Taxes

Tax counterparty. Problem partners. Federal Tax Service: counterparty check

Last modified: 2025-01-24 13:01

The counterparty is one of the key participants in the transaction. He assumes obligations in accordance with the concluded contract. Each entity that signed the agreement will act as a counterparty to the other party to the transaction

What is the percentage of VAT in Russia in 2014

Last modified: 2025-01-24 13:01

Before registering their own business with the relevant authorities, beginning entrepreneurs often wonder what percentage is VAT in Russia. This abbreviation stands for value added tax. It is subject to business objects engaged in the production and sale of goods, as well as the provision of services

Personal income tax object: concept, structure

Last modified: 2025-01-24 13:01

Paying income tax is the responsibility of any individual receiving income in Russia (and abroad). The correct calculation of the amount payable to the budget is possible only with the correct definition of the object of taxation. Let's try to figure out what is meant by the concepts of personal income tax payers and the object of taxation

What amount is not taxed: the subtleties of taxation

Last modified: 2025-01-24 13:01

Taxes are an integral part of a citizen's life. Therefore, it is useful to know how you can save on this. Therefore, you need to study the Tax Code

Minimum tax under the simplified taxation system (simplified taxation system)

Last modified: 2025-01-24 13:01

All start-up entrepreneurs who have chosen a simplified taxation system are faced with such a concept as the minimum tax. And not everyone knows what lies behind it. Therefore, now this topic will be considered in detail, and there will be answers to all relevant questions that concern entrepreneurs

NDFL: abbreviation decoding

Last modified: 2025-01-24 13:01

Tax issues themselves are extremely important. Especially if you don't know what specific tax you're dealing with. Maybe you don't need to pay it at all? It is enough to know how to correctly decipher personal income tax in order to understand this issue

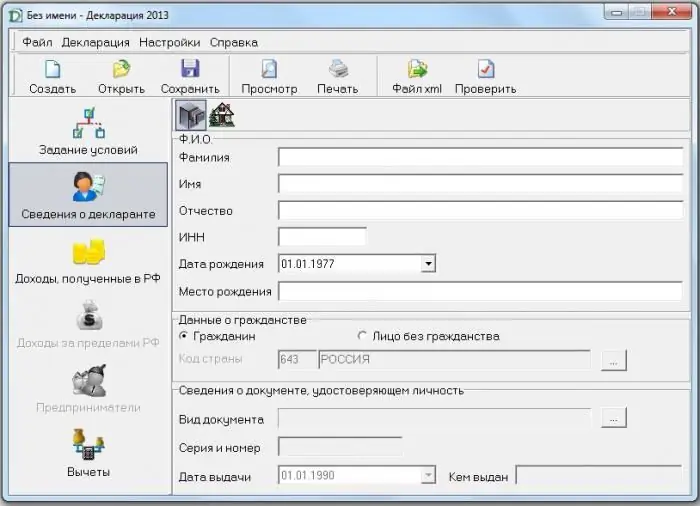

Declaration 3-personal income tax: how to fill it out correctly

Last modified: 2025-06-01 07:06

From time to time in our lives there come moments when we need a 3-NDFL declaration. Not all taxpayers know how to fill it out. Yes, and the fear of messing up something discourages doing this business. However, everything is not so scary. The main thing is to be careful when filling out and not be nervous. And within the framework of this article, we will try to tell in detail when a 3-personal income tax declaration is needed, how to fill it out and how to simplify this process

Tax deduction on property of individuals

Last modified: 2025-01-24 13:01

Almost every citizen can get a property tax deduction in Russia. This article will tell you all about how to arrange it. What features of obtaining a tax deduction for property should everyone know?

How much taxes does an employer pay for an employee? Pension Fund. Social Insurance Fund. Compulsory Medical Insurance Fund

Last modified: 2025-06-01 07:06

The legislation of our country obliges the employer to make payments for each employee in the state. They are regulated by the Tax Code, Labor Code, and other regulations. Everyone knows about the famous 13% personal income tax. But how much does an employee actually cost an honest employer?

