2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:33

The legislation stipulates that with the advent of the new Federal Law "On Accounting" (No. 402-FZ of December 6, 2011), all enterprises, regardless of the taxation regime, are required to submit financial statements. The new law brought many innovations regarding the forms of financial statements.

Thus, organizations on the simplified tax system must also draw up and submit reports. But for such organizations there is a new form of balance sheet, simplified. Many balance sheet items of the usual form are combined into one. Thus, the Asset of the balance consists of 5 items, and the Liability - of 6. It is possible to compare the items of the old and new forms for a very long time, but there are small clarifications. If suddenly something is not clear to the tax authorities in the abbreviated form of the balance sheet, they may require disclosure of information about a particular balance sheet item. This may add work to the accounting department, as additional clarifications will have to be made.

Most of the organizations that must keep a balance sheet are given a few particularly importantquestions. One of them: "How to fill in the balance sheet for previous years, if there is no exact data?" In this case, there are two options. Organizations can calculate data from documentation, but there is one caveat. The data may not be calculated correctly, resulting in inaccuracies in reporting, and many documents will have to be sorted out in order to calculate each indicator for the previous two years. According to the second option, the Ministry of Finance allows not to fill in data for previous years at all. This is in accordance with the legislation of the Russian Federation, since organizations cannot fill in data that they did not previously enter.

Another question is asked regarding the application of the new form of the balance sheet: "In what form is it correct to hand over the balance sheet?". The new form is intended exclusively for small businesses, as the Ministry of Finance explained. But the old form of the balance sheet is also suitable for organizations on the simplified tax system, if they need to describe the data for owners in more detail.

The balance sheet form is one of the forms of financial statements that shows the state of the organization for 3 consecutive years, and is submitted to the Federal Tax Service at the end of the year. With the adoption of the new law "On Accounting", the variety of forms has increased. But here's the catch: Accounting software still only has the old form, so many organizations won't switch to the new one. Moreover, regardless ofexemption from reporting, organizations on the simplified tax system in the majority all kept accounting records. This is another plus in favor of the old form.

But for newly created organizations, there is now a lightweight form of the balance sheet, which will allow you to combine some data, which will facilitate the work of the company's chief accountant. It is not yet possible to judge this form, since it will be applied starting from the reporting for 2013. As soon as the reporting is submitted, it will be possible to understand which form is mostly adopted by small businesses.

Recommended:

Net sales in the balance sheet: string. Sales volume in the balance sheet: how to calculate?

Annually, enterprises prepare financial statements. According to the data from the balance sheet and income statement, you can determine the effectiveness of the organization, as well as calculate the main planned indicators. Provided that the management and finance department understand the meaning of terms such as profit, revenue and sales in the balance sheet

General concepts of the balance sheet: assets, liabilities, balance sheet currency

The balance sheet contains important information for assessing the company's financial results. Each section of the asset, liability, as well as the balance sheet currency is necessary to calculate many financial indicators

Formula of net assets on the balance sheet. How to calculate net assets on a balance sheet: formula. Calculation of net assets of LLC: formula

Net assets are one of the key indicators of the financial and economic efficiency of a commercial firm. How is this calculation carried out?

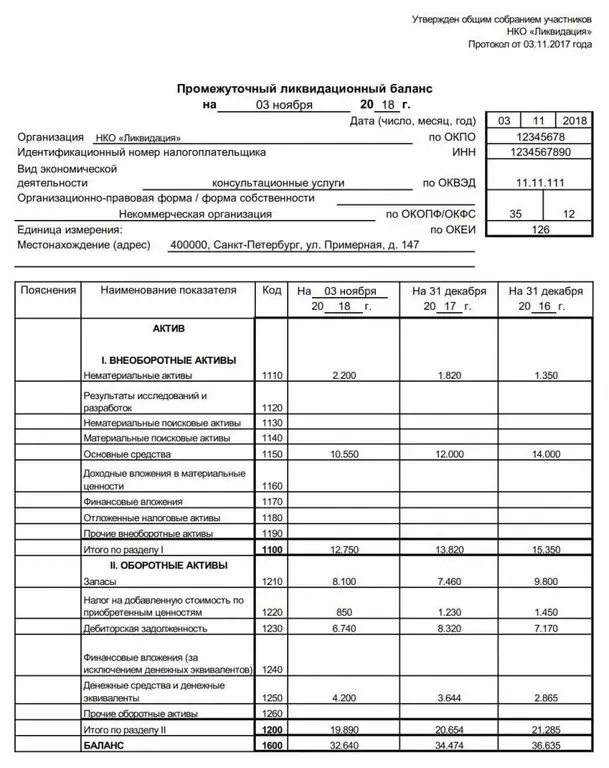

Liquidation balance sheet is Definition of the concept, approval, form and sample of filling out the liquidation balance sheet

The liquidation balance sheet is an important financial act drawn up during the closing of an organization. It can be intermediate or final. The article tells what is the purpose of these documents, what information is entered into them, as well as how and when they are approved and submitted to the Federal Tax Service

Balance: types of balance. Types of balance sheet

The balance sheet is the most important accounting document of an institution. What is it, what are the rules for filling it out, types and classification