxes online. How to find out and pay transport, land and road tax via the Internet

Last modified: 2025-01-24 13:01

Federal Tax Service, in order to save time and create convenience for taxpayers, has implemented such a service as paying taxes online. Now you can go through all the stages - from the formation of a payment order to the direct transfer of money in favor of the Federal Tax Service - while sitting at home at your computer. And then we will take a closer look at how to pay taxes online easily and quickly

How to pay transport tax through "Gosuslugi"? Pay taxes online, through a bank

Last modified: 2025-01-24 13:01

How to pay transport tax through "Gosuslugi"? In truth, this issue worries many modern citizens. After all, you don’t always want to stand in line at the bank for a long time in order to pay off the state. Sometimes online payment is much faster and more convenient. Fortunately, this possibility officially takes place. Now we will try to understand how to pay the transport tax through the "Gosuslugi" or in any other way

What is the pen alty for not filing a tax return?

Last modified: 2025-01-24 13:01

The Tax Code of the Russian Federation imposes on subjects the obligation to submit reports to the regulatory authority, if it is provided for in the relevant legislation. The payer sends documents to the inspection at the place of registration

How to find out the car tax? Transport tax

Last modified: 2025-01-24 13:01

Any owner of a vehicle must pay tax on it, which is mandatory. This instruction contains the Tax Code. How to find out car tax? We multiply the base rate of transport tax, which is valid in the region of residence, by the number of horsepower

Legalization - what is it? Legalization of documents and income

Last modified: 2025-01-24 13:01

What is legalization? Is it always associated with crime? And what is the legalization of documents and income?

Pen alty for late submission of the declaration. Pen alty for late submission of VAT returns

Last modified: 2025-01-24 13:01

Today there are quite a few tools that an accountant can use. However, in practice, there are malfunctions in the functioning of the software, a human factor, various unforeseen circumstances that lead to a violation of the requirements of the NDT. Accordingly, non-compliance with the requirements of the law implies the application of sanctions to the perpetrators. One of them is the pen alty for late submission of the declaration

What taxes do citizens of the Russian Federation pay. How much taxes do citizens pay

Last modified: 2025-01-24 13:01

How many taxes are available to citizens of the Russian Federation? How much do the most popular taxes take?

Tax on deposits of individuals: calculation procedure, interest

Last modified: 2025-06-01 07:06

Most of the depositors do not think about the tax on deposits of individuals. Having opened a deposit, the client expects to receive the amount calculated by him based on the term, the interest rate of the deposit. And it often comes as a surprise to him that taxes must be paid on the profits received

Tinting tax in Russia. Bill to allow tinting for tax

Last modified: 2025-01-24 13:01

The Ministry of Internal Affairs is developing amendments that will increase the punishment for driving a vehicle with tinted windows. The question of whether a tax on tinting will be introduced has long been discussed

UTII tax period. Single tax on imputed income for certain types of activities

Last modified: 2025-01-24 13:01

UTII is the preferred tax for many Russian entrepreneurs. What is the reason for its demand? What are its main features?

Tax on an apartment: how to find out the debt?

Last modified: 2025-06-01 07:06

The object for calculating property tax is the real estate of individuals. The Inspectorate annually sends notices to payers. Read more about how the apartment tax is calculated, how to find out the amount of the debt, if you do not agree with the numbers on the receipt, read on

What taxes do firms pay in Russia?

Last modified: 2025-01-24 13:01

Taxes are the main source of replenishment of the state budget. The obligation to transfer them to the treasury is largely the responsibility of commercial firms. What are the main taxes paid by Russian organizations?

Property tax under USN IP, LLC

Last modified: 2025-06-01 07:06

Until recently, enterprises using the simplified tax system did not pay property tax, which was one of the advantages of the simplified taxation system. With the introduction of new legislative acts from 2015, simplified firms are required to transfer this tax to the budget

Giving an apartment to a relative: gift tax

Last modified: 2025-01-24 13:01

Apartment, like any property, can be donated. As a rule, they give property to relatives. Let's talk about the nuances of this procedure, the procedure for its execution and find out in which cases a donated apartment is taxed, and when this can be legally avoided

Transport tax return. Sample filling and deadlines for filing a declaration

Last modified: 2025-01-24 13:01

In Russia, cars that are equipped with engines are taxed. The higher the power of the vehicle (TC), the more money you have to pay. For more information on how to make a calculation and fill out a declaration, read on

Documents for a social deduction for the treatment of a child, parents, spouse

Last modified: 2025-01-24 13:01

Any citizen of the Russian Federation who regularly pays income tax to the country's budget has the right to expect that the state will take care of him in a difficult situation

Local taxes and fees are introduced by which authorities? Local taxes and fees in the Russian Federation

Last modified: 2025-01-24 13:01

The tax system of the Russian Federation provides for local taxes and fees. What are their specifics? Which authorities set them up?

Direct taxes include a tax on what? Tax classification

Last modified: 2025-01-24 13:01

In most countries of the world, legally established taxes imply a division into direct and indirect. What is the fundamental difference between them, if we talk about the Russian classification of the corresponding payments? What are the specifics of direct taxes in the Russian Federation?

Corporate property tax: due date for advance payments

Last modified: 2025-01-24 13:01

Russian businesses have a statutory obligation to pay property tax. What is its specificity? How long does it take to fulfill this obligation?

Desk check what is it? Terms of the desk audit

Last modified: 2025-01-24 13:01

The article will consider in detail what is a desk audit, what goals it pursues, the main features, timing and place of its conduct will be determined. Special attention will be paid to the execution and appeal of the results of the audit

A consolidated group of taxpayers is The concept and goals of creating a consolidated group

Last modified: 2025-01-24 13:01

In the article below we will get acquainted with such a phenomenon as a consolidated group of taxpayers, consider the concept and goals of creating such an association, and also find out how beneficial it is for entrepreneurs

USN tax - what is it in simple words, how is it calculated

Last modified: 2025-01-24 13:01

Many Russian enterprises operate under the simplified taxation system, USN. What is its specificity?

What can I get tax deductions for? Where to get a tax deduction

Last modified: 2025-01-24 13:01

The legislation of the Russian Federation allows citizens to apply for various tax deductions. They may be related to the acquisition or sale of property, the implementation of social protection mechanisms, professional activities, training, medical treatment, the birth of children

How to fill out a VAT return? Calculate VAT. Completing a VAT return

Last modified: 2025-01-24 13:01

implementation. Therefore, you need to know how to fill out a VAT return. What is VAT? If you tell the layman in simple words what VAT is, it will look something like this: this is a type of tax paid by a manufacturer to the state for creating (or selling something created by others) a product from which he will then make a profit, exceeding the cost of its production.