Corporate income tax, tax rate: types and size

Last modified: 2025-01-24 13:01

Income tax is mandatory for all legal entities that are on the general taxation system. It is calculated by summing up the profit from all activities of the company and multiplying by the current rate

Does the church pay taxes in Russia: expert's answer

Last modified: 2025-01-24 13:01

What is called a church in a tax context? What is her income? Legal acts regulating taxation in relation to a religious organization. Tax incentives: VAT, property, land, profit tax. Tax fees paid by the church

Google tax in Russia: who pays and how much

Last modified: 2025-01-24 13:01

In early 2017, a bill dubbed the "Google tax" came into force in Russia. Let's figure out what is good and not very dangerous for its introduction for global corporations and individual users, as experts commented on it, is it possible to avoid paying it

Recording to the tax office via the Internet: tips and tricks

Last modified: 2025-01-24 13:01

The tax office is a place that both entrepreneurs and individuals often have to turn to. You can save a lot of time by booking online

Income tax - what is it? How to return?

Last modified: 2025-01-24 13:01

This article will tell you all about income tax and its refund. What it is? Who pays income tax? How much is it? How can you return it?

Tax deduction: payment terms after application and features

Last modified: 2025-01-24 13:01

This article will tell you all about the timing of obtaining tax deductions. What should everyone remember about this procedure?

Required documents for the tuition tax deduction: list and requirements

Last modified: 2025-01-24 13:01

Tax deductions in Russia are provided for a variety of expenses. For example, for education. This article will talk about how to return part of the money spent on studying in Russia

Do people with disabilities of the 2nd group pay transport tax in the Russian Federation?

Last modified: 2025-01-24 13:01

This article will tell you everything about the transport tax in Russia for the disabled. Should these people pay this tax? What payment are you talking about? What features does it imply?

How to fill out section 2 of the 6-personal income tax: step by step instructions

Last modified: 2025-01-24 13:01

How to fill in the 2 section 6 of the personal income tax: the structure of the declaration, step by step instructions. Sample filling section 2 of the calculation of 6NDFL

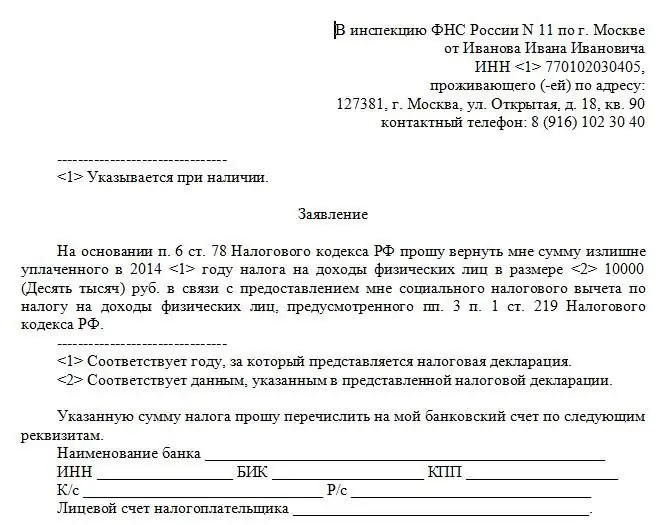

Application for refund of overpaid tax amount, refund procedure and terms

Last modified: 2025-01-24 13:01

Today we have to find out what the application for the return of the overpaid amount of tax is. What should every conscientious taxpayer know about this document (and the process of writing it)? What features of the procedure are recommended to pay attention to?

What is more profitable - "imputation" or "simplification" for IP? What is the difference? Types of taxation systems

Last modified: 2025-01-24 13:01

The choice of a tax system for an individual entrepreneur is an extremely important component. Next, we will talk about what types of taxation systems there are in Russia. What is better to use IP - "imputation" or "simplification"?

UTII: rate, deadline for filing and payment deadline for UTII

Last modified: 2025-01-24 13:01

UTII is a taxation system in which an entrepreneur pays taxes based not on actual, but on potential (imputed) income. Imputed income is regulated by the state and is established, in accordance with the Tax Code of the Russian Federation, depending on a particular type of activity

Refund of tax when buying property. Refund of overpaid tax

Last modified: 2025-01-24 13:01

Income tax is refunded to all citizens who have submitted an appropriate application and a complete package of documents to the tax office. In order for the procedure for registering and receiving a sum of money to be successful, it is necessary to perform all actions according to the rules

Who is eligible for transport tax benefits?

Last modified: 2025-01-24 13:01

Transport tax benefits are assigned by regional authorities. The article tells how to properly issue an indulgence, as well as what assistance is provided by the local administration to different categories of the population

Tax return for land tax: sample filling, deadlines

Last modified: 2025-01-24 13:01

A land tax return must only be filed by companies that own plots of land. The article tells what sections this document consists of, as well as what information is entered into it. The terms during which the documentation is submitted are given. Describes pen alties for companies violating legal requirements

Single agricultural tax - calculation features, requirements and payment

Last modified: 2025-01-24 13:01

The single agricultural tax is a specific taxation regime that can only be used by firms and individual entrepreneurs working in the field of agriculture. The article describes the rules for calculating the tax, the applicable interest rate, the possibility of combining with other taxation systems, and also provides responsibility for violation of tax laws

Simplified taxation system for individual entrepreneurs: types of activities, application

Last modified: 2025-06-01 07:06

The simplified taxation system is the most common special tax regime for individual entrepreneurs. To apply this regime, there are two main restrictions that most individual entrepreneurs do not fall under, so the use of the simplified tax system is popular among entrepreneurs

Notification of opening a current account: the procedure for drawing up, methods of filing

Last modified: 2025-01-24 13:01

The article discusses the current simplifications for 2018 in the field of filing strict reporting forms with the regulatory authorities of the Russian Federation: IFTS, CHI, PF and FSS. Previously performed procedures are described in detail: the procedure for compiling, the rules for filling out notifications about opening a current account. As well as the terms and methods of referral and pen alties provided for non-compliance with the instructions

The tax on childlessness in the USSR: the essence of the tax, who paid how much and when it was canceled

Last modified: 2025-01-24 13:01

In today's world, it's hard to imagine what it's like to pay tax for not having children. However, in the Soviet Union this was by no means a utopia. What is the childlessness tax? What was it for and how much was paid?

The tax on houses. Calculation of real estate tax for individuals

Last modified: 2025-01-24 13:01

Taxes in Russia play an important role. Great attention in 2016 is paid to the property tax paid by citizens. We are talking about individuals. How to calculate property tax? What should citizens know about?

NDFL: tax period, rates, deadlines for filing declarations

Last modified: 2025-01-24 13:01

Taxes are an important part of every citizen's life. Only not everyone knows the features associated with them. Personal income tax plays a huge role for the entire able-bodied adult population. The tax period, rates, features and deadlines for submitting declarations - all this remains to be learned further. This will help to avoid many problems and explanations before the tax authorities. What should you pay attention to first of all?

How do I get my tuition tax refund?

Last modified: 2025-01-24 13:01

Currently, a huge number of people receive higher and secondary specialized education on a paid basis. However, many do not know that it is possible to get a tuition tax refund

Property tax deduction for an apartment. Mortgage apartment: tax deduction

Last modified: 2025-01-24 13:01

When buying an apartment, a tax deduction is required. It consists of several parts, but is invariably present and amounts to a significant amount. To work correctly with this aspect, you need to study its features

How to register with the tax office via the Internet: tips and tricks

Last modified: 2025-01-24 13:01

Recording to the tax service is a process that every citizen should know about. This article will tell you everything about making an appointment with the Federal Tax Service via the Internet

Patent taxation system for individual entrepreneurs: activities, contributions

Last modified: 2025-01-24 13:01

This article will tell you everything about patents for IP in Russia. What is this document? How much will it cost? How to open an IP with a patent? What features of the procedure should every citizen know about?

Does a pensioner have to pay transport tax? Legal advice

Last modified: 2025-01-24 13:01

This article will tell you all about the transport tax for pensioners. What is this payment? Do older people have to pay for a car they own? Are there any benefits for pensioners in Russia in this case?

Expensive treatment: list for 3 personal income tax. What is expensive treatment?

Last modified: 2025-01-24 13:01

Tax legislation provides that when paying for medicines, you can recover part of the funds by issuing a tax deduction. This opportunity is available to officially employed persons (from whose income personal income tax is paid), who pay for treatment for themselves or their relatives. For more information on how to apply for a tax deduction for expensive treatment, a list for 3-personal income tax documents, read on

Tax on holidays in Russia: pros and cons. Resort fee

Last modified: 2025-01-24 13:01

Most of the inhabitants of our country go on holiday to the resorts. The southern cities of Russia are still popular. Today, the actual problem is the introduction of the resort tax. The instruction to introduce this fee was given by Putin

Commercial property tax: calculation features, rates and interest

Last modified: 2025-01-24 13:01

Changes in legislation concern different areas. One of them is commercial real estate, the owners of which from 2016 have to pay taxes under the new rules

What happens if you don't pay taxes? Liability for non-payment of taxes

Last modified: 2025-01-24 13:01

This article will tell you all about the consequences of not paying taxes. What will happen in this case? What is the punishment for such an act? And does it exist at all?

Sold the car, but the tax comes: what to do, where to go

Last modified: 2025-01-24 13:01

Issues related to taxes are of interest to many citizens. This article will tell you everything about what to do if, after selling the car, the transport tax still comes to the seller. How legal is it? What should every citizen know about the transport tax?

The apartment tax does not come: what to do if there is no receipt?

Last modified: 2025-01-24 13:01

This article will tell you everything about what to do if a citizen does not receive taxes for an apartment. How to act? Should I be afraid of this process? What should citizens pay attention to?

Basis of payment 106: transcript, filling rules

Last modified: 2025-06-01 07:06

In 2014, the type of payment orders for transferring funds to the budget changed. In particular, the paragraph “Reason for payment” (106) appeared in the document. Banks no longer control the correctness of filling in all fields. This responsibility rests with taxpayers

How to file a tax return via the Internet: ways

Last modified: 2025-01-24 13:01

Recently, more and more services are provided via the Internet. Sending documents, including tax returns, over the Internet to various government services is especially popular. What are the features of this procedure? How to file a tax return online? Can they refuse a service?

VAT refund when exporting from Russia: procedure and schemes

Last modified: 2025-01-24 13:01

The tax authorities pay special attention to the verification of VAT amounts when exporting. Since operations for the sale of goods abroad are subject to VAT in a different manner

Tax authorities - what is it? Responsibilities, activities

Last modified: 2025-01-24 13:01

The concept, system, powers and features of the tax authorities of the Russian Federation today

How to get 13 percent from buying an apartment? Return of 13% from the purchase of an apartment

Last modified: 2025-01-24 13:01

Residential real estate market, like a living organism, is constantly in motion. People have always bought and sold houses. Today, Russian legislation establishes the possibility of returning a share of the financial resources spent on the purchase of housing - apartments, houses, rooms, etc. Let's talk about which categories of taxpayers are eligible for a refund, how to actually return the tax on the purchase of an apartment

Code of the tax authority. Code of the tax authority at the place of residence

Last modified: 2025-01-24 13:01

Different kinds of codes are an integral part of many documents related to tax and accounting reporting. What is a tax authority code? How is it used in practice?

Deferred tax liability - what is it?

Last modified: 2025-06-01 07:06

Deferred tax liability is that part of the deduction to the budget, which in the next period should lead to an increase in the amount of the payment. For brevity, the abbreviation IT is used in practice

The fiscal authority is Features of work, general tasks

Last modified: 2025-01-24 13:01

The fiscal authority is a law enforcement structure whose key task is to ensure the economic stability and security of the country. The work of this institute includes a set of measures for the use of financial resources, their distribution between industries, regions, social groups

Tax benefit - what is it? Types of tax benefits. Tax social benefit

Last modified: 2025-01-24 13:01

A tax break is a certain relief for a person who is obliged to make contributions to the budget. The legislation provides several opportunities to reduce the burden of taxation. The individual chooses whether to use them or not

Does income tax always make up 13% of wages in Russia?

Last modified: 2025-01-24 13:01

Income tax raises many questions among the population. This article will tell you everything about this tax payment. When and how much do citizens pay from their earnings? Do they always keep 13% from them?

Application for a refund of personal income tax for education: when you can get it, the rules for applying for a tax deduction

Last modified: 2025-01-24 13:01

Getting tax deductions in Russia is a very simple process. This article will tell you all about how to get a tuition deduction and apply for a refund of the money spent

Tax deduction for a pensioner: conditions, rules for registration

Last modified: 2025-01-24 13:01

Tax deduction is due to almost all citizens in Russia. How to issue it? To whom is it due? This article will talk about tax deductions for pensioners

Who is exempt from paying property tax? Heroes of the Russian Federation, disabled since childhood, Heroes of the Soviet Union

Last modified: 2025-01-24 13:01

More and more often, citizens are interested in who is exempt from paying property tax. This topic is actually extremely relevant. After all, property tax is an important payment. If you do not produce it if you have property, you can be left homeless

Real estate tax in Moscow for individuals and legal entities. New property tax

Last modified: 2025-01-24 13:01

Taxes are what interests all citizens and legal entities. This article will tell you everything about the property tax for organizations and ordinary people in Russia

US tax system: structure, characteristics and features

Last modified: 2025-01-24 13:01

The US tax system is currently one of the most advanced in the world. Fees collected from the most economically active segments of society provide the bulk of the federal budget

What documents are needed for a tax deduction: a list of papers for registration

Last modified: 2025-01-24 13:01

Tax deduction - the right to a refund of part of the costs for certain services. This article will explain how to request this service

What is UTII - definition, activities, types and features

Last modified: 2025-01-24 13:01

Each entrepreneur must choose the appropriate tax regime before starting work. Often businessmen are interested in what UTII is. The article describes the features of this mode, as well as the rules for its calculation and payment. Tells when the UTII declaration must be submitted

Tax deduction for treatment: who is en titled, how to get it, what documents are needed, rules for registration

Last modified: 2025-01-24 13:01

This article will tell you how to get a tax deduction for treatment. What is it and what are the rules for issuing a return?

Personal income tax deduction codes: decoding

Last modified: 2025-01-24 13:01

The tax agent fills out a certificate of 2 personal income tax for each individual who received income in the reporting period. Each type of income and tax deduction has its own code - a specific four-digit (for income) or three-digit (for deductions) digital designation. Income and deduction codes are updated almost annually

Federal taxes include a tax on what? What taxes are federal: list, features and calculation

Last modified: 2025-01-24 13:01

Federal taxes and fees include different payments. Each type is provided for a certain branch of life. It is the duty of citizens to pay the necessary taxes

Where to look at the property tax of individuals: tips and tricks

Last modified: 2025-01-24 13:01

Checking taxes and debts on these payments - the process is not that complicated. How can I find out how much to pay for a property? How long does it take to pay this invoice? Best tips and tricks - next

Why doesn't the apartment tax come and do I need to pay without a receipt?

Last modified: 2025-01-24 13:01

The apartment tax is the same as the property fee. These accruals come to all property owners. This is an annual fee that must be paid

VAT 10 percent: list of goods and services

Last modified: 2025-01-24 13:01

If your product was not on our list, and you have a question: "VAT 10% in what cases (or rather, to what goods and services) does it apply?", you need to look at the Resolution. We have already indicated the number and date. It has a complete list. As a rule, these are all socially significant groups of goods that are in high demand among citizens

The method of tax law and its characteristics

Last modified: 2025-01-24 13:01

Tax law is a complex area of law. What is the specificity of her method? In what varieties can it be presented?

6-NDFL: terms of submission, sample filling

Last modified: 2025-01-24 13:01

Reporting 6-personal income tax - a new document for employers. It must be presented to the regulatory authorities from the 1st quarter of 2016. This document is compiled not for each employee individually, but for the entire enterprise as a whole. Let's consider further how to fill out 6-personal income tax

In Russia introduced a tax on manure

Last modified: 2025-01-24 13:01

"The manure tax will appear in Russia from September 1", "Legal lawlessness", "They went crazy". These and many other phrases could be heard and seen in the vastness of the information space. The opposition publicly began to inflate the news among the electorate, the Ukrainian media began to laugh at the fact that we have a tax on manure

Relief on transport tax for families with many children. What tax benefits do large families have?

Last modified: 2025-01-24 13:01

Families with many children in Russia often receive a variety of benefits. For example, they can receive free textbooks in schools. And what about taxes? Are there any transport tax exemptions for families with many children? And if so, how do you arrange them?

How to check the taxes of an individual by last name: step by step instructions and recommendations

Last modified: 2025-01-24 13:01

It's not good to have tax debts. Therefore, you should know how to check your debt. For example, by the name of an individual. The best tips and tricks regarding this process are presented in the article

Do pensioners pay land tax? Land tax benefits for pensioners

Last modified: 2025-01-24 13:01

Do pensioners pay land tax? This topic is of interest to many. After all, older people are eternal beneficiaries. And so often relatives draw up real estate on them. What for? To avoid paying taxes. What can be said about the payment for land? Are pensioners en titled to any bonuses from the state in this area? What should the public know about the payment under study?

Municipal fees from entrepreneurs. Bill on fees from entrepreneurs

Last modified: 2025-01-24 13:01

“No need to “nightmare” business”, “Support small business”, “We must reduce the burden on enterprises”. Many remember these words from the President and Prime Minister of our country. Business breathed a sigh of relief. No sooner said than done. Legislators consulted and decided to "help" individual entrepreneurs. How exactly? An additional tax, which will be called the "municipal fee from entrepreneurs"

What to do if the car tax does not come?

Last modified: 2025-01-24 13:01

The car has long ceased to be a luxury. In today's mobile world, it is considered a necessity. But the cost of maintaining a car is not only insurance, gas stations and spare parts. Also, the state takes a transport tax

Property tax for pensioners. Do pensioners pay property tax?

Last modified: 2025-01-24 13:01

Pensioners are eternal beneficiaries. Only not everyone knows what their capabilities extend to. Do pensioners pay property tax? And what rights do they have in this regard?

Return of the state duty from the tax: all the nuances of the procedure

Last modified: 2025-01-24 13:01

The Tax Code of the Russian Federation lists all situations where such a fee is required. In general, you will have to pay money whenever you need a service from the state

When does the car tax come? How to calculate car tax

Last modified: 2025-01-24 13:01

Most citizens of the country either have their own transport or are thinking about purchasing it. But you will have to fork out for a car not only when it is purchased or regularly refueled at the station. It is also necessary to pay a substantial amount for taxes. According to the tax code, they are not subject to any taxes at all

VAT "5 percent" rule: calculation example when applied. Separate accounting

Last modified: 2025-01-24 13:01

If an organization simultaneously conducts transactions that are taxable and not taxable with VAT, it is obliged to carry out separate accounting for tax amounts. This is provided for in Art. 170 Tax Code of the Russian Federation

Where and how to find out the cadastral value of a land plot?

Last modified: 2025-01-24 13:01

Each of us faced with the housing issue. However, not everyone understands the intricacies of pricing and terminology. Therefore, these issues need to be carefully considered. How to find out the cadastral value and why is it needed?

Do I need to change the TIN when changing my residence permit: where to go, documents

Last modified: 2025-01-24 13:01

Do I need to change the TIN when changing my residence permit? This question worries many citizens. Yes, permanent residence rarely changes. But what to do if this happened? TIN is directly related to the tax authorities. This means that if you use an invalid number, you can run into trouble. So you have to study this issue thoroughly. Maybe you don't really need to deal with the extra paperwork?

The share of the taxpayer in the right to the vehicle in the declaration

Last modified: 2025-06-01 07:06

When buying a car, it is important to pay attention to the technical characteristics of the vehicle. After all, not only the speed of movement depends on the amount of horsepower, but also the amount of tax that must be paid annually. Also of great importance is the share of the taxpayer in the right to a vehicle (TC) and a correctly drawn up declaration

What is the tax on parcels from abroad in Russia, Ukraine, Belarus, Kazakhstan? What parcels are taxed

Last modified: 2025-01-24 13:01

In this article we will consider the basic rules for the passage of postal items across the state border of Russia, Ukraine, Belarus and Kazakhstan. And we will find out what tax on parcels from abroad needs to be paid in each of these countries

When taxes and fees of the subjects of the Russian Federation are put into effect and cease to operate?

Last modified: 2025-01-24 13:01

The procedure for establishing, changing and abolishing taxes and fees is determined by the highest representative body of the country. The rules for calculating and deducting payments are fixed in the Tax Code

Utilization fee rates for cars in the Russian Federation

Last modified: 2025-01-24 13:01

Disposal fee rates are different for different countries. For example, in Europe they amount to about one hundred euros and are paid when purchasing a car. In our country, during the period of 2010-2011, during the program of exchanging old cars for new ones, the owner of the old car paid 3 thousand rubles for recycling and received a discount of 50 thousand rubles. to a new car. Today, the recycling fee rates are determined in Decree No. 870, adopted in 2012 (August 30)

How to calculate property tax for individuals and legal entities

Last modified: 2025-01-24 13:01

Property taxation has been around for thousands of years. In the ancient world, requisitions of this kind were made in relation to rather individuals, because. cash savings and real estate belonging to a particular person were taxed. Today, the tax for individuals and legal entities is calculated differently, so everyone should know how to calculate property tax

What you should pay attention to when choosing a code for the type of business activity

Last modified: 2025-01-24 13:01

Economic activity is a process in which various material resources, equipment, technology and labor are combined in such a way that a homogeneous set of products is obtained. The type of business activity code is usually required at the very beginning of opening a business, when an application for registration of an individual entrepreneur is filled out

Taxation of an entrepreneur: what are the options

Last modified: 2025-01-24 13:01

Entrepreneurs in most cases can choose one of several taxation systems. Looking for profit

What taxation system can an individual entrepreneur apply: USN, ESHN, patent, OSNO

Last modified: 2025-01-24 13:01

Today we have to find out what taxation system an individual entrepreneur can apply. Moreover, it is also best to understand which scenario is most suitable for entrepreneurs to run their own business. In general, the issue of business is closely related to taxes. Depending on your activity, this or that alignment will be beneficial

Art 89 of the Tax Code of the Russian Federation. Field tax audit

Last modified: 2025-01-24 13:01

Article 89 of the Tax Code of the Russian Federation regulates field tax audits. What are its main provisions? What are the main nuances of conducting an on-site audit of taxpayers by the Federal Tax Service?

German tax system. Principles and main types of payments

Last modified: 2025-01-24 13:01

German tax system. What taxes do Germans pay? What are the basic principles of the financial flywheel of one of the most stable countries in the world?

Recycling fee helps save the environment

Last modified: 2025-01-24 13:01

Residents of many settlements and cities in Russia often complain about the formation of spontaneous dumps that spread unpleasant odors and, often, are a source of toxic substances. Our country is far from Japan, where garbage is processed at a high quality level, freeing nature from its presence. However, in July 2012, a legislative act was adopted (FZ No. 128), containing a definition of such a concept as a recycling fee

Limitation period for taxes

Last modified: 2025-01-24 13:01

How is the tax limitation period calculated? What pen alties can the tax inspectorate apply to non-payers?

How to find out tax arrears of individuals without problems

Last modified: 2025-01-24 13:01

How to find out tax arrears of individuals, pay them on time and still go abroad and relax

How to calculate car tax in Russia

Last modified: 2025-01-24 13:01

How to calculate car tax? To do this, you need to know the engine power in metric or off-system units. Metric is the value in kW, and off-system is horsepower. Convert kW to hp can

Fee for late payment of tax: useful information

Last modified: 2025-01-24 13:01

When does the pen alty for non-payment of tax start? How can I calculate the pen alty amount myself? All this is covered in this article

Tax when selling a car: the amount in which cases you do not need to pay?

Last modified: 2025-01-24 13:01

Purchase and sale deals are subject to taxation. This article will tell you how and when to pay taxes on the sale of a car

How to calculate the transport tax on horsepower?

Last modified: 2025-01-24 13:01

Each legal owner of a car or other registered vehicle receives an annual tax notice from the local Revenue Service indicating the amount of the tax. Making calculations is the responsibility of the executive authority, and the taxpayer should not be involved in this. However, errors in accruals occur from time to time, so it is better to double-check the indicated amount. This is easy to do if you know what the tax consists of

Transport taxes in Kazakhstan. How to check transport tax in Kazakhstan? Deadlines for paying transport tax in Kazakhstan

Last modified: 2025-01-24 13:01

Tax liability is a huge problem for many citizens. And they are not always resolved quickly. What can be said about the transport tax in Kazakhstan? What it is? What is the procedure for paying it?

13 percent back on dental treatment. What documents are needed?

Last modified: 2025-01-24 13:01

The tax deduction is quite an important payment that interests many taxpayers. But how can you get it for dental treatment? What does that require? What deadlines do you need to meet?

How to return 13 percent of the purchase of an apartment? Tax deduction when buying an apartment

Last modified: 2025-01-24 13:01

Tax deductions for real estate transactions are of interest to many. How can I get part of the funds spent on an apartment? What is needed for this? What pitfalls can be encountered?

Transport tax in St. Petersburg: rate and calculation

Last modified: 2025-01-24 13:01

Transport tax can bring a lot of problems to citizens. Therefore, many are interested in it. How much and how should you pay for a car in St. Petersburg? What should its inhabitants prepare for in 2016?

How to pay taxes through Sberbank Online: instructions

Last modified: 2025-01-24 13:01

How to pay taxes through Sberbank Online? This question interests many citizens. After all, Sberbank cards are in great demand. And, accordingly, an Internet service that helps pay bills and receipts without problems right from home - too. But not everyone knows how to make debt repayment